Saturated Kraft Paper Market Size

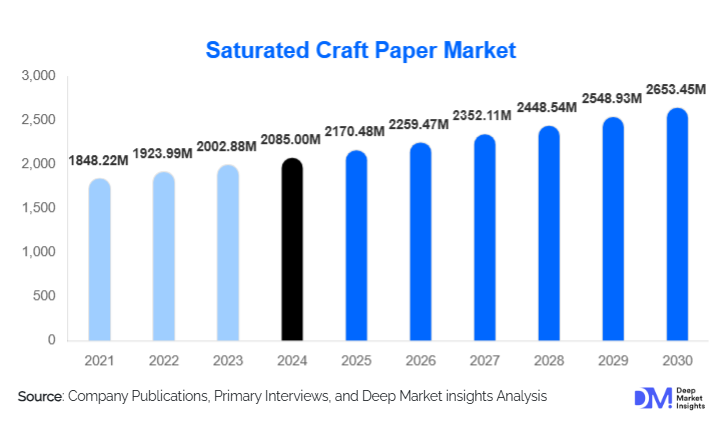

According to Deep Market Insights, the global saturated craft paper market size was valued at USD 2,085 million in 2024 and is projected to grow from USD 2,170.48 million in 2025 to reach USD 2,653.45 million by 2030, expanding at a CAGR of 4.1% during the forecast period (2025–2030). The saturated kraft paper market growth is primarily driven by rising demand for high-performance laminate substrates, expansion of the furniture and interior décor industry, and increasing adoption of recyclable, sustainable kraft-based materials across industrial and residential applications.

Key Market Insights

- Unbleached saturated kraft paper dominates global demand, supported by strong resin-absorption properties, cost efficiency, and its eco-friendly profile.

- Asia-Pacific accounts for the largest market share (≈43%), driven by booming modular furniture, laminate flooring, and engineered wood production.

- Industrial end-use applications lead the market, accounting for more than two-thirds of total consumption due to large-scale furniture and panel manufacturing.

- 50–100 GSM grades are the most widely used, benefiting from their balance of strength, flexibility, and suitability for laminate substrates.

- Digital printing compatibility and lightweight resin-impregnated grades are emerging technological trends enhancing product versatility.

- Countertops and laminate panels remain the largest application segment, with significant demand for high-pressure decorative laminates (HPL).

Latest Market Trends

Shift Toward Sustainable, Recyclable, and Unbleached Grades

Manufacturers are increasingly prioritizing eco-friendly saturated kraft paper grades, especially unbleached variants, which reduce chemical use and carbon footprint while maintaining high mechanical strength. Strong regulatory pressure on plastic and synthetic laminates is pushing industries to adopt kraft-based laminates for panels, countertops, and furniture components. Companies are also focusing on FSC/PEFC certifications and recycled-fiber integration to align with sustainability commitments from both consumers and large furniture brands.

Technological Advancements in Lightweight and High-Performance Grades

Product innovation is shifting toward lightweight kraft substrates (including 50–100 GSM) that maintain high resin impregnation capability. New technologies improve surface uniformity, digital-print compatibility, and moisture resistance, making saturated kraft paper more suitable for decorative laminates and flexible packaging applications. Improved resin-impregnation systems and faster curing technologies are enabling higher throughput for laminate producers.

Saturated Kraft Paper Market Drivers

Expansion of Furniture, Interior Décor, and Laminate Flooring Industries

Global growth in real estate, modular furniture, and renovation activities is fueling strong demand for high-pressure laminates (HPL), engineered panels, and decorative surfaces. Saturated kraft paper, used as a core substrate in these laminates, directly benefits from this expansion. Emerging markets such as India, China, and Southeast Asia are witnessing rapid construction and urbanization, further accelerating kraft paper consumption for panels, flooring, and countertops.

Increasing Demand for Sustainable, Paper-Based Materials

With rising environmental awareness and government restrictions on non-recyclable materials, saturated kraft paper is increasingly used as a substitute for plastics and synthetic composites. The material’s biodegradability, lower toxicity, and efficient recyclability make it attractive for packaging, decorative surfaces, and industrial manufacturing. Furniture producers are also demanding sustainable components that comply with green building standards and eco-label certifications.

Market Restraints

Raw Material Price Volatility

The saturated kraft paper market is highly sensitive to fluctuations in wood pulp, fiber, and resin prices. Rising energy and transportation costs also add pressure on producers, limiting profit margins. Volatility in the global pulp market can lead to inconsistent input costs, complicating long-term pricing strategies for manufacturers.

Competition from Alternative Materials

Synthetic laminates such as PVC, PET, and polymer-backed sheets continue to compete with saturated kraft paper, especially in applications requiring enhanced abrasion resistance, water resistance, and cost competitiveness. In scenarios where high-performance specifications are needed, synthetic options may outperform kraft-based substrates, limiting adoption in certain industrial applications.

Saturated Kraft Paper Market Opportunities

Growth of Lightweight & Specialty Packaging Applications

The expansion of e-commerce and demand for sustainable shipping materials is creating new opportunities for low-GSM saturated kraft paper in flexible packaging, protective layers, and label backing. Manufacturers focusing on optimized resin-impregnational techniques can develop high-strength, lightweight specialty grades that capture emerging niche markets.

Rising Regional Production in Asia-Pacific and India

Growing industrialization and furniture manufacturing in China, India, and Southeast Asia are creating strong market entry opportunities. Local production facilities, backward-integrated pulp sourcing, and partnerships with laminate producers can significantly reduce supply chain costs while expanding market reach. Government initiatives promoting domestic manufacturing (such as India’s Make-in-India program) further support capital investment in the sector.

Product Type Insights

Unbleached saturated kraft paper leads the market with over 60% global share due to superior resin absorption, cost-effectiveness, and sustainability. Bleached grades, while smaller in share, support premium decorative laminates where color consistency is required. Lightweight grades (50–100 GSM) are witnessing the fastest growth, particularly for flexible laminates, premium packaging, and digitally printable surfaces. Heavier grades (>200 GSM) remain essential for high-pressure laminates used in countertops, tabletops, and heavy-duty panels.

Application Insights

Countertops represent the largest application segment, accounting for nearly 30% of global market share, driven by the rising installation of HPL-based kitchen and commercial work surfaces. Panels and laminate flooring also hold significant shares due to growing construction and modular furniture trends. Shelving, partitions, and decorative wall panels are expanding steadily across both residential and commercial sectors. Emerging applications include flexible packaging layers, industrial insulation backers, and digitally printed décor sheets.

Distribution Channel Insights

Direct sales dominate the market as saturated kraft paper is primarily purchased by laminate manufacturers, panel producers, and industrial converters. However, paper merchants and distributors play a growing role in mid-sized markets where local manufacturers require smaller batch quantities. Digital procurement platforms are emerging, with transparent pricing and real-time inventory visibility helping streamline B2B transactions. Many large producers are enhancing online catalogs and corporate ordering portals to improve customer engagement.

End-Use Industry Insights

The industrial sector is the largest end-use category, representing more than two-thirds of global saturated kraft paper consumption. It includes furniture manufacturing, panel production, flooring, and commercial interiors. The residential sector is expanding due to increased home renovation cycles and the adoption of modular kitchens, wardrobes, and décor surfaces. Export-driven furniture industries in Asia are also boosting the consumption of kraft substrate materials.

Age Group Insights (for B2C-linked Applications)

For applications indirectly linked to consumer demand (e.g., residential décor, DIY laminates), the 31–50 age group drives the majority of purchases due to higher spending power and strong home-improvement tendencies. Younger customers (18–30) influence demand through preference for eco-friendly materials, especially in DIY and budget furniture. Older demographics (51+) indirectly support demand via premium home remodeling and long-lasting decorative surfaces.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately one-quarter of global market demand, supported by mature furniture manufacturing, construction industries, and high adoption of laminate flooring. Strong sustainability initiatives and rising renovation activity in the U.S. and Canada continue to boost consumption of unbleached kraft laminates.

Europe

Europe is one of the fastest-growing regional markets due to stringent environmental regulations, high demand for eco-friendly materials, and the rising popularity of engineered wood products. Countries such as Germany, the U.K., and France lead demand for certified saturated kraft paper used in premium interiors, countertops, and commercial décor.

Asia-Pacific

Asia-Pacific is the largest and fastest-expanding region, holding roughly 43% of the global market. China and India dominate demand through large-scale furniture manufacturing, construction growth, and rising disposable income. Southeast Asia is increasingly becoming a manufacturing hub for laminate panels, creating long-term growth potential.

Latin America

Latin America, led by Brazil and Mexico, is experiencing steady growth as modular furniture and decorative surfaces gain popularity. Rising commercial infrastructure development and expansion of local furniture brands support kraft paper demand.

Middle East & Africa

MEA is an emerging market with growing adoption of decorative laminates in hospitality, commercial real estate, and retail. Gulf countries are investing heavily in construction and luxury interiors, indirectly boosting demand for kraft-based laminates and panels.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Saturated Kraft Paper Market

- WestRock Company

- International Paper Company

- Stora Enso Oyj

- Mondi Group Plc

- Sappi Limited

- Ahlstrom-Munksjö Oyj

- Nordic Paper AS

Recent Developments

- In 2024, WestRock expanded its kraft paper production capabilities in North America, emphasising sustainable and lightweight grades for laminate and packaging applications.

- In 2024, Mondi Group introduced new eco-certified saturated kraft paper products tailored for furniture panels and high-pressure laminates.

- In 2024, Ahlstrom-Munksjö announced investments in advanced resin-impregnation technology to support high-quality decorative laminate applications and digital-print-compatible kraft grades.