Smart Clothing Market Size

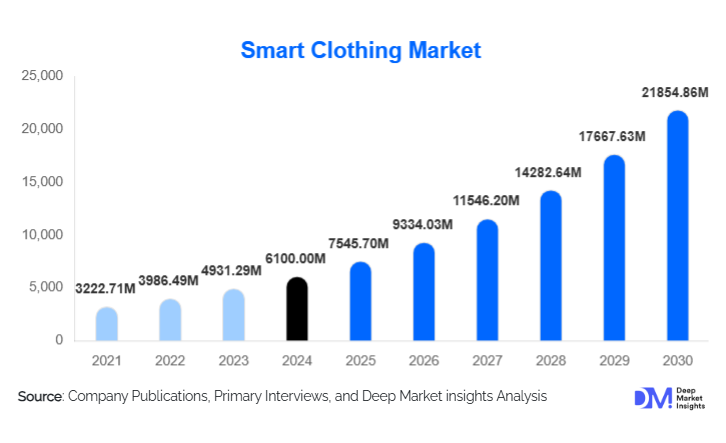

According to Deep Market Insights, the global smart clothing market size was valued at USD 6,100.00 million in 2024 and is projected to grow from USD 7,545.70 million in 2025 to reach USD 21,854.86 million by 2030, expanding at a CAGR of 23.7% during the forecast period (2025–2030). The smart clothing market growth is primarily driven by advancements in textile-integrated electronics, rising adoption of wearable health monitoring devices, and increasing demand for performance optimization across sports, healthcare, and industrial sectors.

Key Market Insights

- Passive smart textiles dominate the market, accounting for over 42% of global revenue due to their cost-effectiveness and ease of integration into consumer garments.

- Smart apparel represents the largest product category, capturing more than 57% of market share as everyday clothing becomes a key medium for biometric monitoring.

- North America leads the market globally, supported by strong technological adoption, high consumer spending, and expanding healthcare wearables demand.

- Asia-Pacific is the fastest-growing region, driven by massive textile production capabilities and rapid digitization across China, Japan, India, and South Korea.

- Sensing and biometric monitoring are the leading functionalities, propelled by rising demand for activity tracking, clinical-grade remote monitoring, and occupational safety solutions.

- Defense and industrial safety applications are accelerating, with governments and enterprises investing in sensor-embedded uniforms and protective garments.

What are the latest trends in the smart clothing market?

Healthcare-Integrated Smart Wearables Accelerate Adoption

Smart clothing is rapidly expanding into healthcare by integrating non-invasive biometric sensors into everyday garments. Hospitals and telehealth providers are using smart shirts, socks, and undergarments to track heart rate, respiration, body temperature, and muscle activity in real time. These wearables support early diagnosis, elderly monitoring, chronic disease management, and post-surgery recovery. Partnerships between textile manufacturers, med-tech developers, and digital health platforms are driving innovation, with many companies developing medical-grade smart garments that comply with global health regulations. Machine-learning-enabled predictive analytics embedded within garments is also emerging as a transformative trend in preventive healthcare.

Energy-Harvesting and Sustainable Smart Textiles Gain Momentum

Eco-friendly, energy-autonomous smart clothing is becoming increasingly popular. Manufacturers are integrating solar, kinetic, and thermoelectric energy-harvesting systems directly into fabrics, reducing reliance on external batteries. These technologies enhance sustainability while improving user convenience, especially in applications like long-term health monitoring and field operations for military or industrial workers. The blending of biodegradable fibers, low-power electronics, and self-charging systems aligns with global sustainability mandates and rising consumer demand for environmentally responsible wearables. This shift is also enabling extended product life cycles and reducing electronic waste.

What are the key drivers in the smart clothing market?

Rising Demand for Continuous Health & Fitness Monitoring

Smart clothing is gaining traction as consumers and healthcare providers seek more accurate and seamless biomonitoring solutions. Unlike wrist-based wearables, smart garments can capture data from multiple body points, offering superior accuracy. The global rise in chronic diseases, aging populations, and demand for preventive healthcare strongly supports market expansion. In sports and fitness, athletes rely on smart apparel to optimize training, prevent injuries, and analyze performance in real time. Growing consumer preference for integrated, comfortable wearables positions smart clothing as a natural evolution of the wearable technology industry.

Industrial Safety & Defense Sector Digitalization

Smart uniforms embedded with environmental and biometric sensors are increasingly being adopted in high-risk industries such as construction, mining, manufacturing, and firefighting. These garments monitor fatigue, heat exposure, chemical risks, and physiological stress to prevent accidents and improve worker safety. Defense organizations are investing in next-generation combat uniforms equipped with vital-sign monitoring, adaptive camouflage, and communication systems. These institutional use cases provide stable long-term market demand and accelerate large-scale smart clothing deployments.

What are the restraints for the global market?

High Production Costs and Complex Manufacturing

Smart clothing production requires specialized machinery, conductive yarns, miniaturized sensors, and rigorous durability testing, resulting in higher manufacturing costs compared to traditional textiles. This cost challenge limits mass adoption, particularly among price-sensitive consumers. Additionally, washability, comfort, and long-term durability remain engineering challenges, raising product development expenses and slowing widespread commercialization.

Regulatory, Data Privacy, and Standardization Challenges

Because smart garments collect sensitive biometric data, they must comply with strict medical, cybersecurity, and data privacy regulations. The absence of universal standards for smart textile safety, sensor calibration, and data transmission creates uncertainty for manufacturers and healthcare providers. Regulatory hurdles are particularly high for clinical-grade smart garments, slowing product approvals and increasing compliance costs.

What are the key opportunities in the smart clothing industry?

Remote Patient Monitoring & Telehealth Expansion

The global shift toward home-based care and telemedicine presents a substantial opportunity for smart clothing adoption. Sensor-embedded garments can continuously monitor vital signs, enabling physicians to track patients remotely and intervene early when abnormalities arise. Healthcare systems are increasingly investing in such technologies to lower hospital readmissions and support aging populations. Smart clothing manufacturers can partner with medical institutions and digital health platforms to create integrated care ecosystems.

Smart PPE and Industrial Workforce Digitization

Smart personal protective equipment (PPE) offers major opportunities as enterprises invest in worker safety and productivity. Smart vests, gloves, and shirts that measure fatigue, posture, heat stress, and gas exposure can significantly reduce workplace injuries. As Industry 4.0 accelerates, integrating smart clothing with IoT-based workplace management systems will unlock new enterprise-level applications, including predictive maintenance of human workers.

Product Type Insights

Smart apparel dominates the market, accounting for over half of total revenue due to widespread use in fitness, healthcare, and occupational environments. Smart shirts, jackets, sports bras, and undergarments lead adoption because they offer multi-point sensing and seamless integration into daily wear. Smart footwear is gaining attention for gait analysis and fall detection, while smart patches serve medical applications requiring localized monitoring. Accessories such as smart gloves and belts are emerging in niche sectors, particularly industrial and military operations.

Application Insights

Sports and fitness remain the largest application category, driven by consumer demand for performance tracking and injury prevention. Healthcare applications are rapidly expanding as hospitals, clinics, and telehealth providers adopt smart garments for remote monitoring. Industrial and workplace safety is a growing application, with enterprises deploying sensor-embedded uniforms to track worker health and environmental hazards. Fashion and lifestyle smart clothing—such as color-changing or illuminated garments—appeal to tech-savvy consumers seeking unique interactive experiences, though this segment remains smaller in scale.

Distribution Channel Insights

Offline retail channels account for the majority of smart clothing sales due to consumer preference for in-store trials, hands-on demonstrations, and fit verification. Specialty stores and branded retail outlets dominate this segment. Online sales, however, are growing rapidly as brands adopt direct-to-consumer (D2C) models, offering personalized recommendations, subscription-based services, and detailed product tutorials. E-commerce platforms and digital marketplaces enable broader reach, while influencer marketing and social media are shaping customer preferences.

End-User Insights

Sports and fitness enthusiasts form the largest end-user group, valuing accurate real-time data and physiological insights. Healthcare users—including chronic patients, elderly populations, and post-operative patients—represent a fast-growing segment. Industrial workers benefit from smart PPE designed to enhance safety and operational efficiency. Military personnel are adopting advanced smart uniforms for improved situational awareness and physiological monitoring. Consumer lifestyle users are increasingly exploring interactive fashion and wellness-oriented garments.

Age Group Insights

Adults aged 31–50 years represent the core user demographic, driven by interest in fitness performance, health monitoring, and workplace safety. Young adults aged 18–30 are quick adopters of smart fashion, athletic wear, and tech-integrated clothing, with strong online purchasing tendencies. Older adults aged 51–65 are increasingly using smart garments for health monitoring and preventive care. The above-65 population represents a high-potential segment for medical smart clothing, particularly for elderly monitoring and fall detection applications.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global smart clothing market with nearly 39% share, driven by strong R&D, technologically advanced consumers, and early adoption in sports, healthcare, and military sectors. The U.S. dominates the regional market with high penetration of biometric wearables, a well-developed telehealth infrastructure, and significant defense investments in smart uniforms. Growing partnerships between tech companies and apparel brands continue to accelerate market expansion.

Europe

Europe is a major market supported by strong textile engineering capabilities, rapid adoption of sustainable smart textiles, and stringent healthcare standards that promote advanced wearable solutions. Germany, the U.K., France, and Italy are leading adopters. European consumers are highly receptive to eco-friendly and energy-harvesting smart textiles, while industrial use is strong due to workplace safety regulations across the EU.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by large-scale manufacturing, rising disposable incomes, and expanding health-tech ecosystems. China leads in both production and consumption of smart garments. Japan and South Korea are innovation centers for smart textiles and flexible electronics, while India is emerging as a key consumer market due to increased fitness awareness and telehealth adoption. APAC’s manufacturing cost advantages significantly accelerate global smart clothing supply chains.

Latin America

Latin America is gradually adopting smart clothing, with Brazil, Mexico, and Argentina leading demand. Growth is supported by expanding fitness culture and rising interest in health monitoring wearables. Industrial smart PPE adoption is increasing in mining and oil & gas sectors, though high import costs limit widespread adoption.

Middle East & Africa

The Middle East shows rising demand for fitness-oriented smart wear and medical textiles, especially in high-income markets such as the UAE, Saudi Arabia, and Qatar. Africa, while still nascent in smart clothing adoption, is witnessing increased use of industrial and medical smart textiles in South Africa and Kenya. Regional growth is supported by investments in digital health, sports performance optimization, and workplace safety modernization.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Clothing Market

- AiQ Smart Clothing

- Sensoria

- DuPont

- Hexoskin (Carre Technologies)

- Myontec

- Adidas

- Toray Industries

- Under Armour

- Myzone

- Siren

Recent Developments

- In March 2025, Sensoria launched a next-generation smart sock line with enhanced pressure sensors for diabetic foot monitoring.

- In February 2025, AiQ Smart Clothing announced a partnership with a major U.S. telehealth provider to deploy medical-grade smart shirts for remote patient monitoring.

- In January 2025, Adidas introduced a new performance smart apparel collection designed with energy-harvesting conductive fibers for endurance athletes.