Seismic Server Rack Cabinet Market Size

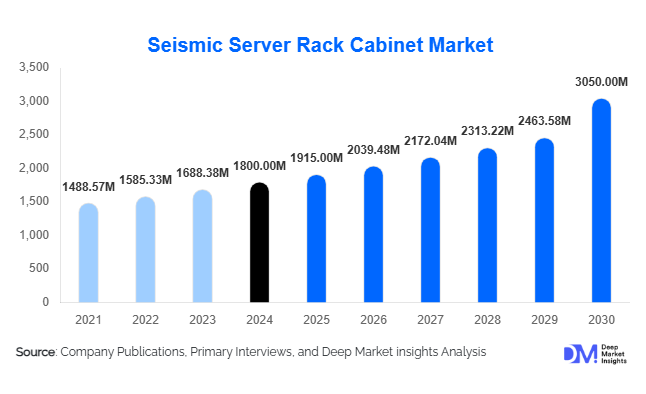

According to Deep Market Insights, the global seismic server rack cabinet market was valued at approximately USD 1,800 million in 2024 and is projected to grow from about USD 1,917 million in 2025 to reach USD 2626.46 million by 2030, expanding at a compound annual growth rate (CAGR) of 6.5% during the forecast period (2025–2030). The growth is underpinned by intensifying demand for resilient data infrastructure, regulatory push in earthquake-prone zones, and rising adoption of advanced rack technologies.

Key Market Insights

- Enclosed, floor-mounted seismic cabinets dominate demand due to superior protection and flexibility in retrofits or new data center builds.

- Steel remains the prevailing material choice, owing to its structural strength, cost efficiency, and familiarity among manufacturers and users.

- Data centers are the principal end users, accounting for nearly half of total demand, driven by cloud, colocation, and hyperscale buildouts.

- North America commands the largest regional share, supported by stringent building codes, high IT infrastructure spending, and awareness of disaster resilience.

- Asia-Pacific is the fastest-growing region, led by demand in China, India, Japan, and Southeast Asian nations, expanding digital infrastructure.

- Technology integration is shifting the competitive edge, with cabinets increasingly embedded with vibration sensors, IoT monitoring, modularity, and advanced materials.

Latest Market Trends

Retrofit & Resilience Upgrades Are Gaining Traction

A growing number of existing data centers built without seismic safeguards are now undergoing retrofits or rack replacements. Enterprises are upgrading older racks or integrating bracing, damping systems, or replacement cabinets to meet updated safety codes or mitigate risk. This retrofit demand helps supplement the new-build pipeline and smooths deployment cycles as downtime windows are managed carefully.

Smart Racks & Predictive Monitoring Are Becoming Standard

Seismic racks are no longer only structural. Manufacturers are embedding sensors (accelerometers, tilt/motion detectors), IoT connectivity, real-time monitoring, and analytics capabilities so that rack performance under vibration can be tracked proactively. Predictive maintenance, remote diagnostics, and alerting functions are influencing purchasing decisions, especially in mission-critical applications.

Seismic Server Rack Cabinet Market Drivers

Explosive Data Infrastructure Growth

The surge in cloud computing, AI/ML workloads, IoT, and edge services is driving a massive expansion of data center capacity globally. Every new rack deployment or densification of existing rack space adds potential demand for seismic-rated cabinets, especially where continuity and resilience are prioritized.

Regulatory & Insurance Mandates in Seismic Zones

In earthquake-prone regions, building codes, safety regulations, and insurance underwriting increasingly demand or incentivize seismic protection for critical infrastructure. Data centers, telecom hubs, hospitals, government facilities, and financial institutions often face mandates or opt for compliance to reduce liability. This regulatory push ensures a baseline of demand in high-risk geographies.

Heightened Risk Awareness & Business Continuity Planning

Organizations are more sensitive to the financial and reputational fallout from downtime or damage following natural disasters. Seismic server rack cabinets are viewed as one of the defensive investments to guard against losses. This conscious risk mitigation mindset is a strong pull for adoption in sectors such as finance, healthcare, defense, and telecom.

Market Restraints

Higher CapEx & Cost Sensitivity

Seismic-rated cabinets carry a significant cost premium due to stronger materials, reinforcement, compliance testing, and certification overhead. For small and medium enterprises or cost-constrained projects, this premium may deter adoption, especially in regions with lower perceived seismic risk.

Complex Manufacturing, Logistics & Customization Challenges

Designing and producing seismic cabinets requires more stringent tolerances, custom bracing, heavier frames, and additional components. Logistics (shipping heavier units, anchoring systems) and long lead times add complexity. Manufacturers must balance customization with scale, which constrains rapid cost reduction.

Seismic Server Rack Cabinet Market Opportunities

Regulatory & Infrastructure-Driven Upside in Seismic Zones

Regions with known seismic risksuch as Japan, Taiwan, California/West Coast USA, Chile, Peru, parts of India, Southeast Asiarepresent ongoing opportunities. Governments are rewriting building codes, enforcing retrofits, or requiring new infrastructure to include seismic-rated racks. Companies that pre-certify (zone ratings, compliance labs) or enter local markets early tend to gain first-mover advantage.

Scalable Retrofit & Modular Upgrade Solutions

The large base of non-seismic or partially compliant data centers and telecom facilities presents an addressable retrofit market. Systems such as bracket kits, retrofit reinforcement modules, seismic sub-frames, or partial-upgrade pathways (rather than full replacements) may appeal to buyers seeking cost-effective transitions. This modular upgrade opportunity can accelerate penetration in mature markets.

Value-Added Integration & Smart Features as Differentiators

Beyond structural resilience, integrating vibration feedback, environmental monitoring, remote diagnostics, modular reconfiguration, thermal management, and “rack as a service” models can command a premium. Edge computing, telecom sites, micro data centers, and ruggedized installations increasingly demand lightweight, smart, and compact seismic enclosures opportunity for niche innovation.

Product Type Insights

Among product types, enclosed/full cabinets dominate due to superior protection, the ability to accommodate cabling, secure doors, and integrated airflow control. The premium and critical infrastructure buyers prefer these over open frames in seismic environments. Open-frame and wall-mounted versions are used in smaller or non-mission-critical settings, but command a lower share. Portable racks see niche use in field or temporary installations, especially in disaster response or mission deployments.

Application Insights

Data centers remain the largest application category, accounting for nearly half of total revenue. Telecommunications infrastructure (especially mobile base station hubs, central offices) is another strong segment, as is enterprise IT for mission-critical operations (financial services, banking, government). Industrial automation, manufacturing, utilities, and defense/critical infrastructure represent smaller but growing segments. In recent years, edge compute sites in volatile or remote zones have emerged as new application pockets needing seismic resilience.

Distribution Channel Insights

Large-scale projects (hyperscale cloud, telecom operators, government) are primarily procured via direct OEM contracts, design-build integrators, or system integrators. Smaller users often purchase through channel distributors, rack enclosure specialists, or local partners. Value-added features (installation, testing, certification, and monitoring service) are often bundled. Some manufacturers are exploring “rack as a service” or managed services models to deepen customer lock-in.

End-User Insights

High-end enterprises (hyperscale, colocation, government, telecom) form the bulk of early adoption, given their high reliability and continuity requirements. Mid-tier enterprises, hospitals, and financial institutions are increasingly adopting seismic racks as part of their risk mitigation strategy. Sectors with high uptime sensitivity, such as healthcare, finance, and defense, are expanding their use. The mid- to long-tail of smaller businesses is still gradually catching up as awareness, cost, and scale barriers lower.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads with 35–40% of the global market in 2024. The U.S. is the powerhouse, driven by high levels of data center construction, tight seismic building codes (especially in California and, Pacific Northwest), strong IT spending, enterprise demand, and regulatory/insurance pressure. Canada also contributes to telecom and government infrastructure expansions. The region’s maturity means retrofit demand is strong, and reliability expectations push premium adoption.

Europe

Europe holds a 15–20% share. Major countries such as Germany, the UK, France, and the Nordics are mature markets with stable demand, strong infrastructure, and moderate seismic risk. Southern Europe (Italy, Greece, Turkey) shows pockets of higher risk-driven demand. Growth is steady, fueled more by replacement, upgrades, and regulation than fresh build expansions.

Asia-Pacific

Asia-Pacific holds a 25–30% share and is the fastest-growing region. China, Japan, India, and Southeast Asia drive demand. Japan’s strong seismic tradition ensures early adoption, China’s rapid data center investment adds volume, and India’s infrastructure catch-up and regulatory modernization push growth. Southeast Asian nations with seismic risk (Indonesia, Philippines) are emerging. The region’s growth rate is expected to outpace North America.

Latin America

Latin America accounts for 8–10% of global demand. Key countries are Brazil, Mexico, Chile, Peru, and the Andean states. Chile and Peru, being high seismic risk areas, show more urgency. Growth is tied to data center, telecom expansion, and cloud provider entry. The region has higher growth potential but from a modest base.

Middle East & Africa

MEA contributes a 5–7% share. Seismic risk is uneven across the region, so uptake is concentrated in zones with active geology (e.g., parts of Turkey, Iran, East Africa). Meanwhile, Gulf states (UAE, Saudi Arabia) are investing heavily in cloud, data center, and government ICT infrastructure. Intra-Africa demand is nascent but rising as regional digitalization accelerates.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Seismic Server Rack Cabinet Market

- Schneider Electric

- Eaton Corporation

- Vertiv

- Rittal

- Chatsworth Products

- Tripp Lite

- NetRack Enclosures

- Maysteel

- AIB Kunstmann

- nVent (Hoffman division)

- Amphenol

- Gaw Technology

- Electron Metal

- Newton Instrument

- Equipto Electronics

Recent Developments

- In 2025, several major rack OEMs have introduced seismic-certified modular systems with embedded sensor arrays and IoT connectivity to monitor vibration and structural integrity in real time.

- In early 2025, a leading global rack manufacturer signed a collaboration agreement with a seismic testing laboratory in Southeast Asia to accelerate local certification and reduce lead times.

- Also in 2025, some cloud/data center operators announced retrofitting programs in California and Japan to replace non-seismic racks in their mission-critical sites, signaling rising secondary demand.