Sail Canvas Market Size

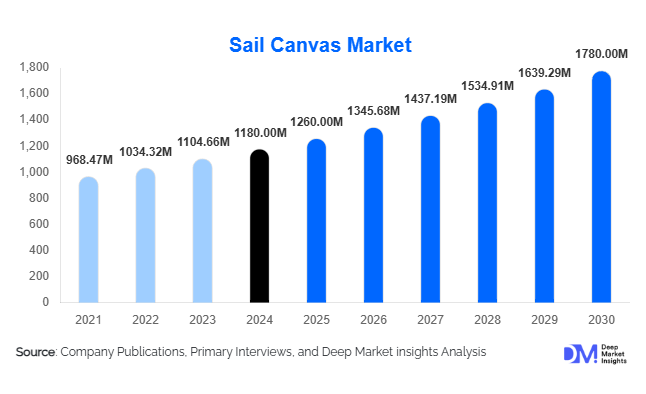

According to Deep Market Insights, the global sail canvas market size was valued at USD 1,180 million in 2024 and is projected to grow from USD 1,260 million in 2025 to reach USD 1,780 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The sail canvas market growth is primarily driven by rising demand for high-performance sail materials in recreational, competitive, and commercial sailing, technological advancements in synthetic and hybrid fabrics, and increasing investments in marine tourism infrastructure globally.

Key Market Insights

- Technological innovation in sail materials, such as laminated, composite, and UV-resistant fabrics, is enhancing durability, performance, and efficiency, meeting the growing demand from competitive sailing segments.

- Recreational sailing is expanding rapidly in emerging economies, including India, China, and Southeast Asia, driven by increasing disposable incomes and government investments in marinas and sailing clubs.

- North America dominates global sail canvas demand, led by the U.S. and Canada, due to a strong boating culture and high per capita ownership of yachts and sailboats.

- Europe is witnessing steady growth, particularly in Germany, France, and the U.K., driven by professional sailing events and eco-conscious sail material adoption.

- Asia-Pacific is emerging as a critical growth market, fueled by rising interest in sailing sports, recreational boating, and export opportunities to mature markets.

- Military and defense applications for high-strength, lightweight sail canvas are creating niche demand, especially for training and auxiliary naval vessels.

Latest Market Trends

Adoption of Advanced Composite and Laminated Fabrics

Manufacturers are increasingly replacing traditional cotton sails with high-performance polyester, PVC, and hybrid composites. Laminated sails provide superior wind resistance, longer life cycles, and improved aerodynamic efficiency, especially in competitive and professional sailing. This trend is driving premium pricing and attracting investment in research and development for next-generation sail materials. Sustainability trends are also influencing material selection, with eco-friendly coatings and recyclable fabrics becoming mainstream in Europe and North America.

Integration of Smart and Digital Sail Technologies

Digital design tools such as CAD-based sail modeling and performance simulation are revolutionizing sail manufacturing. Smart fabrics with embedded sensors are being piloted to monitor tension, wear, and environmental stress, enabling optimized sail performance for competitive and commercial sailing vessels. These innovations appeal to professional sailors and commercial operators seeking efficiency gains and long-term durability. The integration of smart technologies is expected to become a key differentiator for market leaders over the next five years.

Sail Canvas Market Drivers

Technological Advancements in Material Performance

High-strength polyester, PVC, and laminated composites have largely replaced traditional cotton sails due to superior durability, weather resistance, and aerodynamic efficiency. This shift is particularly evident in professional and competitive sailing, where performance optimization directly impacts outcomes. Advanced UV-resistant and waterproof coatings further enhance fabric longevity and reduce maintenance requirements, creating strong demand among recreational and commercial operators alike.

Growth of Recreational and Competitive Sailing

Participation in sailing competitions and recreational boating activities has surged in North America, Europe, and APAC. The growth of yacht clubs, sailing academies, and organized regattas has contributed to a steady rise in sail canvas demand. Additionally, government-backed marine tourism initiatives and increasing consumer spending on leisure sports are fueling market expansion globally.

Export Opportunities from Emerging Economies

Manufacturers in Asia-Pacific and Latin America are capitalizing on export demand in developed markets. Competitive pricing, coupled with adherence to international technical standards, has allowed manufacturers to expand into North America and Europe. These exports are particularly focused on laminated and composite sail fabrics for recreational and competitive sailing vessels.

Market Restraints

High Cost of Advanced Sail Materials

Premium laminated, composite, and smart sail fabrics can be cost-prohibitive for smaller recreational vessels and local commercial fleets, limiting adoption. While high-performance sails deliver superior efficiency, the initial investment remains a key barrier for price-sensitive buyers.

Volatility in Raw Material Prices

Fluctuating polyester, PVC, and synthetic resin prices directly impact production costs, affecting profit margins. Market participants need robust supply chain management to mitigate the effect of raw material price swings, particularly in regions with limited domestic manufacturing capabilities.

Sail Canvas Market Opportunities

Emerging Recreational Sailing Markets

Rapid urbanization and rising disposable incomes in countries such as India, China, and Southeast Asia are driving the adoption of recreational boating. Governments are investing in marinas, sailing schools, and coastal tourism infrastructure, creating a favorable environment for sail canvas manufacturers to expand their regional presence. Affordable, durable sail options tailored to emerging markets represent a major growth opportunity.

Technological Integration and Smart Fabrics

Next-generation sail materials embedded with sensors to monitor performance, tension, and wear are creating premium product lines. Professional and competitive sailors are increasingly adopting these innovations for performance optimization. Integration of digital design, predictive modeling, and IoT-enabled sail fabrics is a promising avenue for manufacturers to differentiate their offerings and capture higher-margin segments.

Export-Driven Growth

North America and Europe continue to dominate global sail canvas demand. Manufacturers in emerging economies can leverage cost-competitive production, quality certification, and sustainable material innovations to tap into these mature markets. Additionally, defense and military contracts requiring high-strength sail fabrics offer specialized export opportunities for niche segments.

Product Type Insights

Polyester sail canvas dominates the market due to its balance of strength, durability, and affordability, accounting for approximately 38% of the 2024 market share. PVC sail fabrics, valued for waterproofing and longevity, hold a 28% share, while hybrid and composite materials are gaining traction in competitive and professional sailing, capturing 20% of the market. Cotton sails, although declining, continue to serve traditional vessels and niche recreational segments at a 14% share. The trend toward high-performance laminates and composites is expected to accelerate, particularly in competitive and export-driven markets.

Application Insights

Recreational sailing represents the largest application segment with 40% of the 2024 market, driven by increasing yacht and sailboat ownership globally. Competitive and professional sailing follows with 25%, benefiting from technological upgrades in sail performance. Commercial vessels account for 20%, particularly in cargo and fishing fleets using durable polyester and PVC sail fabrics. Military and defense applications contribute 15%, primarily through contracts for lightweight, high-strength sail fabrics for auxiliary naval vessels. Recreational and competitive segments are expected to drive future growth due to rising disposable incomes and increased leisure boating participation.

Distribution Channel Insights

Direct sales to OEMs and boat manufacturers account for the largest share of sail canvas distribution at 50%, driven by bulk orders and long-term supplier agreements. Dealers and distributors capture 30% of the market, offering regional reach and after-sales support. Online platforms, while currently representing 20%, are growing rapidly as manufacturers expand D2C channels, provide product customization options, and leverage digital marketing to engage recreational and professional sailors directly.

End-Use Insights

The recreational segment is growing the fastest due to rising yacht ownership, sailing schools, and leisure tourism in emerging and developed markets. Professional sailing events and regattas are creating high-value demand for performance fabrics. Commercial applications, particularly in cargo and fishing vessels, are expanding steadily in regions like Southeast Asia and Europe due to cost-effective and durable sail options. Export-driven demand is increasingly shaping market dynamics, with Europe and North America being key importers of advanced sail fabrics from Asia-Pacific manufacturers.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates global sail canvas demand with 28% of the 2024 market, driven by strong recreational sailing culture, high disposable incomes, and professional sailing competitions in the U.S. and Canada. Growth is supported by technological adoption and investments in sailing clubs and marinas.

Europe

Europe holds approximately 24% of the market, led by Germany, France, and the U.K. The region emphasizes eco-friendly and high-performance sail fabrics, with competitive sailing and leisure boating driving steady demand. Sustainability initiatives and premium product adoption contribute to market growth.

Asia-Pacific

APAC is the fastest-growing region, fueled by China, India, Japan, and Australia. Rising recreational boating, yacht clubs, and exports to North America and Europe are boosting demand. Governments in China and India are promoting coastal tourism and sailing, creating new market opportunities.

Latin America

Brazil, Argentina, and Mexico are gradually increasing sail canvas imports, mainly for high-income recreational sailors and niche adventure boating segments. Growth remains moderate but steadily increasing as awareness of sailing and water sports expands.

Middle East & Africa

Africa is the center of regional sailing activities, particularly in coastal nations. Middle Eastern markets, led by the UAE, Saudi Arabia, and Qatar, are seeing rising recreational boating demand, luxury yacht ownership, and competitive sailing events, supporting premium sail canvas imports.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sail Canvas Market

- Dimension-Polyant

- Contender Sailcloth

- North Sails

- UK Sailmakers

- Quantum Sails

- Challenge Sailcloth

- Gurit

- Elvstrøm Sails

- Incidences Sailcloth

- Harken

- North Cloth

- Neil Pryde Sails

- Asymmetrical Sails

- Dimension-Polyant China

- Future Fibers

Recent Developments

- In March 2025, Dimension-Polyant launched a new line of UV-resistant laminated sails targeting professional sailing competitions in Europe and North America.

- In January 2025, North Sails expanded its production facility in China to meet rising export demand for high-performance sail fabrics in APAC and Europe.

- In February 2025, Contender Sailcloth introduced hybrid composite sail materials for commercial and military applications, emphasizing durability and lightweight performance.