Rubberwood Furniture Market Size

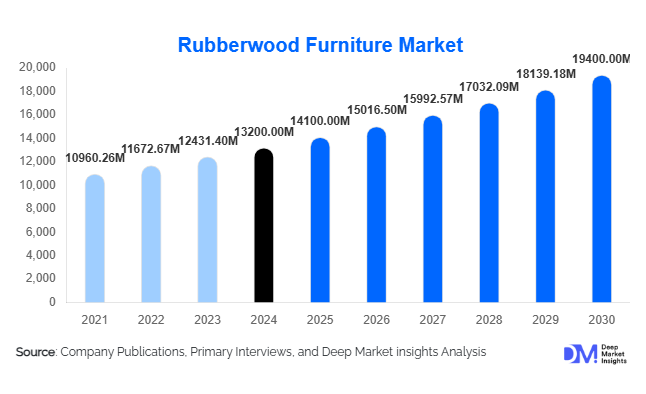

According to Deep Market Insights, the global rubberwood furniture market size was valued at USD 13,200 million in 2024 and is projected to grow from USD 14,100 million in 2025 to reach USD 19,400 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for sustainable furniture, rising residential and commercial construction, and the growing preference for durable, eco-friendly, and cost-effective wood solutions across global markets.

Key Market Insights

- Sustainability is at the forefront of furniture design, with rubberwood gaining prominence as an eco-friendly alternative to traditional hardwoods sourced from forests.

- Residential furniture dominates demand, driven by urbanization and rising middle-class income levels, particularly in the Asia-Pacific and North America.

- APAC is the fastest-growing region, led by India, Vietnam, and Thailand, fueled by increasing disposable incomes and expanding real estate development.

- Commercial applications such as hospitality and office furniture are becoming key growth segments, with hotels and offices adopting modular and multi-functional rubberwood furniture.

- Online retail channels are rapidly expanding, offering convenience and wider product variety, while offline retail still dominates due to tactile purchase preferences.

- Technological integration in manufacturing, including CNC machining, surface finishing, and modular design, is enhancing product quality and design flexibility.

Latest Market Trends

Shift Toward Eco-Friendly and Modular Designs

Rubberwood furniture manufacturers are increasingly incorporating sustainability into their product lines by utilizing plantation-grown wood and eco-certified materials. Modular and multi-functional designs are gaining traction, particularly in urban apartments and office spaces where space optimization is critical. These products cater to consumer preferences for durable, lightweight, and aesthetically versatile furniture. Online marketing campaigns highlighting environmental benefits, combined with certifications, are further driving adoption among environmentally conscious consumers.

Technology-Enhanced Manufacturing

Advanced manufacturing technologies such as CNC machining, automated surface finishing, and precision cutting are being adopted to improve efficiency, reduce waste, and maintain high-quality standards. These technologies allow manufacturers to produce complex designs at scale, meeting both residential and commercial demand. Smart production also supports customization, enabling personalized furniture solutions, which is increasingly important for premium and mid-range segments.

Rubberwood Furniture Market Drivers

Rising Demand for Sustainable Furniture

Consumers and businesses are prioritizing sustainable and renewable materials. Rubberwood, sourced from plantation trees after latex extraction, provides an eco-friendly alternative to conventional hardwoods. The growing adoption of green building standards in Europe, North America, and APAC is accelerating demand for rubberwood furniture in both residential and commercial segments.

Growth in Residential and Commercial Construction

Urbanization, apartment development, and commercial real estate projects are key drivers. Increasing residential construction in Asia-Pacific and North America is stimulating demand for living room, bedroom, and dining furniture. Similarly, commercial spaces such as offices, hotels, and restaurants are opting for modular and aesthetically appealing rubberwood furniture to balance cost and design quality.

Cost-Effectiveness and Design Versatility

Rubberwood is more affordable than traditional hardwoods while offering similar durability. Its ability to be laminated, veneered, or finished in diverse styles makes it highly adaptable for various consumer preferences. This affordability, combined with design flexibility, is particularly appealing to mid-range and premium furniture segments globally.

Market Restraints

Susceptibility to Moisture and Pests

Rubberwood furniture requires proper chemical treatment to resist termites and moisture. In humid regions, untreated or improperly treated furniture is prone to damage, limiting adoption in certain markets.

Raw Material Price Fluctuations

Rubberwood availability depends on plantation yield and latex industry cycles, leading to price volatility. Manufacturers must manage production costs carefully to maintain profitability, particularly in mid-range furniture segments sensitive to pricing changes.

Rubberwood Furniture Market Opportunities

Eco-Friendly Furniture Adoption

Rising global awareness of sustainable living presents a significant opportunity. Manufacturers can differentiate through eco-labeling, FSC certification, and marketing campaigns highlighting environmental benefits. This is particularly relevant in Europe and North America, where environmentally conscious consumers are willing to pay a premium for green products.

Expansion in Emerging Markets

Urbanization and rising disposable incomes in countries such as India, Vietnam, and Brazil are increasing demand for modern, affordable, and stylish furniture. Manufacturers and new entrants can tap into tier-2 and tier-3 cities, supported by e-commerce platforms and organized retail expansion.

Integration of Smart and Modular Furniture Designs

There is a growing demand for adjustable, foldable, and modular furniture, particularly in small apartments and offices. Rubberwood’s flexibility allows innovative design, creating opportunities for companies to offer multifunctional furniture that meets evolving urban lifestyle needs.

Product Type Insights

Indoor furniture dominates the market, accounting for approximately 60% of global demand in 2024. Living room and bedroom furniture, including sofas, beds, and coffee tables, are the most popular due to urban residential growth. Outdoor furniture, such as garden and patio sets, is growing steadily but remains a smaller share, highlighting a potential area for market expansion.

Application Insights

Residential end-use is the largest application, contributing nearly 65% of market revenue. Commercial applications, particularly in hospitality and offices, are the fastest-growing segments. Export-driven demand is significant, with Thailand, Vietnam, and Malaysia supplying high-quality rubberwood furniture to the U.S., Europe, and Japan.

Distribution Channel Insights

Offline retail channels hold 50% of the market share in 2024, driven by consumers’ preference for physical inspection of furniture. Online channels are growing at a faster pace, benefiting from convenience, customization options, and wider reach through e-commerce platforms. Institutional B2B contracts for hotels and office spaces are emerging as another key distribution channel.

End-Use Insights

Residential consumers remain the primary buyers of rubberwood furniture, while hospitality and office segments are gaining momentum. Hotels and restaurants are adopting durable and visually appealing furniture, often customized for thematic interior designs. Offices are increasingly opting for modular furniture, enhancing ergonomic design and space optimization.

| By Product Type | By Material Type / Finish | By End-Use Industry | By Distribution Channel | By Price Tier / Positioning |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 25% of global demand, driven primarily by the U.S. and Canada. Demand is fueled by sustainability trends, urban residential expansion, and high disposable income, with mid-range and premium furniture being particularly popular.

Europe

Europe contributes approximately 22% of market share, led by Germany and the U.K. High awareness of sustainable furniture and stringent environmental regulations support growth. Eco-certified furniture and modular designs are in strong demand.

Asia-Pacific

The fastest-growing region, APAC, accounts for 45% of global market share, led by India, Vietnam, and Thailand. Urbanization, rising middle-class incomes, and export opportunities are key drivers. Modular and affordable rubberwood furniture is witnessing rapid adoption.

Latin America

Brazil and Argentina are emerging markets for rubberwood furniture, driven by rising urban middle-class incomes and demand for modern designs. While growth is moderate, customized solutions and exports are fueling market expansion.

Middle East & Africa

Key markets include the UAE, Saudi Arabia, and South Africa. Luxury and hospitality furniture dominate demand, while Africa’s local consumption remains limited to urban regions with higher purchasing power. Regional governments are supporting furniture manufacturing and exports.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rubberwood Furniture Market

- IKEA

- Ashley Furniture

- Godrej Interio

- Natuzzi

- Williams-Sonoma

- La-Z-Boy

- Haworth

- Kian Furniture

- Crown Furniture

- Shanxi Lijia

- Okamura Corporation

- Masco Corporation

- HNI Corporation

- Duresta

- Zhuhai Horizon

Recent Developments

- In 2025, IKEA expanded its sustainable rubberwood product line across Europe, emphasizing FSC-certified sourcing and modular design options.

- In 2025, Godrej Interio launched a mid-range modular furniture collection for urban apartments in India, enhancing space optimization and eco-friendly finishes.

- In 2025, Natuzzi introduced a premium indoor rubberwood collection with advanced surface treatments to increase durability against moisture and pests.