Snowboard Bindings Market Size

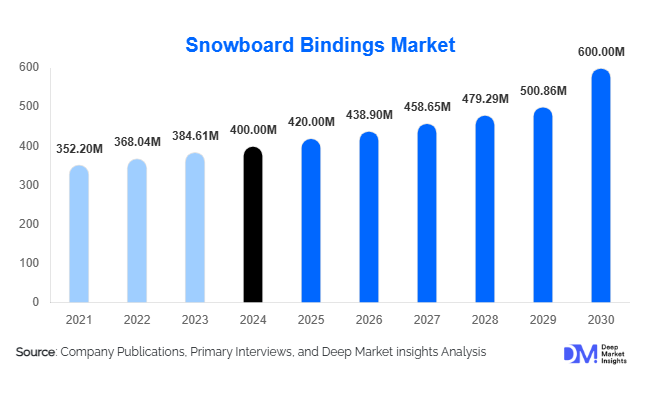

According to Deep Market Insights, the global snowboard bindings market size was valued at USD 400 million in 2024 and is projected to grow from USD 420 million in 2025 to reach USD 600 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing participation in snowboarding activities, rising adoption of advanced binding technologies, and expansion of winter sports tourism across North America, Europe, and the Asia-Pacific regions.

Key Market Insights

- Technological innovation is transforming snowboard bindings, with smart sensors, adjustable flex systems, and lightweight composite materials enhancing performance and safety.

- Sustainability trends are influencing consumer preferences, with eco-friendly bindings made from recycled or sustainable materials gaining popularity among environmentally conscious riders.

- North America dominates the snowboard bindings market, driven by established snowboarding culture, well-developed infrastructure, and high winter sports participation rates.

- Europe represents a mature market, with countries such as Switzerland, Austria, and France showing strong demand for performance-oriented and premium bindings.

- Asia-Pacific is the fastest-growing region, supported by emerging winter sports facilities, rising middle-class income, and increasing popularity of snowboarding in countries like Japan, China, and South Korea.

- Online retail channels are gaining traction, providing convenience, a wider selection, and easy comparison of snowboard bindings for consumers globally.

Latest Market Trends

High-Tech and Performance-Focused Bindings

Snowboard bindings are increasingly incorporating advanced technology, including customizable flex systems, quick-entry mechanisms, and smart sensors for performance tracking. These features enhance rider comfort, control, and responsiveness on various terrains. Riders are seeking bindings that allow fine-tuning for specific styles such as freestyle, all-mountain, or backcountry riding. Manufacturers are also focusing on lightweight and durable composite materials that reduce fatigue and improve performance, driving demand for mid-range and premium segments.

Sustainability and Eco-Friendly Materials

Growing awareness of environmental issues is shaping the development of snowboard bindings. Brands are adopting recycled plastics, plant-based composites, and eco-conscious production processes. Consumers increasingly favor products that align with sustainability values, particularly in Europe and North America. Eco-friendly bindings also appeal to younger riders who prioritize ethical consumption, reinforcing the market trend toward sustainable winter sports equipment.

Snowboard Bindings Market Drivers

Increasing Participation in Snowboarding

The rising popularity of snowboarding among recreational and competitive riders globally is a key growth driver. Winter sports tourism, especially in North America and Europe, is expanding, with ski resorts offering improved snowboarding facilities. This trend boosts demand for high-quality bindings suitable for diverse riding styles.

Technological Advancements

Innovations such as adjustable highbacks, ergonomic straps, and sensor-enabled bindings are enhancing user experience. Performance-oriented riders seek bindings that offer control, durability, and comfort, prompting manufacturers to focus on product R&D and differentiation.

Expansion of Winter Sports Tourism

The development of ski resorts and snowboarding infrastructure in emerging markets such as Asia-Pacific, including Japan, South Korea, and China, is fueling global demand. Improved facilities and promotional campaigns are encouraging participation, further boosting market growth.

Market Restraints

High Cost of Premium Bindings

Advanced snowboard bindings are often priced at a premium, which may limit adoption among recreational riders or beginners. The high initial investment can restrict market penetration in price-sensitive regions.

Seasonal Demand Fluctuations

Snowboard binding sales are highly seasonal, peaking during winter months in key markets. This seasonal nature poses challenges for manufacturers and retailers, including inventory management, revenue predictability, and production planning.

Snowboard Bindings Market Opportunities

Integration of Smart Technologies

There is growing potential for integrating sensors, app connectivity, and performance tracking features into snowboard bindings. These innovations allow riders to monitor their riding style, enhance safety, and optimize performance, creating a niche for high-tech bindings targeting competitive and tech-savvy consumers.

Growth in Emerging Markets

Asia-Pacific and Latin America are emerging markets for winter sports. Countries like Japan, China, South Korea, and Argentina are investing in ski resorts and snowboarding infrastructure, presenting opportunities for binding manufacturers to expand their footprint and cater to increasing demand.

Sustainable Product Development

Consumer preference for environmentally friendly products is creating opportunities for manufacturers to develop bindings using recycled materials, plant-based composites, and low-impact production processes. Sustainability-focused marketing can attract younger demographics and environmentally conscious riders, strengthening brand loyalty and market penetration.

Product Type Insights

Strap bindings dominate the market due to their versatility and compatibility with different boot types, accounting for approximately 60% of global market share in 2024. Rear-entry and step-in bindings are gaining traction in niche segments, appealing to riders seeking convenience and quick adjustments. Composite materials are preferred in premium bindings for their lightweight and durable properties, while mid-range bindings balance performance and affordability, appealing to recreational riders.

Application Insights

Recreational snowboarding represents the largest end-use segment, accounting for nearly 70% of market demand. Competitive and professional riders drive demand for high-performance bindings, while ski resorts, rental shops, and winter sports training facilities are also key buyers. Emerging applications include freestyle and backcountry snowboarding, which require specialized bindings for enhanced maneuverability and safety.

Distribution Channel Insights

Online retail channels are experiencing rapid growth due to convenience, price transparency, and wider product selection. Specialty sports stores remain critical for professional riders seeking expert guidance. Direct manufacturer sales and partnerships with ski resorts are also contributing to distribution, with some brands offering rental or subscription-based models to increase accessibility.

Traveler Type Insights

Recreational snowboarders dominate the market, with mid-range bindings preferred for affordability and performance. Competitive riders focus on high-end, performance-oriented bindings. Beginners often opt for entry-level or rental options, while tech-savvy riders are drawn to smart bindings with advanced features. Growth in winter sports tourism has expanded the consumer base across all age groups and skill levels.

Age Group Insights

Riders aged 18–35 years account for the largest share due to high participation rates and interest in adventure sports. Ages 36–50 years are increasingly adopting premium bindings for recreational use. Riders above 50 years represent a smaller, niche segment, often prioritizing comfort, ease of use, and safety in binding selection.

| By Product Type | By Application / Riding Style | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 40% in 2024. The U.S. and Canada drive demand due to established snowboarding culture, well-developed infrastructure, and high participation rates. Premium and mid-range bindings are particularly popular among recreational and competitive riders. Investment in winter sports resorts and rental facilities continues to support growth.

Europe

Europe accounts for nearly 30% of the global market. Countries such as Switzerland, Austria, France, and Germany are key consumers, driven by strong winter sports participation and performance-oriented riders. The trend toward eco-friendly bindings is also prominent, reflecting growing sustainability awareness among consumers. Seasonal tourism and competitive snowboarding events further stimulate demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by Japan, China, and South Korea. Investments in ski resorts, increased middle-class income, and the rising popularity of snowboarding contribute to rapid adoption. Online sales channels are particularly influential, enabling wider reach in this emerging market.

Latin America

Latin America is a smaller but growing market, with Argentina, Chile, and Brazil investing in winter sports infrastructure. Growth is driven by adventure tourism and niche winter sports activities, with mid-range bindings preferred for cost-effectiveness.

Middle East & Africa

The Middle East has a small but affluent consumer base, mainly in the UAE, Saudi Arabia, and Qatar, focusing on premium bindings. Africa remains primarily a manufacturing hub rather than a key consumption market, with growth concentrated in South Africa’s winter sports facilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Snowboard Bindings Market

- Burton

- Union Binding Company

- Ride Snowboards

- Salomon Snowboards

- Flow

- Rome SDS

- Arbor

- K2 Sports

- Nidecker

- GNU

- Rossignol

- DC Shoes

- ThirtyTwo

- Specialized Snowboards

- Capita Snowboards

Recent Developments

- In March 2025, Burton launched a new line of eco-friendly snowboard bindings using recycled materials and lightweight composites.

- In February 2025, Union Binding Company introduced smart bindings with integrated sensors for performance tracking and mobile app connectivity.

- In January 2025, Salomon Snowboards expanded its mid-range bindings portfolio in Asia-Pacific, targeting emerging snowboarding markets in Japan and China.