Skateboard Bearing Market Size

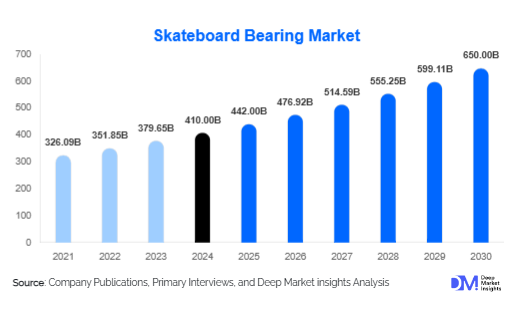

According to Deep Market Insights, the global skateboard bearing market size was valued at USD 410 million in 2024 and is projected to grow from USD 442 million in 2025 to reach USD 650 million by 2030, expanding at a CAGR of 7.9% during the forecast period (2025-2030). Market growth is driven by rising youth participation in skateboarding, the sport’s inclusion in global competitions, and technological innovation in materials such as ceramic and hybrid bearings.

Key Market Insights

- Steel bearings continue to dominate, accounting for more than 65% of 2024 revenues, owing to affordability and mass adoption among amateurs.

- ABEC 5-rated bearings hold the largest precision rating share, balancing cost-effectiveness and performance for both casual and semi-professional users.

- Online distribution channels account for 60% of global sales, reflecting the buying preferences of Gen-Z and millennial skateboarders.

- North America and Europe collectively capture 55% of the global market, fueled by strong skateboarding culture and high professional participation.

- Asia-Pacific is the fastest-growing region, led by China, India, and Japan, where skateboarding culture is rapidly expanding through government initiatives and youth sporting programs.

- Premium and hybrid bearings are gaining traction, as professionals increasingly demand high-speed, durable, and eco-friendly alternatives.

What are the latest trends in the skateboard bearing market?

Adoption of Advanced Materials

Manufacturers are investing in ceramic and hybrid skateboard bearings, which offer superior performance compared to traditional steel bearings. Ceramic bearings reduce friction, are lighter in weight, and resist wear over time, making them popular among professional and competitive skateboarders. Hybrid models that combine steel races with ceramic balls are also gaining traction, offering an optimal balance of cost and performance. This trend is creating clear segmentation between entry-level and professional demand.

Growth of Online and Direct-to-Consumer Sales

Online retail channels, particularly brand-owned D2C websites and e-commerce marketplaces, are reshaping the skateboard bearing market. Social media and influencer-driven campaigns play a crucial role in brand visibility, with younger demographics preferring to engage directly with skateboarding communities online. Subscription-based models for replacement bearings and customization kits are emerging as new revenue opportunities.

What are the key drivers in the skateboard bearing market?

Rising Popularity of Skateboarding

The inclusion of skateboarding in the Olympics and international competitions has significantly boosted global participation. Recreational and competitive skateboarders are increasingly investing in quality bearings to improve speed, control, and durability. This surge in participation is particularly strong in urban regions with growing skatepark infrastructure.

Technological Innovation

The market is benefiting from advancements in precision engineering and lubrication technology. Bearings with ABEC 7 and ABEC 9 ratings, along with eco-friendly lubrication solutions, are gaining attention. These innovations are enhancing performance for professional athletes while attracting premium consumer interest.

Cultural Adoption and Urban Infrastructure

Urban skateparks and government-backed youth sports initiatives are driving skateboard adoption worldwide. Cities in North America, Europe, and Asia are increasingly integrating skateboarding into youth programs and urban recreation planning, creating steady demand for skateboard components such as bearings.

What are the restraints for the global market?

High Costs of Premium Bearings

While ceramic and hybrid bearings provide superior performance, their high price points limit mass-market adoption. Amateur skateboarders often opt for steel alternatives, slowing premium market penetration.

Prevalence of Counterfeit Products

The growing availability of counterfeit bearings in online marketplaces creates pricing distortions and reduces consumer trust in established brands. This threatens the growth of premium categories and increases competition for legitimate manufacturers.

What are the key opportunities in the skateboard bearing industry?

Expansion into Emerging Markets

Asia-Pacific and Latin America represent untapped potential, with governments investing in skateparks and urban youth programs. Rising disposable incomes in China, India, and Brazil provide fertile ground for both entry-level and premium skateboard bearings.

Digital Commerce and Community Branding

The shift toward digital retail allows brands to build strong community-driven marketing campaigns. Direct-to-consumer channels, influencer partnerships, and skateboarding events provide opportunities to strengthen brand loyalty and capture younger demographics.

Material Sustainability

Eco-friendly bearing manufacturing and recyclable packaging are gaining importance as sustainability becomes a competitive differentiator. Manufacturers investing in green production processes and bio-based lubricants are expected to capture environmentally conscious consumers.

Product Type Insights

Steel bearings dominate the market with a 65% share in 2024, supported by their affordability and wide availability. Ceramic bearings (15%) are rapidly growing due to their superior performance, particularly among professionals. Hybrid bearings combine both strengths and are expected to witness the highest CAGR through 2030 as mid-tier skateboarders upgrade from steel bearings.

Application Insights

Amateur skateboarders account for nearly 50% of global demand, driven by recreational use and lifestyle adoption. Professional skateboarders represent a smaller segment but generate high-value demand for premium bearings. Recreational users—casual skaters outside competitive circuits—form a significant middle ground, fueling demand for mid-range bearings with ABEC 5 ratings.

Distribution Channel Insights

Online retail dominates with a 60% share in 2024, reflecting strong e-commerce adoption among Gen-Z consumers. Offline retail, including skate shops and sporting goods stores, remains relevant for community engagement and trial-based purchases but is steadily losing share to digital platforms.

| By Material | By Precision Rating | By Lubrication Type | By Price Range | By Distribution Channel | By End-User |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America leads the market with a 30% share in 2024, supported by a deeply rooted skateboarding culture and strong participation in professional leagues. The U.S. remains the single largest national market, driven by established skateparks and brand sponsorships.

Europe

Europe captures 25% of global revenues, led by Germany, the U.K., and France. Skateboarding’s strong cultural integration, coupled with government-backed youth sports initiatives, makes the region a steady demand hub. Premium bearing adoption is high in Western Europe due to consumer willingness to pay for performance.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to grow at over 10% CAGR. China, India, and Japan are fueling demand through youth sporting events and urban adoption. Japan, in particular, has a growing professional skateboarding scene, while India represents the largest untapped opportunity with a rapidly expanding youth demographic.

Latin America

Brazil dominates Latin America’s skateboard bearing demand, supported by its strong skateboarding culture and export-driven board manufacturing base. Argentina and Mexico are also emerging as key contributors to regional growth.

Middle East & Africa

The region remains a smaller but steadily growing market. The UAE and South Africa are leading, with investments in urban recreational infrastructure. Growing youth interest is expected to gradually expand demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Skateboard Bearing Market

- Bones Bearings

- Bronson Speed Co.

- Independent Truck Company (Bearings Division)

- Mini-Logo Bearings

- Shake Junt Bearings

- Rush Bearings

- Andale Bearings

- Lucky Bearings

- Zero Bearings

- Enuff Skateboard Bearings

- Element Bearings

- Spitfire Bearings

- Black Panther Bearings

- Speed Demons Bearings

- FKD Bearings

Recent Developments

- In June 2025, Bones Bearings launched a new eco-friendly line of ceramic bearings featuring bio-based lubricants and recyclable packaging.

- In April 2025, Bronson Speed Co. announced a partnership with top Olympic skateboarders to co-develop high-performance ABEC 9 bearings.

- In March 2025, Andale Bearings expanded distribution into Latin America, establishing localized e-commerce channels in Brazil and Argentina.