Soft Foam Ear Plugs Market Size

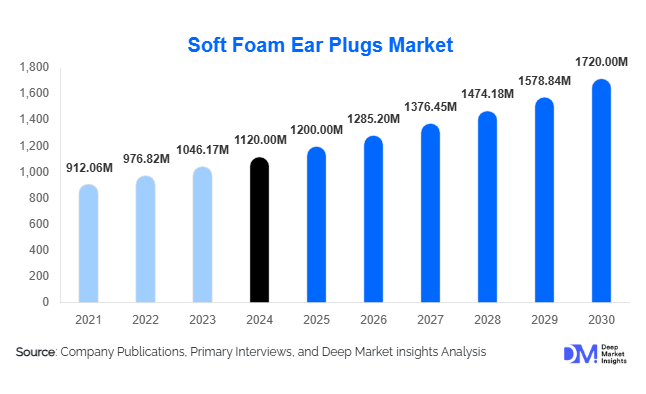

According to Deep Market Insights, the global soft foam earplugs market size was valued at USD 1,120 million in 2024 and is projected to grow from USD 1,200 million in 2025 to reach USD 1,720 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by increasing industrial noise protection regulations, rising awareness of noise-induced hearing loss, and the adoption of innovative foam materials, enhancing comfort and acoustic attenuation.

Key Market Insights

- Industrial and occupational safety applications dominate the market, driven by compliance with global workplace safety regulations and rising industrialization in emerging economies.

- Technological innovations in foam materials, such as memory foam and hypoallergenic options, are increasing product adoption across healthcare, personal, and recreational segments.

- North America currently holds the largest market share, led by strong regulatory frameworks and high consumer awareness of hearing protection.

- Asia-Pacific is the fastest-growing region, fueled by rapid industrial expansion, urban noise pollution, and increasing disposable incomes in China and India.

- Personal and recreational usage is rising, with demand for travel, sleep, and leisure applications contributing significantly to market growth.

- Export opportunities and e-commerce adoption are enabling manufacturers in APAC and Europe to reach high-demand regions like North America efficiently.

What are the latest trends in the soft foam earplugs market?

Technological Advancements in Foam Materials

Soft foam earplugs are increasingly incorporating memory foam and hypoallergenic materials to improve comfort, fit, and noise attenuation. Memory foam plugs conform to the ear canal, offering superior protection and repeated use potential. Hypoallergenic materials cater to sensitive skin, expanding adoption in healthcare and personal use segments. Innovations also include reusable foam plugs and ergonomic designs targeting premium consumers. These advancements are helping manufacturers differentiate products and meet evolving customer expectations.

Rising Personal and Recreational Use

Growing urban noise pollution, increasing awareness of sleep hygiene, and the popularity of leisure activities such as concerts, travel, and sports events are boosting personal and recreational demand. Consumers are seeking high-quality, comfortable earplugs that can be used during sleep, travel, and music events. Online retail platforms have further facilitated access to these products, allowing consumers to explore options and purchase specialized earplugs conveniently. This trend is accelerating market expansion beyond traditional industrial segments.

What are the key drivers in the soft foam earplugs market?

Industrial Noise Protection Regulations

Global occupational safety regulations are driving widespread adoption of earplugs in industries such as manufacturing, construction, and mining. Employers are mandated to provide hearing protection for employees exposed to high noise levels, creating a significant and consistent demand base for industrial-grade soft foam earplugs. Regulatory compliance is especially strong in North America and Europe, ensuring continued market growth.

Increasing Awareness of Noise-Induced Hearing Loss

Awareness campaigns and public health initiatives are educating consumers about the long-term risks of exposure to loud environments. This trend has increased adoption in personal use applications, including sleep, travel, and leisure activities. Younger demographics, influenced by social media and wellness trends, are particularly contributing to growth in this segment.

Innovation in Comfort and Materials

Advancements in foam technology, such as memory foam and hypoallergenic materials, have enhanced comfort and noise reduction capabilities. Reusable designs and ergonomic shapes allow for better fit, contributing to repeat purchases and premium pricing opportunities. Manufacturers leveraging these innovations are gaining market share in both industrial and consumer segments.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

High-quality foam earplugs are relatively expensive, limiting their adoption in price-sensitive regions such as Africa and parts of the Asia-Pacific. Consumers in these markets often opt for cheaper alternatives such as silicone plugs or earmuffs, restricting market penetration.

Competition from Alternative Hearing Protection Devices

Alternative products, including electronic noise-canceling devices, silicone earplugs, and earmuffs, pose competition to soft foam earplugs. These alternatives may offer perceived higher comfort or technology-based noise reduction, slowing adoption in certain segments.

What are the key opportunities in the soft foam earplugs market?

Industrial Expansion in Emerging Economies

Countries such as India, Vietnam, and Indonesia are witnessing rapid industrialization and stricter workplace safety regulations. These markets offer opportunities for manufacturers to expand industrial-grade ear plug adoption and supply chains, benefiting from increasing noise protection compliance requirements.

Integration of Advanced Foam Materials

Innovations such as memory foam, hypoallergenic materials, and reusable designs enable premium product differentiation. Targeting healthcare, personal, and recreational segments with high-value products provides significant growth potential for both new and established players.

Rising Personal and Recreational Awareness

Increasing urbanization and exposure to noise pollution are driving demand for earplugs for sleep, travel, and leisure. Manufacturers can target niche segments like concert-goers, travelers, and wellness-conscious consumers, offering specialized designs and marketing campaigns tailored to personal use.

Product Type Insights

Tapered soft foam earplugs dominate the market (45% share) due to superior fit and comfort. Cylindrical foam plugs are preferred in industrial settings for ease of mass deployment, while pre-molded plugs are gaining traction in the premium personal use segment due to reusability and ergonomic design. Market trends show steady growth in premium and reusable designs.

Material Insights

Polyurethane foam accounts for 50% of the market share in 2024 due to excellent noise attenuation, comfort, and low weight. Memory foam is emerging as a preferred choice in premium personal and healthcare applications, while PVC foam remains cost-effective for industrial bulk usage.

End-Use Insights

Industrial & occupational safety represents the largest end-use (55% share), driven by regulatory compliance and workplace safety initiatives. Personal and recreational usage is growing fastest (8% CAGR), fueled by urban noise awareness, leisure activities, and sleep hygiene. Healthcare applications, including hospital noise reduction, are emerging as high-value markets. Export-driven demand from APAC to North America and Europe supports further growth.

Distribution Channel Insights

Offline retail remains dominant (60% share) due to pharmacies, industrial suppliers, and specialty stores. Online platforms, however, are experiencing rapid growth, driven by direct-to-consumer convenience, e-commerce penetration, and targeted marketing campaigns.

| By Product Type | By Material | By Application / End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 35% of the market in 2024. Strong regulations, high awareness, and industrial adoption drive demand. The U.S. leads with widespread industrial and personal use, while Canada shows steady growth, particularly in occupational safety applications.

Europe

Europe accounts for 30% of the market. Germany and the UK dominate due to stringent workplace safety laws, with Eastern Europe showing the fastest growth (6.5% CAGR). Consumer awareness and adoption for personal use are also expanding, particularly in urban regions.

Asia-Pacific

Asia-Pacific is the fastest-growing region (8.5% CAGR), led by China and India. Rising industrialization, urban noise pollution, and disposable income growth are driving both industrial and personal usage. Japan and Australia show steady demand for premium and personal-use earplugs.

Middle East & Africa

Moderate growth (5% CAGR) is observed, driven by industrial applications in GCC countries and increasing awareness of occupational safety. South Africa is a key industrial market within the region.

Latin America

Brazil leads in the region with demand from industrial and recreational applications (5.5% CAGR). Outbound demand for high-quality imported earplugs is increasing among affluent consumers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Soft Foam Ear Plugs Market

- 3M

- Honeywell

- Moldex

- Howard Leight (Sperian)

- Kimberly-Clark

- Uvex

- Alpha Solway

- JSP

- Bullard

- Sordin

- ProGuard

- Delta Plus

- Peltor

- Klingspor

- Tingley

Recent Developments

- In 2025, 3M launched new memory foam earplugs with enhanced acoustic attenuation and hypoallergenic properties, targeting industrial and personal use.

- In 2025, Honeywell expanded its industrial earplug production in India and China to meet rising demand in the APAC region.

- In 2024, Moldex introduced reusable soft foam earplugs for premium personal and healthcare segments, increasing product adoption in Europe and North America.