Rugged Tablets Market Size

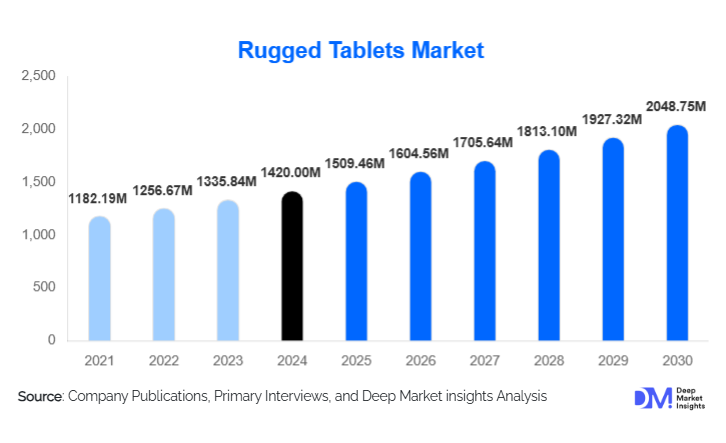

According to Deep Market Insights, the global rugged tablets market size was valued at USD 1,420 million in 2024 and is projected to grow from USD 1,509.46 million in 2025 to reach USD 2,048.75 million by 2030, expanding at a CAGR of 6.3 during the forecast period (2025–2030). This growth is being driven by increasing digitization of field operations, rising demand for durable and connected devices in harsh environments, and the expansion of rugged tablet adoption across industrial, defense, and public safety sectors.

Key Market Insights

- Semi-rugged tablets dominate demand, as they strike a balance between ruggedness and cost, making them ideal for many field-service and industrial use cases.

- Android-based operating systems lead the market, thanks to their flexibility, wide app ecosystem, and lower licensing costs compared to Windows.

- 10–12 inch screen sizes are highly preferred, large enough for data entry and mapping, yet portable for field use.

- Cellular connectivity (4G/5G) is rapidly gaining share, as field workers need always-on access in remote or mobile environments.

- Field services and utilities are the largest end-use verticals, driven by the digital transformation of the field workforce and remote operations.

- North America holds a leading regional share, while Asia-Pacific emerges as the fastest-growing region due to industrialization and infrastructure digitization.

What are the Latest Trends in the Rugged Tablets Market?

Edge-Enabled Rugged Devices

One of the most significant trends is the integration of edge computing capabilities into rugged tablets. More manufacturers are embedding AI inference engines, powerful CPUs, or NPUs so that these devices can perform analytics locally, rather than relying purely on back-end servers. This enables predictive maintenance, real-time decision-making, and lower latency in field environments (e.g., utilities, telecommunications, oil & gas). As operations get more data-intensive, rugged tablets are evolving into true edge nodes, collecting sensor data, processing it on the spot, and supporting intelligent workflows.

Modular & Connectable Rugged Tablets

Modularity is gaining traction: rugged tablet vendors are offering add-on modules such as barcode scanners, thermal imaging sensors, hot-swappable batteries, and extended I/O ports. This design flexibility allows organizations to configure a tablet precisely for their needs, reducing the need for separate devices. Modular rugged tablets lower TCO by enabling upgrades instead of full replacements. They also support rugged docking stations, field mounts, and other peripherals tailored for specific industries.

5G & Advanced Connectivity Adoption

As 5G coverage grows globally, rugged tablets are increasingly equipped with 5G modems. This trend supports bandwidth-heavy applications like video streaming, real-time high-resolution mapping, and AR-assisted field maintenance. Enhanced connectivity also helps in remote diagnostics, live collaboration between field workers and central teams, and secure data transfer. For industries operating in remote, mission-critical environments (defense, energy, public safety), 5G-enabled rugged tablets are becoming an essential tool.

What Are the Key Drivers in the Rugged Tablets Market?

Industrial Digital Transformation & Field Workforce Automation

Organizations are accelerating the digitization of their field operations, especially in sectors like energy, utilities, telecom, and construction. Rugged tablets offer real-time data capture, connectivity, and processing, enabling improved task management, remote diagnostics, and efficiencies in service delivery. By deploying rugged tablets, companies can replace paper-based workflows, reduce manual errors, and optimize the productivity of field personnel.

Demand for Durable Devices in Harsh Environments

Many industrial, military, and public safety operations take place under extreme conditions: high or low temperatures, dust, vibration, water exposure, or rough handling. Consumer-grade tablets often fail in such environments; rugged tablets are built to meet MIL-STD, high IP ratings (e.g., IP67), and have reinforced chassis and long-life batteries. This durability makes them indispensable for mission-critical applications, driving strong demand.

Growth of Edge Computing & Predictive Maintenance

The rise of edge technologies, IoT, and Industry 4.0 is pushing enterprises to adopt devices that can process data locally. Rugged tablets act as mobile edge-computing endpoints, collecting and analyzing sensor data, triggering predictive maintenance alerts, and enabling AI-driven insights in real time. This minimizes downtime and supports proactive maintenance in industrial operations.

What Are the Restraints for the Global Market?

High Cost of Ownership

Rugged tablets are substantially more expensive upfront than consumer-grade tablets, due to specialized components, certifications, rugged materials, and testing. Additionally, their total cost of ownership (TCO) includes repair, battery replacements, and potentially higher service costs. For cost-sensitive buyers, especially in emerging markets, this high price barrier limits adoption.

Integration & Legacy System Challenges

Many organizations operate with legacy infrastructure, proprietary software, or custom field-service applications. Integrating rugged tablets into these existing systems can be complex: there are challenges around software compatibility, device management, firmware security, and data synchronization. These integration issues slow down deployment and reduce the appeal for buyers who need seamless compatibility with their current workflows.

What Are the Key Opportunities in the Rugged Tablets Industry?

Smart Infrastructure & Utility Modernization

As governments and utilities worldwide invest in smart grids, smart meters, and infrastructure modernization, there’s a strong opportunity for rugged tablet vendors to supply devices for field technicians. Rugged tablets with edge analytics and connectivity can support grid inspections, meter reading, asset maintenance, and outage diagnostics. For new entrants, partnering with utility companies or forming alliances with system integrators in smart infrastructure projects can unlock significant demand.

Defense, Public Safety & First Responders

Government agencies, including defense, police, and emergency services, increasingly require rugged, secure, and connected devices for mission-critical operations. Rugged tablets built to withstand extreme environments, with secure communications and real-time data access, are vital in these sectors. There’s room for growth in rugged devices tailored for situational awareness, mapping, secure communication, and tactical operations.

Emerging Markets & On-site Industrial Applications

Emerging economies in Asia-Pacific, Latin America, and Africa are accelerating industrialization, infrastructure development, and field services expansion. These markets present a growth runway for rugged tablets in construction, mining, agriculture, and telecom tower maintenance. New entrants can target these geographies by offering cost-optimized semi-rugged tablets, localized manufacturing or assembly, and customized service models.

Product Type Insights

The rugged tablet market is primarily divided by type into fully rugged, semi-rugged, and ultra-rugged devices. Semi-rugged models currently dominate in terms of adoption, as they provide a solid compromise between durability and cost, making them highly attractive for industries like field service and utilities. Fully rugged tablets, with higher levels of protection (e.g., IP67, MIL-STD drop), cater to mission-critical sectors such as defense and public safety. Ultra-rugged tablets (including special-purpose, blast-resistant, or submersible variants) address very niche use cases such as extreme environments or hazardous locations. Modular design is also gaining traction across types, enabling customization with add-ons like 5G, barcode scanners, or hot-swappable batteries.

Application Insights

Rugged tablets are extensively used in industrial automation, defense & aerospace, field operations, construction, transportation & logistics, and public safety. In the energy and utilities sector, they are used for inspections, meter reading, and maintenance tasks. In field service, technicians use them for asset tracking, diagnostics, and remote reporting. Manufacturing firms leverage rugged tablets on their shop floors for quality checks and process control. In public safety, tablets enable secure communication, mapping, and incident management. Emerging use cases include edge AI applications, predictive maintenance, AR-assisted repairs, and mobile command centers.

Distribution Channel Insights

Rugged tablets are sold through a mix of direct enterprise sales, value-added resellers (VARs), system integrators, and industrial e-commerce platforms. Large enterprises and government agencies often buy directly from OEMs to get customized devices and service contracts. VARs and system integrators play a critical role in field-service verticals, bundling rugged tablets with software, docking stations, and maintenance services. Online industrial marketplaces are also gaining traction, especially for standardized semi-rugged devices, while offline channels (distributors, local partners) are important in emerging regions with strong field-service demand.

User Segment Insights

The primary user segments for rugged tablets are field service technicians, utility workers, public safety personnel, and defense operators. Among these, field service technicians (in telecom, utilities, and construction) represent the largest share, as they require durable, portable, and connected devices. Public safety and first responders are very important for fully rugged devices, given their need for reliability and secure communications. Defense users demand ultra-rugged, high-spec tablets with encryption, top durability, and long lifecycle support. There's also growing adoption among inspection & maintenance engineers, mining workers, and surveyors, who benefit from rugged tablets with GNSS, barcode scanning, and data-collection tools.

| By Product Type | By Operating System | By Display Size | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest single region in the rugged tablet market, holding an estimated 33% share in 2024. The United States is the primary driver, thanks to strong demand from defense, public safety, utilities, and field services. High technology adoption, established rugged device manufacturers (Panasonic, Getac, Zebra), and robust service ecosystems further reinforce the region’s dominance.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the rugged tablet market. Rapid industrialization, smart infrastructure investments, telecom tower proliferation, and increased field-service operations are fueling demand. Key markets include China (large manufacturing base, utilities), India (infrastructure build-out), and Southeast Asia. Local players, as well as global OEMs, are expanding their presence to tap into this growth.

Europe

Europe is a mature market for rugged tablets, driven by industrial automation, manufacturing, construction, and utility digitization. Countries such as Germany, the UK, and France show stable demand. Regulatory emphasis on worker safety, data security, and mobile workforce efficiency strengthens the adoption of rugged devices.

Latin America

Latin America represents a smaller but promising portion of the rugged tablet market. Countries like Brazil, Mexico, and Argentina are seeing rising use of rugged tablets in construction, mining, and field service. As industrial CapEx increases and logistics infrastructure modernizes, demand for semi-rugged tablets is expected to rise.

Middle East & Africa

In the Middle East & Africa (MEA), demand is primarily driven by the oil & gas sector, utilities, and infrastructure development. Rugged tablets are used in harsh conditions (deserts, remote sites), motivating the deployment of fully rugged models. While the region’s overall market share is smaller, growth potential is supported by government investment and remote-site digitization.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rugged Tablets Market

- Panasonic

- Getac

- Zebra Technologies

- DT Research

- MobileDemand

- Leonardo DRS

- Trimble

- AAEON

- NEXCOM

- HP

- Dell

- Honeywell

- Kontron

- Juniper Systems

- MilDef

Recent Developments

- Getac launched the F120 ultra-rugged tablet with an Intel Core Ultra processor and hot-swappable batteries, targeting AI use cases in extreme environments.

- Oukitel released the RT10 Industry rugged tablet, offering 5G, a massive 25,000 mAh battery, barcode scanning, NFC, and high durability, directly challenging established rugged OEMs.

- Winmate reported plans for double-digit YoY growth in its rugged tablet business, citing strong demand in defense, industrial automation, and enterprise mobility. :contentReference[oaicite:0]{index=0}