Smart Shower Market Size

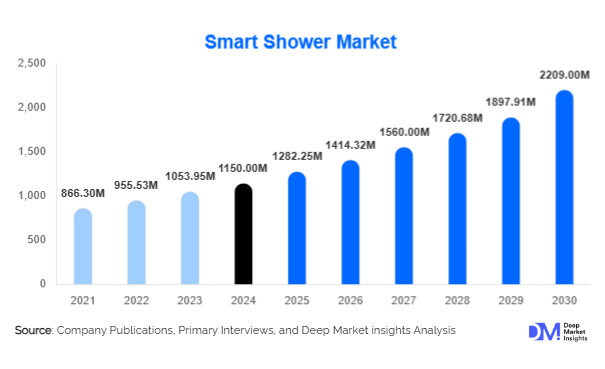

According to Deep Market Insights, the global smart shower market size was valued at USD 1,150 million in 2024 and is projected to grow from USD 1,282.25 million in 2025 to reach USD 2,209.77 million by 2030, expanding at a CAGR of 11.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing smart home adoption, rising consumer awareness of water and energy conservation, and growing demand for luxury and connected bathroom experiences.

Key Market Insights

- Smart showers are becoming integral to connected home ecosystems, with IoT-enabled systems offering personalized water control, temperature presets, and energy-saving analytics.

- Luxury residential and hospitality segments are driving premium product adoption, as hotels, resorts, and high-end homes increasingly integrate smart showers for enhanced comfort and guest experiences.

- North America dominates the market, with high penetration of smart homes and early adoption of IoT devices in the U.S. and Canada.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable incomes, and government initiatives promoting energy efficiency in China, India, and Japan.

- Europe remains a key market for eco-friendly smart shower systems, particularly in Germany, the U.K., and France, driven by strict environmental regulations and sustainability-focused consumers.

- Technological innovation, including voice-activated showers, sensor-based systems, and AI-driven water management, is enhancing user experience and adoption rates globally.

What are the latest trends in the smart shower market?

Integration with Smart Homes and IoT Platforms

Smart showers are increasingly being integrated with home automation systems. IoT connectivity allows users to control shower temperature, flow, and pre-set programs remotely via smartphone apps or smart assistants like Alexa and Google Home. This integration not only enhances user convenience but also facilitates data-driven energy and water management. Advanced analytics provide insights into consumption patterns, enabling cost and resource savings, and encouraging adoption in environmentally conscious households and commercial buildings.

Eco-Friendly and Water-Saving Solutions

Global trends toward sustainability are pushing manufacturers to introduce water-efficient and energy-saving shower solutions. Digital and thermostatic showers are being designed with low-flow technology, automated shut-off features, and precise temperature control to minimize wastage. Rising consumer preference for green solutions, along with government incentives for water conservation, is driving widespread adoption, particularly in Europe and North America.

What are the key drivers in the smart shower market?

Rising Smart Home Adoption

With the proliferation of connected devices, smart homes have become a central driver for the smart shower market. Consumers increasingly prioritize convenience, automation, and personalization, leading to higher demand for IoT-enabled showers. Features such as voice control, app-based scheduling, and usage analytics appeal to tech-savvy homeowners and premium hospitality providers, accelerating market growth.

Demand for Luxury and Personalized Experiences

Luxury residential and commercial projects are fueling demand for showers with temperature memory, customizable water jets, LED lighting, and integrated wellness features. Hotels, resorts, and high-end apartments leverage smart showers to enhance guest experiences and differentiate themselves in competitive markets. This trend is particularly strong in North America, Europe, and APAC urban hubs.

Environmental and Energy Awareness

Growing concerns about water scarcity and energy consumption have prompted both consumers and governments to adopt water-efficient smart showers. Automated flow control, real-time consumption monitoring, and temperature regulation allow significant water and energy savings, which are increasingly valued in residential, commercial, and hospitality sectors.

What are the restraints for the global market?

High Initial Investment

The relatively high upfront cost of smart showers compared to conventional systems limits penetration in price-sensitive markets. While operational savings and convenience provide long-term benefits, initial costs remain a barrier to mass-market adoption.

Complexity of Installation and Maintenance

Smart showers often require specialized installation and ongoing technical maintenance. Limited infrastructure for support in certain regions restricts adoption, particularly in emerging markets where trained personnel and service networks are scarce.

What are the key opportunities in the smart shower market?

Technological Innovation and AI Integration

Manufacturers have the opportunity to differentiate through AI-driven features, including voice control, automated temperature adjustments, and water consumption analytics. Advanced sensor-based showers that reduce touchpoints and enhance hygiene are gaining traction post-pandemic. Companies investing in R&D for eco-friendly and personalized smart showers can capture premium market segments.

Emerging Regional Demand

Asia-Pacific, the Middle East, and Latin America present significant growth opportunities. Rapid urbanization, increasing disposable incomes, and government initiatives promoting energy-efficient appliances drive adoption. Luxury hotels, high-end residences, and commercial projects in China, India, and the UAE are increasingly adopting smart shower solutions, creating a growing market for both local and international manufacturers.

Expansion in Hospitality and Wellness Sectors

Premium hotels, resorts, and wellness centers are integrating smart showers to enhance guest experience and attract high-paying clientele. Features like hydrotherapy jets, personalized temperature profiles, and app-controlled lighting contribute to higher occupancy rates and customer satisfaction, offering a lucrative opportunity for market players.

Product Type Insights

Digital showers dominate the product segment globally, accounting for approximately 35% of the 2024 market. They offer precision temperature control, customizable presets, and advanced interface features, making them highly preferred in both residential and commercial premium segments. Thermostatic and smart shower panels are growing steadily due to rising demand for energy-efficient and multi-functional solutions.

Technology Insights

Wi-Fi-enabled showers hold 28% of the market, driven by the need for remote control, integration with home automation, and real-time water usage analytics. Sensor-based and voice-activated showers are gaining traction, especially in luxury apartments, hotels, and wellness centers where automation and convenience are prioritized.

Connectivity Platform Insights

IoT-connected showers are leading in the connectivity segment with a 22% market share. The demand is driven by smart home integration, data analytics for energy and water efficiency, and compatibility with AI-based assistants. Standalone smart showers retain niche demand, particularly in regions with lower smart home penetration.

End-User Insights

The residential segment dominates, accounting for 60% of 2024 consumption. Luxury homes and high-end apartments drive adoption, while commercial applications in hotels, gyms, and hospitals are expanding rapidly. Export-driven demand is increasing in APAC and the Middle East, where domestic manufacturing is limited and premium smart shower products are imported for high-end projects.

| By Product | By Functionality | By End-user | By Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 32% of the global market, with high adoption in the U.S. and Canada. Smart home integration, luxury residential projects, and early IoT adoption contribute to strong demand. Premium and energy-efficient solutions dominate.

Europe

Europe accounts for 28% of the market, led by Germany, the U.K., and France. Strict environmental regulations and high consumer awareness drive the adoption of eco-friendly smart showers. Energy efficiency and sustainability are key purchasing criteria.

Asia-Pacific

APAC is the fastest-growing region with a CAGR of 13%, driven by urbanization, rising middle-class incomes, and energy-efficient initiatives in China, India, and Japan. Luxury hotels and high-end residential projects are key demand drivers.

Middle East & Africa

Demand is concentrated in luxury hospitality and high-end residences in the UAE and Saudi Arabia. High disposable incomes and premium preferences are supporting market growth.

Latin America

Brazil, Argentina, and Mexico are emerging markets, with growing demand in luxury hotels and high-end residential sectors. Export-driven smart showers are increasing in popularity due to limited local production.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Shower Market

- Moen

- Kohler

- Grohe

- Hansgrohe

- Delta Faucet

- American Standard

- Toto Ltd.

- Roca

- Jaquar Group

- LIXIL Group

- Bristan

- VitrA

- Kohler India

- Xiaomi (Smart Home Division)

- Oras

Recent Developments

- In January 2025, Moen launched a new Wi-Fi-enabled smart shower panel in North America, integrating app-based controls with energy-saving analytics.

- In March 2025, Kohler expanded its digital shower range in Europe, focusing on eco-friendly and sensor-based designs for luxury apartments.

- In June 2025, Grohe introduced voice-activated smart showers in the Asia-Pacific region, targeting the premium residential and hospitality segments.