Snowboards Market Size

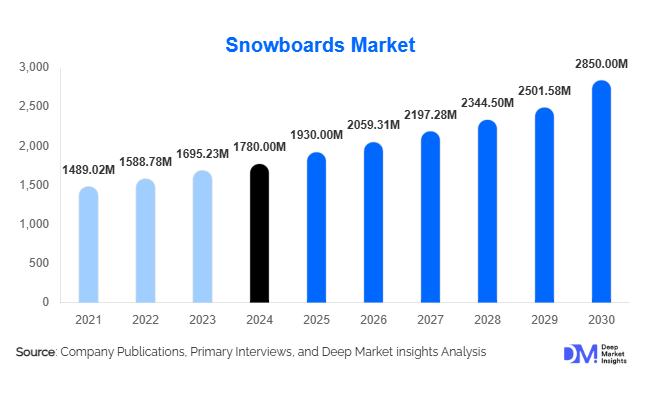

According to Deep Market Insights, the global snowboards market size was valued at USD 1,780 million in 2024 and is projected to grow from USD 1,930 million in 2025 to reach USD 2,850 million by 2030, expanding at a CAGR of 6.7% during the forecast period (2025–2030). The snowboard market growth is primarily driven by increasing participation in winter sports, rising investments in ski resorts and snowboarding facilities, and product innovation focused on lightweight, eco-friendly, and performance-enhancing snowboards.

Key Market Insights

- All-mountain boards dominate due to their versatility, capturing a major share of the global market.

- North America leads globally, accounting for the highest demand in 2024 with a strong snowboard culture in the U.S. and Canada.

- Europe follows closely, supported by well-established ski resorts in France, Switzerland, Austria, and Italy.

- Asia-Pacific is the fastest-growing region, led by rising snowboard participation in Japan, China, and South Korea.

- Technological innovation, including eco-friendly materials, hybrid camber-rocker designs, and AI-driven customization, is shaping product development.

- Rental and e-commerce sales channels are expanding rapidly, enabling accessibility for both beginners and international travelers.

Latest Market Trends

Eco-Friendly Snowboard Manufacturing

Sustainability is gaining momentum in the snowboard market, with manufacturers adopting bio-based resins, recycled cores, and FSC-certified wood. Companies are introducing snowboards that minimize carbon footprints without compromising performance. Brands are also experimenting with algae-based laminates and natural wax alternatives, appealing to environmentally conscious riders. This aligns with broader sustainability initiatives across the sporting goods sector, creating a premium niche for eco-friendly boards.

Customization and Technology Integration

Snowboarders increasingly seek personalized gear tailored to riding style, terrain, and skill level. AI-driven customization platforms are enabling brands to design boards based on rider weight, stance, and preferred riding environment. Technologies such as smart sensors integrated into boards are being tested to analyze performance metrics, including speed, turning radius, and air time, enhancing both training and competitive use. This integration of data-driven insights is attracting younger, tech-savvy consumers.

Snowboards Market Drivers

Rising Popularity of Winter Sports

Global participation in winter sports has expanded, supported by the inclusion of snowboarding in the Winter Olympics and X-Games. Youth participation and growing exposure through social media have also boosted demand, making snowboarding one of the fastest-growing winter activities. This is driving consistent sales of both entry-level and advanced boards.

Resort and Infrastructure Development

Investment in ski resorts across North America, Europe, and Asia-Pacific has created new opportunities for snowboarding. Countries like China have expanded ski infrastructure ahead of major events such as the Winter Olympics, while Japan and South Korea continue to attract international snowboard tourists. This has supported both snowboard equipment sales and rental markets.

Product Innovation and Performance Enhancement

Lightweight composites, rocker-camber hybrid profiles, and improved binding systems are enhancing snowboard performance. These innovations cater to both professionals and recreational snowboarders seeking better maneuverability, stability, and durability. Custom board design and direct-to-consumer sales are also enabling brands to strengthen their positioning.

Restraints: High Cost and Climate Dependency

Snowboarding remains an expensive sport, with high equipment and resort costs limiting participation in developing regions. Moreover, climate change and declining snowfall in certain regions are constraining growth potential, as shorter winter seasons impact demand for snowboards and rentals.

Snowboards Market Opportunities

Emerging Asian Markets

China, Japan, and South Korea are rapidly expanding snowboard adoption. With government-backed investments in ski infrastructure and rising middle-class spending on adventure sports, the Asia-Pacific region presents strong untapped potential. International brands are actively expanding retail and rental services in these regions to capture demand.

Technology-Enabled Customization

AI-driven board personalization and 3D-printed snowboard prototypes offer opportunities for brands to differentiate themselves. Personalized product lines can command higher margins while appealing to riders seeking unique experiences. Integrating IoT sensors into boards also opens up training-focused niche markets for competitive athletes.

Sustainability and Eco-Friendly Boards

Growing consumer preference for sustainable products provides a significant growth avenue. Boards made from bamboo cores, recycled plastics, and bio-resins are gaining traction. Brands that prioritize transparency in supply chains and promote eco-credentials are expected to capture a premium market share in environmentally conscious regions such as Europe and North America.

Product Type Insights

All-Mountain Snowboards dominate the global market, accounting for approximately 42% of the total market share in 2024. Their adaptability across terrains, from groomed slopes to powder conditions, makes them the preferred choice for both beginners and seasoned riders. The segment’s leadership is supported by increasing participation of recreational snowboarders who favor multipurpose boards over specialized freestyle or alpine boards.

End-Use Insights

Recreational snowboarding is the largest end-use segment, driven by demand from casual riders and tourists at ski resorts. Professional and competitive snowboarding also contributes significantly, with global competitions fueling product innovation. Rental demand is rising sharply, especially in regions like Europe and Asia-Pacific, where tourists prefer short-term access to snowboards. The rental market is projected to grow at over 8% CAGR, supporting overall equipment demand.

| By Product Type | By End-Use/Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share of the snowboards market, representing around 38% of global demand in 2024. The U.S. dominates, driven by established snowboard culture, extensive ski resorts, and high disposable incomes. Canada also contributes significantly, with British Columbia and Alberta serving as snowboard tourism hubs.

Europe

Europe accounts for nearly 32% of the global market in 2024. France, Switzerland, Austria, and Italy lead in demand, supported by world-class ski infrastructure and international tourism. Increasing participation in winter sports festivals and competitions strengthens demand for premium snowboards.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a CAGR above 9% during 2025–2030. Japan remains a mature market with steady demand, while China and South Korea are emerging rapidly with government-backed ski infrastructure investments. China is expected to become one of the largest future markets post-2030, given its expanding snowboard community.

Latin America

Latin America remains a niche market, with Argentina and Chile being the primary contributors due to the Andes mountain range. Growth is seasonal but attracts international snowboarders seeking off-season experiences.

Middle East & Africa

While limited in natural snowboarding destinations, indoor snow parks in the UAE and Saudi Arabia are driving niche demand. South Africa also records small-scale snowboard adoption among enthusiasts traveling abroad.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Snowboards Market

- Burton Snowboards

- K2 Sports

- Ride Snowboards

- GNU Snowboards

- Lib Tech

- Capita Snowboards

- Jones Snowboards

- Salomon Snowboards

- Arbor Collective

- Rome SDS

- YES. Snowboards

- Never Summer Industries

- Bataleon Snowboards

- Rossignol

- Nidecker

Recent Developments

- In January 2025, Burton launched a new line of eco-friendly boards using bio-based resins and FSC-certified cores.

- In March 2025, Jones Snowboards introduced an AI-powered customization tool for riders, enabling personalized snowboard designs online.

- In April 2025, Capita Snowboards announced the expansion of its Austrian manufacturing facility with renewable energy-powered production.