Skin Rejuvenation Market Size

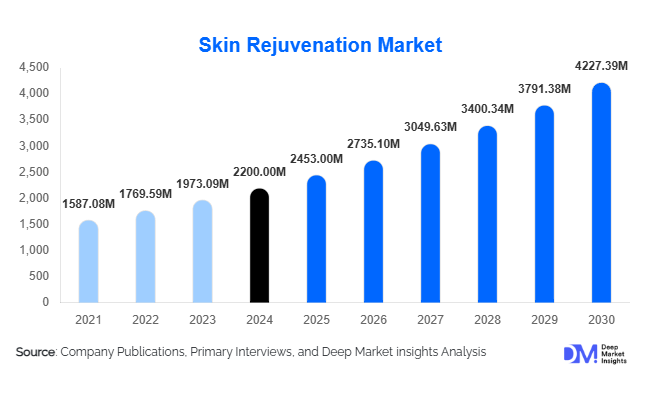

According to Deep Market Insights, the global skin rejuvenation market size was valued at USD 2,200 million in 2024 and is projected to grow from USD 2,453.00 million in 2025 to reach USD 4,227.39 million by 2030, expanding at a CAGR of 11.5% during the forecast period (2025–2030). Market growth is driven by surging demand for non-invasive aesthetic procedures, technological advances in energy-based systems, and a rising global population seeking anti-aging, scar-reduction, and complexion-improvement treatments.

Key Market Insights

- Laser-based rejuvenation remains the dominant modality, accounting for roughly 30 % of total 2024 revenue, supported by innovations in fractional and hybrid lasers.

- Dermatology clinics lead the end-use landscape, holding around 45 % market share due to specialized expertise and advanced device adoption.

- North America dominates the global market with about 38 % share in 2024, driven by mature clinic networks and high disposable incomes.

- Asia-Pacific is the fastest-growing region, exhibiting double-digit CAGR on the back of rising aesthetic awareness and medical-tourism activity.

- Home-use rejuvenation devices and AI-powered skin-analysis tools are reshaping consumer engagement and expanding addressable demand.

- Manufacturers are focusing on hybrid platforms (laser + RF) and consumable-tip recurring models, ensuring steady post-sales revenue streams.

Latest Market Trends

Rise of Non-Invasive and Hybrid Rejuvenation Systems

Minimally invasive treatments such as fractional lasers, microneedling RF, and HIFU are increasingly preferred over surgical facelifts. Hybrid systems combining multiple energies (laser + RF + light) are delivering superior efficacy with minimal downtime, making them the go-to solutions in clinics worldwide. Manufacturers are integrating cooling, automated calibration, and AI-assisted settings for consistent outcomes, broadening patient adoption across age groups.

Personalized and Data-Driven Skin Aesthetics

Digital diagnostics, AI-powered skin mapping, and tele-dermatology consultations are revolutionizing treatment personalization. Clinics use analytics platforms to track progress, predict optimal treatment intervals, and tailor protocols to ethnicity and skin type. Subscription-based rejuvenation programs, loyalty apps, and smart-device integration are creating sustained engagement and recurring revenue opportunities for service providers.

Skin Rejuvenation Market Drivers

Growing Demand for Non-Invasive Aesthetic Procedures

Consumers increasingly favor rejuvenation options offering natural-looking results without surgery or lengthy recovery. This preference has accelerated demand for laser, IPL, and RF-based systems worldwide. The convenience of same-day procedures and reduced downtime has made these treatments mainstream across both genders and age groups.

Aging Populations and Aesthetic Consciousness

Global aging trends and rising aesthetic awareness fueled by social media culture are stimulating demand for wrinkle-reduction and skin-firming solutions. Older demographics seek to maintain a youthful appearance, while younger consumers pursue preventative skin care. This convergence of age groups broadens the long-term market base.

Technological Innovation and Expanding Clinic Infrastructure

Continuous R&D investment has led to more efficient, safer, and multi-purpose rejuvenation systems. Simultaneously, the global proliferation of aesthetic clinics, med-spas, and dermatology chains has improved treatment accessibility. Financing options and flexible pricing plans further encourage patient uptake, particularly in emerging economies.

Market Restraints

High Equipment and Procedure Costs

Advanced devices and consumables entail substantial capital investment, raising per-procedure costs for clinics and consumers. Price sensitivity in emerging regions can restrict adoption, while smaller operators face entry barriers due to expensive certification and maintenance requirements.

Regulatory Complexity and Safety Concerns

Inconsistent regulatory frameworks across countries, coupled with practitioner skill variability, create trust and safety challenges. Adverse event risks and lack of standardized guidelines can slow patient acceptance and impede the cross-border expansion of aesthetic service providers.

Skin Rejuvenation Market Opportunities

Emerging-Market Expansion and Medical-Tourism Growth

Rapid economic development and rising disposable incomes in Asia-Pacific, Latin America, and the Middle East are unlocking new patient pools. Medical-tourism hubs such as Thailand, India, and the UAE offer cost-effective procedures with global-standard technology, enabling device manufacturers and clinic chains to capture underserved segments.

Innovation in Home-Use and AI-Integrated Devices

Consumer appetite for self-care solutions has spurred demand for portable RF, LED, and micro-current devices. Integration with smartphone apps and AI-driven diagnostics enhances treatment accuracy and user engagement. This democratization of rejuvenation technology creates new revenue channels and strengthens brand loyalty.

Personalized Protocols and Subscription-Based Aesthetic Programs

Data analytics now enables customized treatment plans tailored to individual skin conditions. Clinics and brands are launching membership or subscription programs that offer periodic maintenance sessions, exclusive product bundles, and digital progress tracking, ensuring predictable recurring income and stronger customer retention.

Product Type Insights

Laser-based rejuvenation devices dominate the global market, accounting for around 30 % of 2024 revenue. Their proven efficacy in wrinkle, pigmentation, and texture correction, along with continued innovation in fractional and hybrid technologies, sustains leadership. Radio-frequency and IPL systems follow closely, driven by affordability and compatibility with diverse skin tones. Consumables, including peel agents, RF tips, and filler products, represent a steady recurring revenue stream, increasingly important for manufacturers seeking profit stability.

Application Insights

Aging-skin and wrinkle-reduction treatments lead all applications, capturing roughly 35 % of the 2024 market. The global rise in middle-aged and older populations ensures consistent demand for anti-aging solutions. Acne-scar and pigmentation-correction treatments are the next-largest categories, fueled by youth-focused marketing and expanding men’s skincare participation. Emerging use cases include vascular-lesion correction and stretch-mark removal, offering incremental growth potential.

End-Use Insights

Dermatology and aesthetic clinics dominate the end-use segment, holding around 45 % of total market revenue in 2024. Their qualified staff, ability to offer combination therapies, and strong brand credibility underpin leadership. Beauty clinics and med-spas are expanding rapidly, appealing to mid-income consumers seeking non-invasive rejuvenation at accessible price points. Home-use devices represent a nascent but fast-growing category, projected to record double-digit CAGR as consumers invest in maintenance and preventative care solutions outside clinical settings.

| By Technology | By Product Type | By Application | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

Holding approximately 38 % of the global market in 2024 ( USD 830 million), North America remains the largest regional hub. The United States leads with dense clinic networks, advanced technology adoption, and a strong culture of aesthetic care. Canada follows with steady growth in med-spa and home-device segments.

Europe

Europe accounts for roughly 27 % of the 2024 market ( USD 590 million). Germany, the U.K., France, and Italy anchor demand, supported by aging demographics and robust healthcare systems. Regulatory consistency (CE-mark standards) bolsters consumer confidence, while rising eco-consciousness promotes uptake of sustainable, energy-efficient devices.

Asia-Pacific

Asia-Pacific commands about a 22 – 25 % share in 2024 ( USD 500 million) and is the fastest-growing region with CAGRs exceeding 12 %. China, India, South Korea, and Japan are the primary demand centers. Expanding middle-class wealth, influencer-driven beauty trends, and flourishing medical-tourism ecosystems propel growth. Local manufacturing incentives such as “Make in India” and “Made in China 2025” further accelerate device availability.

Latin America

Representing about 5–6 % of the global share ( USD 120 million), Latin America’s market is led by Brazil and Mexico. Growing adoption of aesthetic treatments among urban professionals, coupled with government support for cosmetic exports, fosters gradual yet consistent growth.

Middle East & Africa

Also holding roughly a 5–6 % share ( USD 120 million), this region is seeing rising medical-tourism inflows to the UAE, Saudi Arabia, and South Africa. Wealthy consumers’ preference for premium clinics and quick-recovery procedures drives demand. Investments in dermatology infrastructure are expanding access across GCC nations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Skin Rejuvenation Market

- Lumenis Ltd.

- Cutera Inc.

- Cynosure Inc.

- Alma Lasers Ltd.

- Fotona d.o.o.

- Sciton Inc.

- Solta Medical (AbbVie Inc.)

- Lutronic Corporation

- Hologic Inc.

- InMode Ltd.

- Venus Concept Canada Corp.

- El.En. S.p.A.

- BTL Industries

- Syneron Medical Ltd.

- Fotona Group

Recent Developments

- May 2025, Lumenis launched its latest hybrid fractional laser platform, integrating AI-assisted pulse control for customized skin resurfacing.

- April 2025 InMode Ltd. announced expansion into Southeast Asia, partnering with regional distributors to meet rising med-spa demand.

- February 2025: Cutera introduced an advanced RF microneedling system with smart-cartridge tracking, reducing consumable waste and improving precision.