Shoe Shine Machine Market Size

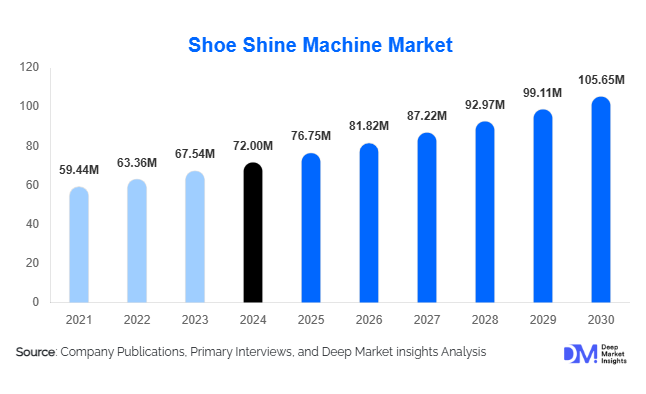

According to Deep Market Insights, the global shoe shine machine market size was valued at USD 72 million in 2024 and is projected to grow from USD 76.75 million in 2025 to reach USD 105.65 million by 2030, expanding at a CAGR of 6.6% during the forecast period (2025–2030). The growth of the shoe shine machine market is primarily driven by the expansion of the hospitality and transportation sectors, increasing adoption of automation technologies, and rising consumer demand for convenience-oriented and hygienic footwear care solutions in both commercial and residential settings.

Key Market Insights

- Automatic shoe shine machines dominate the market with over 60% share in 2024, driven by widespread use in hotels, airports, and corporate offices.

- Commercial end-use applications account for nearly 70% of the global market, highlighting the prominence of business and hospitality demand.

- Asia-Pacific is the fastest-growing region, with a projected CAGR above 7% owing to rapid urbanization and infrastructure development in China and India.

- North America leads globally with approximately 38% market share in 2024, supported by a mature hospitality and corporate infrastructure base.

- Smart and eco-friendly shoe shine machines are emerging as a key trend, integrating sensors, IoT, and sustainable materials to meet consumer expectations for convenience and environmental responsibility.

- Online distribution channels are expanding rapidly for residential and small commercial segments, though offline channels still dominate installations in large facilities.

Latest Market Trends

Technological Advancements and Automation

The shoe shine machine industry is undergoing a technological transformation characterized by sensor-based activation, dual-brush configurations, and automatic polish dispensing systems. These innovations reduce manual intervention and enhance user convenience in high-traffic zones such as airports and hotel lobbies. Manufacturers are integrating IoT-enabled monitoring and remote maintenance to minimize downtime and improve operational efficiency. Premium models now feature touchless operation, energy-efficient motors, and self-cleaning mechanisms designed for hygiene-conscious environments.

Eco-Friendly and Compact Product Designs

Growing consumer and regulatory focus on sustainability has led to the development of eco-friendly shoe shine machines. Manufacturers are emphasizing the use of recyclable materials, low-energy motors, and non-toxic polishes. Compact designs suitable for residential spaces and small offices are gaining popularity, particularly in the Asia-Pacific markets. This trend is expanding the addressable market beyond commercial users, creating new opportunities for manufacturers targeting the premium home appliance segment.

Shoe Shine Machine Market Drivers

Expansion of Hospitality and Transport Infrastructure

Global tourism growth, rising investments in hotels, airports, and corporate facilities are key drivers for the shoe shine machine market. As hospitality operators focus on enhancing guest convenience and maintaining premium aesthetics, automated shoe shine systems are increasingly being installed in lobbies, lounges, and corridors. Airport modernization projects and business complex developments in Asia and the Middle East further amplify demand.

Growing Preference for Automation and Hygiene

The ongoing shift toward automation is driving market expansion. Automatic and sensor-based shoe shine machines minimize manual effort, ensure hygiene, and deliver consistent performance. With post-pandemic hygiene awareness, contactless shoe polishing solutions are increasingly viewed as a hygiene necessity rather than a luxury service, especially in public and semi-public facilities.

Rising Urbanization and Disposable Incomes

Rapid urbanization and higher disposable incomes in emerging economies are boosting demand for luxury and convenience appliances. As more households and small offices invest in compact, premium shoe shine machines, the residential segment is expected to grow steadily. This is complemented by the increasing importance of personal presentation and professional grooming among working professionals.

Market Restraints

Limited Awareness and Niche Demand

The shoe shine machine market remains a niche segment, with awareness and perceived necessity still limited to select industries such as hospitality and corporate offices. Manual shoe polishing or outsourced cleaning services are still prevalent in many regions, restraining large-scale adoption.

High Upfront Costs and Maintenance Requirements

Automatic shoe shine machines involve higher acquisition costs compared to manual alternatives. For low-traffic venues and residential customers, the cost-benefit ratio remains modest. Regular maintenance, replacement of brushes, and polish refills also increase operational expenses, potentially limiting repeat purchases among smaller clients.

Shoe Shine Machine Market Opportunities

Expansion in Emerging Commercial Hubs

Urban development initiatives in Asia-Pacific, the Middle East, and Latin America are driving the construction of new hotels, airports, and business complexes. These projects represent significant opportunities for machine installations as part of broader facility enhancement and automation efforts. Localized manufacturing and distribution partnerships can further accelerate regional penetration.

Home-Use Product Line Development

The untapped residential segment presents an opportunity for manufacturers to design compact, affordable, and aesthetically appealing machines for home use. Integration with smart-home ecosystems, subscription-based polish delivery, and stylish designs can attract affluent consumers seeking luxury convenience appliances.

Innovation in Smart and Eco-Conscious Machines

Smart shoe shine machines featuring IoT connectivity, energy-efficient components, and eco-friendly polish refills are emerging as a strong opportunity for product differentiation. These machines align with sustainability goals while providing superior performance, supporting brand positioning among premium buyers and environmentally conscious customers.

Product Type Insights

Automatic shoe shine machines dominate the market, capturing approximately 62% share in 2024. These machines are preferred for commercial installations due to their convenience, hygiene, and speed. Semi-automatic machines serve mid-range customers seeking partial automation at lower costs, while manual units cater to budget-conscious buyers or smaller establishments. The automatic segment will continue leading, supported by technological integration and premium positioning in hospitality infrastructure.

Application Insights

Commercial applications accounted for around 70% of the global market in 2024, driven by widespread deployment in hotels, airports, and business complexes. The hospitality sector alone contributes over half of total commercial demand, followed by airports and corporate buildings. The residential segment, though smaller, is projected to grow at over 7% CAGR as compact designs and online retail availability improve accessibility for individual consumers.

Distribution Channel Insights

Offline distribution channels dominate the shoe shine machine market, representing nearly 65% of global revenue in 2024. Facility equipment suppliers and specialized distributors cater to large-scale commercial customers requiring installation and servicing support. Online channels, however, are growing rapidly, particularly in Asia-Pacific and North America, where consumers increasingly purchase compact or residential models directly through e-commerce platforms.

| By Product Type | By Application / End-Use | By Distribution Channel | By Price / Quality Tier |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 38% share in 2024, supported by advanced hospitality and corporate infrastructure. The U.S. remains the largest market, characterized by high penetration of automation technologies in hotels and airports. Growth is stable, around 4–6%, driven by replacement demand and upgrades to sensor-enabled machines.

Europe

Europe holds a significant market share of 20–25%, with demand concentrated in Germany, the U.K., and France. The region’s emphasis on energy efficiency and design aesthetics encourages the adoption of premium automatic shoe shine machines. Growth remains steady due to renovation cycles in established commercial buildings.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, projected to expand at a CAGR of over 7% between 2025 and 2030. China and India are key growth engines, supported by rapid urbanization, tourism development, and infrastructure investment. Rising middle-class income levels are also fostering home-use demand for compact shoe shine machines.

Latin America

Latin America accounts for a smaller market share but is poised for gradual expansion driven by the modernization of airports, hotels, and commercial centers in Brazil and Mexico. Growth opportunities are centered on mid-range and semi-automatic models that balance cost and performance.

Middle East & Africa

MEA markets, especially the UAE and Saudi Arabia, are investing heavily in luxury hospitality and transport infrastructure. Although current adoption levels are modest (5–8% share), the region exhibits strong growth potential as part of broader smart-city and tourism diversification strategies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Shoe Shine Machine Market

- HEUTE Maschinenfabrik GmbH & Co. KG

- Moneysworth & Best

- Sunpentown International Inc.

- Euronics Industries Pvt. Ltd.

- Dolphy India Pvt. Ltd.

- Bartscher GmbH

- Askon Hygiene Products Pvt. Ltd.

- Orchids International

- Beck Shoe Products Co.

- Dasco Shoe Care

- Esfo AB

- Avro India Ltd.

- Shinola

- Comfort House

- Kalorik

Recent Developments

- In March 2025, HEUTE Maschinenfabrik GmbH launched a new line of energy-efficient shoe shine machines with smart sensor control designed for luxury hotels and business lounges.

- In January 2025, Dolphy India Pvt. Ltd. announced the expansion of its production facility to cater to the rising export demand from Southeast Asia and the Middle East.

- In September 2024, Sunpentown International introduced a compact home-use model targeting premium residential consumers across North America and Japan.