Smart Toilet Seat Market Size

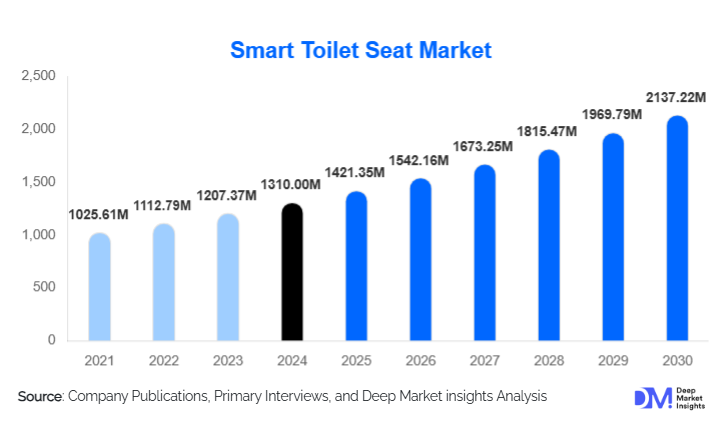

According to Deep Market Insights, the global smart toilet seat market size was valued at USD 1,310 million in 2024 and is projected to grow from USD 1,421.35 million in 2025 to reach USD 2,137.22 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). This robust growth is being driven by rising hygiene awareness, the proliferation of smart home ecosystems, and increasing demand for water-efficient and connected bathroom solutions.

Key Market Insights

- Bidet-enabled smart seats dominate, leveraging strong consumer preference for cleansing, especially in regions with cultural acceptance of bidet usage.

- Energy-efficient instant water heating technology (on-demand) is outpacing reservoir-based heating, as users prioritize lower energy consumption.

- Retrofit smart seat attachments remain the most popular form, because they enable consumers to upgrade existing toilets without full replacement.

- Residential adoption leads the market, with homeowners investing in comfort, wellness, and smart-home integration.

- Offline retail remains critical, especially for premium models, since consumers often prefer to test and compare features in showrooms.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising income levels, rapid urbanization, and strong cultural affinity toward bidet cleansing.

Latest Market Trends

Health-Monitoring and Wellness Integration

Smart toilet seats are increasingly being positioned not just as hygiene appliances but as wellness devices. Leading manufacturers are embedding sensors to track weight, body composition, and even hydration levels. These insights are linked to smartphone apps or cloud platforms, allowing users to monitor health trends over time. This trend aligns with broader consumer interest in preventive health and home-based health monitoring, converting a bathroom fixture into a daily health touchpoint.

Sustainability & Energy Efficiency

There is a growing emphasis on eco-friendly design: on-demand heating systems reduce standby power use, while water-saving bidet wash cycles help conserve water. Moreover, some smart seats are being designed with modular and repairable parts to extend product life. Manufacturers are also experimenting with bio-based plastics or recycled materials in seats, responding to consumer demand for sustainable and circular-economy products.

Growing Retrofits in Emerging Markets

Smart seat attachments are rapidly gaining traction in emerging markets where replacing the entire toilet bowl is cost-prohibitive. Retrofit models allow consumers to modernize their bathrooms without major plumbing or construction work. This trend is especially strong in urbanizing markets across Asia-Pacific and the Middle East, where rising middle-class incomes and aspirations for smart-home upgrades are fueling retrofit demand.

Smart Toilet Seat Market Drivers

Hygiene & Infection Prevention Demand

Heightened sensitivity to hygieneamplified by the global pandemic, accelerated the adoption of bidet cleansing, self-cleaning nozzles, and UV sterilization in toilet seats. These hygiene-centric features reduce reliance on toilet paper and minimize the risk of contamination, making smart seats especially appealing for health-conscious consumers.

Smart Home Ecosystem Integration

The rapid spread of connected home deviceslike lighting, security systems, and thermostats pushing smart toilet seats into the same ecosystem. Seats that support app-based control, voice commands, and automatic lid operation (via occupancy sensors) are increasingly seen as natural extensions of smart-home living, thereby driving consumer adoption.

Aging Population & Assisted Living Needs

In many developed markets, the rise in elderly and mobility-impaired populations is creating demand for toilet seats that provide comfort, safety, and dignity. Features such as heated seating, remote-controlled bidets, automatic lid lifting, and health-monitoring sensors reduce the physical burden and offer enhanced sanitation, making smart toilet seats particularly attractive in residential and healthcare / elder-care settings.

Market Restraints

High Upfront Costs

Smart toilet seats, especially those with advanced features like app connectivity, bidet cleansing, and self-cleaning, often come with a premium price tag. This initial cost is particularly prohibitive in price-sensitive or emerging markets, which slows penetration.

Limited Awareness and Infrastructure Barriers

In many regions, consumers still lack awareness of the benefits of smart toilet seats. Misconceptions or low familiarity with features such as bidets or smart controls can limit adoption. Additionally, in areas with unreliable electricity supply, inconsistent water pressure, or limited plumbing infrastructure, installations become technically challenging.

Smart Toilet Seat Market Opportunities

Wellness-Driven Innovation

The smart toilet seat market is entering a wellness phase: manufacturers can tap into health data integration by building weight, body composition, hydration, or even biomarker sensors into their products. By partnering with health-tech firms or offering subscription-based analytics, companies can monetize ongoing health tracking and predictive insights, positioning smart seats as more than a hygiene tool.

Emerging Market Penetration through Affordability

There remains substantial opportunity in underpenetrated geographies such as India, Southeast Asia, Latin America, and parts of the Middle East. Offering more affordable retrofit attachments tailored for local plumbing contexts can unlock wide-scale adoption. Strategic collaborations with governments, local distributors, or smart-city initiatives can accelerate market entry and scale.

Green Building and Regulatory Incentives

Smart toilet seats with water-efficient bidet cycles, energy-saving heating, and modular design align well with green-building certification programs (e.g., LEED, BREEAM). Manufacturers can partner with real estate developers to integrate smart seats into sustainable residential or commercial projects. Additionally, governments or utilities offering rebates or incentives for water- or energy-efficient fixtures could serve as a strong catalyst.

Product-Type Insights

Bidet-enabled smart toilet seats remain the dominant product type globally, accounting for the largest share of installations across households and commercial spaces. Their leadership is driven by the strong and rising consumer preference for advanced hygiene benefits, including precise water cleansing, deodorization, and drying functions. This trend is especially entrenched in Asia-Pacific, where bidet culture has long been mainstream, and is rapidly spreading across North America and Europe as consumers prioritize cleanliness, post-pandemic hygiene awareness, and wellness-focused bathroom upgrades.

While basic heated-seat models retain relevance in cost-sensitive markets, their adoption is primarily convenience-driven rather than hygiene-driven. On the premium end, washlet-style seats featuring automatic self-cleaning, electrolyzed water sterilization, and UV disinfection are gaining significant traction. These advanced models appeal to affluent buyers, luxury hotels, and residential projects aiming to balance hygiene, automation, and high-end bathroom aesthetics.

Functionality & Technology Insights

Technology integration remains the defining factor behind rapid product differentiation in the smart toilet seat market. Instantaneous water heating technology is becoming the preferred standard, replacing traditional tank-based heating due to its superior energy efficiency and ability to deliver unlimited warm-water cleansing. This shift aligns with global energy-conscious consumer behavior and sustainability targets in developed regions.

Connectivity features such as mobile app control, voice-assistant compatibility, and AI-based user personalization are increasingly embedded into mid-to-premium smart seat models. These capabilities allow users to automate settings (temperature, pressure, seat warmth), remotely activate cleaning modes, and enable hands-free operationenhancing accessibility for elderly and disabled users. Features like auto-lid opening, deodorization modules, air dryers, night lights, and intelligent self-cleaning nozzles elevate the user experience and strengthen the value proposition for both residential and commercial buyers.

Installation / Form Insights

Retrofit smart toilet seat attachments dominate the market due to their cost-efficiency, installation flexibility, and ability to modernize existing toilets without requiring structural changes. This segment benefits from a large global base of standard toilets and is especially strong in North America, Europe, and emerging Asian markets, where consumers opt for incremental upgrades rather than full bathroom renovations.

Integrated smart toiletswhich combine the seat and bowl into a fully connected unitare witnessing accelerated adoption in luxury real estate developments, premium hospitality projects, and new-build smart homes. Their seamless design, advanced aesthetic integration, and comprehensive functionality (e.g., auto-flush, tankless systems, real-time diagnostics) make them a preferred choice in high-income segments and metropolitan areas with rising smart home penetration.

End-User Insights

The residential sector continues to command the majority share of smart toilet seat demand, driven by rising global interest in smart-home ecosystems, premium bathroom renovations, and hygiene-enhancing bathroom fixtures. Adoption is especially strong among urban homeowners in Asia-Pacific and North America, who value comfort, automation, and wellness-driven home upgrades.

Commercial adoption is gaining momentum, with hospitality emerging as one of the fastest-growing segments. Luxury hotels, boutique resorts, and premium serviced apartments are integrating smart toilet seats to enhance guest experience, differentiate services, and meet modern hygiene expectations. Healthcare and elder-care facilities also represent a rapidly expanding end-user segment, as smart seats improve sanitation, reduce caregiver workload, enhance patient dignity, and support infection-control protocols.

Distribution Channel Insights

Offline retailincluding premium sanitaryware showrooms, home improvement stores, and bathroom specialty outletscontinues to play a pivotal role in driving product adoption. Feature-rich models often require in-person demonstrations, and installation-related consultations are better facilitated in offline environments.

However, online channels are expanding quickly, driven by e-commerce penetration, aggressive pricing, and the increased availability of retrofit seat models. Consumers increasingly rely on digital platforms for product comparisons, reviews, and bundled installation support. Manufacturers are leveraging direct-to-consumer (D2C) models through branded websites, offering extended warranties, service subscriptions, and professional installation scheduling to enhance customer confidence and lifetime value.

| By Product Type | By Functionality & Technology | By Installation / Form | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific remains the largest and fastest-growing region, commanding approximately 45–50% of global market value in 2024. Mature markets such as Japan and South Korea continue to dominate due to long-standing bidet culture, high technological affinity, and strong government support for water-efficient sanitaryware. China is emerging as a major volume driver as rising urban incomes, smart-home adoption, and aspirational living standards encourage bathroom modernization. India's growth trajectory is reinforced by expanding urban middle-class households, increasing hygiene awareness, and government-led sanitation initiatives under the Smart Cities Mission.

North America

North America accounts for around 30–35% of the global market, supported by the rapid adoption of smart-home technologies and rising post-pandemic hygiene consciousness. Consumers in the U.S. and Canada show a strong preference for app-connected and voice-controlled smart toilet seats, with retrofit installations dominating due to ease of upgrading and an established DIY culture. New home constructions increasingly incorporate smart bathroom fixtures as part of integrated smart-living ecosystems.

Europe

Europe contributes about 12–15% to global market demand, with notable traction in Germany, the UK, France, and the Nordic countries. European consumers prioritize sustainability, water efficiency, and advanced sanitation features, driving preference for eco-certified smart washlets. Hospitality, luxury real estate, and elder-care facilities represent strong commercial adoption bases. Regulatory pressure on water efficiency accelerates the shift toward low-flow smart bidet systems.

Latin America

Latin America accounts for roughly 3–5% of the global market share. Brazil, Mexico, and Chile are the primary growth centers due to accelerating urbanization and rising disposable incomes. Adoption is currently strongest for retrofit models because they offer affordable modernization without requiring structural renovations. However, limited awareness and price sensitivity remain obstacles, signaling substantial long-term potential as consumer education increases.

Middle East & Africa

The Middle East & Africa (MEA) region represents approximately 3–4% of the 2024 market. The Gulf nationsUAE, Saudi Arabia, Qatardrive premium segment demand as luxury real estate, smart-city megaprojects, and five-star hospitality developments increasingly integrate smart toilet seats. African markets remain nascent, with adoption growing in high-income urban clusters and modern healthcare facilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Toilet Seat Market

- TOTO Ltd.

- LIXIL Group Corporation

- Panasonic Corporation

- Kohler Co.

- Coway Co., Ltd.

- Brondell Inc.

- Bio Bidet

- Smart Bidet

- Jomoo Group Co., Ltd.

- Duravit AG

- Roca Sanitario S.A.

- Huida Sanitary Ware Co., Ltd.

- Villeroy & Boch AG

- Toshiba Corporation

- Arrow / HEGII