Slewing Scraper Market Size

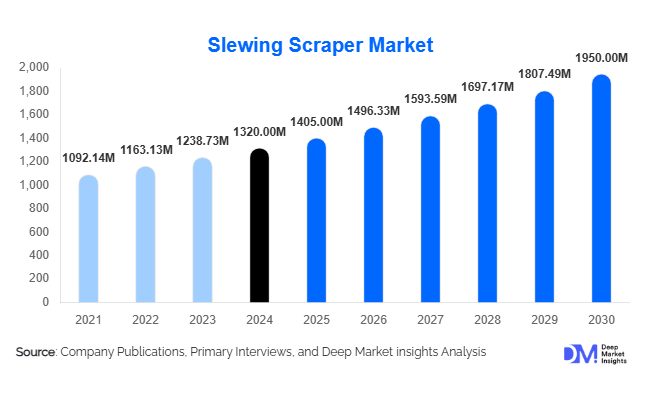

According to Deep Market Insights, the global slewing scraper market size was valued at USD 1,320 million in 2024 and is projected to grow from USD 1,405 million in 2025 to reach USD 1,950 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing infrastructure development, rising mining activities, and the adoption of advanced technologies such as hydraulic, electric, and IoT-enabled slewing scrapers for efficient bulk material handling.

Key Market Insights

- Hydraulic slewing scrapers dominate the market, representing approximately 45% of the market share in 2024, due to their high lifting capacity, operational efficiency, and suitability for mining and construction projects.

- Large-capacity scrapers (25+ tons) are increasingly adopted globally, holding 40% market share, driven by mega construction projects and high-volume mining operations.

- Mining remains the leading application, contributing 35% of the market in 2024, owing to the demand for bulk excavation in coal, iron ore, and mineral operations.

- Construction & Infrastructure end-use accounts for 38% of the market, propelled by urbanization, road, and airport development projects across Asia-Pacific and North America.

- Asia-Pacific emerges as the fastest-growing region, with a 7–8% CAGR, led by China, India, and Australia due to rapid industrialization and government-backed infrastructure initiatives.

- Technological integration, including electric/hybrid drives, IoT, and predictive maintenance, is enhancing equipment efficiency and reducing operational costs, reshaping market dynamics.

What are the latest trends in the slewing scraper market?

Technological Integration and Automation

Advanced slewing scrapers are increasingly equipped with IoT-enabled sensors, GPS, and telematics for real-time monitoring and predictive maintenance. Automation reduces downtime, improves fuel efficiency, and enhances operational safety, making these scrapers highly attractive to mining and construction companies. Manufacturers are focusing on electric and hybrid models that comply with stringent emission standards, particularly in Europe and North America, providing a competitive advantage in environmentally regulated regions.

Electrification and Sustainable Machinery

Electric and hybrid slewing scrapers are gaining traction due to the growing emphasis on sustainability. Reduced carbon emissions, lower fuel consumption, and quieter operations appeal to both industrial operators and regulatory bodies. Incentives for clean energy machinery in countries like Germany, the U.K., and India further accelerate adoption. This trend aligns with global corporate sustainability initiatives and positions manufacturers who invest in green technologies for long-term market leadership.

What are the key drivers in the slewing scraper market?

Rising Infrastructure Development

Infrastructure expansion in emerging economies, including highways, metro systems, airports, and dams, is driving demand for slewing scrapers. These machines enhance efficiency in earthmoving operations and meet the large-scale material handling needs of construction and civil engineering projects, particularly in the Asia-Pacific and North America.

Technological Advancements

The integration of automation, GPS tracking, and telematics enables operators to optimize scraper performance, reduce fuel consumption, and extend machine life. These features make advanced scrapers more cost-effective and reliable for high-volume mining and construction projects, further stimulating market growth.

Replacement of Aging Machinery

Companies in developed regions are replacing older equipment with modern, high-capacity scrapers to improve productivity and operational efficiency. This trend is particularly evident in North America and Europe, where infrastructure and mining operators are upgrading fleets to meet higher output requirements and environmental standards.

What are the restraints for the global market?

High Capital Investment

The upfront cost of advanced hydraulic and electric slewing scrapers can be prohibitive for small and mid-sized operators. High initial investment limits market adoption, particularly in developing regions, and slows the overall growth potential despite increasing infrastructure projects.

Operational Complexity and Maintenance

Advanced scrapers require skilled operators and specialized maintenance services. Regions lacking technical expertise or after-sales support may experience reduced adoption rates. Additionally, the complexity of maintaining hybrid and electric systems can deter smaller construction and mining firms from investing in high-end models.

What are the key opportunities in the slewing scraper industry?

Expansion in Emerging Markets

Rapid urbanization and industrialization in India, China, and Southeast Asia present significant opportunities. Government-led infrastructure initiatives, including road networks, airports, and smart cities, are boosting demand for large-capacity and technologically advanced skyscrapers. Companies entering these markets can tap into high-growth construction and mining projects to increase market share.

Technological Innovation and Smart Scrapers

Integrating IoT, GPS, AI-based predictive maintenance, and automation provides a strong differentiation for manufacturers. Smart scrapers reduce operational costs, minimize downtime, and enhance productivity, allowing both new entrants and existing players to capture niche technology-driven market segments.

Sustainability and Green Machinery

The push for environmentally friendly operations creates opportunities for electric and hybrid slewing scrapers. Incentives for low-emission machinery, particularly in Europe and North America, encourage the adoption of sustainable equipment, offering manufacturers a competitive advantage in regulated markets.

Product Type Insights

Hydraulic slewing scrapers dominate the market, valued for their superior lifting capacity, energy efficiency, and adaptability in diverse applications. Diesel-powered models continue to serve traditional operations due to cost-effectiveness, while electric scrapers are gaining prominence in Europe and North America. Large-capacity scrapers (25+ tons) are preferred for high-volume projects, whereas medium and small scrapers are used in urban construction and specialized mining operations.

Application Insights

Mining applications lead the market, accounting for 35% of revenue in 2024, driven by coal, iron ore, and mineral extraction operations. Construction and infrastructure applications follow closely, contributing 38% of the market, particularly in urban development projects, roads, and airports. Ports, industrial material handling, and civil infrastructure represent emerging applications, highlighting the expanding versatility of slewing scrapers across sectors.

Distribution Channel Insights

Direct sales by manufacturers dominate the market, particularly for high-capacity and technologically advanced scrapers. Online platforms and industrial equipment marketplaces are increasingly used for smaller and mid-range units. OEM partnerships with construction and mining contractors facilitate bulk equipment supply. Service-based offerings and long-term maintenance contracts are emerging channels that enhance customer retention and optimize equipment utilization.

End-Use Industry Insights

The construction & infrastructure sector leads end-use demand, accounting for 38% of the market, fueled by urbanization and government projects. Mining follows closely with a 35% share, driven by bulk material handling requirements. Industrial material handling and port operations are emerging end-use sectors. Export-driven demand from Asia-Pacific to Africa and Latin America is increasing, particularly for mining-focused equipment, supporting growth in cross-border markets.

| By Type | By Capacity | By Application | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global market in 2024, led by the U.S. and Canada. High demand is driven by highway expansion, mining operations, and the adoption of technologically advanced scrapers. Growth is projected at a CAGR of 5.5% from 2025 to 2030.

Europe

Europe holds 22% market share, led by Germany, France, and the U.K. Strong construction and mining projects, combined with stringent emission regulations, drive adoption of hybrid and electric scrapers. Moderate growth is projected at a 4.8% CAGR.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a 7–8% CAGR, accounting for 32% market share. China, India, and Australia lead due to rapid urbanization, infrastructure spending, and mining activities.

Middle East & Africa

The market is expanding due to mining and large-scale construction projects in Saudi Arabia, the UAE, and South Africa, representing approximately 10% of global demand.

Latin America

Brazil and Argentina drive demand in Latin America, accounting for 8% of the market, primarily through mining and infrastructure projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Slewing Scraper Market

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- Liebherr Group

- Hitachi Construction Machinery

- Doosan Infracore

- Terex Corporation

- SANY Group

- XCMG Group

- JCB

- Kobelco Construction Machinery

- Wirtgen Group

- Zoomlion Heavy Industry

- Hyundai Construction Equipment

- Shantui Construction Machinery

Recent Developments

- In January 2025, Caterpillar launched a new hybrid slewing scraper in North America, integrating IoT sensors for predictive maintenance and improved fuel efficiency.

- In March 2025, Komatsu expanded its electric scraper portfolio in Europe, aligning with stringent emission standards and sustainability initiatives.

- In June 2025, SANY Group inaugurated a new manufacturing facility in India, increasing production capacity for large-capacity hydraulic scrapers to meet growing infrastructure demand.