Smart Surfaces Market Size

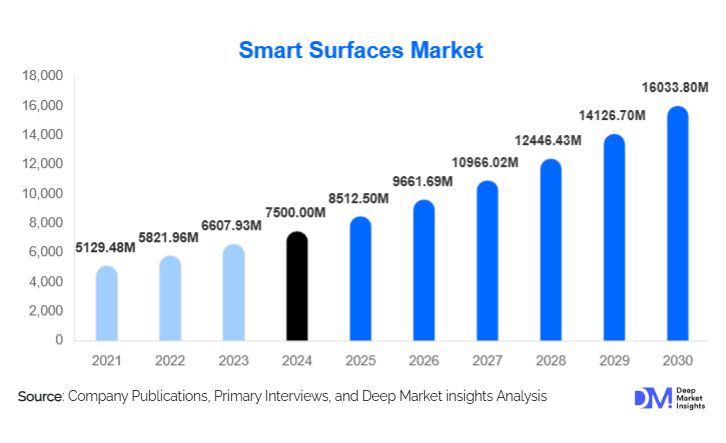

According to Deep Market Insights, the global smart surfaces market size was valued at USD 7,500.00 million in 2024 and is projected to grow from USD 8,512.50 million in 2025 to reach USD 16,033.80 million by 2030, expanding at a CAGR of 13.5% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for antimicrobial and self-cleaning surfaces, increasing adoption of interactive and responsive materials in healthcare, construction, and electronics, and government-backed initiatives promoting smart infrastructure development.

Key Market Insights

- Healthcare and infection control are the primary growth drivers, with hospitals and clinics adopting antimicrobial surfaces to reduce the spread of infections.

- Interactive and responsive smart surfaces are expanding in commercial and consumer electronics sectors, including touch-sensitive walls, smart countertops, and haptic interfaces.

- North America dominates the market, accounting for 28% of global demand in 2024 due to high adoption in healthcare, commercial, and public infrastructure.

- Asia-Pacific is the fastest-growing region, driven by urbanization, smart city projects, and rising technological adoption in China and India.

- Europe shows strong demand, especially in Germany, the U.K., and France, fueled by stringent building regulations and healthcare hygiene mandates.

- Technological integration, including IoT-enabled surfaces, touch interactivity, and advanced antimicrobial coatings, is reshaping product offerings and enhancing value across applications.

What are the latest trends in the smart surfaces market?

Integration of Antimicrobial and Self-Cleaning Technologies

Smart surfaces are increasingly incorporating antimicrobial and self-cleaning functionalities, leveraging materials such as silver, copper, and photocatalytic coatings. Hospitals, hotels, airports, and public infrastructure facilities are the primary adopters, where hygiene and durability are critical. Manufacturers are also focusing on polymer- and composite-based surfaces that combine self-cleaning properties with scratch resistance and aesthetic appeal. Regulatory pressure and post-pandemic hygiene awareness are further accelerating adoption globally.

Interactive and IoT-Enabled Surfaces

Emerging applications of interactive surfaces include touch-sensitive walls, projection-enabled panels, and smart furniture integrated with IoT capabilities. These surfaces are gaining popularity in offices, retail, and hospitality for enhancing user experience and operational efficiency. Technologies such as haptic feedback, responsive materials, and embedded sensors are enabling new functionality, driving demand for advanced polymer and glass-based surfaces. Younger, tech-savvy end-users are particularly drawn to these innovations.

What are the key drivers in the smart surfaces market?

Growing Demand for Hygiene and Infection Control

Healthcare-associated infections and public hygiene concerns are driving the adoption of antimicrobial and self-cleaning surfaces. Hospitals, clinics, and commercial establishments are increasingly mandating the use of surfaces that inhibit bacterial growth. Government regulations and certification standards are further promoting adoption, particularly in North America, Europe, and the Asia-Pacific.

Urbanization and Smart Infrastructure Projects

Rapid urbanization and smart city initiatives across Asia-Pacific and Europe are propelling demand for advanced surfaces in public spaces, offices, and commercial buildings. Smart surfaces enhance durability, reduce maintenance costs, and integrate advanced features such as interactive walls and energy-efficient coatings. Public-private partnerships in infrastructure projects are also supporting the widespread deployment of these materials.

Technological Innovation and Product Diversification

Continuous R&D in interactive, responsive, and antimicrobial surfaces is expanding product offerings. Innovations such as touch-sensitive walls, haptic surfaces, and IoT-enabled furniture are creating high-value opportunities. Companies investing in next-generation coatings and eco-friendly materials are positioned to capture premium segments of the market.

What are the restraints for the global market?

High Initial Costs

Smart surfaces are generally more expensive than conventional alternatives due to specialized materials, coatings, and R&D costs. High capital expenditure may restrict adoption in price-sensitive regions or small-scale applications, limiting market penetration.

Raw Material Volatility

The dependence on specialized materials such as silver, copper, and high-quality polymers exposes manufacturers to price fluctuations and supply chain challenges. These factors can impact production costs and profit margins, potentially slowing growth.

What are the key opportunities in the smart surfaces market?

Healthcare and Hospital Infrastructure

Stringent hygiene standards in hospitals and clinics create significant opportunities for antimicrobial and self-cleaning surfaces. New hospital construction, retrofitting projects, and government-mandated infection control programs provide long-term demand, particularly in North America, Europe, and APAC.

Smart Cities and Urban Infrastructure

Public and commercial infrastructure projects in smart cities are adopting advanced surfaces for enhanced functionality and durability. Interactive walls, energy-efficient coatings, and touch-enabled panels in offices, airports, and public buildings offer growth potential for manufacturers.

Integration of IoT and Interactive Technologies

Combining surfaces with IoT, touch interactivity, and responsive materials opens new applications in retail, offices, hospitality, and electronics. Next-generation smart surfaces that incorporate haptic feedback, projection capabilities, and eco-friendly coatings provide differentiated solutions for high-value customers.

Product Type Insights

Antimicrobial surfaces dominate the market, holding a 40% share in 2024, due to widespread adoption in healthcare and public infrastructure. Self-cleaning coatings are rapidly growing, particularly in high-traffic commercial spaces. Interactive surfaces, including touch-sensitive and haptic materials, are emerging as high-value products in commercial and electronics applications, driven by technological adoption and user demand for enhanced functionality.

Application Insights

Flooring leads application demand globally, with a 32% share of the market in 2024, driven by self-cleaning and anti-slip solutions in hospitals, airports, and commercial buildings. Walls, furniture, and countertops follow, with interactive and hygienic surfaces gaining traction across commercial, healthcare, and consumer electronics segments. Advanced coatings are also increasingly applied in automotive interiors and high-touch surfaces, expanding market applications.

Distribution Channel Insights

B2B sales dominate, with direct procurement by hospitals, commercial buildings, and infrastructure projects. Specialist construction firms and electronics manufacturers act as key intermediaries. Online platforms are emerging for retail and smaller commercial applications, providing transparent pricing and product information. Partnerships with distributors and system integrators for IoT-enabled surfaces are also gaining relevance.

End-Use Insights

Healthcare and medical facilities represent the largest end-use segment, with 38% of market share in 2024. Commercial buildings and offices are growing rapidly, particularly in APAC and Europe. Automotive interiors and consumer electronics present emerging opportunities for interactive and antimicrobial surfaces. Export-driven demand is increasing, with high-value products shipped from China, Germany, and the U.S. to Europe, North America, and APAC markets.

| By Product Type | By Material | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share with 28% of global demand in 2024. The U.S. leads due to hospital infrastructure upgrades, commercial building modernization, and public infrastructure investments. Canada follows, driven by healthcare and smart building adoption.

Europe

Europe accounts for 26% of the market in 2024, led by Germany, the U.K., and France. Stringent building regulations, hospital hygiene standards, and smart infrastructure projects are driving adoption. Emerging interactive and self-cleaning surfaces further boost demand.

Asia-Pacific

APAC is the fastest-growing region, led by China and India. Rapid urbanization, smart city initiatives, and growing industrial and healthcare infrastructure contribute to a CAGR of ~11%. Japan and South Korea show steady demand in high-tech applications.

Middle East & Africa

UAE and Saudi Arabia are key markets for commercial and hospitality applications. Africa benefits from smart infrastructure development and government-backed projects in hospitals and public buildings.

Latin America

Brazil and Argentina are growing markets, mainly for healthcare and commercial construction. Outbound demand for high-end smart surface solutions is gradually increasing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Surfaces Market

- 3M

- Saint-Gobain

- Corning

- AkzoNobel

- Sherwin-Williams

- BASF

- PPG Industries

- Nippon Paint

- Arkema

- DuPont

- Kansai Paint

- Hempel

- Ecolab

- Henkel

- Tiger Coatings

Recent Developments

- In March 2025, 3M launched a new line of antimicrobial polymer coatings for healthcare and commercial surfaces.

- In February 2025, Saint-Gobain expanded its interactive glass surface portfolio for commercial buildings in Europe and APAC.

- In January 2025, Corning introduced durable touch-sensitive surfaces for consumer electronics and automotive applications, focusing on high-performance polymer composites.