Smart Audio Devices Market Size

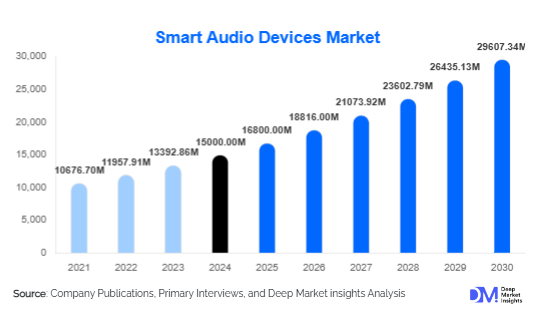

According to Deep Market Insights, the global smart audio devices market size was valued at USD 15,000 million in 2024 and is projected to grow from USD 16,800 million in 2025 to reach USD 29,607.34 million by 2030, expanding at a CAGR of 12% during the forecast period (2025–2030). The smart audio devices market growth is primarily driven by the rising adoption of voice-enabled technologies, expansion of smart home ecosystems, and increasing consumer demand for high-quality wireless and AI-integrated audio solutions across residential, commercial, and automotive applications.

Key Market Insights

- Smart speakers dominate product demand, accounting for nearly half of the 2024 market, supported by multi-room audio, voice assistants, and home entertainment integration.

- Hybrid connectivity (Wi-Fi + Bluetooth) is expanding fastest, enabling seamless portability and high-fidelity streaming across home and outdoor environments.

- North America leads the market, with over 40% share in 2024, driven by high disposable incomes and early smart home adoption.

- Asia-Pacific is the fastest-growing region, led by surging demand in China and India, supported by affordable device launches and rising middle-class spending power.

- Automotive smart audio adoption is accelerating, with OEMs embedding AI-driven voice control and immersive audio systems in connected and electric vehicles.

- AI and edge-computing integration are reshaping device capabilities, offering improved privacy, contextual responses, and localized processing.

What are the latest trends in the smart audio devices market?

AI-Powered and Voice-Enabled Innovations

Manufacturers are embedding advanced AI features and multilingual voice assistants into smart audio devices. Beyond basic commands, these devices are evolving into intelligent hubs capable of contextual responses, emotion recognition, and seamless integration with IoT ecosystems. Edge AI is reducing reliance on cloud processing, enabling faster, privacy-focused voice recognition. This trend is reshaping consumer expectations, turning smart audio devices into central control units for connected homes and workplaces.

Automotive Smart Audio Expansion

Automotive OEMs are rapidly adopting smart audio solutions for infotainment, navigation, and safety applications. Voice assistants and immersive sound systems are being integrated to enhance in-car experiences while ensuring compliance with hands-free driving regulations. The rise of electric and autonomous vehicles further amplifies demand, as cabin audio shifts from functional to experiential, focusing on entertainment, relaxation, and productivity features during travel.

What are the key drivers in the smart audio devices market?

Growing Consumer Demand for Seamless Entertainment

Consumers are increasingly prioritizing high-quality, wireless, and interactive entertainment solutions. Features like noise cancellation, spatial audio, and multi-room streaming have become mainstream, driving widespread adoption of smart speakers, earbuds, and soundbars. Rising usage of subscription music and video platforms reinforces the value proposition of these devices.

Advancements in Connectivity Standards

Upgrades in Bluetooth (LE Audio, low-latency streaming), Wi-Fi 6, and hybrid multi-protocol devices are enabling superior audio performance and interoperability. These advancements improve device versatility, power efficiency, and integration with smart ecosystems, boosting consumer confidence and adoption rates globally.

Automotive Electrification and Connected Mobility

With automakers racing toward electrification and connected vehicle innovations, demand for smart, voice-enabled, and immersive in-car audio is rising. Voice-controlled infotainment and driver assistance features reduce distraction risks, aligning with safety regulations while enhancing passenger experiences.

What are the restraints for the global market?

Fragmented Ecosystems and Privacy Concerns

Incompatibility among smart ecosystems (Alexa, Google Assistant, Siri, proprietary platforms) often frustrates users, limiting device interoperability. Additionally, privacy concerns surrounding voice data collection and compliance with regulations such as GDPR hinder adoption, particularly in regions with stricter data laws.

High Costs of Premium Devices and Components

While entry-level products are affordable, premium devices featuring spatial audio, multi-microphone arrays, and AI-enabled processors are priced significantly higher, limiting accessibility in emerging markets. Rising component costs, including semiconductors and rare earth materials, further pressure margins and restrict scalability.

What are the key opportunities in the smart audio devices industry?

Integration with Smart Home Ecosystems

The expansion of smart home adoption creates opportunities for audio devices to serve as hubs controlling lighting, appliances, and security systems. Manufacturers offering interoperability with standards like Matter and Thread will capture long-term loyalty by anchoring devices at the center of connected living spaces.

Regional Expansion in Emerging Markets

Untapped potential in Asia-Pacific, Latin America, and Africa presents lucrative opportunities. Affordable, localized devices with support for regional languages and cultural preferences can attract new users. Government-backed initiatives promoting digital adoption and smart city infrastructure further accelerate growth prospects.

Specialized Automotive Audio Solutions

The automotive industry offers rising opportunities for suppliers of AI-driven infotainment modules, advanced acoustic hardware, and noise-adaptive audio. As EV adoption expands, smart in-cabin audio experiences—ranging from personalized playlists to wellness soundscapes—can redefine mobility.

Product Type Insights

Smart speakers dominate the market, holding nearly 45% of the global share in 2024. They are widely adopted as entry-level smart home devices, offering voice assistant integration, streaming capabilities, and multi-room control. Smart earbuds and headphones are rapidly growing, propelled by the shift toward wireless lifestyles and premium audio features such as adaptive noise cancellation and spatial audio. Smart soundbars complement home entertainment systems, while automotive-integrated audio solutions are gaining share due to connected car demand.

Application Insights

Residential applications account for nearly 70% of demand in 2024, as consumers embrace smart speakers, headphones, and soundbars for home entertainment and smart living. Commercial applications, including hospitality and retail, are expanding, with smart audio being used for ambience, customer engagement, and conferencing. Automotive applications represent the fastest-growing segment by CAGR, fueled by in-vehicle infotainment systems and regulatory requirements for hands-free operation.

Distribution Channel Insights

Online retail dominates sales, with e-commerce platforms and direct-to-consumer channels enabling competitive pricing and wider reach. Offline retail remains relevant, especially for premium devices, where in-store experiences influence purchase decisions. OEM channels drive significant volumes in the automotive and TV markets, while direct sales through subscription bundles and brand ecosystems are emerging as powerful engagement models.

End-Use Insights

Individual consumers are the largest end-user group, adopting smart audio for entertainment, communication, and smart home integration. Enterprises are increasingly using smart audio in offices and hospitality settings, while OEMs and automotive players are embedding audio solutions into vehicles. Government and institutional use cases, such as smart classrooms and public safety systems, are niche but growing steadily.

| By Device | By Features | By End-user | By Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market with about 40% share in 2024, driven by high smart home penetration and strong adoption of premium devices. The U.S. dominates regional demand, supported by high disposable income, subscription-based ecosystems, and a preference for premium quality audio.

Europe

Europe accounts for nearly 30% of the global market, with Germany, the U.K., and France leading demand. Privacy regulations shape device adoption, pushing demand for on-device AI processing. Strong interest in sustainable and energy-efficient devices is also influencing consumer preferences.

Asia-Pacific

Asia-Pacific holds around 22% of the 2024 market and is the fastest-growing region, with a CAGR above 24%. China dominates regional demand, while India, Japan, and South Korea are rapidly emerging hubs. Growing middle-class spending, affordable launches, and government digitalization initiatives support expansion.

Latin America

Latin America accounts for 5–6% of the global market, with Brazil and Mexico leading. While economic volatility limits mass adoption, demand is growing among urban consumers for budget-friendly devices, often distributed through online channels.

Middle East & Africa

MEA contributes about 2–3% in 2024, led by GCC nations, where luxury electronics are in high demand. Smart city initiatives in the UAE and Saudi Arabia are spurring adoption, while South Africa shows rising penetration due to growing middle-class interest in affordable smart devices.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Audio Devices Market

- Amazon

- Google (Alphabet)

- Apple

- Samsung Electronics

- Sony Corporation

- Bose Corporation

- Sonos

- Harman International (JBL)

- Sennheiser

- Bang & Olufsen

- LG Electronics

- Philips

- Xiaomi

- Panasonic

- Baidu

Recent Developments

- In May 2025, Apple expanded its HomePod line with AI-powered spatial audio features, focusing on multi-room synchronization and enhanced privacy with on-device processing.

- In April 2025, Amazon launched its next-gen Echo devices in India and Southeast Asia, optimized for local languages and regional streaming services.

- In February 2025, Samsung introduced automotive-grade smart audio modules in partnership with major EV manufacturers, integrating immersive cabin soundscapes and voice-driven infotainment.