Solids Dosing Dispenser Market Size

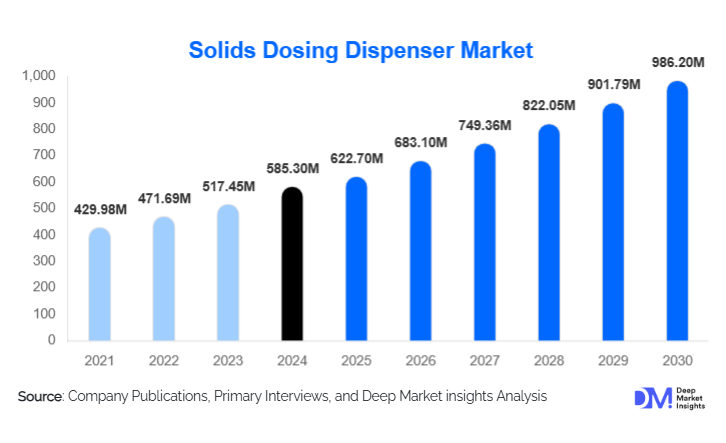

According to Deep Market Insights, the global solids dosing dispenser market size was valued at USD 585.3 million in 2024 and is projected to grow from USD 622.7 million in 2025 to reach USD 986.2 million by 2030, expanding at a CAGR of 9.7% during the forecast period (2025–2030). The market growth is primarily driven by increasing automation in chemical processing, water treatment, and pharmaceutical industries, along with growing adoption of precision dosing systems to improve efficiency, sustainability, and cost-effectiveness.

Key Market Insights

- Demand for automated and smart dosing systems is rising rapidly as industries transition toward digital process control and remote operation capabilities.

- Pharmaceutical and food sectors are driving precision dosing innovation, emphasizing hygiene, consistency, and contamination-free dispensing solutions.

- Europe currently leads the global market due to strong regulatory support for industrial automation and advanced manufacturing practices.

- Asia-Pacific is the fastest-growing region, propelled by rapid industrial expansion and increased water treatment infrastructure investment in China and India.

- Integration of IoT and real-time monitoring is transforming solids dosing dispenser functionality, enabling predictive maintenance and optimized dosing accuracy.

- Sustainability and energy-efficient dosing systems are gaining traction as companies pursue carbon reduction goals and resource optimization.

Latest Market Trends

Adoption of Smart and Connected Dispensers

Modern solids dosing dispensers are increasingly being equipped with IoT sensors and cloud-based monitoring tools, allowing operators to track performance parameters such as flow rate, dosage accuracy, and maintenance status in real time. This digital transformation supports predictive analytics, minimizing downtime and material waste. Smart dispensers are particularly gaining traction in chemical dosing, pharmaceuticals, and food processing sectors where precision and traceability are critical.

Shift Toward Hygienic and Modular Design

Manufacturers are prioritizing hygienic, modular, and easy-to-clean designs to meet the stringent requirements of the pharmaceutical, cosmetic, and food industries. Modular dispenser systems allow for flexible configurations, easy maintenance, and compatibility with automated production lines. These innovations are improving operational safety and compliance with GMP and FDA standards, while also reducing equipment downtime.

Solids Dosing Dispenser Market Drivers

Rising Industrial Automation

Growing demand for precision and repeatability across process industries is driving the adoption of automated solids dosing dispensers. Automation minimizes human error, ensures consistent batch quality, and enhances productivity. Industries such as chemicals, water treatment, and pharmaceuticals are increasingly integrating robotic and programmable dosing systems into their workflows, creating strong demand for high-performance dispensing technologies.

Stringent Quality and Environmental Regulations

Regulatory frameworks promoting safe and sustainable industrial practices are boosting the adoption of efficient solids dosing technologies. Environmental standards on waste reduction and chemical dosing accuracy are pushing industries to adopt automated systems that minimize overdosing, spillage, and emissions. Water treatment facilities and chemical plants, in particular, are investing heavily in accurate dosing technologies to meet compliance requirements.

Market Restraints

High Initial Installation and Integration Costs

Advanced solids dosing dispensers, particularly automated and IoT-enabled systems, involve significant upfront investment. The high cost of integration with existing production lines and the need for skilled operators can limit adoption among small and medium-sized enterprises (SMEs). Additionally, maintenance and calibration expenses add to the overall cost burden, especially in developing markets.

Operational Complexity and Maintenance Challenges

Although solids dosing dispensers enhance process accuracy, they can be prone to clogging, mechanical wear, and calibration drift when handling abrasive or hygroscopic materials. Ensuring long-term accuracy requires regular maintenance and technical expertise, which can be a restraint for facilities with limited technical capacity or budget.

Solids Dosing Dispenser Market Opportunities

Expansion in Water and Wastewater Treatment Applications

The growing emphasis on sustainable water management is creating substantial opportunities for solids dosing dispenser manufacturers. Accurate chemical dosing is essential in wastewater treatment plants to ensure proper coagulation, neutralization, and sludge management. Government investments in water infrastructure, especially in Asia-Pacific and the Middle East, are expected to drive long-term demand.

Integration of AI and Data Analytics

Artificial intelligence and machine learning are emerging as powerful tools to optimize dosing precision and operational efficiency. Advanced dispensers can now analyze historical data to predict material flow inconsistencies and automatically adjust dosing rates. The integration of AI enhances quality control, reduces waste, and supports predictive maintenance, offering strong growth prospects for smart dosing systems.

Product Type Insights

Volumetric dosing dispensers dominate the market due to their widespread use in food, chemical, and construction industries. Gravimetric dosing systems, however, are rapidly gaining share as industries demand higher precision and traceability. Hybrid systems combining both volumetric and gravimetric methods are also gaining traction for applications requiring both speed and accuracy. Compact and portable dosing units are increasingly popular in laboratory and pilot-scale operations, supporting R&D applications.

Application Insights

Chemical processing represents the largest application segment, driven by continuous dosing requirements in powder handling and formulation processes. Water and wastewater treatment is emerging as a fast-growing application due to global emphasis on clean water initiatives. Pharmaceuticals and food & beverage industries are adopting solids dosing dispensers to ensure consistent formulation and compliance with hygiene standards, while construction materials applications leverage these systems for cement and additive dosing precision.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Product Type Insights

Volumetric dosing dispensers dominate the market due to their widespread use in food, chemical, and construction industries. Gravimetric dosing systems, however, are rapidly gaining share as industries demand higher precision and traceability. Hybrid systems combining both volumetric and gravimetric methods are also gaining traction for applications requiring both speed and accuracy. Compact and portable dosing units are increasingly popular in laboratory and pilot-scale operations, supporting R&D applications.

Application Insights

Chemical processing represents the largest application segment, driven by continuous dosing requirements in powder handling and formulation processes. Water and wastewater treatment is emerging as a fast-growing application due to global emphasis on clean water initiatives. Pharmaceuticals and food & beverage industries are adopting solids dosing dispensers to ensure consistent formulation and compliance with hygiene standards, while construction materials applications leverage these systems for cement and additive dosing precision.

Regional Insights

Europe

Europe leads the solids dosing dispenser market due to strong industrial automation infrastructure and stringent environmental regulations. Germany, the U.K., and Italy are major markets, with key players emphasizing energy efficiency and compliance with EU safety directives. Increasing adoption in food and pharmaceuticals also drives growth across Western Europe.

North America

North America holds a significant market share owing to advanced manufacturing capabilities and early adoption of automated systems. The U.S. market benefits from strong demand in chemical processing, healthcare manufacturing, and municipal water treatment. Rising investments in smart factories and sustainability programs are further boosting adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, with China, India, and Japan leading demand. Industrial expansion, rising urbanization, and infrastructure investments in wastewater management are fueling rapid growth. The region is also witnessing increased adoption of cost-efficient modular systems by SMEs, driven by supportive government initiatives for industrial modernization.

Middle East & Africa

The Middle East & Africa market is growing steadily, supported by the expansion of desalination and water recycling plants. GCC nations are investing in industrial water management technologies, while South Africa and Egypt are seeing increased use of dosing systems in mining and wastewater treatment applications.

Latin America

Latin America’s market growth is driven by modernization in the chemical processing and food manufacturing industries, particularly in Brazil and Mexico. Increasing focus on water resource management and industrial efficiency is expected to support continued demand for dosing dispensers through 2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Solids Dosing Dispenser Market

- ProMinent GmbH

- Metito

- Lenntech

- Verder Group

- WAMGROUP

- SPX FLOW

- SEEPEX GmbH

- INOXPA S.A.

- NETZSCH Group

- Yamada Corporation

Recent Developments

- In July 2025, ProMinent launched its next-generation gravimetric dosing system with integrated cloud connectivity for predictive maintenance and real-time dosing analytics.

- In April 2025, WAMGROUP introduced a modular screw feeder system designed for improved powder flow consistency and reduced energy consumption in chemical processing plants.

- In February 2025, SPX FLOW announced the expansion of its European manufacturing facility to meet growing demand for automated solids handling and precision dosing systems.