Smart Speaker Market Size

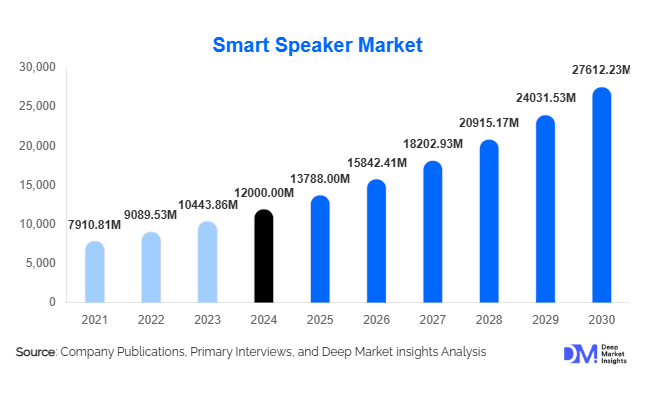

According to Deep Market Insights, the global smart speaker market size was valued at USD 12,000 million in 2024 and is projected to grow from USD 13,788 million in 2025 to reach USD 27,612.23 million by 2030, expanding at a CAGR of 14.9% during the forecast period (2025–2030). The smart speaker market growth is primarily driven by accelerating adoption of voice-enabled assistants, expanding smart-home and IoT ecosystems, and rising consumer preference for seamless voice interfaces that combine entertainment, home automation, and service integrations.

Key Market Insights

- Smart speakers are evolving into central smart-home hubs, enabling control of lighting, HVAC, security, and entertainment through voice and automated routines.

- WiFi-connected devices dominate revenue thanks to cloud-based assistant features, multi-room audio, and deeper home integration compared with Bluetooth-only devices.

- Value/volume is driven by low-price tiers, which accelerate penetration in emerging markets; however premium devices (>USD 150) are growing faster in value terms.

- Asia-Pacific is the fastest-growing region, supported by large populations, local language assistant development, and domestic OEM manufacturing.

- Online distribution channels lead, with D2C and major e-commerce platforms enabling rapid scale, promotional pricing, and global reach.

- Interoperability standards and edge AI (e.g., Matter/Thread, on-device processing) are reshaping vendor strategies around privacy, latency, and ecosystem lock-in.

Latest Market Trends

Smart Speakers as Voice-First Home Platforms

Smart speakers are migrating from single-function audio devices to voice-first home platforms. Modern devices offer multi-protocol radios (WiFi, Bluetooth, Thread/Zigbee), advanced voice assistants, and the ability to run local automations. Users increasingly expect a single device to manage streaming, routines, security alerts, and voice commerce. This trend has catalyzed hardware innovation (microphone arrays, edge AI acceleration) and vendor partnerships with appliance manufacturers, streaming services, and telecom operators.

Premium Audio + Services Convergence

Manufacturers are differentiating by combining superior audio engineering with intelligent assistants. High-fidelity smart speakers, multi-room ecosystems, and spatial audio support target consumers willing to pay higher ASPs. Simultaneously, platform providers are developing subscription services (enhanced assistant features, bundled streaming, premium skills) that convert one-time device sales into recurring revenue. This convergence elevates device value and supports healthier margin profiles for leading brands.

Smart Speaker Market Drivers

Uptick in Smart Home Device Adoption and Voice Interactions

Rapid adoption of IoT devices in homes smart lights, thermostats, cameras, and locks, has positioned smart speakers as the natural voice interface for daily interactions. Improvements in natural language processing, multilingual support, and contextual understanding have raised consumer comfort with voice commands for convenience tasks, entertainment, and home control, thereby pushing device penetration and usage frequency.

Declining Component Costs and E-commerce Penetration

Cost reductions in SoCs, microphones, wireless modules, and mass manufacturing have enabled vendors to offer capable devices at lower price points, broadening the addressable market. E-commerce platforms and D2C channels have further reduced distribution friction, enabling manufacturers to scale quickly with competitive pricing and promotional bundles tied to streaming or smart-home services.

Ecosystem Lock-in and Upgrade Cycles

Once consumers adopt an assistant ecosystem (Alexa, Google Assistant, Siri, regional assistants), they tend to purchase complementary devices and services that operate within the same ecosystem, creating stickiness. This drives replacement and upgrade cycles from basic to premium devices and encourages vendors to expand service offerings to increase lifetime value.

Market Restraints

Privacy, Security, and Regulatory Concerns

Voice-activated devices collect intimate data and raise legitimate privacy concerns. News cycles exposing accidental recordings or data misuse create consumer wariness. Additionally, evolving regulation (data protection regimes, voice recording rules) increases compliance costs for vendors and may slow uptake in privacy-sensitive markets.

Saturation in Mature Markets and Limited Differentiation

In mature markets such as the U.S. and parts of Western Europe, device penetration is high and year-on-year new-user acquisition slows. Many devices are perceived as commoditized, making it challenging for vendors to spur replacement without meaningful innovation. Competition on price also compresses margins in mainstream tiers.

Smart Speaker Market Opportunities

Localization & Emerging Market Penetration

Significant upside exists in under-penetrated regions of South Asia, Latin America, and parts of Africa, where low device penetration and rising internet access create new addressable markets. Vendors that invest in local language NLP, culturally relevant assistant features, and price-competitive SKUs can capture first-mover advantages. Strategic partnerships with telcos and retailers to bundle speakers with broadband or mobile services can accelerate scale.

Vertical Integrations: Healthcare, Hospitality & Enterprise

Beyond residential use, specialized smart-speaker platforms tailored to healthcare (patient assistance, medication reminders), hospitality (voice concierge in hotel rooms), and enterprise (voice-enabled meeting rooms) present high-value opportunities. These verticals value privacy, compliance, and bespoke integrations, areas where white-label or certified devices can command premium pricing and recurring service contracts.

Service Monetization & Premium Hardware Bundles

As hardware ASPs compress in entry tiers, integrated service offerings (subscription assistant features, bundled streaming, home security monitoring) become crucial revenue levers. Pairing premium hardware with exclusive services, high-fidelity audio, personalized voice models, and on-device AI creates differentiated value propositions and higher lifetime revenue per user.

Product Type Insights

Smart speaker product types can be grouped into entry-level portable Bluetooth models, mid-tier WiFi-enabled home speakers, and premium multi-room audio devices with advanced voice agents. Entry-level devices drive volume and rapid adoption in price-sensitive markets. Mid-tier models represent the mainstream value proposition, balancing cost and features. Premium devices target audiophiles and smart-home enthusiasts, combining superior sound, materials, and ecosystem integrations to command higher ASPs. Growth in the premium segment is notable for value, even as volume remains concentrated in lower tiers.

Application Insights

Primary applications remain residential entertainment (music streaming, podcasts), smart-home control (lighting, climate, locks), information search, and voice commerce. Emerging applications include voice-enabled healthcare monitoring, voice assistants for elder-care, voice-driven point-of-sale or kiosk systems in retail, and hospitality guest services. Photographic and content creation use (voice-activated recording, social sharing) is growing as creators leverage voice for hands-free control.

Distribution Channel Insights

Online channels (brand stores, major e-commerce marketplaces) dominate due to convenience, price transparency, and global logistics. Retail showrooms and big-box stores remain important for premium product discovery and impulse purchases, particularly where consumers want to test audio quality firsthand. Telecom bundling (smart speaker with broadband or mobile plans) is an important acquisition channel in several regions. B2B channels (hospitality integrators, enterprise vendors) serve commercial verticals.

User Type Insights

Households are the primary buyers; early adopters and tech-savvy consumers drive premium purchases. Younger demographics (18–35) favor low-cost, multifunctional devices and voice-driven entertainment, while 31–50 age groups drive mid-tier and family use focused on smart-home automation. Older demographics (51+) are an important market for voice-enabled elder-care features and simplified devices with enhanced privacy and accessibility options.

Age Group Insights

Adults aged 31–50 represent the largest purchasing cohort for smart speakers, balancing disposable income with family and home automation needs. The 18–30 group fuels demand for entry-level, social, and streaming-focused devices. The 51–65 cohort is a meaningful contributor to premium and accessibility-focused devices, particularly where voice assistance replaces more complex touch interfaces. The 65+ demographic, while smaller in volume, is a strategic niche for elder-care and voice-first simplicity features.

| By Product Type | By Price Range | By Connectivity Type | By Distribution Channel | By End-Use Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market by revenue due to early adoption, high disposable income, and strong ecosystems (Amazon, Google, Apple). We estimate North America accounted for 35% of global revenue in 2024 (USD 4,200 million). The U.S. leads demand for premium features, multi-room setups, and subscription services.

Asia-Pacific

Asia-Pacific is the fastest-growing region and represented 30% of global revenue in 2024 (USD 3,600 million). China leads both consumption and manufacturing, with strong domestic platforms and OEMs; India shows rapid percentage growth from a low base, driven by low-cost devices and rising internet access. Southeast Asia and Australia add to the regional momentum.

Europe

Europe held approximately 20% of the market in 2024 (USD 2,400 million). Key markets include the U.K., Germany, and France. Consumers demand localized assistants and privacy-forward features; premium audio and multi-room systems are popular among affluent buyers.

Latin America

Latin America represented 8–10% of the market (USD 900–1,200 million) in 2024, led by Brazil and Argentina. Growth is steady as e-commerce and affordable devices expand penetration, though price sensitivity and logistics remain challenges.

Middle East & Africa (MEA)

MEA accounted for 5% (USD 600 million) in 2024. The GCC shows strong luxury adoption while South Africa and other hubs begin to see household uptake. Language and ecosystem localization are key for future expansion.

Fastest-Growing Country/Region

China stands out for its combined manufacturing scale and domestic consumption; India is among the highest percentage growth markets due to its large population and low starting penetration. Overall, APAC is expected to outpace mature regions in CAGR over 2025–2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Speaker Market

- Amazon.com, Inc.

- Google LLC

- Apple Inc.

- Xiaomi Corporation

- Baidu, Inc.

- Alibaba Group Holding Ltd.

- HUAWEI Technologies Co., Ltd.

- Sonos, Inc.

- Bose Corporation

- Sony Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co., Ltd.

- Harman International

- Logitech International

- Lenovo Group Ltd.

Recent Developments

- 2025: Major voice-assistant platforms introduced premium subscription tiers with advanced generative features, emphasizing personalized voice models and enhanced on-device privacy.

- 2024–2025: Several manufacturers announced broader Matter/Thread compatibility and multi-protocol hubs to improve interoperability across smart-home devices.

- 2024–2025: OEMs increased investment in premium audio smart speakers with spatial and multi-room capabilities, targeting higher ASP segments to offset entry-tier margin pressure.