Solar Lighting System Market Size

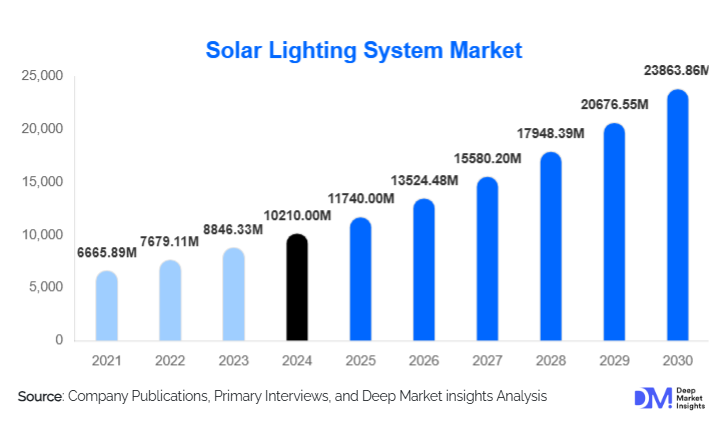

According to Deep Market Insights, the global solar lighting system market size was valued at USD 10,210 million in 2024 and is projected to grow from USD 11,740 million in 2025 to reach USD 23,863.86 million by 2030, expanding at a CAGR of 15.2% during the forecast period (2025–2030). The market growth is primarily driven by declining solar panel costs, increasing adoption of energy-efficient lighting solutions, government incentives for renewable energy, and rising demand for smart urban infrastructure and off-grid lighting solutions.

Key Market Insights

- Off-grid solar lighting systems dominate the market, especially in rural and remote areas where grid connectivity is limited, providing reliable and sustainable energy solutions.

- Technological advancements, including smart sensors, IoT integration, and high-efficiency photovoltaic cells, are transforming traditional lighting into intelligent, energy-efficient systems.

- Asia-Pacific leads the demand, with China and India driving adoption through government initiatives and urban infrastructure development.

- Government initiatives such as "Make in India" and "Made in China 2025" are promoting local manufacturing and reducing dependency on imports.

- Public infrastructure development is increasing demand for solar street lighting, parks, and public spaces in both developed and emerging economies.

- Renewable energy adoption trends and decreasing battery costs are enabling wider commercial, residential, and industrial adoption.

What are the latest trends in the solar lighting system market?

Smart and Connected Solar Lighting

Integration of IoT and smart sensors into solar lighting systems is transforming urban and commercial spaces. Smart solar lights now offer automated dimming, motion detection, remote monitoring, and predictive maintenance. Cities are deploying these solutions to optimize energy consumption, reduce operational costs, and enhance public safety. Commercial and industrial facilities are increasingly adopting solar lighting with AI-enabled energy management systems, allowing real-time monitoring and predictive energy analytics. These advancements attract both municipal planners and private developers, reinforcing solar lighting as a key component of smart city initiatives.

Shift Towards Off-Grid and Remote Area Lighting

Off-grid solar lighting systems continue to gain traction in remote and rural regions, particularly in the Asia-Pacific, Africa, and Latin America. These systems address power scarcity issues while minimizing carbon emissions. Remote villages and industrial facilities in off-grid areas are adopting solar street lighting, solar home lighting, and solar-powered outdoor lighting solutions. Governments and NGOs are also subsidizing off-grid projects to expand electricity access, creating significant growth opportunities for market players.

What are the key drivers in the solar lighting system market?

Environmental Sustainability and Energy Efficiency

Increasing environmental awareness and the global push toward reducing carbon footprints are major drivers. Solar lighting systems offer a renewable, low-emission alternative to conventional lighting, aligning with global sustainability goals. Adoption is particularly high in regions with supportive regulatory frameworks, where energy efficiency incentives encourage both private and public sector investments.

Declining Solar Panel and Battery Costs

Technological advancements and economies of scale have significantly lowered the cost of solar panels and battery storage, making solar lighting systems more affordable. Reduced upfront investment, combined with long-term energy savings, incentivizes adoption across residential, commercial, and industrial segments. This trend is accelerating deployment in emerging economies with limited grid access.

Government Incentives and Urban Infrastructure Development

Government initiatives promoting renewable energy adoption, including subsidies, tax breaks, and public infrastructure programs, are fueling demand. Smart city projects and urban modernization plans are integrating solar lighting systems in roads, parks, and public spaces, enhancing safety and reducing municipal energy expenditures. These programs create stable demand and attract new market entrants.

What are the restraints for the global market?

High Initial Investment Costs

Despite decreasing solar panel costs, the initial investment for solar lighting systems remains higher than conventional lighting solutions. This can deter adoption, especially in cost-sensitive regions. Financing options, leasing programs, and government subsidies are mitigating this challenge, but upfront costs continue to be a key restraint.

Maintenance and Technical Challenges

In remote regions, maintenance issues and a lack of technical expertise can limit system performance and lifecycle. Proper installation, periodic battery replacement, and technical support are critical to ensure consistent performance, which can hinder growth if not managed effectively.

What are the key opportunities in the solar lighting system industry?

Integration with Smart City Initiatives

Urban centers globally are focusing on smart infrastructure, creating opportunities for solar lighting systems integrated with IoT, energy management platforms, and real-time monitoring. This integration allows municipalities to reduce operational costs, optimize energy consumption, and improve public safety, driving demand for technologically advanced solar lighting solutions.

Expansion in Emerging Markets

Emerging economies in Africa, Latin America, and Southeast Asia present significant growth potential. Government programs targeting rural electrification and urban modernization are increasing demand for solar street lights and off-grid solutions. These regions offer opportunities for both local manufacturers and global suppliers to expand market presence and tap into unmet energy needs.

Technological Innovation and IoT Integration

New technologies, including high-efficiency PV panels, advanced battery systems, and IoT-based smart lighting controls, are creating differentiation opportunities for market players. Companies focusing on R&D and product innovation can capture market share by offering cost-effective, reliable, and connected solar lighting solutions across diverse applications.

Product Type Insights

Off-grid solar lighting systems dominate the market, accounting for approximately 45% of the 2024 market. These systems are highly favored in rural areas and remote locations due to the lack of reliable grid connectivity. Grid-tied solar lighting systems, while growing, currently occupy a smaller share, primarily deployed in commercial and urban infrastructure projects where grid access exists. Portable and hybrid systems are gaining interest for residential and temporary commercial applications, offering flexibility and convenience.

Application Insights

Street lighting represents the largest application segment, accounting for nearly 50% of global demand in 2024. Urban modernization and smart city initiatives are driving deployment in public roads, parks, and parking facilities. Commercial and residential outdoor lighting applications are also expanding, particularly in regions with incentives for sustainable energy adoption. Industrial and remote infrastructure applications, such as mining or agricultural lighting, are emerging as niche opportunities.

Distribution Channel Insights

Direct sales from manufacturers and specialized distributors dominate the market, particularly in commercial and industrial segments. Online platforms are increasingly being used for residential and small-scale commercial solutions, offering cost transparency and convenient ordering. Government procurement programs are also significant channels for large-scale public infrastructure projects, while partnerships with construction and urban development companies are enhancing reach in emerging regions.

End-Use Insights

Residential and commercial segments are witnessing the fastest growth. Urbanization, rising electricity costs, and environmental awareness are driving adoption in homes and businesses. Public infrastructure projects, particularly street lighting and parks, remain the largest end-use segment, supported by government initiatives. Industrial applications, such as remote mining and agricultural operations, are emerging as niche end-use segments with high potential for growth.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for approximately 20% of the global market in 2024. The U.S. leads adoption due to federal incentives, urban modernization programs, and smart city projects. Canada is also growing steadily, driven by rural electrification and renewable energy policies.

Europe

Europe held around 18% of the market in 2024, with Germany, France, and the U.K. leading adoption. Strong environmental regulations, renewable energy incentives, and urban infrastructure projects are driving growth. The region emphasizes energy-efficient and smart lighting systems for public infrastructure and commercial spaces.

Asia-Pacific

Asia-Pacific is the fastest-growing region, particularly driven by China and India. Government initiatives, rapid urbanization, and rural electrification programs are boosting demand. Industrial applications in remote areas are also contributing to regional growth.

Latin America

Brazil and Mexico are leading regional demand, focusing on urban and rural electrification projects. Adoption is slower than in Asia-Pacific but presents growth opportunities through infrastructure modernization and renewable energy initiatives.

Middle East & Africa

Africa’s solar lighting market is driven by off-grid applications in remote areas, with South Africa, Kenya, and Nigeria leading adoption. The Middle East focuses on commercial and urban lighting projects, particularly in the UAE, Saudi Arabia, and Qatar.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Solar Lighting System Market

- Philips Lighting

- Havells India Limited

- Schneider Electric

- Siemens AG

- SunPower Corporation

- SolarTech

- Greenlight Planet

- Koninklijke Philips N.V.

- OSRAM Licht AG

- Wipro Lighting

- ABB Ltd

- LG Electronics

- GE Lighting

- Kyocera Corporation

- Delta Electronics

Recent Developments

- In March 2025, Greenlight Planet launched new solar street lighting systems in India with IoT-based remote monitoring and enhanced battery life.

- In January 2025, Philips Lighting introduced a smart solar lighting solution for urban infrastructure in Europe, focusing on energy efficiency and automated controls.

- In December 2024, Havells India completed a large-scale deployment of solar home lighting kits in rural areas under government electrification programs.