Running Shoes Market Size

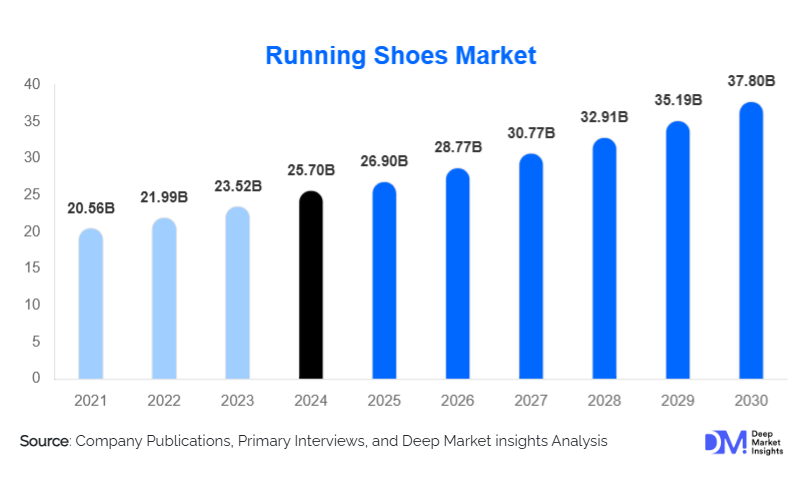

The global running shoes market size was valued at USD 25.7 billion in 2024 and is projected to grow from USD 26.9 billion in 2025 to USD 37.8 billion by 2030, registering a CAGR of 6.95% during the forecast period (2025-2030) The market growth is primarily driven by the increasing marathon participation, rising recreational running trends, and greater health awareness among urban populations.

A recent survey conducted by Deep Market Insights of 1,000 runners highlights that 62% prioritize cushioning and comfort when selecting running shoes, while 40% are willing to invest in models featuring sustainable materials.

Running Shoes Market Size and Growth

- 2024: USD 25.7 billion

- 2030: USD 37.8 billion

- CAGR: 6.95% during the forecast period (2025–2030)

- North America: Largest Market in 2024

- Europe: Fastest Growing Market

Key Market Insights

- Neutral running shoes represent the largest segment, catering to everyday runners with balanced cushioning.

- Carbon plate running shoes are driving growth at the premium end and are widely adopted in competitive marathon events.

- Trail running shoes are witnessing significant demand in North America and Europe, supported by outdoor recreation trends.

- U.S. remains the largest demand hub, while China and the Asia-Pacific are showing the fastest growth momentum.

Emerging Market Trends

- Elite performance adoption: The use of carbon-fiber plates in footwear has become a defining innovation, with models such as the Nike Alphafly and Adidas Adizero Adios Pro consistently chosen by elite athletes. This adoption is spreading to advanced amateur runners seeking performance gains.

- Trail specialization: Growth in the trail running shoes segment is supported by participation in mountain and ultra-distance races in regions such as France, Spain, and the United States. Product designs are increasingly focused on grip, weather protection, and stability across various terrains.

- Sustainability focus: Companies such as Allbirds, Veja, and Hoka are incorporating materials like sugarcane-based EVA and recycled polyester into their mainstream product lines. This shift is aligned with consumer expectations for environmentally responsible products and regulatory requirements in Europe.

- Digital engagement: Virtual try-ons, customization platforms, and direct-to-consumer launches are reshaping consumer interaction. Brands are using digital ecosystems and mobile applications to build loyalty and collect real-time feedback on product performance.

Running Shoes Market Drivers

- Marathon participation: Rising registrations for global marathons and half-marathons in established running hubs such as Tokyo, Berlin, and Boston, alongside emerging events in Asia-Pacific countries like India, China, and Australia, are driving sustained demand for performance footwear. These events encourage repeat purchases as athletes seek footwear optimized for endurance, comfort, and injury prevention, strengthening growth in the global running shoes market.

- Recreational fitness trends: Increasing awareness of personal health, urban fitness initiatives, and lifestyle-driven exercise routines is expanding the base of recreational runners. This trend particularly boosts demand for neutral and stability shoes suitable for casual and long-distance running, as consumers prioritize comfort, versatility, and injury prevention over competition-grade performance. These dynamics are becoming a key growth factor in the running shoes industry.

- Product innovation and technological advancements: Continuous developments in midsole cushioning, energy return systems, carbon plates, lightweight breathable uppers, and biomechanically engineered designs are shortening replacement cycles. Innovative features such as motion control, improved traction, and responsive foams are maintaining consumer interest, enhancing perceived value, and differentiating brands in a competitive market, thereby supporting the global running shoes industry growth.

Market Restraints

- High retail prices: Premium offerings, particularly in carbon plate and advanced trail-running categories, frequently retail above USD 250. Such pricing restricts accessibility in price-sensitive markets and among novice or recreational runners, limiting penetration in emerging regions despite growing interest in running sports. This remains a significant restraint for the global market.

- Counterfeiting and grey market challenges: The proliferation of low-cost imitations, especially across e-commerce platforms in Asia and parts of Latin America, erodes brand equity and reduces consumer confidence in performance claims. Counterfeit products also expose brands to legal and reputational risks, presenting ongoing challenges for the global market.

- Sustainability and material constraints: While consumer preference for eco-friendly and recycled materials is increasing, high production costs and limited supply chains slow widespread adoption. Scaling sustainable innovations remains a significant challenge for manufacturers aiming to balance cost, performance, and environmental impact in the running shoes industry.

Running Shoes Market Opportunities

- Expansion in emerging markets: Rapid urbanization, rising disposable incomes, and growing participation in organized sports across Asia-Pacific and Latin America are creating significant demand for entry-level, mid-tier, and performance running shoes. Market players can leverage targeted marketing and affordable product lines to capture these expanding consumer segments, accelerating growth in the running shoes industry.

- Growing women’s running segment: Female participation in running events is increasing globally, creating opportunities for gender-specific designs that cater to female biomechanics, foot structure, and style preferences. Tailored offerings can also drive loyalty and brand differentiation in both lifestyle and performance categories, positioning the women’s segment as a strong opportunity in the global market.

- Direct-to-consumer channel growth: Leading brands are expanding proprietary online channels to enhance margins, build brand loyalty, and respond rapidly to shifting consumer preferences. Direct-to-consumer strategies enable personalized experiences, subscription models, and exclusive product launches, offering strong revenue opportunities for the running shoes industry.

- Strategic event and athlete collaborations: Sponsorship of marquee global events such as UTMB in France, the Boston Marathon, and regional trail races, combined with endorsements from elite athletes, is increasing visibility for both trail and carbon plate shoe categories. These collaborations support brand credibility, influence purchase decisions, and stimulate interest in high-performance footwear, further driving the market for running shoes.

Segmental Insights

- By Type: Neutral running shoes continue to dominate the market due to their versatility, comfort, and suitability for both recreational and competitive runners. Carbon plate running shoes are gaining attention among elite athletes and marathon participants seeking performance enhancement and energy return. Trail running shoes are increasingly popular in regions with developed outdoor sports infrastructure, supporting off-road and mountain running. Minimalist running shoes maintain a niche following among enthusiasts focused on natural running mechanics and lightweight design, particularly in Europe and North America.

- By End-User: Men currently account for the largest share of the running shoes market, driven by higher participation rates in long-distance and competitive running events. However, women’s running shoes are registering faster growth due to increasing female participation in recreational running, organized races, and fitness programs, prompting brands to introduce gender-specific designs, improved fit, and style-focused offerings.

- By Distribution Channel: Offline specialty stores, including sports retailers and brand-owned outlets, continue to play a key role in providing personalized fitting, expert advice, and in-store experiences. Meanwhile, e-commerce channels are expanding rapidly, recording double-digit growth, fueled by direct-to-consumer initiatives, online-exclusive launches, and digital marketing campaigns that target both urban and emerging markets. Online platforms also facilitate access to international brands in regions with limited physical retail presence.

| By Type | By End-User | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

- North America: North America represents the largest running shoes market globally, driven by a deeply entrenched marathon culture, widespread participation in recreational running, and high consumer spending power. The presence of leading global brands and established specialty retail networks further supports market growth. Trail and carbon plate running shoes are particularly in demand in regions with well-developed outdoor and competitive running infrastructure.

- Europe: Europe remains a key market, with countries such as France, Germany, and the UK leading demand, especially for performance-oriented and trail running shoes. High participation in organized races, mountain marathons, and recreational running, coupled with strong brand awareness, is driving preference for premium and technologically advanced footwear. Sustainability-conscious consumers in Western Europe are also influencing product offerings and innovations.

- Asia-Pacific: Asia-Pacific is the fastest-growing region in the global running shoes market. China and Japan are the primary growth drivers, supported by expanding urban middle-class populations, rising disposable incomes, and increasing awareness of health and fitness. The proliferation of marathons, organized running events, and government-led fitness initiatives across India, Australia, and Southeast Asia is further fueling demand for both entry-level and high-performance running shoes.

- Latin America: Brazil and Mexico are emerging as significant growth hubs, with rising sports participation, urbanization, and an expanding middle class. Investment in recreational and competitive running events, alongside increasing exposure to global running trends, is stimulating demand for both performance-focused and lifestyle running shoes. E-commerce channels are also playing an increasingly important role in market access.

- Middle East and Africa: Demand in the Middle East and Africa is concentrated in major urban centers such as Dubai, Riyadh, and Johannesburg, where rising disposable incomes and growing fitness awareness are driving adoption. Limited but expanding specialty retail networks, combined with increasing online sales penetration, are facilitating the introduction of premium, trail, and performance running shoes in the region. Localized marketing campaigns and sports sponsorships are further supporting market visibility and growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Nike holds approximately 27% Share of the Running Shoes Market

Nike holds the largest share of the global running shoes market at approximately 27%, reinforced by its Alphafly and ZoomX product lines. Adidas follows with an estimated 19% share, leveraging its Adizero and Ultraboost series to strengthen performance and lifestyle positioning. Other notable players include ASICS, New Balance, Hoka, Puma, and On, which collectively account for a significant portion of the remaining market and are expanding through regional growth and specialized running footwear.

Top Companies in the Running Shoes Industry

- Nike Inc.

- Adidas AG

- Asics Corporation

- Puma SE

- New Balance Athletics Inc.

- Brooks Running Company

- Hoka (Deckers Outdoor Corporation)

- Saucony (Wolverine World Wide Inc.)

- Mizuno Corporation

- Under Armour Inc.

- Salomon (Amer Sports / Anta Sports)

- Skechers USA Inc.

- Li-Ning Company Limited

- Anta Sports Products Limited

Latest Developments

- March 2025: Nike introduced the Alphafly 4 with next-generation ZoomX cushioning and an enhanced carbon plate design, strengthening its position in the global running shoes market.

- May 2025: Adidas launched the Adizero Prime X Strung in China, featuring advanced textile engineering and a Strung upper for improved fit and responsiveness, supporting growth in the Asia-Pacific market.

- July 2025: Hoka expanded its Clifton series with midsoles made from sugarcane-based EVA foam, advancing sustainability initiatives in the running shoes industry.