Spiritual Jewelry Market Size

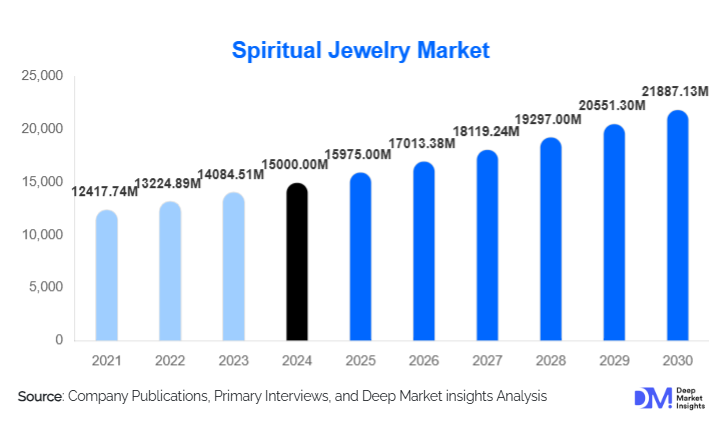

According to Deep Market Insights, the global spiritual jewelry market size was valued at USD 15,000.00 million in 2024 and is projected to grow from USD 15,975.00 million in 2025 to reach USD 21,887.13 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The spiritual jewelry market growth is primarily driven by the rising convergence of spirituality, wellness, and fashion, increasing consumer interest in mindfulness and emotional well-being, and growing demand for culturally symbolic and personalized jewelry across global markets.

Key Market Insights

- Spiritual jewelry is increasingly positioned as a wellness accessory, linked to mindfulness, meditation, and emotional balance rather than purely religious use.

- Bracelets and bead-based jewelry dominate product demand due to affordability, daily wear suitability, and association with chakra and energy-healing practices.

- Asia-Pacific leads global production and consumption, supported by deep-rooted spiritual traditions and strong export-oriented manufacturing ecosystems.

- North America represents the largest premium demand market, driven by wellness trends, personalization, and ethical sourcing preferences.

- Online direct-to-consumer channels account for the largest share, fueled by social commerce, influencer marketing, and customization tools.

- Mid-range pricing (USD 50–200) remains the fastest-growing segment, balancing affordability with authenticity and design quality.

What are the latest trends in the spiritual jewelry market?

Wellness-Oriented and Mindfulness Jewelry

Spiritual jewelry is increasingly marketed as a wearable wellness tool rather than a purely faith-based accessory. Products such as chakra bracelets, crystal pendants, and mantra necklaces are closely aligned with meditation, yoga, and holistic healing practices. Consumers perceive these products as sources of emotional grounding and stress relief, particularly in urban markets with rising mental health awareness. Brands are integrating wellness storytelling into product design, packaging, and marketing, positioning spiritual jewelry as part of daily self-care routines.

Customization and Ethical Transparency

Personalization has become a defining trend, with consumers seeking engraved mantras, birthstone combinations, and spiritually meaningful symbols tailored to individual beliefs. At the same time, ethical sourcing and transparency are gaining importance, especially in premium segments. Buyers increasingly demand traceability of gemstones and precious metals, fair-trade certification, and artisan-backed production narratives. Digital tools enabling customization and provenance verification are reshaping brand differentiation strategies.

What are the key drivers in the spiritual jewelry market?

Growing Global Focus on Mental Health and Mindfulness

The increasing prevalence of stress, anxiety, and burnout is driving consumers toward spiritual and symbolic products that offer emotional reassurance. Spiritual jewelry aligns naturally with meditation, mindfulness, and alternative healing practices, making it highly relevant within the expanding global wellness economy. This driver is particularly strong among Millennials and Gen Z consumers who value experiential and meaning-driven consumption.

Cultural Revival and Identity Expression

Consumers are increasingly embracing jewelry as a medium for expressing cultural heritage, spirituality, and personal belief systems. This trend has fueled renewed interest in traditional symbols, indigenous craftsmanship, and religious motifs, especially in emerging economies. Spiritual jewelry enables consumers to blend modern fashion with ancestral identity, supporting sustained demand across both domestic and export markets.

What are the restraints for the global market?

Commoditization and Price Sensitivity

The widespread availability of low-cost, mass-produced spiritual jewelry, particularly through online marketplaces, has increased price competition and diluted perceived value. Authentic brands face margin pressure as consumers struggle to differentiate between handcrafted products and imitations, especially in entry-level price segments.

Regulatory and Claim-Related Limitations

Marketing spiritual jewelry with healing or therapeutic claims is subject to regulatory scrutiny in several countries. Brands must carefully navigate consumer protection laws and avoid unverified claims, which can restrict aggressive marketing strategies and slow product adoption in regulated markets.

What are the key opportunities in the spiritual jewelry industry?

Integration with the Global Wellness Industry

The rapid expansion of the wellness industry presents strong opportunities for spiritual jewelry brands to collaborate with yoga studios, meditation platforms, wellness retreats, and holistic health practitioners. Positioning spiritual jewelry as an integral part of wellness ecosystems can unlock new demand channels and increase customer lifetime value.

Emerging Market Expansion and Artisan Exports

Rising disposable incomes and cultural affinity in regions such as Southeast Asia, Latin America, and Africa offer significant growth potential. Government-backed handicraft promotion programs and cross-border e-commerce platforms are enabling artisans and brands to scale internationally, creating opportunities for both local players and global entrants.

Product Type Insights

Bracelets represent the largest product segment, accounting for approximately 34% of the global market in 2024, driven by chakra and bead-based designs suited for daily wear. Necklaces and pendants follow with around 26%, benefiting from gifting and ceremonial demand. Prayer beads and malas remain significant in ritual and meditation use, while rings and earrings cater to fashion-forward spiritual consumers. Amulets and talismans maintain niche appeal, particularly in culturally specific markets.

Material Type Insights

Semi-precious stones dominate material usage, contributing nearly 38% of total market revenue, supported by a strong belief in gemstone symbolism and energy properties. Precious metals account for about 29%, driven by premium and luxury spiritual jewelry demand. Natural and organic materials such as rudraksha, wood, and seeds are growing steadily, particularly in traditional and eco-conscious segments.

Distribution Channel Insights

Online direct-to-consumer channels lead the market with approximately 46% share, driven by global reach, personalization capabilities, and social media-driven discovery. Specialty spiritual and metaphysical stores remain important for experiential purchasing, while jewelry retail chains contribute significantly to premium sales. Independent artisans and pilgrimage centers continue to play a vital role in culturally rooted markets.

End-Use Insights

Personal daily wear is the largest end-use segment, accounting for around 44% of demand, as consumers integrate spiritual jewelry into everyday lifestyles. Gifting and ceremonial use contribute approximately 27%, driven by festivals, religious milestones, and life events. Meditation and wellness-related usage is the fastest-growing segment, expanding at an estimated 12.6% CAGR, supported by the global wellness movement.

| By Product Type | By Material Type | By Spiritual Affiliation / Theme | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global spiritual jewelry market with approximately 38% share in 2024, supported by deep-rooted religious practices and high daily-wear adoption. India is the single largest contributor, accounting for nearly 18% of global demand, driven by strong domestic consumption, temple-linked purchases, and a well-established export ecosystem. China, Thailand, and Indonesia further support regional growth through large-scale manufacturing capabilities, cost-efficient supply chains, and cultural affinity for symbolic spiritual accessories across both traditional and modern designs.

North America

North America holds around 24% of the global market, led by the United States. Demand is primarily driven by wellness-oriented spirituality, personalized jewelry, and growing interest in mindfulness-based accessories. Premium customization, ethical sourcing, and gemstone transparency are key purchase factors. The region also represents the fastest-growing developed market, expanding at close to 9.8% CAGR, supported by strong e-commerce penetration and influencer-led consumer awareness.

Europe

Europe accounts for approximately 21% of the market share, with consistent demand across the U.K., Germany, France, and Italy. Consumer preference leans toward ethically sourced materials, artisanal craftsmanship, and minimalist spiritual designs rather than overt religious symbolism. Sustainability certifications and locally produced collections play an important role in purchasing decisions, particularly in Western European markets.

Middle East & Africa

The Middle East & Africa region represents around 9% of global demand, supported by strong cultural and religious traditions. Islamic spiritual jewelry drives demand in Turkey and the UAE, particularly for calligraphy-based designs and symbolic pendants. In Africa, artisan-led markets in Morocco and Egypt contribute through handcrafted silver and gemstone jewelry, often linked to heritage tourism and export-oriented craft industries.

Latin America

Latin America holds about 8% of the global market, with Brazil and Mexico emerging as high-growth countries. Demand is driven by syncretic spiritual practices, cultural symbolism, and increasing acceptance of spiritual jewelry as everyday fashion. Rising middle-class consumption and expanding online retail platforms are improving product accessibility across urban markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Manufactueres in the Spiritual Jewelry Industry

- Pandora

- Tiffany & Co.

- Swarovski

- Cartier

- Thomas Sabo

- Bulgari

- Chow Tai Fook

- Van Cleef & Arpels

- Malabar Gold & Diamonds

- Tanishq

- Chow Sang Sang

- Mikimoto

- Graff

- Harry Winston

- David Yurman