Scent Machines Market Size

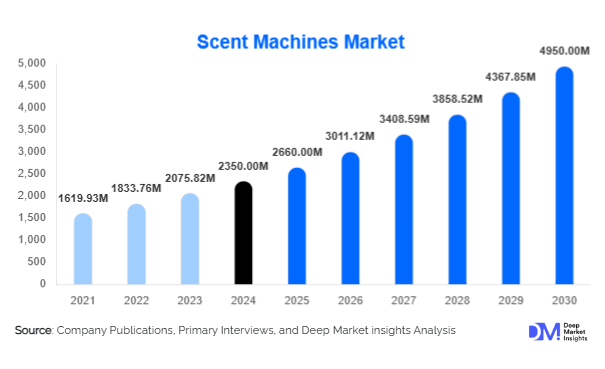

According to Deep Market Insights, the global scent machines market size was valued at USD 2,350 million in 2024 and is projected to grow from USD 2,660 million in 2025 to reach USD 4,950 million by 2030, expanding at a CAGR of 13.2% during the forecast period (2025-2030). The market growth is driven by the rising adoption of ambient scenting in hospitality, retail, and healthcare sectors, coupled with growing consumer demand for personalized home wellness experiences and the integration of scenting systems into smart building technologies.

Key Market Insights

- HVAC scent diffusers dominate commercial adoption, driven by increasing installation in hotels, shopping malls, and corporate buildings for large-area coverage.

- Cold-air diffusion technology accounts for the largest share due to its ability to preserve oil integrity and deliver consistent fragrance without residue.

- Online retail channels are expanding rapidly, supported by e-commerce platforms and direct-to-consumer brand strategies.

- Asia-Pacific and North America together account for over 60% of the global market, with APAC emerging as the fastest-growing region.

- Wellness and experiential branding trends are driving new applications in healthcare, fitness centers, spas, and residential smart homes.

- Technological integration, including IoT-enabled scent machines and programmable smart diffusers, is reshaping customer preferences.

What are the latest trends in the scent machines market?

Smart Scent Machines with IoT Integration

The adoption of connected scent machines is rising globally. IoT-enabled diffusers allow remote control, programmable schedules, and integration with smart home ecosystems. Businesses are leveraging data-driven scenting strategies, adjusting fragrance intensity based on footfall or time of day. This trend is especially strong in retail and hospitality, where scent marketing is combined with AI-driven consumer analytics to improve customer engagement and dwell time.

Shift Toward Wellness-Driven Applications

Scent machines are increasingly marketed as wellness tools beyond fragrance. Aromatherapy-based diffusers using natural essential oils are in high demand among consumers seeking stress relief, better sleep, and mood enhancement. Healthcare providers and corporate offices are adopting scent solutions to improve indoor air quality and employee well-being, reflecting the merging of wellness with ambient scenting technologies.

What are the key drivers in the scent machines market?

Experiential Branding Across Industries

Brands across retail, hospitality, and automotive sectors are leveraging scent machines to create memorable customer experiences. Luxury retailers and hotels use signature scents to enhance brand recall, a trend that has been shown to increase consumer loyalty. With experiential branding becoming a competitive differentiator, demand for professional scent machines continues to rise.

Growing Residential Adoption

The rising popularity of aromatherapy and home ambience management is fueling residential demand. Affordable portable diffusers and designer-branded scent machines are increasingly adopted by households, supported by strong e-commerce penetration. This shift is making the scent machine market less dependent on commercial applications.

Expansion of Public Infrastructure Projects

Governments and urban developers are integrating scenting systems into airports, metro stations, museums, and public spaces to enhance user experience. The rise in CapEx on smart city and infrastructure projects is driving demand for HVAC-integrated scent systems.

What are the restraints for the global market?

High Installation and Maintenance Costs

Advanced scenting systems, especially HVAC-integrated ones, require high upfront investments and ongoing maintenance. This limits adoption among small businesses and cost-sensitive institutions, restraining market growth in emerging economies.

Regulatory and Safety Concerns

Compliance with indoor air quality standards and restrictions on synthetic fragrances in some regions poses challenges. Mismanagement of scent intensity can also lead to consumer discomfort or allergic reactions, requiring companies to ensure regulatory adherence and safe usage protocols.

What are the key opportunities in the scent machines industry?

Expansion in Emerging Markets

Rising disposable incomes and urbanization in Asia-Pacific, Latin America, and the Middle East are creating strong demand for both residential and commercial scent machines. Retail expansion, rapid growth in the hospitality sector, and infrastructural development make these regions attractive for international players.

Integration with Smart Homes and Offices

The proliferation of smart buildings presents opportunities for integrating scent machines with centralized control systems. Partnerships with smart home device manufacturers and office automation providers can expand adoption in premium residential complexes and corporate campuses.

Sustainable and Natural Fragrance Solutions

Eco-conscious consumers are demanding natural essential oils and biodegradable cartridges. Manufacturers focusing on sustainable diffusion technologies and offering green-certified fragrance solutions can gain significant traction in premium markets.

Product Type Insights

HVAC scent diffusers lead the market, accounting for nearly 42% of global revenues in 2024. Their ability to cover large areas makes them the preferred choice for malls, hotels, airports, and offices. Portable standalone diffusers dominate the residential segment, contributing 28% of global revenues, driven by affordability and ease of use. Car scent machines, though niche, are witnessing steady adoption, particularly through OEM partnerships in luxury vehicles.

Technology Insights

Cold-air diffusion technology dominates with a 48% market share in 2024, as it maintains fragrance quality without heat damage. Ultrasonic diffusers are gaining popularity in the residential market due to their affordability and dual use as humidifiers. Nebulizing diffusion holds a strong position in high-end commercial applications, while heat-based technologies are losing share due to inefficiency and oil degradation.

Distribution Channel Insights

Online retail accounts for 36% of sales in 2024, driven by the popularity of e-commerce platforms and D2C models. B2B direct sales remain critical, representing 44% of revenues, as large institutions, hospitality chains, and infrastructure projects rely on direct supplier relationships. Offline retail is still relevant for consumer awareness, but contributes a declining share as digital-first strategies expand.

End-Use Insights

Hospitality is the largest end-use segment, contributing 30% of global revenues in 2024. Hotels and resorts increasingly deploy scent branding to differentiate guest experiences. Retail follows closely at 22%, with malls and premium stores using signature scents. Residential adoption is growing fastest at a CAGR of over 15%, supported by aromatherapy trends. Healthcare facilities and corporate offices are also expanding usage, especially in wellness-driven applications.

| By Product Type | By Technology | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global market in 2024, led by the U.S. with strong adoption in retail and hospitality. Wellness-driven consumer behavior, advanced smart home penetration, and high disposable incomes support regional growth.

Europe

Europe contributed 24% of global revenues, with Germany, the UK, and France leading adoption. The region emphasizes premium retail, luxury hotels, and regulatory-driven demand for natural, safe fragrance solutions. Sustainability is a major growth factor here.

Asia-Pacific

APAC is the fastest-growing region, forecasted to expand at a CAGR of over 15%. China dominates demand, followed by Japan and India, supported by urbanization, retail expansion, and rising household adoption of wellness devices. The region’s growing luxury sector further accelerates adoption.

Middle East & Africa

MEA shows strong growth potential, with the UAE and Saudi Arabia leading demand in luxury hotels, malls, and public infrastructure projects. Africa is gradually expanding, especially in South Africa’s retail and hospitality industries.

Latin America

Latin America is emerging, led by Brazil and Mexico, where rising consumer spending and tourism growth are driving the adoption of scent machines in the hospitality and retail sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Scent Machines Market

- AromaTech

- ScentAir Technologies

- Aroma360

- Air Aroma

- Prolitec Inc.

- OSUMI

- Rezaroma

- Scentevents

- Jo Malone London (Estee Lauder Companies)

- Hotel Collection

- NEOM Organics

- Muji

- Diffuser World

- Zen Air

- Heyland & Whittle

Recent Developments

- In May 2025, AromaTech launched an IoT-enabled scent diffuser line designed for integration with Amazon Alexa and Google Home.

- In March 2025, ScentAir Technologies expanded its European operations with a new distribution hub in Germany, targeting retail and hospitality customers.

- In January 2025, Aroma360 introduced a biodegradable cartridge system aimed at reducing plastic waste in the fragrance diffusion industry.