Shisha Tobacco Market Size

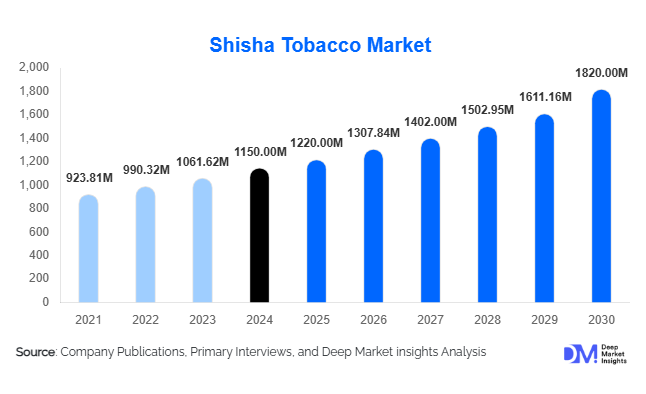

According to Deep Market Insights, the global shisha tobacco market size was valued at USD 1,150 million in 2024 and is projected to grow from USD 1,220 million in 2025 to reach USD 1,820 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The shisha tobacco market growth is primarily driven by the rising popularity of flavored blends, the expansion of hookah lounges in non-traditional markets, and growing consumer demand for herbal and low-nicotine alternatives.

Key Market Insights

- Flavored shisha tobacco dominates the market, accounting for more than 65% of global demand in 2024, led by fruit and mint profiles.

- Middle East & Africa remains the largest regional market, with over 35% share, supported by cultural traditions and strong lounge culture.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, urban café culture, and youth-driven demand.

- Online distribution is expanding rapidly, enabling direct-to-consumer models, subscription packs, and cross-border flavor availability.

- Nicotine-free and herbal alternatives are gaining traction, particularly in regulated markets such as Europe and North America.

- Premiumization trends are boosting sales of artisanal blends, resealable packaging, and exclusive lounge experiences.

Latest Market Trends

Flavor Innovation Driving Market Penetration

Flavor diversification is the single largest trend shaping the shisha tobacco market. Fruit flavors such as apple, berry, and tropical blends account for nearly 40–45% of flavored tobacco sales, while mixed or exotic blends are rapidly gaining market share. Manufacturers are investing in research to deliver unique combinations of dessert-inspired, beverage-based, and spiced flavors that appeal to younger consumers seeking novelty. Frequent flavor launches also strengthen brand loyalty, particularly among lounge operators who rotate menus to attract repeat customers. This continuous innovation cycle ensures consistent consumer engagement, sustaining market momentum despite regulatory challenges.

Rise of Herbal and Tobacco-Free Alternatives

Growing health consciousness and regulatory scrutiny around nicotine use have accelerated demand for herbal and tobacco-free shisha. These alternatives, often based on molasses, glycerin, and plant extract, offer similar sensory experiences without tobacco. Their appeal is particularly strong in Western markets, where flavor bans and nicotine restrictions are more stringent. Producers are leveraging this niche by marketing “clean label” and eco-friendly shisha products, aligning with global wellness trends. Although currently a smaller share of the market, the herbal segment is forecast to grow at double the rate of traditional tobacco-based products through 2030.

Shisha Tobacco Market Drivers

Flavor Diversification and Premiumization

Consumers’ preference for variety has driven companies to launch a wide range of flavors. Premium packaging, resealable jars, and boutique lines enhance user experience while justifying higher price points. This trend is especially popular in Europe and North America, where lifestyle-driven consumption often emphasizes quality and exclusivity.

Social and Cultural Integration

Hookah use has long been embedded in Middle Eastern and African cultures. Now, shisha lounges are becoming mainstream in global urban centers, blending with café and nightlife culture. This strong social component sustains group demand, positioning shisha tobacco as more than just a product; it is part of a cultural experience.

Rising Disposable Incomes in Emerging Markets

Rapid urbanization and income growth in Asia-Pacific and Latin America are creating new consumer bases. With young demographics eager for leisure and social activities, these regions present significant growth potential for shisha tobacco consumption, particularly through lounge openings and retail penetration.

Market Restraints

Regulatory Pressures and Health Concerns

Governments are imposing higher taxes, advertising bans, and flavor restrictions on tobacco products. Growing awareness of health risks associated with shisha consumption also discourages new users in developed markets. Compliance costs and potential flavor bans represent long-term risks for manufacturers.

Raw Material and Supply Chain Volatility

The supply of quality tobacco leaves, molasses, and flavoring agents is vulnerable to agricultural output, tariffs, and logistics costs. Price fluctuations in raw materials and shipping can squeeze margins and raise retail prices, limiting affordability in cost-sensitive markets.

Shisha Tobacco Market Opportunities

Innovation in Herbal and Nicotine-Free Products

Companies can expand market share by offering herbal shisha and low-nicotine alternatives that meet regulatory requirements while appealing to health-conscious consumers. Branding these as safe, lifestyle-oriented products creates scope for higher margins.

Expansion of E-Commerce and Direct-to-Consumer Channels

Online platforms offer wider product availability, cross-border shipping, and subscription-based sampling packs. Direct-to-consumer engagement not only lowers costs but also enables firms to gather consumer insights, personalize offerings, and build brand loyalty.

Geographic Expansion into Emerging Markets

Asia-Pacific, Latin America, and sub-Saharan Africa are witnessing rising café culture, urban leisure trends, and disposable incomes. Manufacturers investing in local production, distribution, and region-specific flavors can capitalize on this demand surge.

Product Type Insights

Flavored shisha tobacco accounts for the majority of the global market, representing over 65% of total consumption in 2024. Fruit-based flavors alone account for 40–45% of the flavored segment, with demand accelerating due to the growing novelty-seeking consumer base and the increasing popularity of blended mixes. Herbal and nicotine-free shisha products, though smaller in base size, are projected to register the highest CAGR as they gain acceptance in regulated and health-conscious markets.

Application Insights

Commercial use primarily in hookah lounges, cafés, and bars remains the largest application, accounting for over 50% of global consumption in 2024. Residential use is expanding quickly, supported by e-commerce and home-use kits. Event-driven demand, particularly in festivals and hotels, is an emerging application contributing to growth in the hospitality sector.

Distribution Channel Insights

Offline channels dominate sales, contributing nearly 70% of revenues in 2024, due to lounge purchases and specialty tobacco shops. However, online sales are growing fastest, driven by digital marketing, subscription models, and the convenience of doorstep delivery. Manufacturers are also experimenting with exclusive online-only flavor launches to build brand engagement.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is expected to contribute approximately 12–15% of the global market in 2024, led by the U.S. The rising demand for premium flavored products and expanding online distribution are driving growth. Regulatory barriers, including flavor bans, present challenges, but demand persists in urban lounge settings and among young adults.

Europe

Europe accounts for 20–25% of the global market, with Germany, the U.K., and France as major contributors. Strong café culture supports demand, though stricter tobacco regulation slows growth compared to emerging regions. Premium flavored blends and artisanal products are particularly popular in Western Europe.

Asia-Pacific

Asia-Pacific holds 20–25% market share in 2024 and is the fastest-growing region. India, China, and Southeast Asia are leading demand, driven by urbanization, rising disposable incomes, and café culture. APAC is forecast to significantly increase its global share by 2030.

Latin America

Latin America contributes about 5–10% of market revenue, with Brazil and Argentina emerging as focal points. While the base is smaller, growing middle-class incomes and exposure to global lifestyle trends are fueling demand for flavored shisha in lounges and home use.

Middle East & Africa

MEA dominates the market with a 35–40% share in 2024, led by countries such as Egypt, the UAE, and Saudi Arabia. Deep cultural integration of shisha and high lounge density drive demand. Although regulatory measures are increasing, MEA remains the core consumption and export hub for shisha tobacco.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Shisha Tobacco Market

- Al Fakher Tobacco Factory

- Starbuzz Tobacco, Inc.

- Fumari, Inc.

- Nakhla Tobacco Co.

- Mazaya Tobacco FZCO

- Social Smoke, Inc.

- Haze Tobacco LLC

- Romman Shisha

- Al Waha Tobacco

- Godfrey Phillips (India)

- Tangiers, Inc.

- Adalya Tobacco International GmbH

- Alchemist Tobacco Company, LLC

- Fantasia Tobacco

- MujeebSons

Recent Developments

- In June 2025, Al Fakher announced a new line of premium blended flavors targeting Asia-Pacific markets, with localized fruit inspirations such as lychee and mango.

- In May 2025, Starbuzz introduced a resealable, eco-friendly packaging design to preserve freshness and reduce plastic waste.

- In March 2025, Fumari launched an herbal, nicotine-free product line in North America to comply with evolving regulatory standards.