Splitboards Market Size

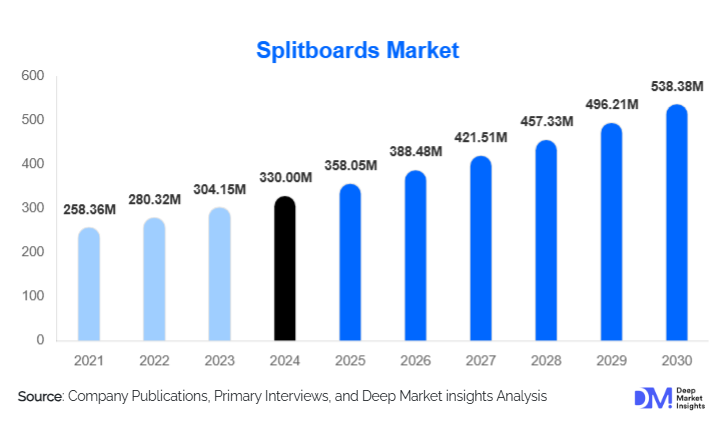

According to Deep Market Insights, the global splitboards market size is estimated at approximately USD 330 million in 2024, with a reasonable midpoint of USD 358.05 million being used for modeling. Based on current growth trajectories and synthesizing multiple forecasts, the market is projected to expand to about USD 538.38 million by 2030, implying a CAGR of roughly 8.5 % during 2025–2030. Growth is fueled by rising backcountry snowboarding interest, technological innovation in lightweight gear, and expanding winter sports infrastructure in underpenetrated regions.

Key Market Insights

- Backcountry adoption is driving demand. As more snowboarders pursue off-piste terrain and want to hike or skin uphill, splitboards are becoming the tool of choice rather than resort-only boards.

- Asia-Pacific is emerging as a growth engine, with rising disposable incomes, growing winter tourism, and infrastructure investment in countries like Japan, China, South Korea, and parts of Australasia.

- Premiumization through lighter materials and bindings is key. Consumers increasingly prioritize weight, portability, modularity, and durability over bare cost, pushing R&D and pricing upward.

- Specialty retail remains influential. Given the complexity and fitting requirements of splitboards, specialty snow sports stores and demo centers continue to command an outsized share of sales despite growth in online channels.

- Sustainability is gaining traction. Brands differentiating on eco-friendly cores, recycled laminates, and responsible sourcing are catching consumer attention, especially among younger adventurers.

- Bundled packages (board + bindings + skins) are gaining preference. Buyers increasingly favor all-in, ready-to-ride kits, reducing compatibility concerns and simplifying purchase decisions.

Latest Market Trends

Lightweight & Modular Design Evolution

One of the most visible trends in split-board development is relentless weight reduction without compromising strength. New composite cores (wood + carbon, hybrid laminates), improved adhesives, and refined binding systems (e.g., lighter baseplates, pin systems, quick-release features) are enabling manufacturers to shave off grams. Modular hardware that allows component replacement (rails, pucks, skins) is also becoming standard. This shift appeals strongly to backcountry users, for whom every ounce counts.

Sustainability & Ethical Materials Integration

With growing awareness of climate impact, many brands are integrating sustainable practices into design and production. This includes using FSC-certified wood cores, bio-resins, recycled fiber laminates, and waste reduction in manufacturing. Brands are also marketing repairability and take-back, or recycling programs. These efforts resonate well with a consumer base that often values nature and outdoor responsibility.

Growth of Rental, Demo & Try-Before-You-Buy Models

As the adoption curve extends into more casual or curious riders, resorts, gear shops, and adventure outfitters are increasingly offering splitboard rentals, demo fleets, and guided backcountry tours. This reduces the barrier to trying the gear before committing to a full purchase. Positive demo experiences often convert into outright sales. This trend helps expand the market by lowering entry friction.

Market Drivers

Escalating Demand for Off-Piste Exploration

Traditional snowboarding is constrained by lift infrastructure and resort boundaries. But many snowboarders now aspire to access untouched slopes, bowls, and remote terrain. Splitboards allow users to ascend with skins and climb gear, then reassemble for downhill runs. This shift to independent mobility is a powerful growth driver, especially among mid- to high-skill riders.

Technological Innovation & Material Advances

Advances in core materials (hybrid composites, carbon reinforcements), binding systems (lighter pins, optimized baseplates, modular attachments), improved skins, and better bonding technologies have lowered the performance and usability barriers. The easier, safer, and lighter the gear becomes, the wider the potential adopter, especially among intermediate riders.

Expanding Participation & Demographic Diversification

Increasing participation in outdoor adventure sports among women, youth, and first-time backcountry users is broadening the addressable market. Coupled with rising disposable incomes in emerging markets, marketing programs targeting underrepresented groups and improved gear for smaller/lighter riders are accelerating adoption.

Market Restraints

High Cost and Complexity of Setup

A full splitboard kit (board, skins, bindings, hardware) costs significantly more than a typical snowboard. Moreover, new users must invest in avalanche safety gear, training, and often ancillary accessories. This high total cost of entry limits adoption among casual riders or in price-sensitive markets.

Seasonality, Weather Risk & Access Barriers

Snow reliability, variable terrain, avalanche conditions, safety infrastructure, and regulatory or permit restrictions pose ongoing challenges. In many regions, inconsistent winters or climate volatility further stress demand. Additionally, import duties, trade barriers, or regulations on materials can hamper availability or increase cost in certain markets.

Splitboards Market Segmentation Insights

Here are representative insights from each major segmentation dimension, focusing on one sub-segment that leads globally:

- By Product Type: All-Mountain splitboards command 32–35 % of the 2024 market. Their versatility across snow conditions makes them the default choice for many buyers transitioning into backcountry use.

- By Binding / Hardware: Baseplate/chassis binding systems hold a 28–30 % share. They balance weight, rigidity, and upgradeability, making them appealing for serious riders who want a robust system.

- By Application / User Type: Recreational/amateur users dominate with a 60–65 % share. Because they make up the broadest user base, their trends (willingness to upgrade, try gear) heavily influence overall growth.

- By Distribution Channel: Specialty stores command 40–45 % share. The complexity of fitting, brand trust, demo access, and service means many buyers still prefer in-person specialty shops.

- By Material / Construction: Composite cores (wood + carbon/fiberglass hybrids) lead with 45–50 %. They hit the sweet spot in weight, stiffness, cost, and durability.

End-Use & Demand Patterns

The predominant end use for splitboards is recreational backcountry snowboarding, comprising the bulk of sales. Within that, intermediate or “resort-to-backcountry transitioners” are the fastest-growing user group. Women and youth segments are expanding fastest, as gear gets lighter and more inclusive in sizing and ergonomics. Another growing end use is rental/demonstration resorts, gear shops, and guiding services are increasingly stocking splitboard fleets, driving trial and conversion. Additionally, ancillary uses such as guiding companies, backcountry safety training schools, and winter photographers also contribute to demand. Export demand is significant: many emerging winter sport markets in Asia, Latin America, and parts of Eastern Europe import gear, leveraging strong domestic growth in outdoor recreation. Thus, growth in the snow sports sector broadly (ski resorts, winter tourism, fitness/leisure) underpins splitboard adoption.

| By Product Type | By Binding System | By Material Type | By Application / User Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, capturing a 38–45 % share in 2024. The U.S. dominates, with strong brand presence, established backcountry culture, and robust infrastructure (ski resorts, guiding services). Canada also contributes significantly. The market is mature but continues growing thanks to product innovation, awareness, and a deep user base upgrading gear.

Europe

Europe holds a 28–33 % share in 2024. Alpine countries (Austria, Switzerland, France, Italy) and the Scandinavian region are key demand centers. Growth is steady, with expansion in Eastern Europe and the development of guided backcountry routes. Regulatory frameworks for safety and terrain access are more established here.

Asia-Pacific

In 2024, APAC accounts for an 18–25 % share but is the fastest-growing region with a forecast CAGR of 10–12 %. Japan, South Korea, China, Australia, and New Zealand lead demand. Growth is backed by new resorts, rising incomes, tourism promotion, and growing exposure to winter sports culture.

Latin America

Latin America contributed a 5–6 % share in 2024. Chile and Argentina are the principal markets owing to the Andes skiing culture. Growth is moderate to strong, depending on infrastructure and economic cycles. Demand is import-driven.

Middle East & Africa

MEA holds a modest 2–3 % share. While natural snowfall is rare except in high altitudes, interest comes from tourists, expatriates, and indoor snow or ski resort developments. Growth is gradual, contingent on niche demand and import availability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Splitboards Market

- Burton Snowboards

- Jones Snowboards

- K2 Sports

- Arbor Collective

- Salomon Group

- Voilé Manufacturing

- Lib Technologies (Mervin Manufacturing)

- Rossignol Group

- Never Summer Industries

- Amplid

Recent Developments

- Product innovation & lightweight builds: Several leading manufacturers introduced lighter composite and carbon-reinforced splitboard lines and updated binding interfaces to reduce uphill weight while improving downhill performance. These launches include improved skin-attachment systems and modular hardware for easier field repairs and upgrades.

- Sustainability initiatives: Brands expanded eco-focused offerings—using FSC-certified wood cores, bio-resins, recycled laminates, and take-back/repair programs—to appeal to environmentally conscious backcountry consumers.

- Demo fleets and rental partnerships: Major players and specialty retailers increased demo fleets and resort rental programs to support try-before-you-buy adoption, helping convert first-time backcountry users into buyers.