Split Snowboards Market Size

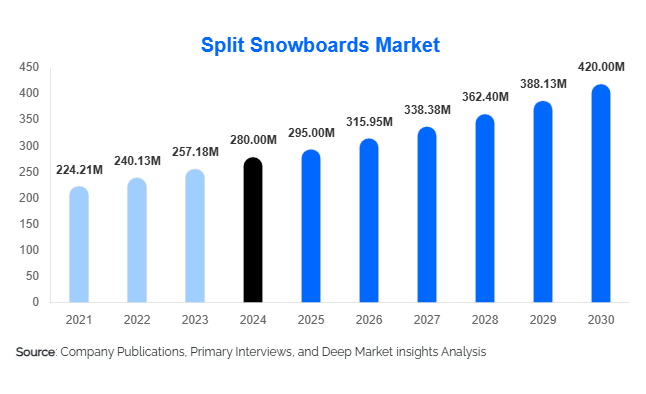

According to Deep Market Insights, the global split snowboards market size was valued at USD 280 million in 2024 and is projected to grow from USD 295 million in 2025 to reach USD 420 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by the increasing popularity of backcountry snowboarding, rising disposable income among adventure enthusiasts, and technological advancements in lightweight and high-performance splitboards.

Key Market Insights

- Alpine touring splitboards dominate global demand due to their stability and performance on steep terrains, appealing to both professional and recreational riders.

- Wood core and carbon fiber materials are leading choices, with wood cores preferred for durability and carbon fiber for lightweight performance in competitive segments.

- Recreational riders represent the largest end-use segment, while professional riders drive innovation in premium boards, and resort rentals contribute to institutional demand.

- North America holds the largest market share, led by the U.S. and Canada, owing to well-established winter sports infrastructure and high disposable income.

- Europe is the fastest-growing region, driven by Switzerland, Austria, and France, due to a strong winter sports culture and expanding backcountry infrastructure.

- E-commerce channels are increasingly shaping market access, enabling global consumers to purchase premium splitboards conveniently.

Latest Market Trends

Technological Advancements in Splitboards

Manufacturers are integrating advanced materials such as carbon fiber, hybrid composites, and lightweight cores to enhance board performance and safety. Modular designs and adjustable flex technologies are gaining traction, particularly among professional and semi-professional riders. These innovations cater to both competitive snowboarding and recreational backcountry enthusiasts, boosting adoption rates and willingness to pay premium prices.

Eco-Friendly and Sustainable Boards

Environmentally conscious consumers are increasingly demanding boards made from sustainably sourced wood and recyclable materials. Brands are investing in eco-friendly manufacturing, carbon-neutral processes, and sustainable packaging to differentiate their offerings. This trend is particularly strong in Europe, where regulatory frameworks and consumer awareness favor sustainable products.

Split Snowboards Market Drivers

Rising Popularity of Backcountry Snowboarding

Backcountry snowboarding is gaining momentum among adventure-seeking riders, driving demand for splitboards that enable off-piste exploration. Resorts and rental services are expanding backcountry offerings, increasing accessibility for recreational users and fostering higher adoption rates.

Technological Innovation in Materials

Lightweight composites, carbon fiber cores, and hybrid boards enhance maneuverability and performance. Riders are willing to pay a premium for advanced designs, which has led to growth in high-end and professional splitboard segments. Modular designs allow customization for terrain-specific needs, supporting broader market growth.

Growing Disposable Income and Adventure Tourism

Higher disposable incomes and increased participation in winter sports vacations in North America, Europe, and emerging APAC markets are driving market expansion. Adventure tourism initiatives, including backcountry snowboarding packages, are further supporting adoption across recreational and professional segments.

Market Restraints

High Product Costs

Premium splitboards, particularly those with carbon fiber and modular designs, remain expensive, limiting adoption among price-sensitive consumers in emerging markets. The high cost of raw materials and manufacturing complexity adds to pricing constraints.

Seasonality and Geographic Limitations

The split snowboard market is highly dependent on snow availability and winter seasons. Regions with limited snowfall experience low demand, creating seasonality in revenue generation and sales fluctuations.

Split Snowboards Market Opportunities

Emerging Market Expansion

Regions such as APAC (Japan, South Korea, China) and LATAM (Chile, Argentina, Brazil) are witnessing rising interest in adventure sports. Growth in disposable income, expanding ski resort infrastructure, and increasing winter tourism provide opportunities for both established brands and new entrants.

Integration of Smart and Performance Technologies

Innovations like GPS tracking, avalanche sensors, modular flex boards, and lightweight composites allow differentiation and performance enhancement. Companies investing in R&D and cutting-edge materials can capture higher market share in professional and premium segments.

Eco-Friendly Manufacturing

Environmentally conscious boards made from sustainably sourced wood, hybrid composites, and recyclable materials are increasingly popular. Brands focusing on eco-friendly processes can attract a growing demographic in Europe and North America and comply with evolving environmental regulations.

Product Type Insights

Alpine touring splitboards dominate the global market with approximately 42% share of revenue in 2024. Their stability and suitability for steep backcountry terrains make them preferred among both professionals and recreational riders. Freeride and freestyle boards are growing in popularity, driven by powder enthusiasts and trick-focused riders, but currently trail alpine touring boards in market share.

Material Insights

Wood core splitboards hold around 38% of the market in 2024, valued for durability and vibration absorption, particularly in heavy snow regions. Carbon fiber boards are rapidly growing among professionals due to their superior strength-to-weight ratio and agility, while fiberglass and hybrid composites capture cost-sensitive and mid-range segments.

End-Use Insights

Recreational riders form the largest end-use segment, accounting for roughly 55% of total demand. Professional riders drive innovation in premium boards, while ski resorts and rental services support institutional demand. Growing adventure tourism and winter sports packages are expected to expand recreational adoption in emerging markets.

Distribution Channel Insights

Specialty stores lead with a 45% market share, offering expert guidance and in-store fitting. E-commerce platforms are rapidly expanding, providing global access and personalized options, particularly appealing to younger demographics and international buyers. Sporting goods chains cater to mass-market consumers and growing casual adoption.

| By Product Type | By Material | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 35% of global splitboard demand in 2024, led by the U.S. and Canada. High disposable income, strong winter sports infrastructure, and a robust backcountry culture support growth. Colorado, Utah, and British Columbia are key demand centers.

Europe

Europe holds 30% of the market in 2024, driven by Switzerland, Austria, and France. Alpine skiing infrastructure, snowboarding culture, and emerging adventure tourism initiatives support growth. France is the fastest-growing country at 8.2% CAGR, fueled by new backcountry resorts and tourism promotion.

Asia-Pacific

APAC is emerging rapidly, with Japan, South Korea, and China leading adoption. Rising middle-class affluence and growing winter sports tourism are driving demand. China shows strong growth in premium and recreational segments, supported by ski resorts and snow parks.

Latin America

Chile and Argentina are experiencing a 7.5% CAGR, driven by adventure tourism and expanding ski infrastructure in the Andes. Niche operators target high-value tourists for customized backcountry experiences.

Middle East & Africa

Africa remains a niche for splitboards, with demand limited to luxury resorts in South Africa. The Middle East, led by the UAE, sees moderate adoption driven by high-income travelers seeking winter sport experiences abroad.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Split Snowboards Market

- Burton

- Jones Snowboards

- Arbor

- K2 Sports

- Lib Tech

- Voilé

- Spark R&D

- Prior Snowboards

- Gnu Snowboards

- Rome SDS

- Rossignol

- Salomon

- Never Summer

- Black Diamond

- Weston Snowboards

Recent Developments

- In May 2025, Jones Snowboards launched a new series of carbon-fiber splitboards optimized for backcountry racing and steep terrain stability.

- In April 2025, Burton expanded its eco-friendly line of splitboards in Europe, using sustainably sourced wood cores and recycled composites.

- In February 2025, Lib Tech introduced a modular flex splitboard, allowing riders to customize stiffness and performance for different snow conditions.