Salon Chairs Market Size

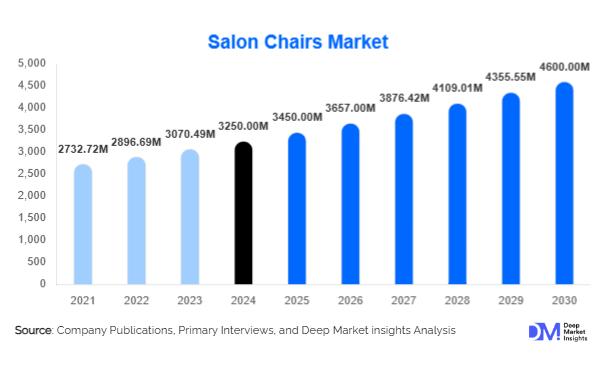

According to Deep Market Insights, the global salon chairs market size was valued at USD 3,250 million in 2024 and is projected to grow from USD 3,450 million in 2025 to reach USD 4,600 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The salon chairs market growth is primarily driven by the rapid expansion of beauty salons, rising consumer spending on grooming services, and technological advancements in ergonomic and multi-functional chair designs.

Key Market Insights

- Hydraulic salon chairs dominate the global market, accounting for around 35% of market share in 2024 due to their versatility and durability.

- PU leather material leads the material segment, contributing approximately 40% of sales thanks to its affordability, hygiene benefits, and easy maintenance.

- Beauty salons are the largest end-use segment, representing nearly 50% of overall demand globally, driven by growing salon density in urban areas.

- Offline sales channels hold about 70% of distribution, as salon owners prefer physical testing and trust specialty store purchases.

- Asia-Pacific is the fastest-growing region, expected to expand at a CAGR of nearly 8% during 2025–2030, led by India and China.

- The premiumization trend is reshaping demand, with salons investing in luxury and smart chairs to elevate customer experience.

Latest Market Trends

Technological Integration in Salon Chairs

Manufacturers are increasingly introducing smart and multi-functional salon chairs with features such as hydraulic lifts, electric recliners, massage systems, and ergonomic footrests. Integration of IoT for adjustable settings and energy-efficient hydraulic systems is gaining traction. These innovations not only improve customer comfort but also enhance service quality, allowing salons to differentiate themselves in a competitive market. Premium salons in North America, Europe, and the Middle East are adopting advanced chairs as part of their customer experience strategies.

Sustainability and Eco-Friendly Materials

Growing environmental awareness is shifting preferences toward chairs manufactured with sustainable materials, vegan leather alternatives, and recyclable components. Eco-friendly upholstery and low-emission foams are becoming preferred in developed markets where compliance with safety and sustainability standards is strict. Manufacturers aligning with green certifications are gaining a competitive edge, particularly in Europe and North America, where salons are rebranding themselves as eco-conscious businesses.

Salon Chairs Market Drivers

Rising Beauty and Grooming Service Demand

The rapid increase in barber shops, beauty salons, and spas worldwide is fueling the demand for salon chairs. Urbanization and lifestyle changes have made professional grooming an essential part of consumer habits. This expansion, particularly in Asia-Pacific and Latin America, continues to create steady demand for functional and durable salon furniture.

Increasing Disposable Income and Luxury Spending

Higher disposable incomes and aspirational lifestyles are pushing consumers toward luxury grooming experiences. As a result, salons are investing in premium chairs with adjustable, motorized, and comfortable designs. This trend is most pronounced in North America, Western Europe, and wealthy Middle Eastern countries such as the UAE and Saudi Arabia.

Advancements in Ergonomic Design

Customer comfort and stylist efficiency are central to modern salon operations. Chairs designed for long-duration comfort, adjustable heights, and ergonomic support are seeing strong adoption. These innovations also reduce fatigue for stylists, thereby improving salon productivity, making ergonomics a strong demand driver globally.

Market Restraints

High Cost of Premium Salon Chairs

While premium chairs offer advanced features, their high cost creates a barrier for small and medium-sized salons. Many emerging market players opt for mid-range or economy products, slowing the adoption of premium categories. This cost sensitivity can limit revenue growth in price-sensitive regions like Latin America and Southeast Asia.

Volatility in Raw Material Prices

Fluctuations in the cost of leather, PU materials, and metals used in manufacturing salon chairs can significantly impact production costs. Unstable raw material prices affect profitability and pricing strategies for manufacturers, especially those operating in export-driven markets.

Salon Chairs Market Opportunities

Emerging Market Expansion

Rapidly urbanizing economies in Asia-Pacific, the Middle East, and Latin America present opportunities for global and regional players. Growing numbers of beauty salons, fueled by rising disposable incomes and government support for SMEs in the grooming sector, provide strong entry points for mid-range and premium chair manufacturers.

Adoption of Smart and Multi-Functional Chairs

Integration of features such as automated recliners, massaging functions, and ergonomic adjustments is opening new revenue opportunities. Premium salons are willing to invest in technology-driven chairs to attract high-value clients, creating a lucrative opportunity for innovation-led manufacturers.

Sustainable and Eco-Friendly Designs

Manufacturers offering recyclable, vegan, or eco-certified materials stand to benefit from a growing eco-conscious customer base. This aligns with consumer demand for sustainable luxury and compliance with stricter government regulations in developed markets.

Product Type Insights

Hydraulic salon chairs dominate the product type category with 35% market share in 2024, driven by their widespread adoption across both beauty salons and barber shops. Recliner and shampoo chairs are secondary contributors, catering to luxury and specialized services. Barber chairs are witnessing renewed demand in North America and Europe due to the resurgence of professional barbershops.

Material Insights

PU leather leads the material segment with a 40% share in 2024, owing to its affordability, hygiene, and durability. Leather chairs cater to luxury salons and premium customers, while fabric and wood-based chairs remain niche offerings in emerging markets.

End-Use Insights

Beauty salons account for the largest end-use segment with a 50% share in 2024. Growth is being fueled by rising numbers of urban salons and the premiumization trend in North America, Europe, and Asia-Pacific. Trichology centers and spas are secondary contributors, while home-use salon chairs are slowly gaining momentum in developed regions due to e-commerce penetration.

Distribution Channel Insights

Offline channels dominate with a 70% share in 2024, reflecting salon owners’ preference to physically evaluate chairs before purchase. However, online channels are growing rapidly as manufacturers and distributors expand their e-commerce presence, offering direct-to-consumer models and price transparency.

Price Range Insights

The mid-range category (USD 150–500) accounts for 45% of the global market, balancing affordability and quality. Premium chairs above USD 500 are witnessing faster growth, especially in the Middle East and North America, where luxury-focused salons prioritize advanced ergonomics and aesthetics.

| By Product Type | By Material Type | By End-Use | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at 40% in 2024, led by the U.S. with a strong network of beauty salons, barber shops, and luxury spas. Premiumization trends and willingness to invest in smart and ergonomic chairs drive steady growth.

Europe

Europe contributes around 30% of the global market, with Germany, the U.K., and France as key markets. Luxury salons and eco-conscious designs are particularly in demand, making Europe a hub for sustainability-driven salon equipment.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at nearly 8% CAGR. Rising disposable incomes, urbanization, and the proliferation of salon chains in India and China are driving demand. Japan and South Korea represent mature, high-value markets focusing on premium products.

Latin America

Brazil dominates the Latin American market, with increasing investments in mid-range and premium salons. The region’s market is growing steadily, though economic volatility limits large-scale adoption of premium chairs.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing rising demand for luxury salon chairs due to high-income populations and rapid growth in wellness centers. Africa remains a smaller but emerging market, with South Africa as the key hub.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Salon Chairs Market

- Takara Belmont

- Pibbs Industries

- Kiela Furniture

- Paragon Equipment

- Collins Manufacturing

- Ceriotti

- Remington

- Belvedere

- Cozzia

- Gamma & Bross

- Minerva

- Condé Equipment

- JAXON

- DIR Salon Furniture

- Salon Ambience

Recent Developments

- In June 2025, Takara Belmont introduced a new line of eco-friendly salon chairs with recyclable PU leather and energy-efficient hydraulics, targeting European salons.

- In April 2025, Minerva announced the expansion of its online sales platform, offering customizable salon chair options for small businesses in North America.

- In January 2025, Gamma & Bross launched a luxury smart chair collection in the Middle East, integrating massage functions and app-controlled adjustments.