Running Gear Market Size

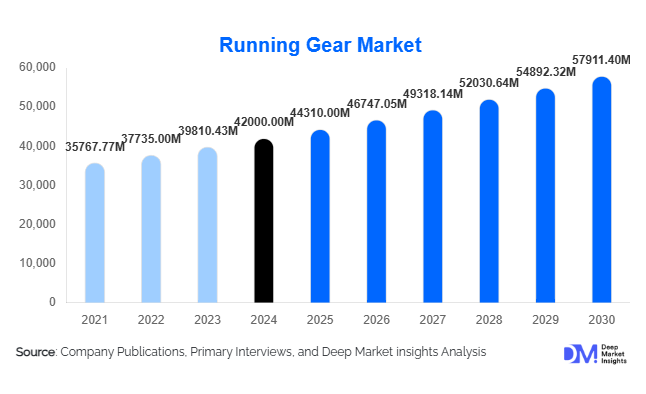

According to Deep Market Insights, the global Running Gear Market was valued at USD 42,000 million in 2024 and is projected to grow from USD 44,310.00 million in 2025 to reach approximately USD 57,911.40 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). Growth in this market is primarily driven by increasing health and fitness awareness, rising participation in marathons and recreational running, and rapid adoption of smart, connected, and sustainable running gear across global markets.

Key Market Insights

- Running footwear remains the cornerstone of the market, accounting for around 50% of total revenues in 2024.

- Online retail channels captured nearly 38% of global sales in 2024 and continue to expand through direct-to-consumer (DTC) models.

- North America dominates the global market with a 35% share in 2024, driven by a strong fitness culture and premium brand penetration.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, middle-class expansion, and rising health awareness in China and India.

- Technological integration through smart wearables, GPS tracking, and AI-based fitness analytics is redefining performance training and product differentiation.

- Sustainability initiatives, including recycled materials, ethical sourcing, and eco-friendly packaging, are reshaping consumer purchasing decisions.

Latest Market Trends

Smart and Connected Running Gear

Running gear manufacturers are increasingly integrating sensors, GPS modules, and AI-based analytics into footwear and apparel to track performance and biomechanics. Smart shoes, connected insoles, and wearable trackers that sync with mobile apps are becoming mainstream. This convergence of fitness technology and running equipment enables data-driven training and personalized recommendations. Consumers now value running gear not only for comfort but also for its digital ecosystem offering training feedback, real-time metrics, and performance comparisons. The growing popularity of smart fitness ecosystems like Garmin Connect, Strava, and Nike Run Club is propelling this shift toward tech-enhanced running experiences.

Sustainable and Recycled Running Gear

Leading brands are re-engineering product lines using recycled polyester, bio-based foams, and plant-derived dyes to meet sustainability goals. Initiatives such as closed-loop recycling, biodegradable shoe soles, and low-impact manufacturing processes are becoming major differentiators. Consumers, especially the younger demographic, are prioritizing eco-conscious choices, driving companies to commit to carbon-neutral operations and transparent supply chains. This movement toward green running gear not only aligns with global environmental goals but also supports brand loyalty and premium positioning in mature markets.

Running Gear Market Drivers

Rising Health and Fitness Awareness

The increasing prevalence of lifestyle-related diseases and heightened focus on personal health are encouraging consumers to adopt running as an accessible fitness activity. Global running event participation has surged, leading to higher spending on performance-oriented gear. The pandemic’s long-term influence on outdoor fitness habits continues to fuel consistent demand for running shoes, apparel, and accessories.

Technological Innovation and Product Enhancement

Breakthroughs in performance materials such as responsive foams, carbon plates, and breathable fabrics have revolutionized running gear. The emergence of smart wearables integrated with biomechanics sensors enables advanced gait analysis and injury prevention. This wave of innovation not only enhances the runner experience but also supports premium product pricing, boosting revenue growth across the industry.

Expansion of E-Commerce and DTC Channels

Digital transformation is reshaping how consumers purchase running gear. Direct-to-consumer platforms and online retail channels now represent nearly 40% of the market, with brands investing heavily in personalized marketing, virtual try-on tools, and subscription models. These channels reduce reliance on traditional retail, increase brand margins, and expand reach to previously underserved geographies.

Market Restraints

Price Sensitivity and Market Saturation

Developed regions such as North America and Western Europe exhibit signs of maturity and pricing pressure, limiting market expansion. High-end running gear competes with value-based alternatives, forcing brands to balance innovation with affordability. This competitive pricing environment challenges sustained profit margins.

Raw Material and Supply Chain Constraints

Fluctuating costs of advanced foams, textiles, and sensor components affect profitability. Global supply-chain disruptions and logistical constraints also increase operational costs, particularly for brands sourcing components across Asia-Pacific and exporting to Europe and North America. Managing inventory and sustainability commitments amidst these pressures remains a critical challenge.

Running Gear Market Opportunities

Emerging Market Expansion

Rapid urbanization and middle-class growth in countries such as India, China, Brazil, and Indonesia are driving new demand for affordable yet high-performance running gear. Fitness awareness campaigns, government-sponsored wellness programs, and marathon events are catalyzing market entry for both global and regional brands. Affordable product portfolios tailored for these markets represent substantial untapped opportunities.

Smart Wearables and Digital Fitness Integration

The fusion of running gear with connected technologies opens recurring revenue streams through app subscriptions and data services. Wearables capable of analyzing stride efficiency, calorie burn, and recovery metrics are gaining mass adoption. Collaborations between sportswear companies and technology firms, such as Nike with Apple and Garmin with Adidas, are redefining the category’s value proposition beyond traditional equipment sales.

Sustainable Manufacturing and Niche Customization

The growing consumer emphasis on sustainability and individuality offers opportunities for product differentiation. Custom-fit shoes, limited-edition designs, and sustainable apparel collections appeal to niche markets while supporting brand reputation. Brands that successfully integrate circular economy principles and transparency in sourcing are expected to capture premium positioning and customer loyalty.

Product Type Insights

Running footwear leads the market, accounting for approximately 50% of the total 2024 revenue. Continuous advancements in cushioning, energy return, and lightweight construction make footwear the most frequently replaced product category among runners. Running apparel and accessories follow, supported by the growing athleisure trend and year-round running participation. The smart wearable segment is the fastest-growing, driven by digital health adoption and increasing integration of connected ecosystems in athletic performance monitoring.

Distribution Channel Insights

Online retail and direct-to-consumer platforms dominate the modern sales landscape, capturing about 38% of global revenues in 2024. Traditional offline retail, such as specialty sports stores and department outlets, remains vital for brand experience but is transitioning toward hybrid omnichannel models. The rise of subscription-based purchases and AI-driven product recommendations is further reshaping consumer buying patterns and enabling data-backed customer retention strategies.

End-Use Insights

Recreational runners and fitness enthusiasts form the largest consumer base, representing around 36% of the global market value. These users prioritize comfort, versatility, and affordable performance. Meanwhile, professional athletes and marathon participants drive demand for high-end, specialized footwear and apparel designed for endurance and competition. The expanding crossover between running and lifestyle fashion (athleisure) is unlocking new revenue streams from casual consumers who use running gear as everyday wear.

| By Product Type | By End User | By Price Range | By Distribution Channel | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

Holding approximately 35% of the global market share in 2024, North America remains the largest regional market. The United States leads with high brand penetration, frequent product replacement cycles, and strong demand for technologically advanced and premium gear. Canada follows closely, benefiting from a thriving outdoor running culture and sustainable gear preferences.

Europe

Europe represents a mature yet innovation-driven market. The U.K., Germany, and France dominate sales due to widespread running communities and sustainability-driven consumer choices. European brands are leading in eco-friendly material adoption and ethical production, aligning with regional regulatory emphasis on circular manufacturing and low-carbon operations.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, projected to register a CAGR exceeding 7% through 2030. Expanding middle-class populations, government wellness initiatives, and rapid urbanization are fueling running participation across China, India, Japan, and South Korea. India’s running gear market alone is expected to double from USD 2.4 billion in 2024 to USD 4.8 billion by 2033.

Latin America

Brazil, Mexico, and Argentina are emerging hotspots for recreational running. Increasing health awareness and improved retail infrastructure are supporting steady market expansion. However, economic volatility and import dependency continue to limit large-scale growth.

Middle East & Africa

The Middle East and Africa region, valued at around USD 940 million in 2024, is witnessing increased participation in marathons and fitness events. The GCC countries are investing in sports infrastructure and wellness initiatives, while Africa’s emerging sportswear industry is increasingly export-driven, supplying gear to Europe and North America.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Running Gear Market

- Nike Inc.

- Adidas AG

- ASICS Corporation

- Puma SE

- New Balance Athletics Inc.

- Under Armor Inc.

- Brooks Sports Inc.

- Hoka (Deckers Brands)

- Skechers USA Inc.

- Salomon Group

- Mizuno Corporation

- Lululemon Athletica Inc.

- On Holding AG (On Running)

- Columbia Sportswear Company

- Decathlon S.A.

Recent Developments

- In August 2025, Nike introduced its next-generation FlyEase Smart Run shoe series with AI-enabled adaptive cushioning, targeting professional and recreational runners.

- In July 2025, Adidas launched its Re-Terra initiative, focusing on circular economy models and 100% recyclable running apparel collections.

- In May 2025, ASICS partnered with Garmin to develop integrated performance tracking across running footwear and wearable ecosystems.

- In April 2025, On Running expanded its production capacity in Vietnam, investing USD 120 million in sustainable foam manufacturing facilities.