Smart Electric Heater Market Size

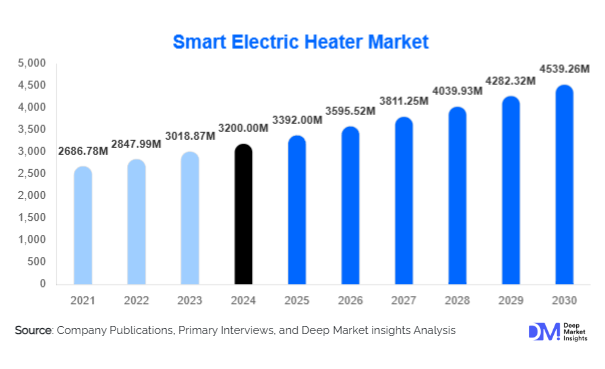

According to Deep Market Insights, the global smart electric heater market size was valued at USD 3,200 million in 2024 and is projected to grow from USD 3,392 million in 2025 to reach USD 4,539.26 million by 2030, expanding at a CAGR of 6% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for energy-efficient heating solutions, increasing adoption of smart home technologies, and government incentives promoting eco-friendly appliances.

Key Market Insights

- Smart electric heaters are increasingly integrated with IoT and smart home ecosystems, allowing remote control, energy monitoring, and adaptive performance optimization.

- Residential applications dominate the market, driven by urbanization, disposable income growth, and home automation trends.

- North America leads the global market due to high consumer awareness, government incentives, and mature smart home infrastructure.

- Asia-Pacific is the fastest-growing region, fueled by rising urban populations, economic growth, and increasing demand for energy-efficient heating solutions in China and India.

- Technological innovation, including Wi-Fi-enabled heaters, AI-based temperature regulation, and app-controlled systems, is reshaping user experience and market expectations.

What are the latest trends in the smart electric heater market?

IoT and Smart Home Integration

Smart electric heaters are increasingly designed to integrate seamlessly with smart home platforms such as Google Home, Alexa, and proprietary IoT ecosystems. This trend allows users to remotely control heating schedules, monitor energy consumption, and link heaters with other devices to optimize efficiency. Growing consumer preference for connected living spaces has accelerated adoption, particularly in developed markets like North America and Europe. Features such as predictive heating based on occupancy patterns, voice control, and integration with home energy management systems are becoming standard for high-end models.

Energy Efficiency and Eco-Friendly Heating

Environmental awareness and rising electricity costs are driving demand for energy-efficient heaters. Advanced sensors and adaptive heating technology enable smart electric heaters to consume less power while maintaining comfort. Governments worldwide are supporting this shift through subsidies, tax incentives, and stricter energy-efficiency standards. Consumers are now seeking devices that balance performance, sustainability, and reduced operational costs, creating opportunities for manufacturers to differentiate via energy ratings and eco-label certifications.

What are the key drivers in the smart electric heater market?

Rising Demand for Energy Efficiency

Consumers and businesses are increasingly focused on minimizing energy consumption and utility costs. Smart electric heaters, with programmable schedules and adaptive heating functions, address this need effectively. This driver is particularly strong in regions with high electricity tariffs and stringent energy regulations, such as Europe and North America.

Technological Advancements

Innovations in Wi-Fi-enabled heating, AI temperature regulation, and app-controlled interfaces have transformed user expectations. Smart electric heaters now offer features such as remote diagnostics, predictive maintenance, and integration with other smart devices, providing both convenience and cost savings. Manufacturers leveraging these advancements are gaining a competitive edge in mature markets.

Growing Environmental Awareness

Increased awareness about climate change and carbon emissions is shifting consumer preference toward electric heating systems over fossil fuel-based alternatives. Smart electric heaters reduce energy wastage and carbon footprints, aligning with government sustainability targets and consumer eco-conscious values.

What are the restraints for the global market?

High Initial Costs

The advanced technologies incorporated into smart electric heaters often result in higher upfront costs compared to conventional heating solutions. Price-sensitive consumers may delay purchases or opt for basic models, limiting market penetration in developing economies.

Compatibility and Infrastructure Challenges

Older buildings and non-standard electrical installations can hinder the seamless integration of smart electric heaters. Compatibility issues with existing home networks and smart platforms may require additional investment or technical support, acting as a potential barrier to adoption.

What are the key opportunities in the smart electric heater market?

Expansion in Emerging Markets

Rapid urbanization and rising disposable incomes in the Asia-Pacific and Latin America are creating significant growth potential. Tailoring products for these markets, including cost-effective models with localized smart features, can drive adoption among first-time users and residential buyers.

Government Incentives and Policy Support

Governments worldwide are promoting energy-efficient appliances through tax rebates, subsidies, and stringent energy standards. Manufacturers aligning their products with these incentives can improve affordability and encourage mass adoption, particularly in developed economies.

Technological Differentiation

Integration of AI, machine learning, and smart scheduling into electric heaters offers a competitive advantage. Manufacturers that innovate with predictive maintenance, voice control, and app-based energy optimization can capture premium segments and build long-term customer loyalty.

Product Type Insights

Wall-mounted smart electric heaters dominate the market, accounting for approximately 35% of the 2024 market share. Their space-saving design, efficient heating performance, and suitability for both residential and commercial applications make them the preferred choice globally. Other product types, such as portable and floor-standing heaters, are gaining popularity in regions with flexible or seasonal heating needs, contributing to incremental market growth.

Application Insights

The residential sector represents the largest end-use segment, with a 60% market share in 2024. Increasing adoption of smart home systems and energy-conscious consumer behavior are primary drivers. Commercial applications in offices, hospitality, and retail spaces are growing steadily, driven by operational efficiency and environmental sustainability. Emerging industrial applications include use in temperature-sensitive manufacturing and storage, expanding the market potential for specialized smart electric heaters.

Distribution Channel Insights

Online platforms, including e-commerce and direct-to-consumer websites, dominate the distribution of smart electric heaters due to convenience, real-time product comparisons, and access to reviews. Specialized retailers and home appliance stores remain significant for in-person consultations and installations. Digital marketing and social media influence, particularly in Asia-Pacific and North America, are increasingly shaping consumer choices.

| By Type | By Smart Features | By End-use | By Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America held approximately 37.3% of the global market in 2024. High consumer awareness, government incentives, and established smart home infrastructure drive demand in the U.S. and Canada. Residential adoption, coupled with integration into commercial buildings, positions the region as a market leader.

Europe

Europe shows steady growth, with Germany, the U.K., and France leading adoption due to stringent energy efficiency regulations. The region emphasizes eco-friendly heating solutions and smart home integration, supporting steady market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing market, particularly in China, India, and Japan, due to rising urban populations, disposable incomes, and smart home adoption. Government subsidies for energy-efficient appliances and growing awareness of climate impact further boost demand.

Latin America

Brazil, Mexico, and Argentina are emerging markets with growing residential adoption. Limited local manufacturing and high import dependence are gradually being offset by rising urban demand for smart electric heaters.

Middle East & Africa

Adoption is nascent, with urban centers in the UAE, Saudi Arabia, and South Africa driving growth. Premium residential and commercial applications are the primary demand sources, supported by high-income populations and infrastructural investments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Electric Heater Market

- Panasonic Corporation

- LG Electronics

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Dyson Ltd.

- De’Longhi Appliances S.r.l.

- Electrolux AB

- Haier Group Corporation

- Sharp Corporation

- Hitachi Ltd.

- Samsung Electronics

- Philips Electronics

- Vornado Air LLC

- Toshiba Corporation

- Stiebel Eltron GmbH & Co. KG

Recent Developments

- In June 2025, Panasonic launched a new Wi-Fi-enabled wall-mounted heater series with AI-based energy optimization targeting North American and European residential markets.

- In March 2025, LG Electronics expanded its smart heater product line in Asia-Pacific with localized app integration for China and India, improving adoption in emerging markets.

- In January 2025, Dyson introduced a portable smart electric heater featuring automated airflow and energy monitoring capabilities, aimed at premium residential and office segments globally.