Sandwich Maker Market Size

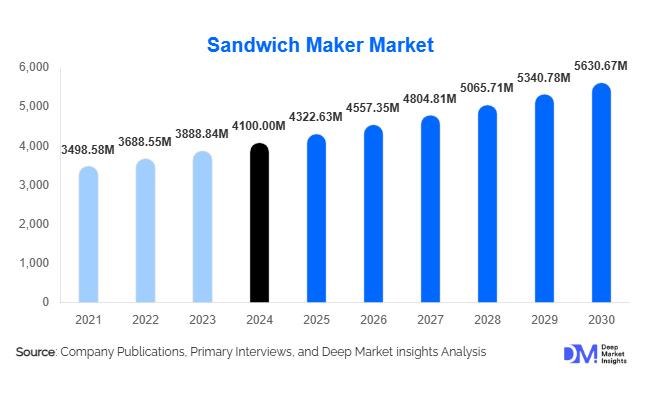

According to Deep Market Insights, the global sandwich maker market size was valued at USD 4,100 million in 2024 and is projected to grow from USD 4,322.63 million in 2025 to reach USD 5,630.79 million by 2030, expanding at a CAGR of 5.43% during the forecast period (2025–2030). Growth in the sandwich maker industry is driven by the rising demand for quick-preparation appliances, increasing household penetration of compact kitchen devices, and strong expansion of e-commerce channels across emerging and developed markets.

Key Market Insights

- Four-triangle sandwich makers dominate global sales, driven by affordability, compact size, and widespread household use.

- Non-stick coated appliances hold the largest market share, supported by strong consumer preference for easy-clean and low-maintenance designs.

- Asia-Pacific is the fastest-growing region due to rising disposable income, urbanization, and growing Western-style breakfast adoption.

- North America remains the largest regional market, with high appliance penetration and strong replacement demand.

- Smart and multi-function sandwich makers are gaining traction as manufacturers integrate IoT, interchangeable plates, and advanced temperature controls.

- E-commerce is the fastest-growing distribution channel, fueled by pricing transparency, wide selection, and direct-to-consumer (D2C) brands.

What are the latest trends in the sandwich maker market?

Multi-Function & Smart-Enabled Appliances Rising

The sandwich maker industry is shifting rapidly toward multi-function designs that combine sandwich toasting, grilling, and waffle-making through interchangeable plates. These hybrid appliances appeal to consumers seeking more value from compact devices. Smart connectivity is emerging in the premium category with features like app-based timers, automatic temperature control, and voice-assisted cooking. As modern households seek convenience and versatility, this trend is accelerating product premiumization and enabling manufacturers to command higher margins.

Shift Toward Easy-Clean, Durable Coating Technologies

Innovation in plate-coating materials, especially ceramic and advanced non-stick coatings, is redefining consumer expectations. Ceramic-coated plates offer improved heat distribution, longevity, and reduced chemical concerns, making them popular among health-conscious buyers. Non-stick dominated 2024, but ceramic variants are growing faster as brands upgrade materials to reduce after-sales service issues. Additionally, detachable and dishwasher-safe plates are becoming mainstream, influencing purchase decisions in urban markets with smaller kitchens and time-strapped consumers.

What are the key drivers in the sandwich maker market?

Growing Demand for Quick, Convenient Meal Solutions

Busy urban lifestyles and the need for rapid meal preparation are major catalysts for sandwich maker adoption. Dual-income households, students, and young professionals increasingly rely on ready-to-eat or quick-prep meals, making sandwich makers a preferred appliance for breakfasts, office snacks, and evening meals. Their low power consumption and compact design further boost adoption among small households and renters.

Strong Growth of E-Commerce & Omnichannel Retail

Online platforms have significantly expanded market reach by offering diverse product ranges, transparent pricing, and customer reviews that accelerate purchase decisions. E-commerce accounted for nearly 30% of sales in 2024, with rapid traction in Asia-Pacific and Latin America. Flash sales, influencer marketing, and D2C appliance startups are reshaping how consumers discover and purchase sandwich makers, contributing to higher unit sales and faster market penetration.

What are the restraints for the global market?

Competition from Substitute Kitchen Appliances

Ovens, toaster-ovens, microwaves, and multifunctional air-fryers present a strong substitution threat, especially in markets where kitchens are larger or consumers prefer multi-purpose devices. As multifunction appliances expand capabilities, dedicated sandwich makers face pressure in premium segments.

Rising Manufacturing Costs & Material Price Volatility

Fluctuating prices of metals, ceramic coatings, and non-stick materials pose cost challenges for manufacturers. Compliance with global safety standards such as CE, UL, and RoHS adds to production costs. These pressures can limit price competitiveness in value-driven markets and slow innovation in low- to mid-tier product lines.

What are the key opportunities in the sandwich maker industry?

Rapid Growth in Emerging Markets

Expanding middle-class populations in India, China, Indonesia, and Brazil offer significant growth potential. Urbanization, lifestyle shifts, and rising appliance affordability are driving household adoption. Brands can capitalize by launching region-specific, budget-friendly models and leveraging local manufacturing incentives.

Commercial Food-Service Expansion

The growth of cafés, convenience stores, and quick-service restaurants (QSRs) is creating demand for high-capacity sandwich makers and panini presses. Commercial models command higher pricing and stronger margins, making this segment a lucrative opportunity for manufacturers to diversify into B2B channels.

Product Type Insights

Four-triangle sandwich makers are the leading segment, holding around 35% of the market in 2024. Their affordability, compact design, and high household penetration make them the preferred choice in both developed and developing markets. Panini presses and multi-functional sandwich makers are growing rapidly as consumers seek upgraded cooking experiences, but triangle models continue to dominate due to their versatility and low maintenance.

Application Insights

Residential usage accounts for nearly 80% of total market revenue. Rising demand for quick snacks, easy breakfast preparation, and compact kitchen appliances drives this dominance. Commercial adoption is accelerating at a double-digit pace in cafés, bakeries, college canteens, and QSRs as food-service operators expand menu offerings and standardize grilled sandwich formats for faster service and consistency. Co-living spaces, student housing, and corporate cafeterias represent emerging application areas.

Distribution Channel Insights

Offline retail remains the largest channel, especially across supermarkets and appliance stores, where consumers prefer hands-on evaluation. However, online channels are the fastest-growing segment, driven by aggressive discounting, wider product visibility, and inventory variety. Direct-to-consumer (D2C) websites by appliance brands are reshaping the distribution landscape, offering membership deals, extended warranties, and exclusive product drops.

| By Product Type | By Plate Material / Coating | By End-Use Application | By Price Range | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 28–30% of global market value, led by the U.S. High disposable income, strong adoption of quick-prep household appliances, and a mature online retail ecosystem drive demand. Replacement cycles and premium appliance upgrades further support steady growth.

Europe

Europe exhibits strong adoption of energy-efficient and multi-functional sandwich makers. The U.K., Germany, France, and Italy are major consumers. Trends emphasize compact designs, sustainable materials, and premium features. Growth is moderate but resilient due to strong replacement demand.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, supported by rapid urbanization, expanding middle-class affordability, and increasing uptake of Western dietary habits. India and China together are registering double-digit growth, with a rising preference for mid-range and value-tier models. Japan and Australia represent stable, high-value markets with demand for premium smart devices.

Latin America

Brazil, Mexico, and Argentina are emerging markets with rising household appliance penetration. Economic recovery and increasing retail modernization are supporting growth. Budget-friendly and mid-range models dominate regional purchases.

Middle East & Africa

Demand is growing steadily in the UAE, Saudi Arabia, and South Africa, driven by expanding residential construction, rising expat populations, and increasing preference for Western-style convenience appliances. Premium models see stronger uptake in affluent Gulf economies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sandwich Maker Market

- Philips

- Breville Group

- Hamilton Beach Brands

- Black+Decker

- Morphy Richards

- Kenwood

- Panasonic Corporation

- Prestige Group

- Russell Hobbs

- Oster

- Sunbeam Products

- Bajaj Electricals

- De’Longhi Appliances

- Dualit Ltd

- Waring Commercial

Recent Developments

- In March 2025, Philips introduced a new multi-function smart sandwich maker featuring interchangeable plates and app-based cooking presets.

- In January 2025, Breville launched a commercial-grade panini press line aimed at cafés and QSRs across North America and Europe.

- In November 2024, Prestige Group expanded its India-based production facilities to increase export capacity for low-cost sandwich makers.