Sensitive Skin Care Products Market Size

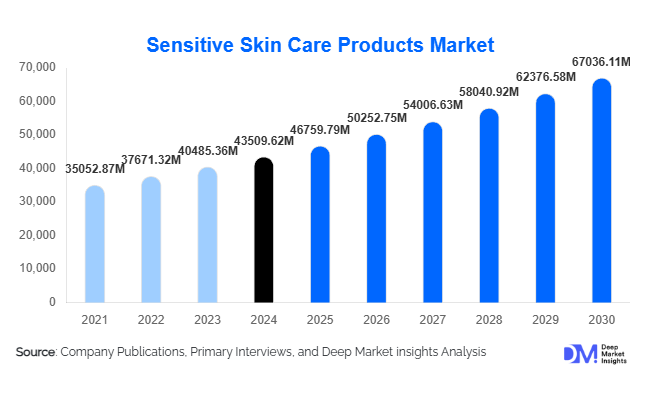

According to Deep Market Insights, the global sensitive skin care products market size was valued at USD 43,509.62 million in 2024 and is projected to grow from USD 46,759.79 million in 2025 to reach USD 67,036.11 million by 2030, expanding at a CAGR of 7.47% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer awareness of dermatological health, growing demand for hypoallergenic and natural formulations, and the increasing penetration of e-commerce and online retail channels globally.

Key Market Insights

- Moisturizers and creams dominate the product segment, driven by daily skin hydration routines and growing focus on barrier repair for sensitive skin.

- Online retail channels are increasingly shaping market access, offering consumers convenience, wide product choices, and AI-driven personalization tools.

- Women remain the largest end-user segment, representing over 55% of total market share, due to higher awareness and proactive skincare routines.

- Asia-Pacific is the fastest-growing region, fueled by rising urbanization, pollution-induced skin sensitivity, and increasing disposable incomes in China, India, and Japan.

- Technological integration in product formulations, including microbiome-friendly and bioactive ingredient-based skincare, is driving consumer adoption globally.

- Luxury and premium natural formulations, including fragrance-free and hypoallergenic products, are gaining traction among high-income consumers across North America and Europe.

What are the latest trends in the sensitive skin care products market?

Shift Toward Natural and Hypoallergenic Products

Consumers are increasingly seeking products free from harsh chemicals, parabens, sulfates, and artificial fragrances. Natural and organic sensitive skin care formulations, including plant-based extracts, ceramides, and hyaluronic acid, are witnessing growing adoption. Brands are marketing clinical studies to validate efficacy, emphasizing hypoallergenic and dermatologist-tested certifications. This trend reflects a broader move toward preventive skincare and avoidance of allergic reactions, particularly among millennials and Gen Z consumers.

Personalized Skincare Solutions

AI-driven and digital platforms now allow consumers to receive personalized recommendations based on skin type, sensitivity, and lifestyle factors. Customized formulations, including serums and creams targeting redness, hydration, or anti-aging, are increasingly popular. Mobile apps and online skin assessments are enabling tailored product subscriptions, strengthening customer engagement and loyalty. Personalized solutions are particularly popular in North America and Europe, where consumers are willing to pay premium prices for customized skincare routines.

What are the key drivers in the sensitive skin care products market?

Increasing Consumer Awareness of Skin Health

Growing knowledge about eczema, rosacea, and general skin sensitivity has driven demand for specialized skin care products. Dermatologist endorsements, influencer campaigns, and educational content are boosting awareness about the importance of gentle formulations. Consumers are actively seeking hypoallergenic products, contributing to 30–35% of overall market growth in 2024.

Environmental Stressors and Urban Pollution

Rising exposure to pollutants, UV radiation, and harsh weather conditions is increasing the prevalence of sensitive skin globally. Consumers are investing in moisturizers, repair creams, anti-redness serums, and sunscreens designed specifically for sensitive skin. Environmental awareness combined with skincare innovation is driving consistent demand in both developed and emerging markets.

Expanding Male and Elderly Consumer Base

While women remain the dominant demographic, men’s skincare routines are evolving, with products like hydrating creams, soothing lotions, and anti-redness treatments gaining popularity. The elderly population is also adopting specialized skin care, boosting demand for products focused on hydration and barrier repair. The male and elderly segments together contribute 25–28% of total market revenue.

What are the restraints for the global market?

High Product Prices

Premium ingredients, specialized formulations, and technological innovations make sensitive skin care products expensive, limiting adoption in price-sensitive regions. Consumers in emerging economies may prefer generic alternatives, restricting market penetration. Price sensitivity remains a key challenge for mass-market expansion.

Fragmented Regulatory Landscape

Different countries maintain varying standards for cosmetics and dermatologically tested products. Compliance with ingredient regulations, labeling requirements, and testing protocols can delay product launches, increase operational costs, and hinder seamless global expansion. Brands must navigate a complex matrix of regulatory frameworks to ensure market access.

What are the key opportunities in the sensitive skin care products industry?

Emerging Markets Expansion

Asia-Pacific, Latin America, and the Middle East offer significant growth potential due to rising pollution levels, urbanization, and increasing consumer awareness of sensitive skin issues. International players can capitalize on these regions through targeted marketing campaigns, local partnerships, and distribution channel expansion, driving long-term growth.

Technological Innovations in Formulation

Advancements such as microbiome-friendly formulations, nanotechnology-based ingredient delivery, and bioactive compounds present opportunities for product differentiation. Companies investing in R&D for personalized and highly effective sensitive skin care solutions can capture premium market segments and build stronger brand loyalty.

Sustainable and Eco-Friendly Skincare

Consumers increasingly demand cruelty-free, eco-friendly, and recyclable packaging. Aligning products with sustainability trends not only strengthens brand image but also attracts environmentally conscious consumers. Europe and North America are particularly receptive to green and ethical skincare products, providing brands with avenues for premium positioning and higher margins.

Product Type Insights

Moisturizers and creams continue to dominate the sensitive skin care products market, accounting for approximately 28% of total revenue in 2024. This leadership is driven by the growing awareness that daily hydration is essential for managing sensitive skin issues, combined with the increasing prevalence of formulations enriched with ceramides, hyaluronic acid, and natural plant extracts. Consumers are particularly focused on products that reinforce the skin barrier and prevent redness or irritation. Serums targeting anti-redness and repair account for around 20% of revenue, fueled by the popularity of targeted solutions for conditions such as rosacea, eczema, and post-treatment skin recovery. Sunscreens specifically formulated for sensitive skin are gaining traction due to rising awareness of UV-induced skin damage and chemical sensitivities. Baby and children’s sensitive skin products represent a high-growth niche, driven by parental concern for hypoallergenic, gentle formulations and the rise of specialized baby skin care routines. Overall, face care products remain the leading driver of growth in this segment, as consumers are more willing to invest in visible areas, reinforcing the market dominance of facial moisturizers and serums.

Application Insights

Daily skincare routines remain the primary application of sensitive skin care products, with increasing consumer focus on anti-redness, hydration, and barrier repair. Professional channels such as dermatology clinics and spas are emerging as important conduits for growth, particularly for hypoallergenic creams, serums, and treatment kits. Baby and children’s skincare represents a significant niche, especially in urban regions where parents are highly conscious of product safety and hypoallergenic credentials. Additionally, online subscription models for sensitive skincare products are expanding rapidly, providing convenience, personalization, ingredient transparency, and regular replenishment, which is increasingly valued by consumers seeking long-term skin health solutions.

Distribution Channel Insights

E-commerce is now a dominant distribution channel, accounting for approximately 22% of total revenue in 2024. It provides consumers with ease of access, wider product selection, and digital personalization while enabling direct engagement with brands through reviews and ratings, which are critical for sensitive skin buyers. Supermarkets and hypermarkets remain important for mass-market visibility, offering convenience and reach. Specialty stores and pharmacies serve as trusted venues for premium and dermatologist-endorsed sensitive skin products, supporting brand education and product credibility. Direct-to-consumer (DTC) models and niche subscription brands are emerging as innovative channels, leveraging social media and influencer marketing to build awareness, trial, and loyalty among younger and digitally active consumers.

End-User Insights

Women remain the largest end-user segment, representing approximately 55% of market share, due to historically higher engagement with skincare routines, greater spending power, and heightened sensitivity to skin irritation. Men account for roughly 18% of the market, with growth driven by rising male grooming trends and increasing awareness of sensitive skin needs. Infants and children (12% share) are emerging as a high-growth segment, reflecting parental demand for gentle, hypoallergenic products. Personal care remains the largest application, while dermatology clinics and spas contribute significantly in urban areas, offering professional recommendations and high-value products. Export-driven demand is strong in regions such as Asia-Pacific and the Middle East, where consumers are increasingly seeking premium imported formulations.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 35% of the market in 2024, with the U.S. as the leading contributor. Growth is driven by high consumer awareness of dermatological conditions, strong penetration of premium skincare brands, and the widespread demand for dermatologist-endorsed sensitive skin products. Canadian consumers are also contributing to steady growth, emphasizing natural and hypoallergenic formulations. E-commerce adoption, social media awareness campaigns, and urban millennial trends further accelerate market expansion, reinforcing North America’s dominant regional position.

Europe

Europe holds around 25% of the global market, with Germany, France, and the U.K. as key contributors. Growth is fueled by a strong regulatory environment for hypoallergenic and dermatologically tested products, a high prevalence of ageing populations with sensitive skin, and the widespread wellness/self-care trend. Consumers increasingly prefer organic, cruelty-free, and sustainable formulations. Younger demographics are embracing eco-friendly and digital purchasing channels, while dermatology clinics and pharmacies support professional guidance and credibility, sustaining growth in premium segments.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a projected CAGR of 7–8%. Key markets include China, India, Japan, and South Korea. Regional growth is driven by rapid urbanization, rising disposable incomes, a growing middle class, the expansion of e-commerce, the influence of social media beauty influencers, and increasing skincare awareness among younger consumers. Rising air pollution and environmental stressors contribute to higher adoption of sensitive skin products. Additionally, local brands are increasingly offering hypoallergenic and natural formulations, while cross-border e-commerce allows consumers access to premium international products, further bolstering growth.

Latin America

Latin America, led by Brazil, Mexico, and Argentina, is witnessing moderate growth (5% CAGR). Drivers include growing penetration of skincare routines, increasing retail infrastructure such as supermarkets and hypermarkets, rising beauty and personal care expenditure among younger consumers, and urbanization. Affluent populations are adopting premium sensitive skin care formulations, while awareness campaigns and social media engagement are influencing purchase behavior, making urban centers key growth hubs.

Middle East & Africa

The Middle East & Africa region is emerging as a high-potential market (6% CAGR), with the UAE, Saudi Arabia, and South Africa leading demand. Growth is driven by rising income levels, luxury product adoption, expatriate-driven demand, and increasing awareness of skincare safety. Expansion of e-commerce and digital marketing is improving accessibility to premium and imported sensitive skin care products. Urban centers are witnessing higher adoption due to lifestyle changes, rising beauty consciousness, and professional skincare guidance, positioning the region for accelerated growth over the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sensitive Skin Care Products Market

- L’Oréal

- Unilever

- Procter & Gamble

- Johnson & Johnson

- Beiersdorf

- Shiseido

- Amorepacific

- Kao Corporation

- Estée Lauder

- The Body Shop

- Bioderma

- La Roche-Posay

- Eucerin

- Aveeno

- CeraVe

Recent Developments

- In March 2025, L’Oréal launched a new line of hypoallergenic moisturizers for sensitive skin, integrating microbiome-friendly technology.

- In January 2025, Beiersdorf expanded its CeraVe sensitive skin range in Asia-Pacific, targeting emerging urban markets with e-commerce campaigns.

- In December 2024, Shiseido introduced fragrance-free anti-redness serums in Europe and North America, reinforcing its premium sensitive skin portfolio.