Splitboard Bindings Market Size

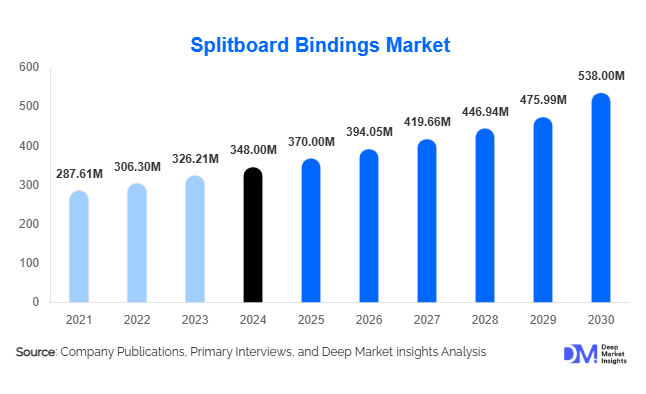

According to Deep Market Insights, the global splitboard bindings market size was valued at USD 348 million in 2024 and is projected to grow from USD 370 million in 2025 to reach USD 538 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by the increasing popularity of backcountry snowboarding, rising adoption of advanced lightweight bindings, and the expansion of adventure tourism and snowboarding-related experiences worldwide.

Key Market Insights

- Technological advancements in binding materials, including carbon fiber and aerospace-grade aluminum, are attracting performance-focused riders by improving strength-to-weight ratios and durability.

- North America dominates the market, with the United States and Canada leading demand due to established snowboarding infrastructure and a large community of recreational and professional snowboarders.

- Europe is the fastest-growing regional market, fueled by alpine tourism, winter sports culture, and increasing demand for high-performance snowboarding equipment in countries like Switzerland, Austria, and France.

- Asia-Pacific is emerging as a key growth region, led by rising interest in snowboarding in Japan, South Korea, and China, supported by adventure tourism growth and increased disposable incomes.

- Integration of smart and eco-friendly technologies in bindings, such as adjustable performance analytics, lightweight sustainable materials, and ergonomic designs, is reshaping consumer expectations.

- Direct-to-consumer and online retail channels are expanding rapidly, allowing consumers to compare products, access reviews, and purchase premium splitboard bindings conveniently.

Latest Market Trends

Advanced Materials Driving Performance

Splitboard bindings are increasingly manufactured using advanced materials such as carbon fiber and aircraft-grade aluminum alloys. These materials provide a high strength-to-weight ratio, enhancing both performance and rider endurance. Lighter bindings reduce fatigue during long backcountry tours, making them highly desirable among professionals and avid snowboarders. Additionally, eco-friendly materials and production processes are gaining traction, appealing to environmentally conscious consumers seeking sustainable snowboarding equipment.

Integration of Smart Technologies

Manufacturers are introducing bindings with tool-free adjustability, ergonomic designs, and compatibility with multiple boot systems. Some high-end models feature integrated performance analytics and connectivity to mobile apps, allowing riders to monitor stability, flex, and torque. These technological advancements appeal particularly to younger, tech-savvy snowboarders seeking a premium experience in backcountry terrain.

Splitboard Bindings Market Drivers

Rising Popularity of Backcountry Snowboarding

The increasing interest in off-piste and backcountry snowboarding has created a robust demand for specialized splitboard bindings. Riders require equipment capable of efficiently transitioning between touring and riding modes, leading to higher adoption of premium bindings designed for performance, stability, and lightweight convenience. Expansion of snowboarding parks, guided backcountry tours, and professional competitions further amplifies this trend globally.

Growth of Adventure Tourism

Adventure tourism, especially in mountainous regions, drives demand for splitboard bindings. Resorts and guided tours in North America, Europe, and Asia-Pacific encourage both amateur and professional snowboarders to invest in specialized equipment. The rising trend of winter adventure tourism packages has positively impacted equipment sales, contributing to market expansion.

Technological Advancements in Bindings

Innovations such as carbon fiber construction, improved heel risers, and ergonomic footbeds improve rider performance and comfort. Adjustable bindings, enhanced torque transfer, and compatibility with multiple boot types appeal to both professional and recreational riders, boosting market adoption.

Market Restraints

High Cost of Premium Bindings

Top-tier splitboard bindings are expensive, limiting accessibility for casual riders and budget-conscious consumers. Price sensitivity restricts market penetration in emerging markets and among recreational snowboarders.

Limited Awareness in Emerging Regions

In countries where snowboarding is not a mainstream sport, awareness about splitboards and their specialized bindings is low. This reduces adoption rates and slows market growth outside traditional snowboarding hubs like North America and Europe.

Splitboard Bindings Market Opportunities

Expansion into Emerging Markets

Regions such as Asia-Pacific and Latin America are witnessing increasing interest in winter sports. Establishing distribution networks, localized marketing, and partnerships with adventure tourism operators can unlock new revenue streams. Japan, South Korea, and Chile are emerging as promising markets for both recreational and professional snowboarders.

Integration of Smart and Sustainable Technologies

Bindings incorporating performance analytics, ergonomic adjustments, and lightweight, eco-friendly materials offer differentiation opportunities. Brands investing in sustainable production methods and smart technologies can attract environmentally conscious and tech-savvy riders, capturing a premium market segment.

Collaborations with Snowboarding Events and Influencers

Strategic partnerships with snowboarding competitions, winter sports influencers, and guided tour operators can boost visibility and credibility. Event sponsorships, product demonstrations, and influencer endorsements enhance brand recognition, driving consumer adoption globally.

Product Type Insights

Baseplate-type bindings dominate the market, offering superior stability and power transfer. They accounted for approximately 30% of the global market in 2024 due to their popularity among both professional riders and performance-oriented recreational snowboarders. The increasing preference for durable and responsive bindings has maintained their leading position.

Application Insights

Men’s bindings represent the largest segment, capturing 50% of the market in 2024. This trend is driven by higher male participation in snowboarding and a preference for specialized backcountry equipment. Women’s and unisex bindings are growing steadily but have yet to surpass men’s in volume. Recreational and professional snowboarders favor performance-oriented bindings that support long touring sessions and advanced riding techniques.

Distribution Channel Insights

Online platforms, including direct-to-consumer websites and specialist e-commerce stores, dominate the market, offering consumers the convenience of product comparison, reviews, and transparent pricing. Retail stores and snow sports outlets remain important for first-time buyers and premium fittings. Influencer marketing and social media engagement are increasingly driving online purchases, particularly among younger demographics.

End-Use Insights

The primary end-users are recreational and professional snowboarders engaged in backcountry snowboarding. Adventure tourism companies are also emerging as a significant demand driver by including splitboarding in guided tours. Rental services at ski resorts are increasing equipment circulation, expanding market reach. North America and Europe lead in end-user adoption, while Asia-Pacific shows high growth potential due to rising interest in winter sports and adventure tourism.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds a significant market share due to strong snowboarding culture, infrastructure, and winter sports tourism. The United States leads demand with established backcountry routes, while Canada contributes steadily. North American market share was approximately 35% in 2024, with the fastest adoption in recreational snowboarders investing in premium bindings.

Europe

Europe, particularly Switzerland, Austria, France, and Italy, accounts for around 30% of the market in 2024. Alpine tourism, adventure sports culture, and high disposable incomes drive growth. Switzerland and Austria are leading countries due to their well-developed winter sports resorts.

Asia-Pacific

Asia-Pacific is a high-growth region with rising demand from Japan, South Korea, and China. Increasing interest in snowboarding, adventure tourism, and disposable incomes is creating strong growth potential. Japan is the largest market in this region, while South Korea is growing fastest at a CAGR of 8.1%.

Latin America

Emerging markets like Chile and Argentina are gaining traction due to winter tourism expansion and adventure sports popularity. Growth is currently smaller but expected to increase with tourism development.

Middle East & Africa

The Middle East has niche demand, primarily from the UAE and Saudi Arabia, driven by luxury consumers seeking adventure sports experiences abroad. Africa itself, while home to mountainous terrains, represents a small but steady market focused on tourism imports.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Splitboard Bindings Market

- Burton

- Union Binding Company

- Spark R&D

- Flow Snowboarding

- Rome Snowboards

- Arbor Snowboards

- Jones Snowboards

- G3 Genuine Guide Gear

- K2 Sports

- Salomon

- Ride Snowboards

- Never Summer

- Lib Tech

- YES Snowboards

- Bataleon Snowboards

Recent Developments

- In March 2025, Burton launched a new line of carbon fiber splitboard bindings, emphasizing lightweight design and enhanced touring performance.

- In January 2025, Spark R&D introduced adjustable bindings with integrated performance analytics for professional riders, receiving global acclaim at winter sports exhibitions.

- In December 2024, Union Binding Company announced a sustainability initiative to produce eco-friendly splitboard bindings using recycled aluminum and responsibly sourced plastics.