Second-hand Luxury Goods Market Size

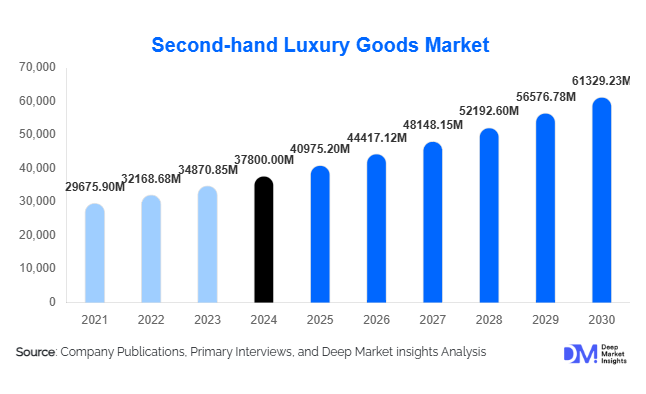

According to Deep Market Insights, the global second-hand luxury goods market size was valued at USD 37,800.00 million in 2024 and is projected to grow from USD 40,975.20 million in 2025 to reach USD 61,329.23 million by 2030, expanding at a CAGR of 8.4% during the forecast period (2025–2030). The surging popularity of sustainable consumption drives the market’s rapid growth, the rising influence of Gen Z and millennials prioritizing circular fashion, and the expansion of authenticated online resale platforms offering luxury items at accessible prices.

Key Market Insights

- Growing consumer preference for sustainable and circular fashion is propelling the resale of luxury items such as handbags, watches, and apparel.

- Digital resale platforms like The RealReal, Vestiaire Collective, and Rebag are transforming the market through AI-based authentication and seamless customer experience.

- Millennials and Gen Z dominate the buyer base, driving demand for pre-owned luxury driven by affordability and sustainability values.

- Europe leads the global market, supported by a strong luxury heritage, evolving sustainability culture, and advanced authentication infrastructure.

- Asia-Pacific represents the fastest-growing region, fueled by booming luxury demand in China, Japan, and South Korea, alongside digital resale adoption.

- Luxury brands are entering the resale ecosystem through partnerships and in-house pre-owned programs, reflecting a major industry shift toward circular business models.

Latest Market Trends

Brand-Integrated Resale Ecosystems

Leading luxury houses are embracing resale as a strategic growth avenue. Brands such as Gucci, Balenciaga, and Burberry have launched certified pre-owned programs or partnered with resale platforms to manage their circular ecosystems. These initiatives ensure brand control over pricing, authentication, and product lifecycle, helping brands retain younger consumers while promoting sustainability. Brand-owned resale platforms also enable direct engagement with buyers, providing opportunities for upselling and enhancing lifetime brand loyalty.

Technology-Driven Authentication and Transparency

AI, blockchain, and RFID technologies are revolutionizing authenticity verification in the second-hand luxury market. Platforms now use AI-powered image recognition to detect counterfeits, while blockchain provides immutable proof of ownership and provenance tracking. Companies like Entrupy and LuxTag are leading in digital authentication innovation. This tech-led transparency is building trust, a key barrier historically limiting second-hand luxury adoption. Enhanced verification systems also appeal to first-time luxury buyers seeking legitimacy and quality assurance.

Second-hand Luxury Goods Market Drivers

Rising Sustainability Awareness

Growing environmental consciousness is encouraging consumers to adopt circular fashion models. Second-hand luxury goods offer an eco-friendly alternative to fast fashion, reducing waste and extending product lifecycles. The alignment of resale with ESG principles and global sustainability goals has made it attractive to both consumers and investors. Luxury brands are now marketing pre-owned programs as eco-conscious lifestyle choices, further accelerating market demand.

Digitalization and Social Commerce Influence

The proliferation of e-commerce and social commerce has democratized access to luxury resale. Platforms such as Vestiaire Collective, Depop, and Poshmark are leveraging social media engagement, influencer marketing, and community-driven resale to reach younger audiences. Integrated payment solutions, real-time inventory updates, and live-stream auctions are improving buyer experiences, making second-hand luxury more mainstream. This digital wave is expected to further expand resale penetration globally.

Market Restraints

Counterfeit and Authentication Challenges

Despite advancements in technology, counterfeit risks remain a significant concern. Unverified sellers and peer-to-peer models on open platforms can undermine consumer trust. Maintaining rigorous authentication processes increases operational costs for resale platforms, creating scalability challenges. Ensuring consistent quality control and maintaining brand integrity continue to be key obstacles to sustained market expansion.

Limited Supply of High-Quality Pre-Owned Items

Supply constraints persist due to the limited release of high-end products and owners' reluctance to resell luxury goods. Scarcity of premium items, such as iconic handbags or limited-edition watches, restricts inventory diversity across resale channels. Moreover, long product retention cycles among affluent consumers reduce market fluidity, impeding volume growth despite rising buyer demand.

Second-hand Luxury Goods Market Opportunities

Emergence of Certified Pre-Owned (CPO) Programs

Luxury brands are increasingly launching certified pre-owned programs to regain control of their secondary markets. These programs ensure authenticity, maintain resale value, and enable brands to capture a share of resale revenues. Brands such as Rolex, Richemont, and Valentino have introduced in-house resale or partnered with established platforms to authenticate and resell products. This shift not only enhances customer confidence but also aligns luxury retail with sustainability objectives.

Expansion in Emerging Economies

Rapid growth in disposable income across emerging markets presents significant opportunities. Countries like India, China, and the UAE are witnessing a surge in aspirational luxury consumers open to purchasing pre-owned goods. Localized online platforms and pop-up resale boutiques are expanding access, while cultural acceptance of second-hand goods is gradually improving, positioning emerging markets as key future growth hubs.

Product Type Insights

Handbags and small leather goods dominate the second-hand luxury goods market, representing the largest revenue share due to their high liquidity and brand recognition. Iconic brands such as Louis Vuitton, Hermès, and Chanel command strong resale values and are easier to authenticate, making them the preferred choice for both first-time buyers and collectors. Watches and jewelry follow closely, driven by collector and investor dynamics, scarcity, provenance, and long-term value appreciation, making items from Rolex, Cartier, and Patek Philippe particularly sought-after in resale channels. Apparel is expanding rapidly, fueled by trend sensitivity and seasonal demand, with designer drops and limited-edition collections creating fast resale cycles among younger consumers. Footwear growth is driven by hype culture and limited collaborations, particularly in sneakers and designer streetwear, where resale prices can exceed retail value. Accessories and eyewear, including scarves, belts, and sunglasses, are experiencing volume-driven growth due to their low entry price and impulse purchase appeal. Collectibles and vintage items remain niche but highly profitable, benefiting from scarcity and provenance-led premiums, yielding the highest margins in the market despite slower turnover.

Distribution Channel Insights

Online platforms account for the majority of second-hand luxury sales, driven by network effects and scale. Platforms like The RealReal, Vestiaire Collective, and Rebag offer global access, AI-powered authentication, and robust curation, enabling consumers to browse diverse inventories and discover fair market prices. Branded or authorized resale channels leverage trust and price stabilization, as brand-backed programs assure authenticity and enhance willingness to pay. Peer-to-peer and social commerce channels are rapidly gaining traction, leveraging lower fees and social proof. Buyers are influenced by online communities, influencers, and trending items, facilitating fast sales and high engagement. Offline channels, such as consignment stores and luxury boutiques, rely on curation and in-person trust, appealing to quality-conscious buyers seeking tactile verification. Auctions and specialist dealers continue to dominate ultra-luxury and collectible items, benefiting from provenance and scarcity premiums for high-value watches, jewelry, and vintage pieces.

| By Product Type | By Distribution Channel | By End User |

|---|---|---|

|

|

|

Regional Insights

Europe

Europe leads the global second-hand luxury goods market, underpinned by a mature vintage and consignment ecosystem. Countries such as France, Italy, and the U.K. boast long heritages in luxury, dense networks of boutique dealers and auction houses, and high consumer awareness of sustainability, making resale culturally accepted and well-structured. Government initiatives promoting circular fashion, combined with strong authentication standards, further support growth. European consumers increasingly prefer certified pre-owned items and luxury refurbishments, reinforcing demand across handbags, watches, and apparel. Luxury brand partnerships with resale platforms and growing e-commerce adoption are accelerating penetration in Western Europe, while specialty vintage shops continue to cater to collectors seeking high-margin, scarce items.

North America

North America ranks second globally, led by the U.S. and Canada, with the market driven by high platform adoption and a strong secondary market culture. Well-developed online marketplaces, advanced logistics infrastructure, and wide availability of consumer credit have mainstreamed luxury resale. Social media and influencer-led promotion amplify trend-driven purchasing, while The RealReal and Fashionphile remain market leaders due to trusted authentication processes. The resale ecosystem benefits from both sustainability-conscious buyers and collector/investor demand for handbags, watches, and jewelry. The rapid adoption of mobile resale apps and AI-based verification tools is further expanding the online market, particularly among millennials and Gen Z demographics.

Asia-Pacific

Asia-Pacific is the fastest-growing second-hand luxury market, with China, South Korea, Japan, and India leading the surge. Growth is driven by rapid uptake among young affluent consumers and cross-border luxury flows. Rising disposable incomes, expanding middle-class wealth, and a strong appetite for luxury products have accelerated both domestic and cross-border resale activity. Social commerce platforms, influencer marketing, and fast-scaling local marketplaces such as Poizon (China) and KREAM (Korea) are shaping consumer behavior. High interest in limited-edition items, streetwear, and collectible watches is driving resale demand, while mobile-first purchasing patterns and digital authentication services ensure consumer trust and market scalability.

Middle East & Gulf

The Middle East, particularly the UAE and Saudi Arabia, is witnessing increasing participation in second-hand luxury, propelled by high per-capita luxury ownership and appetite for exclusivity. Affluent buyers actively seek rare or collectible pieces, often paying premiums for authenticated handbags, watches, and jewelry. Tourism-driven demand also supports cross-border resale, as international visitors fuel short-term market activity. The emergence of luxury-focused resale platforms and boutique consignment shops, alongside growing awareness of sustainable luxury, is normalizing pre-owned consumption in the region. The market is increasingly seeing demand for ultra-luxury and vintage items, which command both scarcity-driven pricing and investment appeal.

Latin America

Latin America remains an emerging market for second-hand luxury, supported by scarcity and import cost economics. Limited local availability of brand-new luxury items and high import taxes create favorable conditions for pre-owned goods, making resale an attractive value proposition. Key markets include Brazil, Mexico, and Argentina, where price-conscious yet brand-aware consumers are driving demand for handbags, watches, and collectibles. Cross-border purchases, particularly from the U.S. and Europe, are a significant growth driver, complemented by an evolving online resale ecosystem. As consumer awareness of authentication and refurbished products increases, the adoption of online marketplaces and boutique consignment stores is accelerating.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Second-hand Luxury Goods Market

- The RealReal

- Vestiaire Collective

- Rebag

- Fashionphile

- Luxury Garage Sale

- WatchBox

- Yoogi’s Closet

- Collector Square

Recent Developments

- In September 2025, The RealReal launched a blockchain-powered authentication system to enhance transparency and track product provenance for luxury handbags and watches.

- In July 2025, Vestiaire Collective expanded operations into South Korea through strategic partnerships with domestic resale platforms to meet soaring Gen Z demand.

- In May 2025, Rebag introduced an AI-based luxury item valuation tool enabling instant resale pricing, improving convenience and seller engagement.

- In March 2025, Richemont announced the global rollout of its certified pre-owned program across Cartier and IWC boutiques, reinforcing its commitment to sustainable luxury.