Single-Handed Sailing Dinghy Market Size

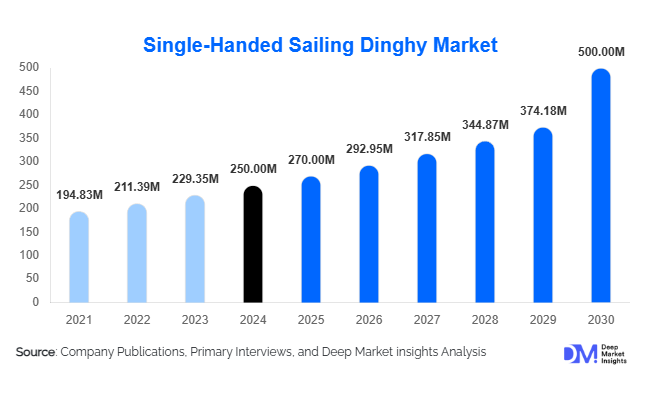

According to Deep Market Insights, the global single-handed sailing dinghy market size was valued at USD 250 million in 2024 and is projected to grow from USD 270 million in 2025 to reach USD 500 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing interest in solo sailing activities, rising participation in competitive sailing events, and continuous technological innovations in dinghy design, enhancing performance and accessibility for both recreational and professional sailors.

Key Market Insights

- Solo sailing is gaining global popularity, with enthusiasts increasingly participating in individual racing and training programs that emphasize skill development and adventure.

- Technological innovations in hull design, sail materials, and hydrofoiling have improved performance, safety, and maneuverability, attracting both recreational sailors and competitive participants.

- Europe dominates the market, particularly countries like the UK, France, and the Netherlands, due to a strong sailing heritage, extensive infrastructure, and numerous sailing clubs.

- North America remains a key market, driven by the United States and Canada, where coastal and inland sailing activities are highly popular among hobbyists and sports clubs.

- Asia-Pacific is emerging as a fast-growing region, led by increasing recreational sailing in Japan, Australia, and emerging interest from India and China, fueled by rising disposable incomes.

- Integration of sustainable materials and eco-friendly designs is increasingly influencing consumer preferences, aligning with the global shift toward environmentally responsible sports equipment.

Latest Market Trends

Innovative Dinghy Designs and Materials

Manufacturers are adopting lightweight composites, high-strength polymers, and advanced sail fabrics to create faster, safer, and more durable dinghies. Hydrofoil technologies, ergonomic hull shapes, and modular designs allow sailors to customize performance according to skill level and sailing conditions. These innovations are not only enhancing competitive performance but also broadening recreational appeal, making sailing more accessible for beginners and hobbyists.

Growth of Sailing Clubs and Solo Events

The rise of sailing schools, solo dinghy competitions, and international racing events is stimulating demand. Institutions are increasingly using single-handed dinghies for skill-building and training purposes. Solo racing events such as national Laser Championships and local regattas highlight individual skill, attracting younger participants and fostering long-term market engagement. Partnerships between dinghy manufacturers and sailing schools are driving targeted sales and promoting brand loyalty.

Single-Handed Sailing Dinghy Market Drivers

Rising Interest in Solo Sailing

The increasing appeal of solo sailing for adventure, personal achievement, and competitive sport is a major driver. Solo sailing events have expanded globally, and enthusiasts are seeking boats that allow skillful maneuvering without compromising safety. This growing interest directly correlates with the adoption of single-handed dinghies in both recreational and competitive contexts.

Advancements in Dinghy Technology

Innovations in lightweight hull materials, reinforced sails, and ergonomically designed cockpits have made dinghies easier to handle and more performance-oriented. These advancements allow both novice and experienced sailors to enjoy safe, efficient, and thrilling sailing experiences, boosting market adoption across diverse geographies.

Expansion of Sailing Infrastructure

The growth of marinas, sailing clubs, and training centers globally has made sailing more accessible. Improved infrastructure supports regular practice, competitions, and recreational activities, thereby increasing the use of single-handed dinghies for a wide spectrum of users.

Market Restraints

High Initial Investment

Quality single-handed dinghies can be costly, with entry-level models often requiring significant initial investment. This can limit accessibility for beginners or hobbyists in emerging markets, slowing potential market growth.

Maintenance and Storage Challenges

Dinghies require proper storage and regular maintenance to ensure longevity and safety. Urban dwellers or sailors without adequate facilities may face logistical challenges, which can inhibit market adoption.

Single-Handed Sailing Dinghy Market Opportunities

Technological Integration for Performance

Opportunities exist in integrating advanced materials, hydrofoils, and IoT-enabled navigation tools into dinghies, providing a high-tech sailing experience. Such innovations can attract competitive sailors and enthusiasts seeking modern equipment that improves handling and speed.

Expansion of Sailing Schools and Programs

Growth in sailing education and recreational programs globally presents opportunities for manufacturers to supply fleets of single-handed dinghies. Partnerships with schools and clubs facilitate brand presence and foster long-term adoption.

Sustainability and Eco-Friendly Designs

Developing environmentally responsible dinghies using recycled or sustainable materials aligns with global consumer trends. Eco-conscious sailors increasingly prefer products that reduce environmental impact, creating a niche segment within the market.

Product Type Insights

Laser dinghies dominate the market, accounting for around 40% of global demand in 2024. Their simplicity, affordability, and recognition in competitive sailing make them the preferred choice among both beginners and professional racers. Other types, including RS Feva and Optimist dinghies, are gaining traction for youth and recreational use.

Application Insights

Recreational sailing remains the leading application segment, contributing approximately 50% of market demand in 2024. Competitive racing and skill-training applications are growing rapidly, driven by solo sailing events and educational programs. Emerging applications in environmental monitoring and research also provide niche growth opportunities.

Distribution Channel Insights

Sales are primarily driven through direct sales from manufacturers, specialized sailing stores, and online platforms. Direct engagement with sailing clubs and schools ensures fleet procurement and brand loyalty. Online sales are increasingly important, enabling global reach and convenience for buyers seeking specific dinghy models and configurations.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

The U.S. and Canada lead North American demand, driven by a strong recreational sailing culture and well-established marinas. The region accounted for approximately 25% of the global market in 2024, with coastal states showing the highest adoption rates.

Europe

Europe holds a dominant 35% share of the global market, with the UK, France, and the Netherlands leading demand due to extensive sailing clubs, competitive events, and a rich maritime tradition. The region continues to grow steadily with increased youth participation and training programs.

Asia-Pacific

Emerging markets such as Japan, Australia, China, and India are witnessing rising adoption of recreational and competitive sailing. Asia-Pacific is the fastest-growing region, supported by expanding middle-class incomes and increased awareness of water sports.

Latin America

Brazil, Argentina, and Mexico show gradual growth, primarily through increased participation in international competitions and niche recreational activities.

Middle East & Africa

Demand in the Middle East is driven by high-income populations in the UAE and Qatar, while Africa’s growth is supported by coastal recreational programs and youth sailing initiatives. These regions are emerging markets with strong potential for expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Single-Handed Sailing Dinghy Market

- LaserPerformance

- RS Sailing

- Topper International

- Ovington Boats

- Harken

- Optimist Sailing

- Devoti Sailing

- Fireball Dinghies

- ILCA (International Laser Class Association)

- North Sails

- Elvstrøm Sails

- Gill Marine

- Laser Radial

- RS Aero

- Laser Bahia

Recent Developments

- In March 2025, LaserPerformance launched a new hydrofoil-equipped dinghy targeting competitive sailors seeking enhanced speed and maneuverability.

- In January 2025, RS Sailing expanded production in Europe to meet rising demand from sailing schools and youth programs.

- In December 2024, Topper International introduced eco-friendly composite dinghies using recycled materials to reduce environmental impact.