Short-Term Vacation Rentals Market Size

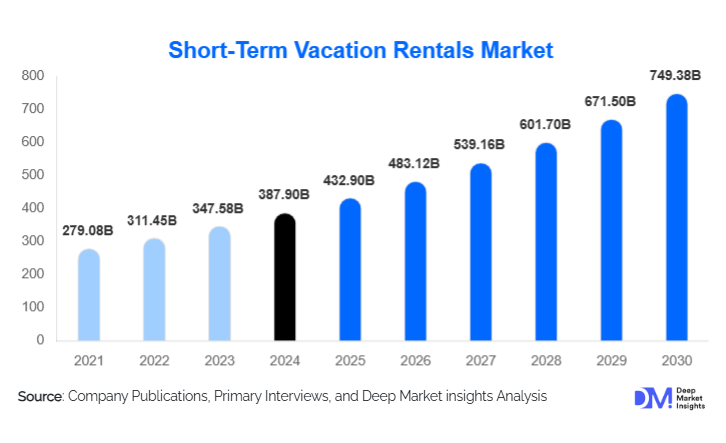

According to Deep Market Insights, the global short-term vacation rentals market size was valued at USD 387.9 billion in 2024 and is projected to grow from USD 432.9 billion in 2025 to reach USD 749.38 billion by 2030, expanding at a CAGR of 11.6% during the forecast period (2025–2030). This rapid growth is being driven by rising adoption of remote work, increasing traveler preference for experiential and home-like stays, and continued expansion of digital booking platforms that democratize access to unique and flexible lodging options.

Key Market Insights

- Homes (single-family houses and villas) dominate the accommodation mix, accounting for the largest share of STVR due to their appeal among families, groups, and digital nomads seeking space and privacy.

- Online platforms (Airbnb, Booking.com, Vrbo) remain the primary channel for bookings, making up the majority of transactions thanks to ease of use, trust mechanisms, and dynamic pricing tools.

- Professionally managed rentals are growing rapidly, supported by scale operators who offer consistency, technology-enabled services, and property optimization.

- Short stays (nightly bookings) continue to drive the bulk of revenue, as most travelers still prefer flexible, high-turnover lodging.

- Leisure travelers account for the largest end-user base, leveraging STVR for vacations, family trips, and group holidays.

- North America remains the largest regional market, while Asia-Pacific is emerging fastest due to rising domestic tourism, remote work adoption, and infrastructure development.

What are the latest trends in the short-term vacation rentals market?

Remote-Work & Digital Nomad Stays

One of the most transformative trends in STVR is the rise of long-stay bookings from remote workers and digital nomads. These guests are increasingly opting for properties that combine living and working space, leading to stronger demand for monthly or extended short-term stays. This shift is encouraging hosts and property managers to optimize listings for productivity, offering high-speed internet, dedicated workspaces, and flexible check-in/checkout policies. As a result, STVR is evolving beyond pure vacation use into a hybrid “live + work + travel” model.

Technology-Driven Property Management

Technology is playing a central role in scaling STVR operations. Property managers and hosts are deploying AI-based pricing engines, smart-home devices (like smart locks and thermostats), and automated guest communication systems to improve efficiency and profitability. These tools help optimize occupancy, reduce operating costs, and deliver a seamless, contactless guest experience. Meanwhile, guest-facing apps are providing interactive local guides, self-check-in, and personalized recommendations, further blurring the lines between hotels and homes.

Sustainable and Experiential Stays

Sustainability and experience-led travel are deeply influencing STVR. More hosts are retrofitting their properties with eco-friendly upgrades, solar panels, energy-efficient appliances, and water conservation systems. Eco-certification and green credentials are becoming visible differentiators for listings. On the experiential side, travelers are increasingly drawn to unique stays, treehouses, glamping, farm stays, and heritage homes that offer both authenticity and a lower carbon footprint. This is helping STVR align with broader ESG (environmental, social, governance) travel preferences.

What are the key drivers in the short-term vacation rentals market?

Flexible Work Lifestyles

The global shift toward remote work and flexible schedules is perhaps the most powerful driver of STVR growth. As employees no longer need to be tethered to a physical office, they are willing to live and work from destinations that suit their personal preferences. Short-term rentals offer the ideal combination of comfort, privacy, and flexible tenancy, significantly more appealing than traditional hotels or long-term leases.

Platform Reach and Trust

Digital booking platforms continue to democratize access to STVR by connecting hosts and guests across geographies. These platforms enhance trust through reviews, guarantees, and secure payment systems, while also providing tools for dynamic pricing, occupancy forecasting, and property management. This ecosystem reduces friction for both sides, fueling new host entrants and encouraging guest adoption.

Experience-Driven Travel Demand

Travelers are increasingly seeking more than just a place to sleep; they want immersion, authenticity, and unique experiences. Short-term rentals satisfy this demand by offering local flavor, space, and the flexibility to live like a resident. Whether it's a villa by the sea, a countryside cottage, or a quirky treehouse, STVR accommodates experience-first travelers in ways traditional hotels often cannot.

What are the restraints for the global market?

Regulatory and Zoning Challenges

Governments and municipalities in many popular destinations are tightening regulations around short-term rentals, citing housing affordability, neighborhood disruption, and tax fairness. Licensing requirements, caps on permitted rental nights, and restrictions on entire-home listings impose compliance costs and operational risk on hosts, limiting supply growth in certain markets.

Oversupply and Saturation Risk

In highly popular tourist markets, rapid growth in STVR listings is raising the risk of oversupply. As more owners list properties, occupancy rates can decline, pushing down nightly rates. Additionally, growing competition from hotels, branded rental operators, and alternative lodging types (e.g., serviced apartments) can compress margins for independent hosts and smaller operators.

What are the key opportunities in the short-term vacation rentals industry?

Expansion into Secondary & Under-Regulated Markets

As major cities impose stricter regulations on short-term rentals, there is a strong opportunity in secondary, suburban, and rural markets. These less-regulated destinations are attractive to both hosts and guests, travelers craving peace and affordability, and hosts being able to navigate fewer legal hurdles. This opens up a scalable growth path for operators willing to target underserved regions.

Smart & Automated Property Management

There is substantial potential for technology providers and property managers to offer packaged smart-home solutions, dynamic pricing software, and guest automation systems. By reducing operational friction, improving guest satisfaction, and maximizing returns, technology integration can be a key differentiator. New entrants with strong prop-tech offerings can partner with hosts or property management companies to scale efficiently.

Eco-Certified & Experiential Rentals

With sustainability becoming a bigger consideration for travelers, STVR providers who invest in eco upgrades or offer certified green stays can command a premium. Similarly, unique experiential properties, such as glamping sites, eco-lodges, or culturally immersive homes, can appeal to high-value, experience-centric travelers. There is also an opportunity to align with ESG investing by promoting green stays as part of responsible travel portfolios.

Accommodation Type Insights

The homes segment (single-family houses and villas) is the most dominant accommodation type in short-term vacation rentals. These properties are highly favored by families, groups, and remote workers because of their space, privacy, and amenities like kitchens and multiple bedrooms. Such homes often command higher nightly rates and can yield better profitability than smaller apartments or shared units. Their flexibility also makes them ideal for long stays, contributing significantly to the market’s revenue base.

Application Insights

Short-term vacation rentals serve a diverse set of guest applications. The largest application remains leisure tourism, where travelers pick STVRs for vacations, weekend getaways, or group trips. Digital nomads and remote workers are increasingly using STVRs for extended stays, blurring work and travel. Business travel / bleisure guests combine work and leisure, using short-term homes for flexible stays. Additionally, event tourism (e.g., destination weddings) and wellness retreats are emerging as growing applications, driving demand for larger, well-equipped, and experiential properties.

Distribution Channel Insights

The majority of bookings in the STVR market flow through online platforms like Airbnb, Vrbo, and Booking.com, which dominate due to their user-friendly interfaces, secure payments, and review systems. Professional property managers and management companies also act as a key channel, offering branded portfolios and direct listings. Some hosts are increasingly investing in direct-to-guest websites to avoid platform fees and build loyalty. In parallel, referral programs, social media marketing, and influencer partnerships are gaining traction as effective acquisition strategies.

Traveler Type Insights

Leisure travelers remain the largest demographic, often traveling with family or friends and preferring homes that provide space and value. Digital nomads and remote workers are a fast-growing segment, choosing STVRs for flexible, longer-duration stays. Bleisure travelers combine work trips with leisure and lean toward accommodations that offer work-friendly amenities. Group travelers, such as multi-generational families or friend groups, find value in renting homes or villas rather than multiple hotel rooms, giving STVR a competitive edge.

Age Group Insights

Travelers aged 31–50 years dominate the STVR market; they typically have disposable income, family responsibilities, and a desire for experiential travel, making them ideal for home-style rentals. The 18–30 age group is also significant, especially among budget-conscious and experience-driven travelers, contributing to demand for shared apartments, hostels, and unique stays. Older travelers (50+) are increasingly entering the market too, particularly for extended stays, wellness retreats, or comfortable yet flexible accommodations with good amenities.

| By Property Type | By Booking Channel | By Stay Duration | By Traveler Type | By Management Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market for short-term vacation rentals, accounting for approximately 35 % of global STVR revenue in 2024. Robust platform adoption, high consumer spending capacity, and widespread professional property management infrastructure drive strong performance. In the U.S., both urban and destination markets, from beach towns to mountain retreats, are mature, while Canada is seeing growing demand in tourist and remote-work-friendly regions.

Europe

Europe remains a critical STVR market, particularly in countries like France, Spain, Germany, and Italy. Regulatory frameworks are more complex in European cities, but demand for holiday homes and experiential stays is high. Urban centers, coastal regions, and historic towns drive a strong portfolio of listings. Europe is also experiencing emerging demand for eco-lodges and sustainable rentals, aligned with traveler preferences for authentic, green travel.

Asia-Pacific

The Asia-Pacific region is one of the fastest-growing markets in STVR. Countries like China, India, Southeast Asia (Thailand, Indonesia), Australia, and Japan are seeing rising domestic tourism, remote work migration, and infrastructure investment. As platform penetration deepens and destination markets mature, APAC is becoming a hotbed for both short-term hosting and demand.

Latin America

In Latin America, STVR is expanding in nations such as Brazil and Mexico, driven by both domestic tourists and inbound international visitors. Coastal and cultural destinations are particularly attractive, and local hosts are capitalizing on the global sharing economy. As digital connectivity improves and travel recovers, the region offers long-term growth potential.

Middle East & Africa

Africa is both a key supply and demand region for STVR, with destinations like South Africa, Kenya, and Morocco growing strongly in vacation-home listings. Luxury villas and resort-style homes are especially popular. Meanwhile, the Middle East (e.g., UAE, Saudi Arabia) is emerging as a significant source market and host region, fueled by high-income travelers and growing interest in staycation-style, experiential accommodations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Short-Term Vacation Rentals Market

- Airbnb, Inc.

- Booking Holdings, Inc. (Booking.com, Vrbo)

- Expedia Group, Inc.

- Wyndham Destinations / Vacasa

- Sonder Corp.

- TurnKey Vacation Rentals / Vacasa (if separate)

- Hostmaker / Similar Property Management Firm

- Plum Guide

- Blueground

- Oyo Vacation Homes / Oyo Life

- Pacaso (co-ownership rentals)

- Boutique Homes (or local management firms)

- StayAlfred (or similar urban short-term management)

- OneFineStay (or luxury home rental firm)

- Le Collectionist (luxury villa rentals)

Recent Developments

- In early 2025, Vacasa announced a major funding round to expand its professional property management operations in secondary U.S. markets and rural vacation destinations, focusing on tech-enabled scale.

- In mid-2025, Airbnb introduced a new long-stay feature aimed at digital nomads, including discounts for monthly bookings and integration of workspace amenities for hosts.

- In late 2024 / early 2025, several major property managers rolled out sustainability certification programs, encouraging hosts to adopt solar power, energy-efficient appliances, and green cleaning practices, which are now being promoted on platform listings.