Shower Brush Market Size

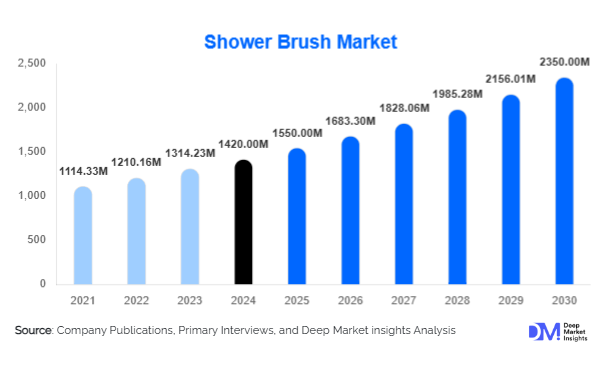

According to Deep Market Insights, the global shower brush market size was valued at USD 1,420 million in 2024 and is projected to grow from USD 1,550 million in 2025 to reach USD 2,350 million by 2030, expanding at a CAGR of 8.6% during the forecast period (2025–2030). The shower brush market growth is driven by rising consumer awareness of personal hygiene, increasing adoption of premium and eco-friendly grooming accessories, and the expansion of e-commerce platforms offering wide product availability at competitive prices.

Key Market Insights

- Eco-friendly and biodegradable shower brushes are rapidly gaining traction as consumers shift toward sustainable personal care products.

- Electric shower brushes are emerging as a premium product line, appealing to wellness-focused consumers seeking convenience and skin-care benefits.

- North America dominates the global shower brush market, driven by high personal care spending and brand penetration.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class incomes and growing grooming culture in China and India.

- Online retail holds the largest distribution share, as consumers increasingly purchase grooming accessories via e-commerce and brand-owned platforms.

- Technological integration, including electric vibration brushes and antimicrobial silicone bristles, is reshaping product innovation.

What are the latest trends in the shower brush market?

Sustainable and Biodegradable Materials

Brands are increasingly introducing shower brushes made from bamboo, wood, and other biodegradable materials. This trend aligns with consumer demand for eco-friendly personal care items. Biodegradable packaging and carbon-neutral production processes are becoming selling points for premium brush lines. Sustainability certifications and transparent sourcing are also influencing buyer preferences, especially in Europe and North America.

Technological Enhancements in Premium Brushes

Electric and vibration-enabled shower brushes are gaining popularity in the mid-to-premium segment. These products integrate features such as adjustable speed settings, waterproof design, and rechargeable batteries. Some advanced models use silicone bristles with antibacterial properties, reducing the risk of skin irritation. These innovations are targeting wellness-conscious consumers and positioning shower brushes as more than just hygiene tools, but also skincare devices.

What are the key drivers in the shower brush market?

Growing Hygiene and Wellness Awareness

Post-pandemic consumer behavior has heightened the focus on personal hygiene. Shower brushes are increasingly viewed as essential grooming products rather than optional accessories. This shift has boosted market penetration in both mature and emerging economies, expanding the consumer base.

Expansion of Online Distribution Channels

E-commerce platforms are significantly fueling market growth. Global players like Amazon, alongside brand-owned direct-to-consumer websites, are making shower brushes accessible across regions. Online channels allow companies to reach niche consumers with specialized products such as vegan, cruelty-free, or luxury brushes.

Rise of Premiumization and Gifting Trends

Consumer willingness to spend on high-quality personal care products is increasing, especially in urban markets. Premium shower brushes, often sold in kits with body scrubs and essential oils, are gaining traction as gifting options. This has expanded the product’s appeal beyond hygiene into lifestyle and wellness categories.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

In price-conscious regions, such as parts of Latin America and Africa, low-cost manual brushes dominate. Premium and electric brushes face adoption challenges due to high price points and limited distribution, slowing overall market growth in these regions.

Competition from Substitute Products

Loofahs, exfoliating gloves, and body scrubs serve as direct substitutes for shower brushes, often at lower prices. This high availability of alternatives restrains faster penetration, especially in markets with strong traditional preferences for non-brush products.

What are the key opportunities in the shower brush industry?

Eco-Friendly Product Innovation

There is strong potential for brands to tap into consumer preference for sustainable products. Bamboo-handled brushes, compostable packaging, and cruelty-free certifications can attract eco-conscious buyers and allow companies to command higher price points.

Integration with Skincare and Wellness Routines

Shower brushes can be positioned as multifunctional skincare tools that aid exfoliation, lymphatic drainage, and stress relief. Collaborations with wellness brands, dermatologists, and spas can open premium distribution channels and create new revenue streams.

Expansion in Emerging Markets

Rapid urbanization and rising disposable incomes in the Asia-Pacific, the Middle East, and Latin America present untapped opportunities. Localized marketing campaigns and affordable product lines can help global brands capture demand from new consumer segments.

Product Type Insights

Manual shower brushes dominate the market, accounting for 78% of global share in 2024. Their affordability, availability, and wide consumer acceptance make them the leading category. However, electric brushes are projected to grow at over 12% CAGR, driven by premiumization trends in North America, Europe, and Asia-Pacific.

Material Insights

Plastic-based shower brushes lead with 52% market share, owing to cost-efficiency and large-scale production. Bamboo and wood are gaining rapid traction, especially in Europe, projected to expand at a 10.5% CAGR, supported by sustainability-driven consumer preferences.

Bristle Type Insights

Synthetic bristles hold the largest share at 61% in 2024, primarily due to durability and low cost. Silicone bristles are the fastest-growing category, expected to rise at a 11% CAGR, supported by their antibacterial properties and suitability for sensitive skin consumers.

Application Insights

Personal use dominates with over 85% of demand, driven by household consumers worldwide. Commercial demand from spas and hotels remains niche but is growing steadily at 7% CAGR, supported by wellness tourism expansion.

Distribution Channel Insights

Online retail accounts for 54% of sales in 2024, emerging as the leading channel. Convenience, discount offers, and the ability to compare multiple products drive this trend. Offline retail, especially supermarkets and specialty beauty stores, remains strong in regions like Europe and Latin America.

Price Range Insights

Mass-market products under $10 dominate with a 62% share in 2024, particularly in Asia-Pacific and Latin America. Premium brushes above $25 are expected to grow fastest at a 10% CAGR, fueled by demand from North America and European luxury wellness consumers.

| By Product Type | By Material | By Application | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with a 34% share in 2024. The U.S. is the largest consumer, driven by high personal care spending, established beauty retail networks, and strong adoption of premium and electric brushes. Canada follows with rising e-commerce-driven demand.

Europe

Europe holds a 27% market share, with Germany, France, and the U.K. being the top consumers. Strong emphasis on sustainability and preference for bamboo-based brushes drive growth in this region. Scandinavian countries are particularly active in eco-friendly product adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a 10.8% CAGR. China and India dominate due to rapid urbanization and grooming culture. Japan and South Korea remain innovation hubs, with consumers preferring advanced skincare-integrated shower brushes.

Latin America

Latin America accounts for 7% of global market share, led by Brazil and Mexico. Price-sensitive consumers primarily purchase mass-market brushes, while premium products are gradually gaining ground in urban centers.

Middle East & Africa

The region holds 5% share, with the UAE and Saudi Arabia being key premium markets. South Africa shows steady demand for mid-range brushes. Increasing retail penetration and grooming awareness are expected to support regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Shower Brush Market

- Philips

- Beurer GmbH

- Foreo

- Procter & Gamble

- Shiseido

- Kai Corporation

- The Body Shop

- Watson's Personal Care Stores

- Olay

- Conair Corporation

- Remington Products

- EcoTools

- Panasonic Corporation

- Baiden Mitten

- Swissco LLC

Recent Developments

- In May 2025, Foreo launched an antimicrobial silicone shower brush in Asia-Pacific, targeting sensitive skin consumers with premium skincare functionality.

- In April 2025, Philips expanded its electric shower brush portfolio in North America, introducing multi-speed waterproof devices for spa-like home use.

- In February 2025, EcoTools introduced a 100% biodegradable bamboo shower brush line in Europe, focusing on eco-conscious millennials.