Scuba Rebreather Market Size

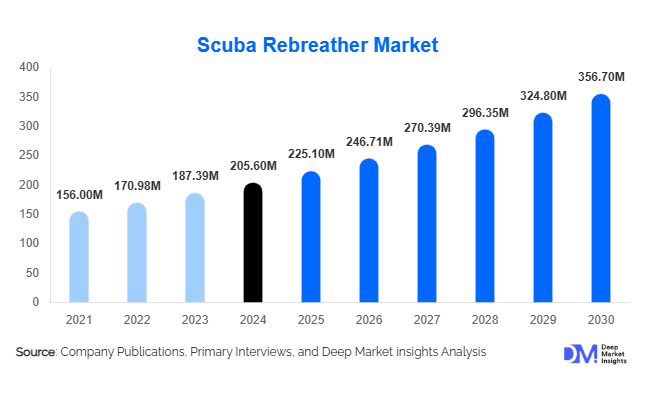

According to Deep Market Insights, the global scuba rebreather market size was valued at USD 205.6 million in 2024 and is projected to grow from USD 225.1 million in 2025 to reach USD 356.7 million by 2030, expanding at a CAGR of 9.6% during the forecast period (2025–2030). The market growth is primarily driven by the increasing popularity of recreational and professional diving activities, rising adoption of advanced rebreather technologies by defense and rescue sectors, and expanding underwater exploration initiatives worldwide.

Key Market Insights

- Technological innovation is driving the development of lighter, safer, and more energy-efficient rebreather systems for both professional and leisure divers.

- Closed-circuit rebreathers (CCR) continue to dominate the market due to their extended dive duration, gas efficiency, and reduced bubble emission, making them ideal for deep and technical diving.

- Military and defense applications are a major growth contributor, with rising demand for stealth underwater operations and long-duration dive missions.

- Europe leads the global market in terms of manufacturing and adoption, driven by a strong diving culture and advanced maritime industries.

- Asia-Pacific is emerging as the fastest-growing region, fueled by increasing coastal tourism, growing diving certifications, and investment in marine research.

- Eco-conscious diving practices and increased awareness of marine conservation are promoting the use of sustainable, low-emission rebreather systems.

Latest Market Trends

Integration of Smart Diving Technologies

Manufacturers are integrating digital technologies such as AI-based oxygen monitoring, real-time data analytics, and wireless connectivity into modern rebreathers. Smart displays and Bluetooth-enabled control units are improving safety and efficiency by providing instant updates on oxygen levels, depth, and decompression data. These advancements appeal to both professional divers and recreational enthusiasts seeking enhanced control and safety during dives. The introduction of rebreathers compatible with mobile diving apps and cloud-based dive logs is also revolutionizing dive planning and performance tracking.

Growing Popularity of Eco-Tourism and Marine Conservation Diving

The global shift toward sustainable travel is encouraging more divers to engage in conservation-oriented diving activities. Rebreathers, which minimize bubble and noise emissions, allow for closer interaction with marine life and minimal disruption to underwater ecosystems. Dive operators are increasingly offering eco-certified packages that utilize rebreather systems to support coral restoration and underwater research. This trend aligns with broader sustainability goals, reinforcing rebreathers’ position as a key tool for responsible and low-impact diving.

Scuba Rebreather Market Drivers

Expansion of Recreational and Technical Diving

The global rise in scuba diving certifications and adventure tourism is fueling rebreather demand. Recreational divers are seeking longer, deeper, and more immersive underwater experiences—capabilities that traditional open-circuit systems cannot offer. The expansion of diving schools, underwater photography, and exploration expeditions in tropical regions is significantly contributing to market growth. Additionally, the increasing availability of rental rebreather systems in tourist hotspots is making advanced diving more accessible to certified users.

Rising Demand from Military and Rescue Operations

Military and rescue organizations are increasingly adopting rebreathers for covert underwater missions and search-and-rescue operations. Closed-circuit systems, which eliminate bubbles and allow extended underwater endurance, are essential for tactical missions and recovery efforts. Defense modernization programs in the U.S., Europe, and Asia-Pacific are investing in advanced underwater breathing systems to enhance naval and marine security capabilities. This trend is expected to strengthen the commercial and defense rebreather market through 2030.

Market Restraints

High Cost and Technical Complexity

Rebreathers are significantly more expensive and complex to operate compared to traditional scuba systems. High initial investment, maintenance costs, and training requirements limit their adoption among casual divers. The need for specialized certification and potential safety risks associated with improper use are also barriers to broader consumer uptake. Manufacturers continue to face challenges in balancing cost efficiency with performance and safety standards.

Stringent Safety Regulations

Given the critical nature of underwater breathing systems, rebreathers are subject to rigorous safety certifications and regional compliance standards. Delays in certification processes and evolving international safety guidelines can restrict product launches and slow market expansion. Operators and dive schools must also maintain strict safety protocols, adding operational overhead to adoption.

Scuba Rebreather Market Opportunities

Technological Innovation and Modular Design

Ongoing advancements in sensor technology, compact battery systems, and modular architecture present major opportunities for product differentiation. Manufacturers are focusing on customizable rebreathers that allow divers to swap components based on mission type, depth, or gas mix. Lightweight materials such as carbon fiber and titanium are enabling the design of more portable units, expanding usage beyond professional diving to recreational markets.

Growth in Underwater Research and Exploration

Scientific research, marine archaeology, and ocean exploration projects increasingly depend on rebreathers for prolonged and non-intrusive underwater operations. Government and private funding for oceanographic studies and coral reef restoration projects are opening new commercial avenues for manufacturers. Collaborations between rebreather producers and marine institutes are expected to drive technology transfer and innovation.

Product Type Insights

Closed-circuit rebreathers (CCR) hold the dominant share of the market due to their superior efficiency, silent operation, and extended dive durations. Semi-closed rebreathers (SCR) are gaining traction for recreational diving due to their balance between performance and affordability. Lightweight and compact CCR systems are being increasingly adopted by adventure divers and underwater photographers, while heavy-duty models continue to serve professional, military, and rescue applications.

Application Insights

The scuba rebreather market serves multiple end-use sectors, including recreational diving, professional diving, military operations, and scientific research. Recreational diving remains the largest segment, supported by growing adventure tourism and diving certifications. Military and rescue applications account for a significant share due to increasing demand for covert operations and underwater endurance. The research segment is also expanding, driven by marine biology and environmental monitoring projects.

| By Product Type | By Application | By Component | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds a substantial share of the global rebreather market, driven by advanced diving infrastructure, strong defense demand, and growing interest in marine conservation. The U.S. Navy’s investment in next-generation underwater systems is a key market driver. Recreational diving in Florida, Hawaii, and California further supports demand for high-end rebreathers.

Europe

Europe remains the global leader in rebreather manufacturing and adoption, with a strong presence of established brands in the U.K., Germany, and France. The region’s robust diving culture, extensive coastal tourism, and focus on underwater archaeology contribute significantly to market growth. Strict safety standards and R&D investment in eco-friendly systems are setting benchmarks for global market regulation.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by the expansion of dive tourism in Thailand, Indonesia, Australia, and the Philippines. Increasing disposable income, coastal development, and a surge in recreational certifications are key growth enablers. Government initiatives supporting ocean conservation and maritime safety are further boosting regional demand for rebreathers.

Middle East & Africa

The Middle East and Africa are witnessing growing interest in technical diving and underwater exploration, particularly in Egypt, the UAE, and South Africa. Strong diving tourism in the Red Sea and Indian Ocean regions, coupled with new diving resorts and training centers, is supporting market penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Scuba Rebreather Market

- Apeks Diving

- Poseidon Diving Systems AB

- rEvo Rebreathers

- Interspiro AB

- Drägerwerk AG & Co. KGaA

- KISS Rebreathers

- Hollis Rebreathers

- Ambient Pressure Diving Ltd.

Recent Developments

- In May 2025, Poseidon Diving Systems launched its upgraded SE7EN+ rebreather, integrating AI-assisted gas monitoring and improved oxygen management for extended dive safety.

- In March 2025, Drägerwerk AG introduced a military-grade rebreather with adaptive oxygen control for special forces and deep-sea applications.

- In January 2025, rEvo Rebreathers announced a collaboration with a European marine research institute to develop lightweight rebreathers for coral reef monitoring and oceanographic exploration.