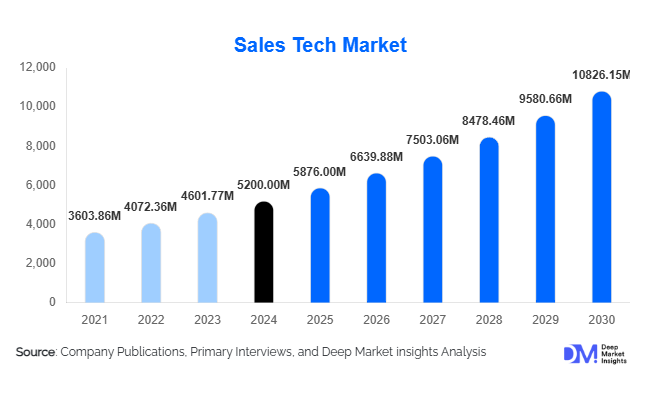

Sales Tech Market Size

According to Deep Market Insights, the global sales tech market size was valued at USD 5,200 million in 2024 and is projected to grow from USD 5,876.00 million in 2025 to reach USD 10,826.15 million by 2030, expanding at a CAGR of 13% during the forecast period (2025–2030). The rapid growth of the sales technology market is driven by the surge in AI-enabled sales automation, rising adoption of cloud-based customer relationship management (CRM) platforms, and increased enterprise investment in analytics-driven decision-making. The transition to hybrid and remote sales operations is also accelerating the demand for digital tools that streamline lead generation, engagement, and forecasting processes.

Key Market Insights

- Cloud-based CRM platforms dominate the global sales tech landscape, accounting for nearly 45% of the 2024 market share.

- AI and predictive analytics integration is reshaping sales forecasting, lead qualification, and conversion optimization.

- North America leads the market, contributing approximately 40–45% of total revenue, driven by strong enterprise digital adoption.

- Asia-Pacific is the fastest-growing region, led by expanding SaaS adoption in India, China, and Southeast Asia.

- Large enterprises represent over 60% of market demand, as they adopt unified platforms for automation and analytics.

- Hybrid and remote sales models continue to increase investment in virtual selling, mobile CRM, and multi-channel engagement tools.

Latest Market Trends

AI-Driven Sales Automation

The integration of artificial intelligence (AI) and machine learning (ML) has become the cornerstone of modern sales tech solutions. AI-driven tools automate repetitive tasks such as lead scoring, email sequencing, and pipeline forecasting, significantly improving productivity and conversion rates. Advanced analytics tools leverage customer intent data, behavioral signals, and historical performance metrics to prioritize high-value prospects. Vendors integrating conversational AI, voice analytics, and natural language processing are witnessing faster adoption among sales teams seeking real-time insights and recommendations.

Rise of Integrated Sales Enablement Platforms

Organizations are increasingly consolidating disparate sales tools into integrated enablement platforms that unify content management, coaching, and analytics. These solutions provide guided selling playbooks, performance dashboards, and on-demand training essential in the era of distributed and remote sales teams. The shift toward centralized sales enablement also improves consistency in messaging, shortens onboarding cycles, and enhances collaboration across global teams. Vendors offering modular, API-driven enablement suites are gaining traction as enterprises seek flexibility and scalability.

Sales Tech Market Drivers

Rapid Shift Toward Cloud-Based Solutions

Cloud-based CRM and automation tools have become critical for modern sales operations. Enterprises prefer SaaS delivery for scalability, lower capital costs, and real-time access to data. Cloud deployment now represents nearly 75% of total implementations, driven by subscription-based pricing and ease of integration. This transition enables continuous product updates, strong data security protocols, and faster deployment, key factors fueling overall market growth.

Growing Emphasis on Predictive Analytics

Predictive analytics tools are transforming how sales teams identify prospects, manage pipelines, and forecast revenue. AI-enabled analytics solutions help sales leaders make data-backed decisions by predicting churn, determining optimal pricing strategies, and identifying cross-selling opportunities. The surge in available customer and intent data has accelerated investment in these tools, particularly within BFSI, retail, and IT sectors, where data-driven accuracy directly impacts profitability.

Expansion of Remote and Hybrid Selling Models

The post-pandemic sales environment has permanently shifted toward remote and hybrid operations. Virtual selling tools, video conferencing, real-time engagement analytics, and mobile CRM are now essential. Companies increasingly invest in multi-channel engagement platforms that connect email, phone, and social selling into one interface. This trend enhances productivity and supports globally distributed sales forces, driving sustained demand across industries.

Market Restraints

Data Privacy and Security Concerns

The growing reliance on data-rich sales systems has elevated concerns over data privacy, security, and compliance. Regulations such as GDPR, CCPA, and local data sovereignty laws limit how organizations collect, store, and process customer information. Enterprises in regulated sectors, including healthcare and finance, face strict compliance requirements that increase implementation complexity and cost, slowing adoption among risk-sensitive buyers.

Integration Complexity and High Implementation Costs

Integrating sales tech tools with existing IT and marketing systems remains a key challenge. Many organizations operate fragmented tech stacks, making synchronization of data and workflows difficult. The total cost of ownership, including software, integration, training, and customization, can be prohibitive for SMEs. Additionally, the lack of skilled professionals who can optimize advanced tools such as AI analytics limits full utilization and ROI realization.

Sales Tech Market Opportunities

AI and Predictive Intelligence Integration

AI-driven predictive intelligence remains one of the most significant opportunities for growth. Vendors capable of leveraging deep learning and natural language processing can offer tools that anticipate customer intent, automate recommendations, and improve forecasting accuracy. As sales cycles become shorter and more data-dependent, demand for intelligent automation platforms is expected to surge across all industries.

Regional Expansion and Vertical Customization

Emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing strong digital transformation initiatives. Companies offering localized, industry-specific solutions such as regulatory-compliant CRM tools for BFSI or CPQ systems for manufacturing can capture new revenue streams. Government programs like “Digital India” and “Made in China 2025” are further enabling enterprise tech adoption, creating fertile ground for regional expansion.

Multi-Channel Engagement and Hybrid Sales Enablement

The continued evolution of hybrid selling has created a growing need for unified engagement tools that integrate communication channels, AI insights, and content delivery. Solutions that combine virtual meeting tools, digital playbooks, and performance analytics offer tangible ROI. Vendors investing in mobile-first platforms and seamless MarTech-SalesTech integration are likely to lead the next phase of market consolidation.

Product Type Insights

Customer Relationship Management (CRM) platforms dominate the sales tech market, representing approximately 45% of total revenue in 2024. Cloud CRM adoption is especially strong, driven by scalability, mobility, and robust data analytics. Sales automation tools and analytics & forecasting platforms follow closely, growing at double-digit rates due to demand for efficiency and data-driven decision-making. Sales enablement solutions are gaining traction as enterprises prioritize performance optimization and coaching to improve sales effectiveness.

Application Insights

Large enterprises account for roughly 60–65% of total market spending, given their complex sales networks and need for integration across multiple departments. SMEs, while representing a smaller revenue share, are growing faster in percentage terms due to the availability of affordable SaaS-based tools. Industry-wise, IT & telecom lead adoption, followed by the BFSI and retail sectors. These industries prioritize omnichannel engagement, customer intelligence, and predictive forecasting capabilities.

Deployment Mode Insights

Cloud deployment accounts for approximately 75% of total installations in 2024, reflecting the strong shift from on-premise to SaaS-based platforms. Enterprises prefer cloud delivery for its agility, cost-efficiency, and support for remote access. Hybrid models remain relevant in regulated sectors where data security and compliance require localized storage.

| By Product Type | By Application | By Deployment Mode | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates the global sales tech market, holding approximately 40–45% of total revenue in 2024. The U.S. drives most of this demand, backed by a mature enterprise ecosystem, robust cloud infrastructure, and heavy investment in AI-driven CRM systems. Canada also contributes to market growth through increasing digital transformation initiatives among SMEs. Continuous innovation and a high concentration of global vendors further reinforce regional leadership.

Europe

Europe represents around 20–25% of the global market share, driven by demand from the U.K., Germany, and France. European companies emphasize data protection and compliance, making GDPR-compliant CRM and sales enablement platforms particularly attractive. The region is characterized by a strong presence of enterprise clients in BFSI and manufacturing that require secure, integrated solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at over 17% CAGR between 2025 and 2030. Countries such as China, India, Japan, and South Korea are witnessing rapid SaaS adoption supported by growing SME digitalization and government-led digitization programs. India and Southeast Asia are emerging as hotbeds for local sales tech startups targeting affordable, localized platforms.

Latin America

Latin America accounts for approximately 5–7% of the market, with Brazil and Mexico as leading adopters. Enterprises in these regions are transitioning from manual to automated systems, supported by expanding internet penetration and a thriving e-commerce ecosystem. SaaS vendors offering low-cost, modular solutions are increasingly gaining traction among SMEs.

Middle East & Africa

The Middle East and Africa contribute a smaller but rapidly expanding share of global demand (around 5–7%). Growth is concentrated in the UAE, Saudi Arabia, and South Africa, where government digitalization drives enterprise adoption of CRM and analytics tools. Local enterprises are partnering with international vendors to accelerate transformation under national initiatives like Saudi Vision 2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sales Tech Market

- Salesforce

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- HubSpot Inc.

- Zoho Corporation

- Adobe Inc.

- Freshworks Inc.

- Pipedrive

- SugarCRM

- ZoomInfo Technologies

- Outreach

- Gong.io

- Seismic

- Insightly

Recent Developments

- In August 2025, Salesforce introduced AI-powered sales forecasting tools integrated with Einstein GPT to improve deal-closing accuracy and predictive insights.

- In June 2025, Microsoft launched Copilot for Dynamics 365 Sales, embedding generative AI capabilities for automated follow-ups and contextual suggestions.

- In April 2025, HubSpot announced a strategic partnership with ZoomInfo to integrate real-time buyer intent data into its CRM ecosystem, enhancing lead qualification.

- In February 2025, Freshworks expanded its AI automation suite with Freshsales Neo, offering low-code customization for SMEs and mid-market clients.