Sleeveless Softshell Market Size

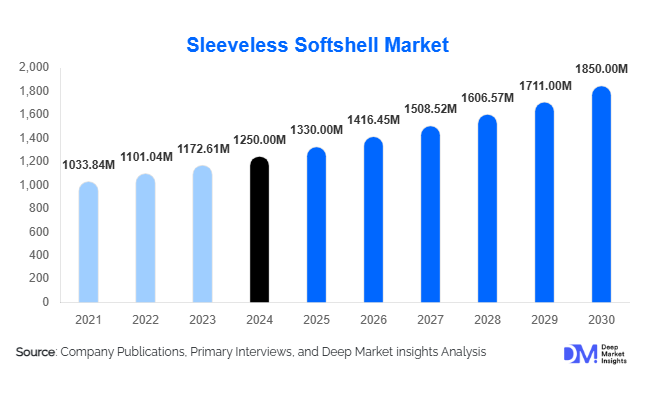

According to Deep Market Insights, the global sleeveless softshell market size was valued at USD 1,250 million in 2024 and is projected to grow from USD 1,330 million in 2025 to reach USD 1,850 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for versatile, weather-resistant apparel, rising outdoor and adventure sports participation, and the adoption of sleeveless softshells in urban and tactical applications.

Key Market Insights

- Technological innovations in fabrics, including breathable composites, water-repellent coatings, and UV protection, are enhancing product performance and expanding consumer appeal.

- Emerging markets in APAC and LATAM are showing strong growth potential due to rising disposable incomes, adventure tourism, and expanding e-commerce channels.

- Eco-friendly and sustainable sleeveless softshells are gaining traction among environmentally conscious consumers, driving premium product adoption.

- North America dominates the market, supported by high outdoor activity participation and a mature retail infrastructure.

- APAC is the fastest-growing region, driven by rising middle-class wealth, increased outdoor recreation, and online retail expansion.

- Direct-to-consumer channels and online platforms are reshaping sales and distribution, providing convenience and personalization for consumers globally.

What are the latest trends in the sleeveless softshell market?

Integration of Advanced Fabrics and Technology

Manufacturers are incorporating advanced textile technologies such as waterproof membranes, breathable composites, and stretchable fabric blends. These innovations improve performance for outdoor activities, tactical use, and urban wear. Eco-friendly and recycled fabrics are being introduced to meet sustainability goals and align with increasing environmental awareness among consumers. In addition, temperature-regulating fabrics and moisture-wicking coatings are becoming more mainstream, enhancing comfort during high-intensity activities.

Growth of Online Retail and Direct-to-Consumer Channels

E-commerce platforms and brand-owned online stores are dominating sales for sleeveless softshells, offering convenience, a wide product variety, and transparent pricing. Digital marketing and social media campaigns help brands reach niche consumer segments, including urban outdoor enthusiasts, tactical users, and adventure sports participants. Direct-to-consumer sales allow brands to gather data on consumer preferences, enabling rapid product adaptation and personalized offerings. Subscription-based and limited-edition collections are also emerging to target loyal consumers.

What are the key drivers in the sleeveless softshell market?

Rising Outdoor Recreation and Adventure Participation

The increasing popularity of outdoor sports, hiking, trekking, cycling, and adventure tourism is a significant driver of sleeveless softshell demand. Consumers seek lightweight, durable, and weather-resistant clothing for multi-season use. This trend is strongest in North America and Europe, where organized adventure sports participation is high. Urban consumers are also adopting performance-inspired softshells for casual wear, expanding the market beyond traditional outdoor use.

Preference for Versatile and Functional Apparel

Modern consumers prefer versatile garments that combine style, comfort, and performance. Sleeveless softshells meet this demand by offering windproof, breathable, and water-resistant properties suitable for both outdoor activities and everyday urban wear. Rising awareness of health, fitness, and outdoor lifestyles contributes to sustained growth. Brands leveraging design aesthetics alongside technical functionality are seeing higher adoption and customer loyalty.

Expansion of Sustainable and Eco-Friendly Products

Eco-conscious consumers are driving demand for sustainable fabrics and production processes. Recycled polyester, organic blends, and low-impact coatings are increasingly being adopted. Manufacturers promoting environmental responsibility enhance brand reputation and attract premium buyers willing to pay higher prices, positively impacting market growth.

What are the restraints for the global market?

High Product Costs

Advanced fabrics and technical coatings increase the production costs of sleeveless softshells, making premium products expensive. This limits adoption in price-sensitive markets, particularly in emerging economies. Brands need to balance performance with affordability to expand consumer reach.

Supply Chain and Raw Material Volatility

Fluctuating prices of synthetic fibers, composites, and specialized coatings can impact profit margins and production planning. Disruptions in manufacturing hubs or shipping networks, as observed during global supply chain challenges, may lead to delays and inventory shortages, affecting market expansion.

What are the key opportunities in the sleeveless softshell market?

Innovation in Smart and Functional Apparel

Integration of wearable technology, temperature regulation, and moisture-wicking fabrics opens opportunities for premium product lines. Companies that invest in R&D to offer enhanced comfort, performance, and sustainability features can differentiate themselves and capture high-value consumer segments.

Expansion in Emerging Regions

APAC, LATAM, and the Middle East represent high-growth markets due to increasing disposable incomes, rising outdoor recreation, and growing e-commerce penetration. Local partnerships, targeted marketing campaigns, and region-specific product lines can help companies capitalize on these expanding markets.

Sustainability and Eco-Friendly Focus

Consumer demand for environmentally responsible products creates opportunities for brands to develop eco-friendly sleeveless softshells. Leveraging recycled materials, sustainable manufacturing practices, and certifications can attract premium buyers and improve brand positioning globally.

Product Type Insights

Waterproof sleeveless softshells dominate the market, accounting for nearly 35% of the global market in 2024. Their high demand is attributed to multi-season usability and suitability for adventure sports, tactical operations, and outdoor activities. Windproof and breathable variants are also gaining traction, particularly among cyclists, hikers, and urban consumers, driven by increasing lifestyle versatility and performance preferences.

Application Insights

Outdoor & adventure sports remain the largest end-use segment, representing approximately 40% of the market in 2024. Hiking, trekking, and cycling are key drivers of demand. Casual & urban wear applications are growing rapidly, supported by fashion-conscious consumers seeking performance apparel. Military & tactical applications contribute significantly to high-margin sales due to specialized requirements for durability and mobility. Corporate & promotional use is an emerging niche, leveraging customizable softshells for branding and employee uniforms.

Distribution Channel Insights

Online retail channels dominate, accounting for nearly 45% of total market sales in 2024. Specialty sports stores are significant for high-performance products, while departmental and supermarket channels cater to casual wear consumers. Direct-to-consumer platforms and online marketing are enabling brands to reach niche segments, enhance customer engagement, and improve margins through personalized offerings.

| By Product Type | By Material Type | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 30% in 2024, driven by high outdoor sports participation, strong disposable income, and mature retail infrastructure. The U.S. leads demand due to the popularity of adventure tourism and urban adoption of performance apparel. Canada shows steady growth with rising interest in winter sports and trekking.

Europe

Europe accounts for nearly 28% of the global market, led by Germany, the UK, and France. Demand is driven by eco-conscious consumers, active outdoor lifestyles, and well-established retail networks. Fashion and sustainability trends are shaping product adoption across the region.

Asia-Pacific

APAC is the fastest-growing region, fueled by China, India, Japan, and Australia. Increasing disposable incomes, adventure tourism, and e-commerce penetration are driving growth. China is leading premium product adoption, while India is expanding mid-range segments. Japan and Australia remain mature markets with steady demand for performance apparel.

Latin America

Brazil, Argentina, and Mexico are contributing to gradual market growth, with outbound travel for adventure tourism and urban lifestyle adoption being the primary drivers. Niche operators are marketing functional softshells emphasizing durability and weather resistance.

Middle East & Africa

Africa benefits from outdoor activity demand and local textile manufacturing hubs. The Middle East, particularly the UAE and Saudi Arabia, is expanding due to high-income consumers seeking luxury and performance apparel. Intra-African trade and regional outdoor events are increasing awareness and adoption of sleeveless softshells.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sleeveless Softshell Market

- Patagonia

- The North Face

- Columbia Sportswear

- Arc’teryx

- Mammut

- Helly Hansen

- Mountain Hardwear

- Salomon

- Rab

- Montane

- Black Diamond

- Berghaus

- Outdoor Research

- Jack Wolfskin

- Fjällräven

Recent Developments

- In June 2025, Patagonia launched a new sustainable sleeveless softshell line using recycled polyester and eco-friendly water-repellent coatings for urban and adventure wear.

- In May 2025, Arc’teryx expanded its e-commerce presence in APAC, targeting high-growth markets in China and India with localized product offerings.

- In March 2025, Columbia Sportswear introduced a new breathable and stretchable sleeveless softshell, optimized for cycling and trekking enthusiasts, strengthening its premium performance segment.