Glass Skin Cosmetics Market Size

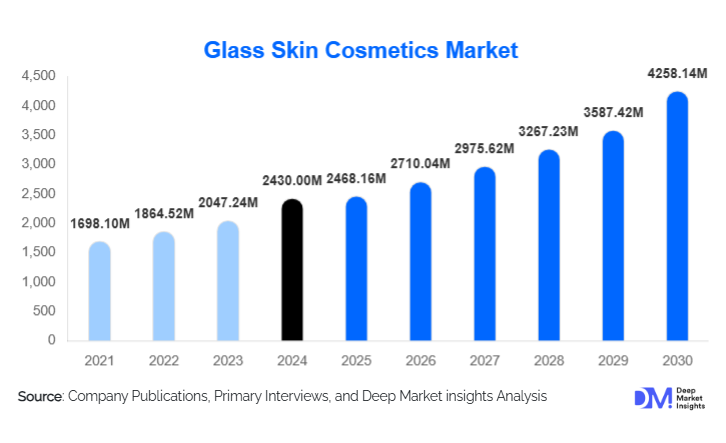

According to Deep Market Insights, the global glass skin cosmetics market size was valued at USD 2,430.00 million in 2024 and is projected to grow from USD 2,668.14

million in 2025 to reach USD 4,258.14 million by 2030, expanding at a CAGR of 9.8% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for luminous, dewy skin aesthetics, innovations in hydration-focused skincare, and the viral adoption of Korean beauty (K-beauty) routines worldwide.

Key Market Insights

- Skincare products dominate the category, accounting for nearly 78% of the total market value in 2024, led by serums, essences, and lightweight moisturizers.

- Asia-Pacific leads global market share with around 35–40% of 2024 revenue, driven by South Korea, China, and Japan as originators of the glass skin trend.

- Online channels capture over 64% of global sales, with e-commerce and social media influencers shaping purchasing behavior.

- Premiumization is accelerating as consumers favor clean, vegan, and ingredient-transparent formulations for luminous, hydrated skin.

- Technology integration, such as AI skin analysis tools and LED facial devices, is transforming product personalization and at-home skincare experiences.

- Emerging markets like India and Southeast Asia are witnessing double-digit growth due to rising disposable income and digital retail penetration.

Latest Market Trends

Technology-Integrated Skincare Routines

The fusion of skincare with technology is reshaping consumer expectations. Smart devices such as LED therapy masks, ultrasonic infusion tools, and AI-powered skin analyzers are becoming integral to the glass skin regimen. Beauty-tech platforms enable consumers to receive personalized product recommendations and monitor hydration levels, enhancing engagement and loyalty. Major brands are launching app-connected products and digital skin consultations, which are expanding market accessibility and premium appeal.

Clean, Sustainable, and Vegan Beauty Movement

Consumers are increasingly demanding eco-friendly and cruelty-free glass skin cosmetics. Brands are responding with recyclable packaging, water-saving formulations, and transparency about ingredient sourcing. Vegan serums, refillable bottles, and biodegradable sheet masks are gaining traction. This clean beauty transition aligns closely with the glass skin ideal of purity and wellness, strengthening brand differentiation and consumer trust across developed and emerging markets.

Glass Skin Cosmetics Market Drivers

Rising Popularity of Multi-Step Skincare Regimens

The glass skin aesthetic emphasizes multi-layered hydration and radiance. Consumers are investing in serums, toners, and lightweight moisturizers that promote translucency and long-lasting glow. This trend, originally rooted in K-beauty, has now become a global skincare routine adopted by Gen Z and Millennials, particularly in urban markets. The hydration and moisture retention segment accounts for over 42% of total market value, underscoring its central role in driving product innovation and consumption.

Digital-First Distribution and Influencer Marketing

Online and social-commerce platforms have become pivotal for market expansion. Over 64% of purchases in 2024 were made online through e-commerce and DTC brand channels. Beauty influencers, YouTube tutorials, and TikTok trends have accelerated consumer education, brand visibility, and cross-border demand. The digital ecosystem allows indie and established brands to scale quickly and connect directly with target audiences, sustaining high engagement rates and repeat purchases.

Ingredient Innovation and Premiumization

Active ingredients such as hyaluronic acid, niacinamide, ceramides, and fermented botanicals are redefining skincare formulations. Premium brands are launching high-potency ampoules, essences, and hybrid skincare-makeup products to deliver instant radiance and long-term benefits. The pursuit of effective yet gentle formulations drives up average selling prices, supporting industry profitability and attracting R&D investments in biotechnology-based actives and micro-delivery systems.

Market Restraints

High Product Pricing and Limited Mass Accessibility

While premiumization supports brand margins, it also limits mass-market penetration. Many glass skin products are positioned as luxury skincare, with elevated price points restricting adoption in emerging economies. This affordability gap is particularly evident in lower-income markets, where high average selling prices constrain volume growth despite growing interest in K-beauty-inspired routines.

Market Saturation and Trend Fatigue

The global skincare sector is saturated with “glow” and “radiance” claims, making differentiation challenging. Consumers outside East Asia sometimes perceive glass skin routines as time-intensive or climate-specific. As the market matures, brands must innovate beyond hydration and glow to maintain relevance, or risk losing momentum to newer beauty trends such as “cloud skin” or “skin minimalism.”

Glass Skin Cosmetics Market Opportunities

Geographic Expansion into Emerging Markets

Emerging economies such as India, Indonesia, Brazil, and the UAE offer substantial opportunities due to rising disposable incomes and online retail access. Localization of product formulations, such as lightweight textures for tropical climates, combined with influencer collaborations in regional languages, can significantly boost penetration and brand loyalty in these high-growth markets.

Integration of AI, AR, and Smart Beauty Devices

Technology-driven personalization is redefining the customer journey. Augmented reality (AR) try-ons, AI skin diagnostics, and connected devices allow users to simulate results and customize skincare routines. Brands that integrate these innovations into their product ecosystems stand to capture tech-savvy, premium consumers and enhance data-driven product development.

Sustainability and Ethical Branding

Global regulations and consumer preferences are pushing brands toward sustainability. Adopting refillable packaging, clean-label certifications, and ethical sourcing enhances brand reputation and compliance. Transparent environmental communication, carbon-neutral operations, and ESG initiatives provide differentiation in a competitive market increasingly driven by conscious consumption.

Product Category Insights

Skincare products continue to dominate the Glass Skin Cosmetics Market, contributing nearly 78% of total market value in 2024 (approximately USD 11 billion). Within this category, serums and ampoules have emerged as the leading sub-segment, driven by consumers seeking high-potency, fast-acting hydration and brightening benefits. These formulations align with the core glass-skin ideal of translucency and radiance, often featuring concentrated actives such as multi-molecular hyaluronic acid (HA), peptides, and fermented extracts. The demand for such products also benefits from consumers’ willingness to pay premium prices for efficacy and immediacy, giving this segment strong pricing power.

Moisturizers and creams represent another crucial growth area, underpinned by the need for barrier repair and long-lasting hydration, key attributes in maintaining a consistent “glass” look through both day and night cycles. Meanwhile, essences and toners continue to gain traction due to their lightweight, layerable hydration properties that prepare the skin for deeper absorption of subsequent products. Masks and sheet masks serve as impulse-driven hero products that benefit from instant visible results and social-media shareability, reinforcing the trend cycle around “glass-skin” transformations. Together, these categories highlight a layered skincare ecosystem built on progressive hydration and visible glow enhancement.

Functional Benefit Insights

Hydration and moisture retention lead the functional segmentation, representing approximately 42% the total market value in 2024. Hydration remains the primary consumer demand driver, with users associating deep, multi-layered moisture with the hallmark glass-skin glow. Brands are responding through innovations in humectant chemistry, particularly multi-molecular HA blends, ceramide complexes, and slow-release hydration technology. Brightening and tone-correction products occupy the second-largest functional niche, growing steadily due to strong demand across Asia-Pacific and Latin America, where radiant and even-toned skin remains a top beauty ideal. Formulations often combine hydration with niacinamide and fermented ingredients, amplifying translucency and light reflection, core traits of the glass-skin aesthetic.

Formulation and Delivery Format Insights

Essence or watery formulations dominate due to their lightweight texture, fast absorption, and compatibility with multi-step routines. These products form the cornerstone of the glass-skin regimen, enabling layer-by-layer hydration. Gels and jelly-based formats are the emerging innovation frontier, driven by viral “bouncy” or “jello-skin” claims that emphasize elasticity and texture refinement. Their visual and tactile appeal makes them particularly suitable for social-media engagement and influencer-driven marketing, sustaining product virality and consumer excitement.

Distribution Channel Insights

Online distribution remains the dominant sales channel, accounting for roughly 64% of global market revenue in 2024. E-commerce and direct-to-consumer (DTC) channels are thriving on social commerce models that link influencer recommendations directly to purchase decisions. Platforms such as TikTok Shop, Amazon Beauty, and region-specific beauty portals have streamlined discovery-to-purchase pathways. Subscription services and limited-edition drops are reinforcing repeat buying behavior. Meanwhile, specialty retailers and pharmacies continue to play a key role in the premium and clinical skincare categories, offering personalized guidance and building trust among high-spending consumers.

Price Tier Insights

The premium and prestige tier leads with an estimated 60% share of global market sales. This dominance stems from the willingness of consumers to invest in clinically proven formulations and visible results. Prestige brands often emphasize hero serums, smaller SKUs, and advanced delivery systems that promise instant transformation. The mass and mass-premium tiers are gaining momentum through the social proof of viral low-cost alternatives that mimic the efficacy of premium offerings. This dual-tier pricing model, combining accessibility with aspiration, has allowed brands to capture wider demographics while sustaining profitability through value engineering and localized production.

End-Use Insights

Women remain the core consumers of glass-skin products, but men’s skincare adoption is accelerating, reflecting shifting perceptions around grooming and self-care. The rise of unisex and gender-neutral brands signals a structural shift in marketing approaches toward inclusivity. Among demographics, Gen Z and Millennials (18–35 years) are the most dynamic buyers, motivated by social discovery, trend adoption, and product experimentation. They dominate online purchases of viral glass-skin boosters. Meanwhile, consumers aged 35–50 exhibit stronger brand loyalty and spending consistency, focusing on hydration, anti-aging, and barrier-repair properties. New subcultures,beauty-tech enthusiasts, and wellness-oriented users are integrating glass-skin routines with home devices and holistic self-care regimens, adding another growth vector to the market.

| By Product Type | By Functional Benefit | By Formulation / Delivery Format | By End-User Demographics | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific (APAC)

Asia-Pacific (APAC) leads the global market with an estimated 35–40% share in 2024 (USD 5–6 billion). Its dominance stems from its cultural ownership of the glass-skin aesthetic and a deeply ingrained preference for multi-step skincare rituals. South Korea continues to serve as the innovation hub, introducing fermented ingredients, snail mucin, and hyaluronic acid complexes that set global standards for formulation quality. China and Japan remain the consumption engines, leveraging vast social commerce ecosystems and homegrown beauty influencers. India, meanwhile, is projected to be the fastest-growing APAC market, expanding at a CAGR of about 12.4% through 2035. Drivers include the rapid rise of digital retail channels, the localization of K-beauty formulations, and growing middle-class purchasing power. Collectively, APAC’s strength lies in its seamless integration of heritage, innovation, and consumer sophistication.

North America

North America accounts for approximately 25% of global sales (USD 3.5 billion in 2024). Growth is led by the U.S., where social-media virality, influencer marketing, and direct-to-consumer (DTC) brand models are the core commercial engines. Consumers here favor simplified glass-skin adaptations, light essences, HA-based serums, and hybrid skincare solutions that fit time-efficient lifestyles. The market also benefits from rising male participation and clean beauty preferences. Canada mirrors these trends but emphasizes sustainability, vegan formulations, and ethical sourcing. Regionally, growth is supported by digital brand ecosystems, AR-powered skincare personalization tools, and the premiumization of everyday skincare routines.

Europe

Europe holds roughly 20% of the global market share (USD 2.8 billion), led by the U.K., Germany, and France. The region’s growth is driven by demand for clean, ingredient-transparent, and efficacy-driven formulations that align with EU regulatory standards emphasizing safety and labeling. European consumers are particularly drawn to brightening and barrier-repair skincare, incorporating glass-skin ideals into minimalist routines. The trend toward sustainable packaging, biotech-derived actives, and regulatory-backed claims further defines the market. Additionally, European K-beauty fusion brands, those blending Korean methodology with European sensibility, are reshaping consumer expectations and reinforcing regional innovation leadership.

Latin America

Latin America contributes an estimated 5–8% of global demand, with Brazil and Mexico as the primary growth engines. Expansion is fueled by a rising middle class, increasing disposable income, and social-media exposure to global beauty trends. Consumers favor hydration-focused serums and glow-enhancing skincare that align with tropical climates and diverse skin tones. The rapid expansion of e-commerce and mobile beauty platforms has democratized access to glass-skin brands, while local manufacturers are forming partnerships to produce affordable, regionally adapted formulations. Key drivers include growing retail digitization, aspirational youth demand, and preference for visible radiance-oriented results.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) region accounts for approximately 5% of the global market, with GCC nations such as the UAE and Saudi Arabia leading consumption. Regional growth is driven by premiumization among urban consumers and a cultural affinity for radiance-enhancing, luxury skincare. Strong retail expansion, through both flagship beauty boutiques and e-commerce platforms, has boosted market penetration. The rising preference for halal-certified and climate-adapted formulations has further strengthened the market base. South Africa is emerging as a production and innovation hub for vegan and clean-beauty lines. Collectively, premium brand entry, online accessibility, and tailored skincare innovation are setting the stage for accelerated growth across MEA.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Glass Skin Cosmetics Market

- L’Oréal S.A.

- Shiseido Co., Ltd.

- Beiersdorf AG

- Estée Lauder Companies Inc.

- Kao Corporation

- Amorepacific Corporation

- LVMH Moët Hennessy Louis Vuitton SE

- Unilever PLC

- Coty Inc.

- Johnson & Johnson

- Revlon Inc.

- Paula’s Choice Skincare Inc.

- The Hut Group (THG)

- H & M Hennes & Mauritz AB

- L’Occitane International S.A.

Recent Developments

- In March 2025, L’Oréal launched an AI-enabled skincare diagnostic tool integrated with its new “Hydra Radiance” line to personalize glass skin routines globally.

- In February 2025, Amorepacific introduced a refillable serum system under its Laneige brand, reducing plastic use by 40% and aligning with sustainability goals.

- In January 2025, Shiseido unveiled a microcurrent-infused sheet mask technology designed to enhance glow and absorption efficiency, setting a new benchmark for hybrid skincare innovation.