Sapphire Jewellery Market Size

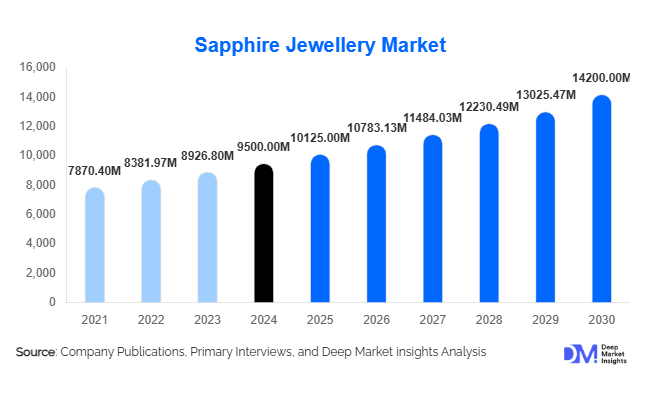

According to Deep Market Insights, the global sapphire jewellery market size was valued at USD 9,500 million in 2024 and is projected to grow from USD 10,125 million in 2025 to reach USD 14,200 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The sapphire jewellery market growth is primarily driven by rising demand for colored gemstone jewellery, increasing disposable incomes in emerging markets, and growing consumer preference for luxury, investment-grade, and ethically sourced sapphire designs.

Key Market Insights

- Luxury and investment-oriented sapphire jewellery continue to dominate global demand, with premium rings and bespoke collections capturing high-value consumer segments.

- Online and omnichannel retailing is reshaping market access, enabling global consumers to explore curated sapphire designs and personalised services.

- Asia-Pacific is emerging as the fastest-growing region, led by China and India, where rising middle-class wealth and cultural affinity for gemstones are boosting sapphire jewellery sales.

- North America maintains a significant market share, driven by the U.S. and Canada, where luxury and engagement sapphire jewellery are increasingly popular.

- Technological innovations, such as virtual try-on, CAD design, and online customisation, are enhancing customer experience and supporting market expansion.

- Sustainability and ethical sourcing trends, including traceable sapphires and environmentally conscious practices, are creating premium branding opportunities.

Latest Market Trends

Rising Popularity of Colored Gemstones

Consumers worldwide are increasingly preferring colored gemstones over traditional diamonds, with sapphires being highly favored due to their range of colors, durability, and symbolic value. Engagement rings, luxury pendants, and bespoke designs featuring sapphires are witnessing significant uptake. Market players are focusing on customization, offering unique cuts, mixed gemstone designs, and ethically sourced sapphires to cater to this trend. This shift is particularly pronounced among millennials and Gen Z, who prioritize individuality and exclusivity in jewellery purchases.

Digital and Omnichannel Retail Growth

E-commerce platforms, online marketplaces, and brand-owned websites have accelerated sapphire jewellery sales globally. Virtual try-on technologies, AR customization, and AI-powered recommendations allow consumers to make confident purchasing decisions remotely. The integration of online platforms with offline retail channels has created seamless omnichannel experiences, particularly appealing to younger, tech-savvy buyers. Subscription-based luxury jewellery services and membership programs are emerging as niche channels, offering repeat customers early access to premium sapphire collections.

Sapphire Jewellery Market Drivers

Rising Affluence and Luxury Consumption

The growth of high-net-worth individuals in regions like North America, Europe, and Asia-Pacific is driving demand for high-value sapphire jewellery. Luxury collections, engagement rings, and bespoke pieces are increasingly preferred as status symbols and investment assets. Consumers are willing to pay a premium for exclusive designs, ethically sourced gemstones, and brand recognition. Emerging wealth hubs, particularly in China, India, and the Middle East, are fueling strong demand for mid-to-high-end sapphire jewellery.

Expansion of Online and Omnichannel Retail

The proliferation of digital channels has significantly expanded market accessibility. Sapphire jewellery retailers are leveraging e-commerce, social media, and AR-based virtual try-on technologies to attract global consumers. This trend enables new entrants to reach niche markets without heavy reliance on physical storefronts and supports established brands in capturing millennial and Gen Z demographics who prefer online discovery and purchase.

Increased Preference for Ethical and Sustainable Sourcing

Consumer awareness regarding sustainability and conflict-free sourcing is driving the premiumization of sapphire jewellery. Certifications for ethically sourced gemstones, transparent supply chains, and environmentally friendly practices are increasingly influencing purchase decisions. Brands that prioritize traceable sapphires and responsible mining practices are gaining a competitive advantage, attracting socially conscious buyers willing to pay higher prices for verified products.

Market Restraints

Volatility in Raw Material Prices

Sapphire prices are highly sensitive to mining output, geopolitical factors, and global gemstone demand. Price fluctuations can negatively impact profit margins, particularly for small and mid-market manufacturers. Scarcity of high-quality sapphires may restrict production capacity and slow market growth.

High Cost and Limited Accessibility

Premium sapphire jewellery often remains prohibitively expensive for mass-market consumers. This limits adoption in lower-income regions and among younger buyers. In addition, high entry costs for mining and manufacturing operations restrict new entrants and slow overall market penetration.

Market Opportunities

Expansion in Emerging Markets

Rapid economic growth in India, China, and Brazil presents strong opportunities for market expansion. Rising urbanization, increasing exposure to luxury lifestyles, and wedding season demand in these countries drive sapphire jewellery consumption. Companies offering region-specific designs while maintaining international quality standards are well-positioned to capitalize on these growing markets.

Digital and Technological Integration

The adoption of virtual try-on, AI-driven personalization, and e-commerce solutions presents opportunities to capture tech-savvy consumers. Brands can leverage digital tools to enhance customer engagement, offer bespoke designs, and drive online sales growth. Integration of AR/VR technology for immersive shopping experiences is likely to become a key differentiator in the market.

Ethical and Sustainable Jewellery

Rising consumer preference for traceable, environmentally responsible sapphires provides differentiation for brands. Certifications and sustainable sourcing practices increase brand credibility and allow premium pricing. Companies investing in conflict-free supply chains and eco-friendly manufacturing are expected to gain a competitive edge, particularly among luxury-conscious and socially responsible buyers.

Product Type Insights

Rings dominate the sapphire jewellery market, accounting for approximately 30% of global consumption in 2024. Engagement and wedding rings, often featuring high-quality sapphire stones, drive the demand. Necklaces and pendants follow closely, particularly multi-stone and solitaire designs. Bracelets and earrings are gaining popularity among fashion-conscious buyers, while brooches, tiaras, and cufflinks constitute niche segments. The trend toward customizable and mixed gemstone designs is increasingly influencing consumer choice.

Application Insights

Luxury and investment jewellery remain the most prominent applications. Luxury jewellery captures over 55% of global demand, catering to high-net-worth individuals seeking exclusivity and bespoke designs. Fashion-oriented sapphire jewellery is gaining popularity among younger consumers, while investment-grade sapphires are increasingly viewed as alternative assets. Bridal and engagement jewellery, gifting, and high-end fashion accessories represent key end-use applications, with exports to Europe and North America strengthening global market penetration.

Distribution Channel Insights

Offline retail, including branded stores, boutiques, and high-end jewellery outlets, accounts for nearly 60% of the 2024 market share. Physical stores remain preferred for authenticity and personalized services. Online platforms, including e-commerce websites and marketplaces, are rapidly growing due to virtual try-on technologies and global accessibility. Auctions, exhibitions, and wholesale channels contribute to niche sales and luxury collector segments. Omnichannel integration is becoming a standard practice for top market players, enhancing reach and customer experience.

Traveler Type Insights

Luxury buyers dominate the market, followed by aspirational mid-market consumers. Millennials and Gen Z are increasingly driving demand for online and fashion-oriented sapphire jewellery. Couples purchasing engagement or wedding rings form a high-value segment, while family gifting, personal collections, and investment purchases contribute to consistent market demand. The mid-market segment is growing due to rising disposable incomes in Asia-Pacific and Latin America, offering accessible entry points to premium jewellery.

| By Product Type | By End-Use | By Distribution Channel | By Price Range |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 20% of the global sapphire jewellery market. The U.S. leads demand with premium engagement rings and luxury collections, while Canada contributes moderately through high-value fashion and investment pieces. Strong consumer affinity for branded and bespoke jewellery, along with high disposable incomes, sustains market growth.

Europe

Europe accounts for around 25% of the market, led by the UK, Germany, and France. Buyers in this region emphasise heritage brands, ethical sourcing, and bespoke designs. Mid-range and luxury segments dominate, with growing awareness of colored gemstone trends. Europe remains a mature, high-value market with steady growth potential in ethical and customizable sapphire jewellery.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing 35% of global demand. India (10% of the global market) and China (15%) are major drivers due to wedding and luxury jewellery demand. Rising middle-class wealth, cultural significance of sapphires, and increased exposure to international fashion trends support sustained growth. Japan and South Korea contribute to premium and fashion segments, while Australia sees consistent demand for luxury and investment-grade pieces.

Middle East & Africa

Middle East & Africa holds 10% of the market, with the UAE and Saudi Arabia leading high-value luxury purchases. Africa is also a key production region, supporting local and export-driven sapphire jewellery demand. Intra-regional purchases are rising among affluent consumers in South Africa and Nigeria.

Latin America

Latin America contributes around 10% of global consumption, led by Brazil, Argentina, and Mexico. Demand is primarily driven by luxury and bridal jewellery purchases among emerging affluent classes. Export and niche high-value segments are slowly growing, supported by customised international collections.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sapphire Jewellery Market

- Tiffany & Co.

- Cartier

- Bvlgari

- Chopard

- Harry Winston

- Graff

- Van Cleef & Arpels

- Mikimoto

- Piaget

- De Beers Group

- David Yurman

- Fabergé

- Buccellati

- Damiani

- Garrard

Recent Developments

- In June 2025, Tiffany & Co. launched a new collection of ethically sourced sapphire engagement rings, emphasizing traceable gemstone origins and sustainable manufacturing practices.

- In March 2025, Cartier introduced a line of fashion sapphire necklaces and bracelets targeting millennial consumers via online and boutique channels in the Asia-Pacific.

- In January 2025, Bvlgari expanded its bespoke sapphire jewellery service, offering AR-based virtual try-on experiences and customized design consultations globally.