Scenic Door Market Size

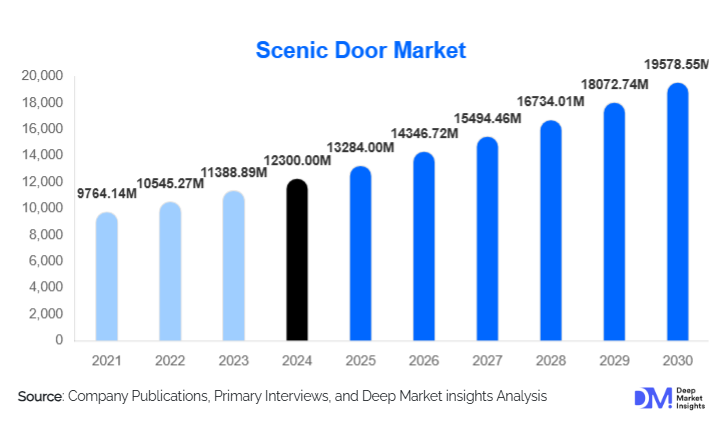

According to Deep Market Insights, the global scenic door market size was valued at USD 12,300 million in 2024 and is projected to grow from USD 13,284.00 million in 2025 to reach USD 19,518.55 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The scenic door market growth is primarily driven by increasing demand for aesthetic and panoramic architectural solutions in residential and commercial buildings, rising adoption of smart and energy-efficient doors, and rapid urbanization in emerging economies.

Key Market Insights

- Luxury residential and commercial projects are driving demand for scenic doors, particularly sliding, frameless, and pivot designs that enhance natural lighting and outdoor views.

- Technological integration, including automated opening systems, thermal insulation, and soundproofing, is shaping consumer preferences and expanding premium product adoption.

- North America and Europe dominate market share, driven by replacement projects in mature residential and commercial infrastructure, and high awareness of premium architectural trends.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising middle-class income, and the expansion of luxury apartments and hotels in China, India, and Japan.

- Government infrastructure initiatives, such as urban regeneration projects and public commercial construction, are providing opportunities for large-scale scenic door adoption.

- Emerging materials and sustainable practices, such as eco-friendly wood and recyclable aluminum, are gaining popularity in premium residential and commercial applications.

What are the latest trends in the scenic door market?

Rise of Frameless and Minimalist Designs

Modern architecture favors frameless scenic doors that provide unobstructed views and a seamless indoor-outdoor connection. These designs are increasingly adopted in luxury villas, apartments, and commercial spaces to meet aesthetic and functional demands. Minimalist doors with hidden frames, floor-to-ceiling glass panels, and sliding mechanisms are gaining traction as homeowners and developers prioritize natural lighting and spatial efficiency.

Smart and Energy-Efficient Scenic Doors

Technological adoption is a major trend, with smart doors featuring automated opening systems, integrated locks, sensors, and thermal insulation. Energy-efficient doors with double or triple-glass panels help reduce heating and cooling costs, appealing to environmentally conscious consumers. Demand is also increasing for soundproof doors in urban apartments and hotels. Manufacturers are investing in automation, IoT-enabled monitoring, and premium glass technology to differentiate products.

What are the key drivers in the scenic door market?

Growing Luxury Residential and Commercial Construction

Urbanization and rising disposable incomes are fueling high-end residential and commercial construction. Scenic doors, especially sliding and pivot types, are widely adopted to enhance natural light, aesthetics, and ventilation. Hotels, resorts, and office buildings are also integrating panoramic doors to create premium environments that attract high-value tenants and guests.

Increasing Demand for Sustainable and Eco-Friendly Solutions

Consumers increasingly prefer doors made from sustainable wood, recyclable aluminum, and low-carbon glass, aligning with global sustainability goals. Energy-efficient scenic doors reduce thermal loss, supporting green building certifications and promoting eco-conscious design. Government initiatives and building regulations are further encouraging the adoption of environmentally friendly door solutions in residential and commercial projects.

What are the restraints for the global market?

High Cost of Premium Materials and Installation

High-quality glass, aluminum, and treated wood increase production costs, which are passed to end users. Complex installations, particularly for frameless or automated doors, require specialized labor, limiting adoption in cost-sensitive markets. The high upfront investment may deter small-scale residential and commercial buyers.

Maintenance and Durability Challenges

Advanced scenic doors, including automated and pivot systems, require regular maintenance and careful handling. Damage or misalignment can lead to functional and safety issues, posing a challenge for long-term performance and user confidence. Ensuring durability and reducing service requirements is critical for broader market penetration.

What are the key opportunities in the scenic door market?

Emerging Market Expansion

Asia-Pacific and the Middle East present significant growth opportunities due to rising urbanization, luxury housing, and commercial projects. Localized manufacturing, customized product offerings, and strong distribution networks can help manufacturers capitalize on regional demand while reducing import dependency.

Integration of Smart and Automated Systems

Smart doors with automated sliding, pivot, or locking systems offer convenience and energy savings. Integration with home automation, IoT, and AI-enabled control systems is creating new revenue streams. Premium consumers increasingly demand these features in residential and commercial developments, opening avenues for differentiated products.

Government Infrastructure and Public Spending

Government-funded infrastructure projects such as airports, hospitals, hotels, and commercial complexes create high-volume demand for scenic doors. Initiatives like India’s “Make in India” and China’s construction modernization programs encourage local production and investment, enabling both domestic and international players to secure large contracts.

Product Type Insights

Sliding doors dominate the market, accounting for 35% of the 2024 global market, driven by space efficiency and aesthetic appeal. Glass scenic doors (30% of market share) are preferred for panoramic views, while frameless/minimalist designs (22%) are rapidly growing in luxury residential and commercial applications. Wooden doors remain premium-focused, whereas aluminum and UPVC doors are gaining traction in mid-range and commercial sectors due to durability and low maintenance.

Application Insights

Residential applications account for 40% of the market, led by luxury villas and high-rise apartments. Commercial applications, including hotels, resorts, and office buildings, are growing fastest, driven by aesthetic demands and urban infrastructure expansion. Emerging applications include smart homes, energy-efficient buildings, and integrated automation in commercial complexes.

| By Product Type | By Material | By Design / Finish | By Application |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 25% of the global market, with the USA and Canada leading adoption. High disposable income, replacement demand, and premium design trends drive market growth. Residential replacement projects and luxury apartments are key segments.

Europe

Europe accounts for 28% of the market, with Germany, France, and the UK leading premium scenic door adoption. Sustainable construction and aesthetic trends are major factors. Growth is steady, supported by regulations encouraging energy-efficient and eco-friendly doors.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, and Japan as key contributors. Rapid urbanization, rising middle-class income, and expansion of luxury apartments and commercial projects drive demand. CAGR in this region exceeds 10%.

Middle East & Africa

MEA represents 8% of the global market, primarily driven by luxury villas, hotels, and resorts in the UAE, Saudi Arabia, and South Africa. High-income populations and luxury real estate developments are key growth factors.

Latin America

LATAM accounts for 6% of the market. Brazil, Argentina, and Mexico show growing demand for high-end residential and commercial scenic doors, with niche operators promoting premium and customized designs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Scenic Door Market

- ASSA ABLOY

- Allegion PLC

- Masonite International

- Pella Corporation

- JELD-WEN Holding

- Hörmann Group

- LIXIL Corporation

- Nabco Entrances

- Topps Tiles (door division)

- Graham Architectural Products

- Stanley Black & Decker (doors division)

- Dynaco

- Roto Frank AG

- Kawneer (Alcoa Group)

- Dongwha Enterprise

Recent Developments

- In March 2025, ASSA ABLOY launched a new series of automated panoramic doors with energy-efficient double-glass panels for luxury apartments in North America.

- In January 2025, Masonite International expanded its European operations with a new manufacturing facility in Germany to meet rising demand for frameless scenic doors.

- In February 2025, Pella Corporation introduced smart sliding doors with integrated IoT systems for commercial buildings, enhancing security and energy efficiency.