Slot Machines Market Size

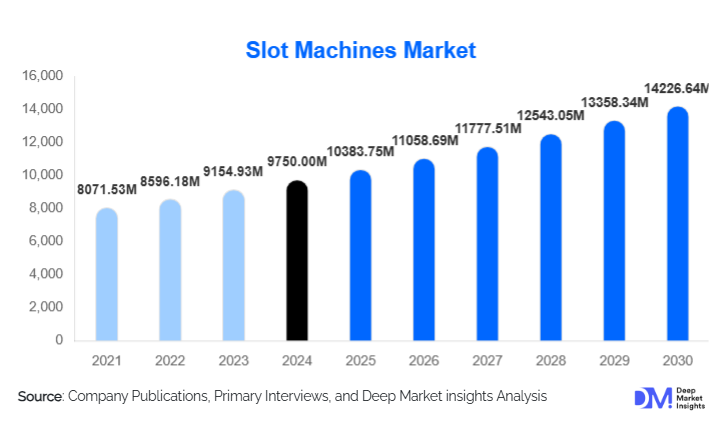

According to Deep Market Insights, the global slot machines market size was valued at USD 9,750 million in 2024 and is projected to grow from USD 10,383.75 million in 2025 to reach USD 14,226.64 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The growth of the slot machines market is primarily driven by rising gambling participation, expansion of online gaming platforms, technological innovation in video and progressive slot machines, and increasing investments in casinos and entertainment complexes globally.

Key Market Insights

- Shift toward digital and online slot machines is transforming traditional gaming, with video and online platforms attracting younger, tech-savvy audiences seeking immersive experiences.

- Progressive and linked slot machines are expanding globally, offering pooled jackpots across multiple locations and driving higher player engagement and casino revenues.

- North America dominates the market, led by the U.S., due to established casinos in Las Vegas and Atlantic City and high disposable incomes.

- Asia-Pacific is the fastest-growing region, fueled by regulatory liberalization in Japan and Macau, tourism-driven casino investments, and growing middle-class wealth.

- Technological innovation, including AR/VR integration, AI-based personalization, and mobile platform connectivity, is reshaping player engagement across both land-based and online slots.

What are the latest trends in the slot machines market?

Digital and Video Slot Adoption

Traditional mechanical slot machines are being increasingly replaced by video and online slot machines. Video slots, offering high-definition graphics, licensed themes, and interactive features, dominate the market due to superior player engagement. Operators are leveraging these machines to attract a younger demographic that favors immersive, gamified experiences. Online platforms are complementing physical casinos by providing remote access, microtransaction-based incentives, and cloud-based gaming, broadening market reach and revenue potential. Linked and networked slot machines with pooled jackpots further enhance the appeal for high-stakes players globally.

Integration of AR/VR and AI Technologies

Slot machines are evolving beyond traditional play by integrating advanced technologies. VR-enabled gaming provides realistic casino experiences at home, while AR overlays enhance on-screen engagement. AI-driven personalization tailors game odds, rewards, and themes to player behavior, increasing retention and playtime. Mobile-enabled slots allow seamless play across devices, boosting adoption among younger audiences. These innovations are setting new standards in the gaming experience, attracting both casual players and high-rollers, while driving digital transformation within the casino industry.

What are the key drivers in the slot machines market?

Rising Online Gambling and Mobile Gaming

The growing popularity of online casinos and mobile gaming platforms is a primary driver for slot machine market growth. Online slots are increasingly preferred for their convenience, accessibility, and variety of gameplay options. In 2024, online slots contributed nearly 35% of global slot revenue, with projections to reach 45% by 2030. Expanding internet penetration and digital payment adoption are further fueling this trend, attracting a broader demographic globally.

Technological Advancements in Gaming Machines

Innovations in slot machine design, including progressive jackpots, multi-line reels, AR/VR gaming, and licensed content themes, are attracting players and increasing session duration. Enhanced interactivity and gamification features are boosting revenues, particularly in markets with high footfall casinos. Operators investing in such technologies gain competitive advantages, leading to market leadership and higher market share.

Expansion of Casino and Entertainment Infrastructure

Global investments in casinos, integrated resorts, and hospitality-driven entertainment complexes are fueling demand for slot machines. Countries like the U.S., Japan, and Macau are expanding resorts, driving the adoption of both advanced mechanical and networked slot machines. This trend is complemented by government support in terms of regulatory frameworks and incentives to modernize entertainment sectors.

What are the restraints for the global market?

Regulatory Restrictions

Strict gambling regulations in certain regions, including parts of Europe and the Middle East, limit slot machine operations. Compliance requirements and licensing costs can increase operational burdens and limit market expansion. Regulatory delays in approvals for online gambling further restrict market growth.

High Capital Costs

Advanced slot machines, especially linked and progressive models, require significant upfront investments, including network infrastructure and software integration. Smaller operators may find adoption challenging, particularly in underdeveloped regions, limiting market penetration.

What are the key opportunities in the slot machines industry?

Expansion in Emerging Markets

Emerging economies in APAC (Japan, China, India) and LATAM (Brazil, Argentina) offer growth opportunities. Increasing disposable incomes, relaxation of gambling laws, and tourism-driven casino developments are driving demand. Early entrants can capture market share in these high-growth regions by leveraging modern slot machines and networked gaming solutions.

Integration of Advanced Technologies

AR/VR, AI personalization, and mobile gaming integrations present opportunities for operators to engage tech-savvy audiences. These technologies enable immersive experiences, extended gameplay, and higher revenues per player. Manufacturers can develop customizable, technology-driven slot machines to differentiate from competitors and capture premium segments.

Government Initiatives and Infrastructure Investments

Government-backed casino expansions, incentives for gaming modernization, and public-private partnerships offer avenues for growth. Programs promoting domestic manufacturing of gaming hardware (e.g., “Make in India”) and modernization of entertainment infrastructure further support market expansion, providing opportunities for both local and global operators.

Product Type Insights

Video slot machines dominate the market, accounting for approximately 55% of the global share in 2024 due to their engaging gameplay and digital features. Mechanical slot machines remain in niche segments but are gradually declining. Linked and networked machines, representing about 40% of the market, are expanding due to their pooled jackpot features, which increase player engagement and casino revenue.

Application Insights

Casino and gaming houses are the largest end-users, accounting for 65% of the market in 2024. Online gambling platforms are the fastest-growing segment, projected to capture 45% of global revenue by 2030. Cruise ships, hotels, and entertainment complexes are emerging applications, with increasing adoption in regions like APAC and LATAM due to tourism-driven demand. Export-driven demand is significant in the U.S., Japan, and Australia, where advanced slot machines are imported for high-end casinos.

Distribution Channel Insights

Slot machines are primarily distributed through direct sales to casinos and gaming operators. Online platforms for virtual slots are gaining traction, enabling remote access and microtransaction monetization. Trade shows, gaming expos, and specialized distributors facilitate B2B sales. Digital marketing, mobile apps, and integrated platforms are increasingly influencing consumer adoption and repeat play.

| By Type | By Product Offering | By End-Use Industry |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds around 38% of the global market in 2024, led by the U.S. with major casinos in Las Vegas and Atlantic City. Strong tourism, high disposable incomes, and advanced gaming regulations drive growth. Canada contributes moderately, primarily through casino expansions in major cities.

Europe

Europe accounts for roughly 30% of the global market, with the U.K. and Germany leading adoption. The region benefits from mature casino markets, strong online gaming uptake, and regulatory frameworks supporting licensed gaming operations. Younger demographics are driving growth in budget and online slots.

Asia-Pacific

APAC is the fastest-growing region, driven by Japan, China (Macau), and Australia. Expanding tourism, regulatory relaxation, and rising disposable incomes support strong demand for high-end slot machines, progressive jackpots, and online slots. CAGR for APAC is projected at 7% between 2025–2030.

Latin America

Brazil and Argentina are emerging markets with growing casino infrastructure and tourism-driven entertainment investments. Affluent consumers are increasingly adopting premium and adventure-focused slot experiences.

Middle East & Africa

South Africa and the UAE are key markets, driven by luxury resorts, high-income populations, and tourism-led casino expansions. Intra-African tourism also supports regional slot machine demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Slot Machines Market

- International Game Technology (IGT)

- Scientific Games

- Aristocrat Leisure

- Konami Gaming

- Everi Holdings

- Ainsworth Game Technology

- Novomatic AG

- Playtech

- Merkur Gaming

- WMS Gaming

- Gamblit Gaming

- Spinomenal

- AGT (American Gaming Systems)

- Novomatic Interactive

- Novomatic Lotteries

Recent Developments

- In Q1 2025, IGT launched a new range of progressive jackpot machines with AR integration for U.S. casinos, enhancing player engagement.

- In Q3 2024, Aristocrat Leisure expanded its digital slot portfolio for online platforms in APAC, targeting emerging markets in Japan and China.

- In Q2 2025, Scientific Games upgraded linked slot machine networks in European casinos, integrating AI-based personalized gaming features to boost retention.