Skin Resurfacing Market Size

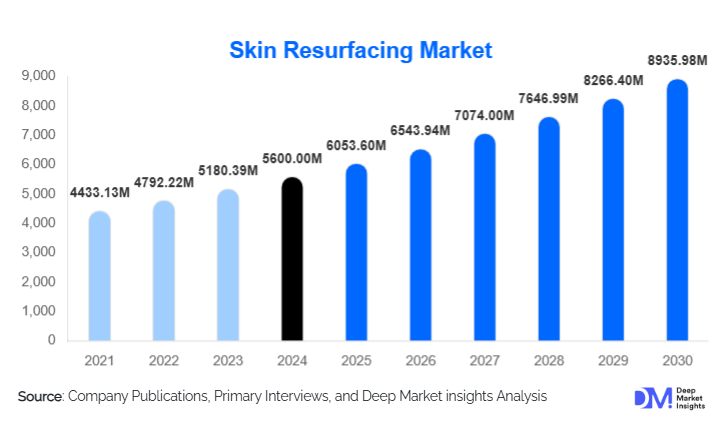

According to Deep Market Insights, the global skin resurfacing market size was valued at USD 5,600 million in 2024 and is projected to grow from USD 6,053.60 million in 2025 to reach USD 8,935.98 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for minimally invasive anti-aging procedures, technological advancements in laser and RF devices, and the growing acceptance of cosmetic dermatology treatments across emerging and developed markets.

Key Market Insights

- Laser-based and hybrid resurfacing technologies dominate the market due to their superior efficacy in treating wrinkles, acne scars, pigmentation, and sun damage, capturing a significant share of revenue globally.

- Medical spas and dermatology clinics are expanding, making resurfacing procedures more accessible and attracting a broader patient base seeking non-surgical cosmetic solutions.

- North America leads in market share, supported by advanced clinical infrastructure, high disposable incomes, and rapid adoption of cutting-edge resurfacing devices.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class incomes, increased awareness of aesthetic treatments, and the expansion of medical tourism.

- Technological integration, including AI-enabled treatment planning, hybrid laser-RF devices, and smart energy delivery systems, is reshaping patient outcomes and clinic adoption strategies.

- Home-use resurfacing devices are emerging as a high-potential segment, targeting wellness-conscious consumers and enabling recurring revenue for device manufacturers.

What are the latest trends in the skin resurfacing market?

Hybrid and AI-Enabled Devices

Technological innovation is transforming skin resurfacing. Hybrid devices that combine fractional lasers with RF microneedling or plasma systems are becoming popular for delivering customized, multifaceted treatments. AI-enabled devices allow clinicians to analyze skin type, determine optimal energy settings, and monitor results in real time, enhancing safety and treatment efficacy. This trend is particularly appealing in high-income markets, where patients demand personalized and minimally invasive procedures with minimal downtime.

Shift Toward Medspas and Consumer-Centric Services

There is a noticeable shift from traditional hospital-based dermatology to medspas and aesthetic centers, offering more affordable, convenient, and patient-friendly resurfacing treatments. Medspas focus on creating a holistic patient experience, combining skin rejuvenation with wellness services. The trend also includes the rise of at-home devices for microneedling and mild chemical peels, catering to consumers who prefer self-administered, maintenance-focused treatments under professional guidance.

What are the key drivers in the skin resurfacing market?

Increasing Anti-Aging Awareness

Rising awareness of age-related skin concerns and the growing preference for non-invasive treatments among aging populations are significant drivers. Skin resurfacing procedures are highly effective for reducing fine lines, wrinkles, and pigmentation, which has encouraged wider adoption among adults aged 31–50, representing the largest patient demographic.

Advances in Minimally Invasive Technology

Continuous innovation in laser, RF, and plasma devices has improved safety, reduced downtime, and enhanced outcomes. Clinicians are increasingly adopting fractional and hybrid systems that deliver precise energy, promoting better skin regeneration while minimizing complications. This technological advancement is a primary factor fueling growth in both developed and emerging markets.

Growing Acceptance of Aesthetic Procedures

Cosmetic treatments have become more culturally acceptable across genders and age groups. Social media, influencer-driven content, and increasing male participation in aesthetic care have broadened the target audience. Non-surgical, minimally invasive resurfacing procedures are particularly attractive to first-time users due to low-risk profiles and faster recovery compared to surgical options.

What are the restraints for the global market?

High Procedure Costs and Limited Reimbursement

Skin resurfacing treatments can be expensive, with multiple sessions often required for optimal outcomes. Most insurance providers classify these procedures as elective cosmetic treatments, limiting reimbursement options. This cost barrier restricts adoption, particularly in emerging markets or among price-sensitive consumers.

Shortage of Skilled Practitioners

The effectiveness and safety of resurfacing procedures depend on the clinician's skill. Lack of trained dermatologists and certified aestheticians in several regions limits adoption, as improper use of high-energy devices can lead to complications such as scarring and pigmentation changes. Training requirements and certification costs present ongoing challenges for market expansion.

What are the key opportunities in the skin resurfacing industry?

Expansion in Emerging Markets

Rising disposable incomes, growing awareness of aesthetic procedures, and the growth of medical tourism present substantial opportunities in the Asia-Pacific and Latin America. Countries like China, India, and Brazil offer potential for both device manufacturers and clinics, particularly in urban centers and tourist hubs.

Integration of Smart Technologies

The adoption of AI, skin-mapping diagnostics, and hybrid energy platforms provides opportunities for differentiation. Devices that optimize treatment delivery, improve patient outcomes, and reduce side effects are highly attractive to dermatology clinics, medspas, and even home-use consumers.

At-Home Resurfacing Devices

The growing wellness and self-care trend is creating demand for safe, regulatory-approved at-home resurfacing devices. Subscription and leasing models for devices and consumables can generate recurring revenue streams, particularly in markets with high smartphone penetration and teledermatology adoption.

Product Type Insights

The skin resurfacing market is predominantly driven by laser-based technologies, with ablative and non-ablative laser systems collectively accounting for nearly 56% of global device revenues in 2024. Their dominance stems from superior clinical efficacy in treating wrinkles, deep scars, pigmentation disorders, and photoaged skin compared to other resurfacing modalities. Ablative CO₂ and Er: YAG lasers remain the gold standard for high-intensity resurfacing, offering dramatic outcomes that appeal to patients seeking long-term skin rejuvenation. Meanwhile, non-ablative lasers continue to gain traction for minimal downtime treatments, especially in medspas and dermatology centers catering to busy, working-age consumers.

Non-ablative RF and microneedling systems represent the fastest-growing product category, supported by expanding demand for low-risk, low-recovery procedures. RF microneedling’s ability to stimulate collagen without compromising epidermal integrity makes it highly attractive for patients with darker skin types and those seeking safer alternatives to fully ablative lasers. Manufacturers are launching hybrid devices combining RF, laser, and ultrasound to broaden treatment capabilities and reduce patient downtime.

Application Insights

Anti-aging and wrinkle reduction is the leading application segment, contributing approximately 38% of global market share in 2024. This dominance is driven by growing aesthetic awareness, rising consumer desire for youthful appearance, and the expanding aging population in developed and emerging markets. Laser and RF resurfacing procedures are widely recognized for their ability to stimulate collagen, tighten skin, and reduce fine-to-deep wrinkles, making them central to anti-aging treatment plans. Patients increasingly prefer non-surgical methods over facelifts and invasive cosmetic procedures due to lower costs and minimal downtime.

Acne and scar revision form the second-largest segment, fueled by growing cases of adult acne, post-inflammatory hyperpigmentation, and rising demand for scar correction among younger populations. The availability of fractional, non-ablative technologies that reduce scarring with a lower risk of post-treatment complications, especially for darker Fitzpatrick skin types, continues to accelerate adoption.

Distribution Channel Insights

Dermatology clinics and medical aesthetic centers remain the dominant distribution channels for skin resurfacing procedures, driven by patient trust, availability of advanced devices, and the need for skilled practitioners for high-energy treatments. Clinics typically invest in multi-functional devices capable of addressing wrinkles, scars, pigmentation, and texture issues, resulting in higher procedure volumes and strong repeat visit patterns.

Medspas represent the fastest-growing channel due to their convenience, affordability, and rising consumer preference for wellness-oriented service environments. Their rapid expansion is also fueled by lower regulatory barriers, widespread franchising models, and bundled packages combining resurfacing, facials, and other non-invasive procedures.

End-User Insights

Hospitals and dermatology clinics accounted for approximately 46.8% of the market share in 2024, driven by demand for high-efficacy treatments requiring advanced devices and certified practitioners. Patients increasingly prefer clinical environments for procedures involving ablative lasers and RF microneedling due to safety considerations and access to professional-grade post-care services.

Medspas represent the fastest-expanding end-user segment, owing to rising consumer preference for quick, convenient, and moderately priced resurfacing services. Their growth is supported by the popularity of non-ablative and lower-intensity resurfacing modalities, which are well-suited to spa-based treatment models.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, capturing approximately 36–37% of global revenue, largely driven by the United States. The region’s growth is underpinned by high consumer spending on cosmetic treatments, widespread acceptance of minimally invasive procedures, and access to technologically advanced resurfacing devices. A strong ecosystem of dermatology clinics, aesthetic centers, and certified practitioners further supports professional-grade treatment uptake. Additionally, North America benefits from robust R&D activity among leading OEMs, accelerating the adoption of hybrid laser-RF systems, AI-based diagnostics, and energy-efficient devices. Growing male participation in cosmetic dermatology and strong demand for combination anti-aging treatments also contribute to regional expansion.

Europe

Europe ranks as the second-largest market, led by Germany, the United Kingdom, France, Italy, and Spain. Regional growth is supported by stringent regulatory standards (CE marking) that ensure high device quality and patient safety, boosting consumer confidence in aesthetic treatments. The proliferation of medspas, rising demand for non-invasive anti-aging solutions, and strong cultural preference for natural-looking results bolster market expansion. Additionally, increasing adoption of fractional and non-ablative laser systems in dermatology clinics, coupled with growing emphasis on evidence-based aesthetic medicine, strengthens Europe’s position. Rising medical tourism in Eastern Europe also fuels demand for affordable resurfacing procedures.

Asia-Pacific

Asia-Pacific is the fastest-growing region worldwide, driven by surging demand from China, India, South Korea, and Japan. Growth is fueled by expanding medical tourism ecosystems, especially in South Korea and Thailand, rising disposable incomes, and urban middle-class adoption of aesthetic procedures. Consumers in APAC exhibit high interest in pigmentation correction, acne scar treatment, and anti-aging, making the region a hotspot for hybrid lasers and RF microneedling technologies. The proliferation of aesthetic clinics, aggressive device marketing, and widespread use of K-beauty and J-beauty routines further accelerates adoption. Strong demographic factors, such as large populations aged 20–45, also create sustained demand for preventive and corrective skin treatments.

Latin America

Latin America, led by Brazil, Mexico, Colombia, and Argentina, is emerging as a high-growth region fueled by increasing beauty consciousness, rising cosmetic healthcare spending, and strong cultural emphasis on appearance. Brazil, in particular, is one of the world’s largest consumers of aesthetic treatments. Clinics in the region increasingly rely on imported U.S. and European devices, which are perceived as technologically superior. Growth is also driven by medical tourism, especially for laser-based resurfacing and anti-aging procedures offered at competitive prices. Social media influence and the rising adoption of medspa models continue to expand the regional consumer base.

Middle East & Africa

The Middle East & Africa market is growing steadily, driven by high disposable incomes, luxury clinic expansion, and strong demand for anti-aging and pigmentation treatments. GCC countries, especially the UAE, Saudi Arabia, and Qatar, lead regional adoption due to thriving medical tourism and the influx of Western-trained practitioners. Consumers in these markets prefer premium procedures such as fractional CO₂ lasers, hybrid resurfacing, and RF microneedling. South Africa serves as the key hub in sub-Saharan Africa, with advanced dermatology facilities and a strong demand for treatments addressing sun damage and hyperpigmentation. Government initiatives supporting cosmetic medicine and rapid medspa expansion further drive regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Skin Resurfacing Market

- Candela Medical

- Lumenis Ltd.

- Cynosure (Hologic, Inc.)

- Alma Lasers

- Cutera, Inc.

- Sciton, Inc.

- Lutronic Corporation

- Quanta System

- Lynton Lasers Ltd.

- Fotona d.o.o.

- Solta Medical (Bausch Health)

- Venus Concept

- Classys, Inc.

- Sofwave Medical

- Altair Instruments

Recent Developments

- In May 2025, Sciton launched an AI-enhanced hybrid laser-RF platform to improve treatment customization and reduce downtime.

- In April 2025, Candela introduced a new at-home microneedling and mild peel device, targeting wellness-conscious consumers globally.

- In February 2025, Hologic (Cynosure) expanded its fractional laser portfolio in Asia-Pacific clinics, strengthening market presence and supporting medical tourism growth.