Smart Plug Market Size

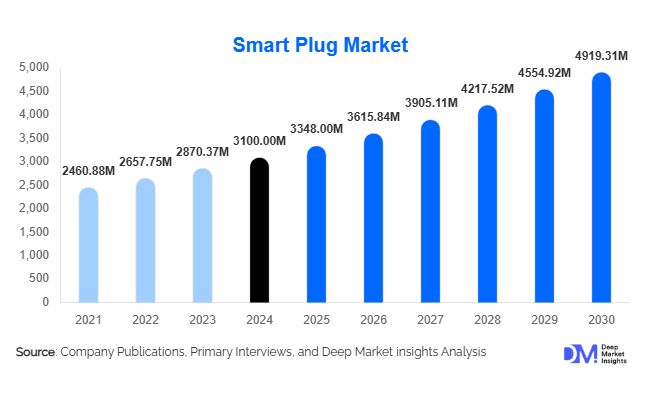

According to Deep Market Insights, the global smart plug market size was valued at USD 3,100.00 million in 2024 and is projected to grow from USD 3,348.00 million in 2025 to reach USD 4,919.31 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The smart plug market growth is primarily driven by the rising adoption of smart home technologies, increasing emphasis on energy efficiency, and growing integration of Internet of Things (IoT) devices across residential and commercial environments.

Key Market Insights

- Smart home adoption is accelerating globally, with consumers seeking plug-and-play IoT devices that enhance energy management and convenience.

- Voice assistant integration with Amazon Alexa, Google Assistant, and Apple HomeKit is a key driver of smart plug demand across developed economies.

- North America leads the global smart plug market, supported by high smart home penetration and the strong presence of leading IoT device manufacturers.

- Asia-Pacific is the fastest-growing regional market, fueled by rising disposable income, expanding urbanization, and smart city initiatives in China, India, and South Korea.

- Energy monitoring and automation capabilities are transforming smart plugs into essential components of modern home energy ecosystems.

- Increased affordability and wider distribution via e-commerce platforms are driving mass-market adoption in emerging regions.

What are the latest trends in the smart plug market?

Integration with Smart Ecosystems

Smart plugs are increasingly being integrated into broader smart home ecosystems, allowing seamless control through centralized apps and voice commands. Users can now automate lighting, heating, and appliances via smart assistants and scheduling tools. The growing adoption of the Matter protocol, a unified connectivity standard, has further improved device interoperability across brands and ecosystems, simplifying user experience and boosting consumer confidence.

Energy Efficiency and Sustainability Focus

With rising global emphasis on energy conservation, smart plugs are evolving into energy intelligence tools. Advanced models now provide real-time power consumption data, automated shutdown options for idle devices, and insights that support sustainability goals. Energy-efficient home certifications and government initiatives promoting eco-friendly technologies are accelerating product adoption across both residential and commercial settings.

What are the key drivers in the smart plug market?

Rising Smart Home Penetration

The growing popularity of smart homes is one of the strongest growth drivers for the smart plug market. Consumers are increasingly embracing connected devices that enhance comfort, convenience, and energy management. Smart plugs, offering easy installation and remote control via mobile apps, serve as an entry point for first-time smart home users. The demand is also being driven by the proliferation of affordable Wi-Fi–enabled devices in both developed and emerging markets.

Increasing Focus on Energy Management

Rising electricity costs and heightened environmental awareness are pushing consumers toward energy-efficient solutions. Smart plugs enable users to monitor and control power usage in real time, helping reduce wastage and optimize consumption. Commercial facilities are also deploying smart plugs for automated load management, supporting sustainability targets and operational efficiency improvements.

What are the restraints for the global market?

Data Privacy and Cybersecurity Concerns

As smart plugs operate within connected home networks, concerns regarding data privacy and hacking risks remain significant. Security vulnerabilities can expose user data or allow unauthorized device access. These concerns may deter adoption, especially among privacy-conscious consumers. Manufacturers are increasingly investing in advanced encryption protocols and secure firmware updates to mitigate such risks.

Compatibility and Connectivity Issues

Despite advancements in interoperability standards, compatibility challenges persist between different smart home ecosystems. Connectivity disruptions due to weak Wi-Fi signals or outdated firmware can reduce device reliability, affecting consumer satisfaction. In regions with limited internet infrastructure, these issues act as barriers to the widespread adoption of smart plug technology.

What are the key opportunities in the smart plug industry?

Commercial and Industrial Applications

While smart plugs are primarily consumer-focused, opportunities are expanding across commercial offices, hospitality, and industrial facilities. Smart energy monitoring systems that integrate smart plugs are being used to manage large-scale power distribution, automate device shutdowns, and monitor equipment health. This growing B2B application base is expected to create new revenue streams for manufacturers.

Integration with Renewable Energy Systems

The transition toward renewable energy and decentralized power systems presents a significant opportunity for smart plug adoption. Integrating smart plugs with solar power systems, smart meters, and energy storage solutions enables optimized load balancing and efficient power utilization. This convergence supports sustainability and energy independence goals, aligning with global decarbonization trends.

Product Type Insights

Based on product type, the Wi-Fi smart plug segment dominates the global smart plug market, accounting for the largest revenue share in 2024. This dominance is primarily driven by its ease of installation, affordability, and compatibility with a wide range of smart home ecosystems, including Alexa, Google Home, and Apple HomeKit. Wi-Fi smart plugs offer users a seamless setup experience without requiring an additional hub, which has accelerated their adoption across residential households worldwide. The segment continues to grow as manufacturers integrate energy monitoring, scheduling, and voice assistant features into compact, cost-effective designs.

The Bluetooth and Zigbee smart plug segments are witnessing growing traction, particularly in smart home ecosystems where network reliability, data security, and low-latency performance are critical. Zigbee-enabled devices are preferred for enterprise or commercial networks that manage multiple smart appliances simultaneously, while Bluetooth-based smart plugs appeal to cost-sensitive consumers seeking local control without dependency on internet connectivity.

Additionally, advanced smart plugs with energy monitoring, surge protection, and load-sensing capabilities are emerging as premium offerings. These products cater to tech-savvy and eco-conscious consumers, helping optimize energy consumption and protect expensive appliances. As sustainability becomes a global priority, the demand for intelligent power control devices is expected to strengthen the market for next-generation smart plug technologies.

Application Insights

The residential segment remains the leading application category in the smart plug market, accounting for nearly 65% of total revenue in 2024. Rising consumer awareness of home automation, energy management, and convenience has fueled strong adoption of smart plugs in households. Consumers increasingly use smart plugs to control lighting, home entertainment systems, and HVAC appliances remotely, contributing to improved energy efficiency and cost savings. Integration with home voice assistants and growing use of mobile applications are key factors driving segment growth.

The commercial application segment is expanding rapidly, supported by demand for energy-efficient solutions in smart offices, hotels, educational institutions, and retail spaces. Businesses are adopting smart plugs to monitor power usage, automate device shutdown during off-hours, and reduce operational costs. Moreover, large-scale deployments in corporate workspaces are helping organizations meet their ESG (Environmental, Social, and Governance) and carbon reduction goals.

The industrial segment, while still nascent, is expected to grow steadily through 2030. Smart plugs are increasingly being integrated into industrial IoT (IIoT) systems for monitoring non-critical equipment and managing small-scale machinery. This allows facility managers to gain greater control over operational energy consumption and predictive maintenance scheduling. As factories move toward digital transformation and automation, industrial use cases will provide new revenue opportunities for smart plug manufacturers.

Distribution Channel Insights

Online retail platforms continue to dominate global smart plug distribution, contributing to over 60% of global sales in 2024. E-commerce giants such as Amazon, Walmart, and Alibaba are driving accessibility by offering a wide selection of brands, transparent pricing, and user-generated reviews that simplify purchasing decisions. Online channels also benefit from frequent promotional campaigns, easy delivery options, and bundled smart home packages that attract digitally savvy consumers.

Offline retail channels remain vital, particularly in emerging markets where consumers prefer hands-on demonstrations before purchase. Electronics stores, supermarkets, and home improvement chains such as Best Buy and The Home Depot continue to promote leading smart plug brands through in-store displays and experiential marketing.

Furthermore, strategic collaborations between telecom operators, energy utilities, and IoT device manufacturers are emerging as a powerful distribution strategy. Bundled offerings that include smart plugs with broadband subscriptions or energy management programs are encouraging first-time buyers to adopt smart home ecosystems, thereby broadening the market’s consumer base.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market for smart plugs, accounting for approximately 38% of the global market share in 2024. The early adoption of smart home technologies, high consumer spending power, and the presence of leading IoT device manufacturers primarily drive the region’s growth. The U.S. continues to lead, supported by widespread use of connected home platforms such as Amazon Alexa and Google Home.

Government initiatives promoting energy efficiency and smart grid integration are further supporting market expansion. Increasing awareness about sustainable living and energy conservation among U.S. and Canadian consumers has led to higher adoption of smart plugs with built-in energy monitoring features. The commercial sector is also contributing significantly, with smart offices and coworking spaces integrating smart plug systems for automated energy management.

Europe

Europe represents a mature and innovation-driven market for smart plugs, holding around 25% of the global share in 2024. Growth across the region is supported by stringent energy efficiency regulations, rising sustainability awareness, and widespread broadband connectivity. Leading economies such as Germany, the U.K., and France are focusing heavily on smart energy management to reduce carbon emissions, aligning with the goals of the European Green Deal and Energy Efficiency Directive.

Furthermore, the increasing adoption of renewable energy and smart grid infrastructure is encouraging consumers and businesses to integrate smart plugs for dynamic load balancing and energy optimization. The growing popularity of voice-controlled smart homes and the rising adoption of the Matter interoperability standard are also accelerating the demand for advanced, cross-compatible smart plug devices across Europe.

Asia-Pacific

The Asia-Pacific (APAC) region is the fastest-growing market, projected to expand at a CAGR exceeding 17% from 2025 to 2030. Growth is fueled by rapid urbanization, government smart city projects, expanding middle-class populations, and rising disposable incomes. China leads the regional market, supported by strong manufacturing capacity and domestic brands such as Xiaomi and TP-Link that offer cost-effective solutions.

India and Southeast Asian countries are witnessing accelerating adoption due to increased smartphone penetration, enhanced internet infrastructure, and government programs promoting digitalization and energy efficiency. Japan and South Korea remain technologically advanced markets with strong demand for high-end, energy-efficient smart plugs compatible with AI-powered home automation systems.

Latin America

Latin America is emerging as a promising region for smart plug manufacturers, supported by growing digital transformation and expanding e-commerce infrastructure. Brazil and Mexico are leading markets, driven by increasing consumer interest in affordable smart home solutions and widespread smartphone connectivity. The region is also benefiting from telecom partnerships and cross-industry collaborations that promote bundled smart home devices with internet services.

Additionally, the integration of smart plugs into energy management programs and smart metering initiatives is expected to gain momentum as Latin American governments prioritize sustainable energy usage and reduce residential electricity costs.

Middle East & Africa

The Middle East & Africa (MEA) region is witnessing strong growth potential, led by urban development projects, rising disposable incomes, and government-backed smart infrastructure initiatives. The UAE, Saudi Arabia, and Qatar are at the forefront, driven by smart city investments such as NEOM (Saudi Arabia) and Dubai Smart City. Consumers in these markets show a strong preference for luxury smart homes that integrate smart plugs as part of centralized automation systems.

In Africa, market penetration remains limited but is expected to grow steadily as energy management and renewable integration become policy priorities. Countries like South Africa and Kenya are gradually adopting affordable smart home technologies to improve energy efficiency and grid reliability. Government-led electrification programs and expanding 4G/5G connectivity are likely to accelerate adoption in the coming years.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Plug Market

- TP-Link Technologies Co., Ltd.

- Belkin International, Inc.

- Amazon.com, Inc. (Amazon Smart Plug)

- D-Link Corporation

- BroadLink Co., Ltd.

- Leviton Manufacturing Co., Inc.

- Xiaomi Corporation

- Honeywell International Inc.

- Panasonic Holdings Corporation

- Harman International (Samsung Electronics Co., Ltd.)

Recent Developments

- In June 2025, TP-Link launched its new Kasa Smart Plug Mini EP25 with support for Matter, enabling seamless cross-platform smart home integration.

- In May 2025, Amazon introduced energy monitoring capabilities for its Alexa Smart Plug lineup, allowing users to track appliance-level consumption.

- In March 2025, Xiaomi expanded its smart plug portfolio in India, targeting budget-conscious consumers through its Mi Home ecosystem.