Sensor Patch Market Size

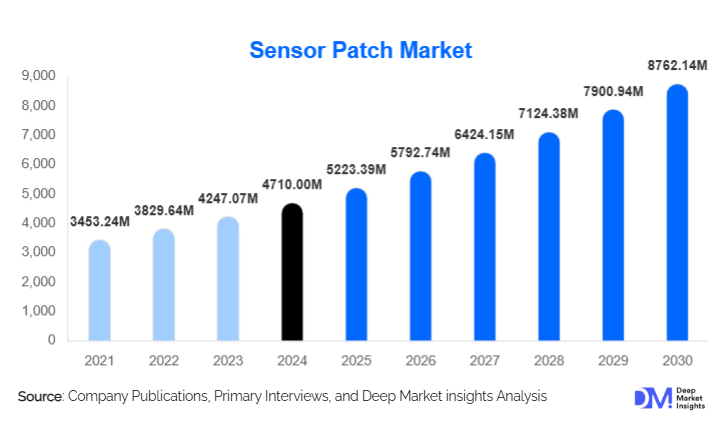

According to Deep Market Insights, the global sensor patch market size was valued at USD 4,710.00 million in 2024 and is projected to grow from USD 5,223.39 million in 2025 to reach USD 8,762.14 million by 2030, expanding at a CAGR of 10.9% during the forecast period (2025–2030). The sensor patch market growth is primarily driven by the rising need for continuous health monitoring, the expansion of decentralized clinical trials, and the advancing wearable electronics technologies enabling low-profile adhesive sensors.

Key Market Insights

- Growth is concentrated on adhesive sensor patches for chronic disease monitoring, particularly continuous glucose monitoring and wearable cardiac/ECG patches that have clear reimbursement pathways.

- Manufacturing scale in Asia-Pacific is accelerating, allowing cost reduction and export growth, which is boosting uptake in emerging markets.

- Bluetooth/low-power wireless connectivity dominates the patch form factor, enabling smartphone integration and remote data transmission for both consumer wellness and home healthcare.

- Healthcare providers and home-health/telehealth platforms are major purchasers, with institutions accounting for over half of the 2024 market share.

- Asia-Pacific region is the fastest-growing segment, driven by China and India’s large population base, rising healthcare investment, and manufacturing expansion.

- Technology convergence, combining multi-parameter sensing, printed electronics, and AI analytics, is reshaping the value chain, moving sensor patches from mere hardware to platform-based solutions.

Latest Market Trends

Multi-Parameter Patches Becoming Mainstream

Sensor patch suppliers are increasingly deploying multi-parameter sensing modules that measure multiple biomarkers or vitals (for example, glucose, heart rate, temperature, sweat metabolites) in one adhesive form-factor. This bundling of functionalities enhances clinical value, improves patient adherence (fewer devices worn), and raises lifetime revenue per patient because of analytics and subscription services. As flexible electronics and sensor fusion technologies mature, the “single-patch does more” trend is reshaping development road maps. Providers are now marketing combined cardiac and biomarker sensors or glucose plus hydration monitoring patches, increasing the market opportunity beyond single-use, single-parameter devices.

Emergence of Home-Based and Remote Monitoring Models

The shift toward home-based care and remote patient monitoring (RPM) is propelling demand for sensor patches outside hospital settings. Patients managing chronic conditions such as diabetes, arrhythmias, and cardiovascular disease increasingly wear adhesive patches that send data to clinician dashboards or telehealth platforms. Reimbursement reforms in major markets (US, EU) favor RPM and remote biomonitoring, accelerating adoption. Moreover, decentralized and hybrid clinical trials are leveraging sensor patches to collect continuous data outside clinic walls, reducing patient burden and improving endpoint resolution. These models are turning wearable patches into recurring-revenue assets (device + data subscription) rather than one-off hardware sales.

Sensor Patch Market Drivers

Growing Prevalence of Chronic Diseases and Demand for Continuous Monitoring

Medical systems worldwide face increasing burdens from chronic conditions like diabetes, cardiovascular disease, and respiratory disorders, and there is a rising demand for continuous, real-time monitoring to improve outcomes and reduce hospital readmissions. Sensor patches offer minimally invasive, long-wear formats that enable frequent or continuous measurement outside of the clinical environment, supporting remote care models and patient engagement. This creates a strong base demand for sensor patches by healthcare providers, home-care agencies, and telehealth platforms, making it a major growth driver.

Technological Maturation of Flexible Electronics and Printed Sensors

The pace of innovation in flexible electronics, printable sensors, low-power wireless communications (Bluetooth LE, NB-IoT), and high-performance adhesives has enabled sensor patches that are more comfortable, longer-wearing, and lower-cost than previous generations. These improvements reduce entry barriers, open volume production, and allow patches to expand into consumer wellness, sports performance, and remote monitoring in emerging markets. This technology readiness is accelerating adoption and driving down unit costs, which supports broader market penetration.

Analytics and Platform Monetization Enabling Recurring Revenue Models

Beyond the hardware, leading vendors now offer cloud-platform services, analytics, and diagnostic insights derived from sensor patch data (trend prediction, alerting, integration with EHRs). These value-added services increase the lifetime value of each user and encourage institutional buyers to adopt patch + platform bundles rather than just devices. Because the business model shifts toward recurring revenue (subscriptions + consumables), investment and innovation accelerate, further expanding market growth potential.

Market Restraints

Regulatory and Clinical Evidence Burden

Sensor patches aimed at diagnostic or therapeutic decision-making must undergo regulatory review (e.g., FDA, CE) and generate clinical validation data. These processes are time-consuming and costly, particularly for new entrants. Delays in approval or shifting regulatory requirements can slow market launch and reduce adoption, particularly in institutional healthcare settings that demand proven evidence. This barrier is a significant restraint for the industry.

Data Security, Interoperability, and Integration Challenges

Sensor patches generate continuous streams of personal health data. For institutional adoption, buyers demand secure, encrypted data flows, compliance with privacy regulations (HIPAA/GDPR), and seamless integration with existing telehealth/health-IT systems. Fragmented standards, evolving cybersecurity threats, and interoperability deficits hinder adoption by conservative healthcare providers. Until such concerns are consistently addressed, some buyers may delay purchase or restrict deployment, slowing growth.

Sensor Patch Market Opportunities

Expansion into Decentralized Clinical Trials and Pharmaceutical Partnerships

The clinical trial ecosystem is increasingly embracing decentralized and hybrid trial designs, seeking continuous biomarker capture, patient-centric monitoring, and reduced site visits. Sensor patches are ideally suited for these models. Vendors can partner with pharmaceutical companies and CROs to supply device + analytics solutions, offering higher-margin contracts that span beyond hardware into data services. This B2B opportunity remains under-penetrated and presents a significant growth vector for existing participants and new entrants.

Scalable Manufacturing and Export Opportunities from Asia-Pacific

Manufacturing cost pressures in the wearables market are increasingly shifting production to Asia-Pacific (China, India, Taiwan, South Korea). Suppliers that set up roll-to-roll printed electronics lines, adhesive sensor assembly, and contract manufacturing in these regions benefit from lower cost structures and favorable export dynamics. Exporting into mature markets (North America, Europe) while serving local rising demand creates a dual advantage. New entrants focusing on manufacturing scale-up and export could capture a sizable share of global demand. Additionally, public-private programs in India (“Make in India”) or China’s manufacturing roadmap support local capacity growth, reinforcing this opportunity.

Emerging Segments: Occupational Health, Maternal & Remote Monitoring Applications

Beyond the traditional medical and consumer wellness segments, sensor patches are gaining traction in occupational health (fatigue monitoring, heat stress, exposure tracking), maternal/neonatal monitoring (remote monitoring of mother and baby), and sports/athlete analytics (performance recovery, biomarker monitoring). These niche verticals are less saturated and offer room for differentiation, tailored product design, and partnerships with specialized end-users. Vendors that build application-specific patches and support services (e.g., employer health programs, maternity tele-monitoring) can harness incremental demand and diversify revenue streams.

Product Type Insights

Among product types, blood-glucose sensor patches dominate current revenues due to strong demand for non-invasive or minimally invasive continuous glucose monitoring (CGM) solutions and the global rise in diabetic populations. This segment benefits from well-established reimbursement frameworks and proven clinical validation, securing a leading position across institutional and home-care markets. Meanwhile, ECG and heart-rate patches are growing rapidly, driven by increasing outpatient arrhythmia detection and ambulatory cardiac care needs, as well as consumer demand for continuous heart-rate monitoring in fitness and wellness applications. Temperature patches are gaining traction for continuous fever monitoring in pediatrics and infection-control settings, supported by simpler regulatory pathways. Blood-oxygen patches continue to find use in home respiratory monitoring for COPD and post-COVID rehabilitation programs, while sweat/metabolite analyzer patches are emerging for sports performance and therapeutic drug monitoring. The dominant market trend is a transition toward multi-parameter adhesive patches, combining multiple sensors (e.g., glucose, heart rate, temperature), that improve data value, enhance patient comfort, and drive higher average revenue per user (ARPU). Disposable, single-use patches remain the largest revenue contributor owing to recurring consumable sales, although hybrid reusable modules with disposable interfaces are gaining attention for lowering per-use costs and improving sustainability.

Remote patient monitoring (RPM) remains the leading application segment, propelled by reimbursement incentives, chronic-care management programs, and the growing shift toward home-based healthcare. Hospitals and providers increasingly rely on sensor patches for continuous tracking of vitals in post-operative or high-risk patients, reducing hospital stays and optimizing staff workloads. Continuous health monitoring for chronic disease management, including diabetes, cardiovascular, and respiratory conditions, accounts for the majority of revenue share, while clinical trials and pharmaceutical R&D applications are rapidly expanding with the rise of decentralized and hybrid trial models that depend on wearable data capture. Fitness and sports applications continue to grow at double-digit rates, fueled by demand from professional athletes and wellness consumers for real-time, actionable biometrics on recovery, fatigue, and hydration. Emerging use cases include occupational safety, maternal monitoring, and elderly care, which broaden the addressable market beyond traditional medical applications.

Distribution Channel Insights

The sensor patch market leverages a hybrid distribution ecosystem blending institutional sales, direct-to-consumer (DTC) e-commerce, OEM partnerships, and subscription-based service models. Institutional channels, including hospitals, home-health agencies, and clinical procurement networks, dominate the medical-grade patch segment, driven by regulatory compliance and long-term contracts. Online DTC channels are rapidly expanding in consumer wellness and sports segments, offering transparency, convenience, and direct engagement. OEM and embedded integrations (sensor patches integrated into broader wearable ecosystems) are emerging as an important growth vector for technology and healthcare device partnerships. A key commercial innovation is the rise of subscription/SaaS-plus-hardware models, wherein analytics dashboards, AI-based alerts, and cloud-based clinician interfaces create recurring revenue streams for manufacturers and stronger stickiness among customers.

End-Use Industry Insights

Hospitals and clinics constitute the dominant end-use segment, utilizing sensor patches to shorten hospital stays, support post-discharge monitoring, and reduce readmissions through continuous outpatient tracking. The home healthcare and patient self-care segment is the fastest growing, supported by telehealth expansion, preventive-care initiatives, and patient preference for comfort and convenience. Pharmaceutical companies and contract research organizations (CROs) represent a rapidly scaling vertical, integrating sensor patches into decentralized clinical trials for real-time data acquisition. Beyond healthcare, sports and athletics organizations increasingly employ sensor patches to improve performance and recovery analytics. Emerging segments such as occupational health, maternal, and neonatal monitoring are adding incremental demand. Together, these trends highlight a shift from hospital-centric care to continuous, distributed, data-driven healthcare ecosystems.

| By Product Type | By Technology | By Application | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for approximately 38% of global sensor patch revenues in 2024. The United States dominates due to high per-capita healthcare spending, mature remote patient monitoring (RPM) reimbursement programs, and a strong consumer base for health-tech and wellness wearables. Early adoption by hospitals, home-care providers, and digital-health startups has created a robust ecosystem that blends clinical validation with commercial scale. Canada contributes through its expanding telehealth initiatives and focus on chronic-care management. The region also benefits from a dense medtech and biotech innovation cluster, particularly across California, Massachusetts, and Ontario, fostering rapid productization and investment inflows into adhesive sensor technologies.

Europe

Europe represents around 20% of the global market and demonstrates steady, evidence-driven adoption. Key markets such as Germany, the U.K., and France lead through national digital-health strategies and public-sector pilots integrating remote monitoring into chronic-care programs. The region’s stringent regulatory standards (MDR compliance, GDPR data frameworks) ensure high device credibility and patient safety, while aging demographics and home-care preferences support long-term demand. Although procurement cycles in public healthcare can be lengthy, they ensure stable, recurring contracts once technologies are validated. Nordic and Western European countries are particularly advanced in reimbursement and telemonitoring integration, setting templates for broader EU adoption.

Asia-Pacific

The Asia-Pacific (APAC) market accounts for about 29% of the global share in 2024 and is the fastest-growing region through 2030. Growth is anchored by rising chronic disease prevalence, a large and aging population base, and increasing disposable income. China leads manufacturing and exports, supported by local innovation and government health-tech incentives. India shows rapid adoption through telemedicine expansion, health-digitization policies, and low-cost wearable production. South Korea and Japan focus on high-tech wellness and elderly monitoring solutions, while Australia represents a mature telehealth market. Government-backed programs such as “Digital Health China” and “Ayushman Bharat Digital Mission” further accelerate ecosystem maturity. Local component manufacturing and cost-competitive production create a strategic export hub serving global demand.

Latin America

Latin America holds roughly 7% of the 2024 global sensor patch market, led by Brazil, Mexico, and Chile. Growth is primarily fueled by private-sector healthcare initiatives, insurer partnerships, and telehealth expansion targeting underserved and remote populations. Governments are increasingly exploring low-cost digital health and RPM programs to improve access in rural regions. However, adoption is tempered by limited reimbursement and price sensitivity among public providers. Local distributors and multinational medtech firms are forming joint ventures to address these affordability barriers, fostering gradual but steady uptake.

Middle East & Africa (MEA)

The Middle East & Africa region accounted for approximately 6% of the 2024 global market. GCC countries such as the UAE, Saudi Arabia, and Qatar drive demand through luxury healthcare systems, military and occupational-health applications, and government-funded telehealth pilots. The African sub-region is at an early adoption phase, focusing on maternal and community-health monitoring through NGO and donor-supported programs. Infrastructure gaps and limited reimbursement continue to pose challenges, but ongoing investments in hospital digitization and national e-health initiatives present long-term opportunities. MEA is expected to gain share through targeted deployments in industrial health (oil & gas, construction) and government employee wellness programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sensor Patch Market

- Abbott Laboratories

- Dexcom, Inc.

- Medtronic plc

- Roche Diagnostics

- Philips Healthcare

- Samsung Electronics

- Garmin Ltd.

- Texas Instruments Inc.

- Nemaura Medical Inc.

- Omron Healthcare Co., Ltd.

- Senseonics Holdings, Inc.

- Fitbit (Alphabet) Inc.

- Oura Health Ltd.

- Isansys Lifecare Ltd.

- Great Plains Conservation

Recent Developments

- In Q2 2025, Abbott Laboratories announced a strategic expansion of its continuous-glucose sensing patch into the consumer OTC market, adding subscription analytics and smartphone integration to its platform.

- In March 2025, Dexcom formed a partnership with a major telehealth provider to supply adhesive cardiac monitoring patches and data analytics services for remote cardiac care programs.

- In January 2025, Samsung Electronics unveiled a flexible printed-sensor patch prototype that integrates hydration, ECG, and temperature sensing, targeted for launch in 2026 as part of its wellness-wearable ecosystem.