Rowing Machine Market Size

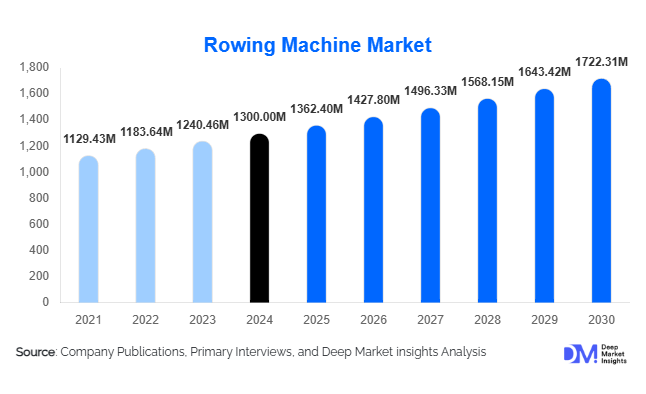

According to Deep Market Insights, the global rowing machine market size was valued at USD 1,300.00 million in 2024 and is projected to grow from USD 1,362.40 million in 2025 to reach USD 1,722.31 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). The rowing machine market growth is primarily driven by increasing health awareness, the rise of home fitness trends, and expanding commercial gym adoption. Technological advancements, such as smart rowers with interactive screens and app-based connectivity, are further boosting market demand globally.

Key Market Insights

- Home fitness adoption is accelerating, with compact, foldable, and IoT-enabled rowing machines appealing to urban consumers seeking convenient workout solutions.

- Commercial gyms and fitness centers dominate usage, due to the high durability and versatility of rowing machines for multiple users.

- North America leads the market, driven by high disposable income, fitness awareness, and the adoption of smart home fitness equipment.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising middle-class income, and government initiatives promoting health and fitness.

- Technological integration, including AI-based coaching, app-based training, and virtual rowing competitions, is reshaping user engagement.

- Sustainable rowing machines, made of eco-friendly materials such as wood, are gaining traction among environmentally conscious consumers and premium buyers.

What are the emerging trends in the global rowing machine market?

Smart and Connected Rowers

Manufacturers are increasingly embedding digital features such as IoT connectivity, AI performance tracking, and interactive screens that simulate real-world rowing experiences. These innovations allow users to track progress, compete virtually, and follow guided workouts, appealing particularly to tech-savvy millennials and urban professionals. Subscription-based platforms bundled with smart rowers are also enhancing user engagement and retention.

Rise of Home Fitness and Compact Designs

The pandemic-driven surge in home workouts has led to increased adoption of compact, foldable rowing machines. Virtual coaching and app-based training allow consumers to maintain effective workout routines at home. This trend is strongest in urban areas, where space limitations drive demand for multifunctional, space-saving equipment.

Which factors are driving growth in the rowing machine market worldwide?

Increasing Health Awareness

Awareness about cardiovascular health, weight management, and preventive fitness has increased demand for rowing machines. Rowing offers a full-body, low-impact workout suitable for all age groups, making it a preferred choice for both home users and gyms. Commercial adoption is high, as gyms incorporate rowers to offer diverse training options.

Technological Innovation

Smart rowing machines with AI coaching, connected apps, and gamified features provide personalized and interactive experiences. These technologies are particularly appealing to premium consumers, allowing remote competitions, social connectivity, and real-time performance analytics.

Home Fitness Boom

Urban households are increasingly investing in home gyms, prioritizing convenience and multifunctionality. Compact, connected rowing machines are becoming a staple for residents seeking effective workouts without leaving home, particularly in North America and Europe.

What challenges or restraints are affecting the rowing machine market?

High Equipment Costs

Premium rowing machines, especially those with smart features, are expensive, limiting adoption among price-sensitive consumers. Budget models often lack advanced features, restricting revenue potential in the premium segment.

Space and Maintenance Requirements

Despite foldable designs, rowing machines require sufficient floor space and occasional maintenance. Limited space in urban apartments and high-traffic usage in gyms can restrict adoption and increase operational costs.

What major opportunities are available for players in the rowing machine market?

IoT and Smart Fitness Integration

Smart, connected rowers integrated with virtual workouts, AI coaching, and gamification present a major growth opportunity. Subscription-based platforms and performance-tracking apps increase engagement and encourage repeat use, driving higher market penetration.

Emerging Markets Expansion

Rising urbanization and disposable incomes in Asia-Pacific, Latin America, and the Middle East present untapped potential. Strategic market entry, partnerships with local distributors, and digital marketing can help manufacturers capture these emerging segments. Government health and fitness initiatives also support growth.

Institutional and Corporate Wellness Programs

Rowing machines are being incorporated into corporate wellness programs, educational institutions, and rehabilitation centers. Bulk procurement contracts and long-term partnerships provide stable revenue streams and market visibility.

Product Type Insights

Magnetic resistance rowers dominate with around 35% share in 2024, offering quiet operation, precise resistance, and low maintenance. Air and water resistance models are preferred in premium gyms for realistic rowing experiences, while hydraulic rowers are popular in home settings due to their compact size.

Application Insights

Commercial gyms represent the largest application with 50% of the 2024 market demand. Home fitness users are the fastest-growing segment, driven by connected rowers and virtual training. Rehabilitation and healthcare facilities are emerging niches, using rowing machines for physiotherapy and recovery programs.

Distribution Channel Insights

Online platforms capture 30% of the market in 2024, providing convenience and access to product comparisons, real-time reviews, and subscriptions. Offline retail, including specialty stores, remains critical for commercial buyers who prioritize hands-on testing and durability assessment.

End-User Insights

Commercial gyms dominate adoption due to high usage and durability needs. Home users are rapidly growing, driven by smart, connected rowers. Emerging end-users include rehabilitation centers and corporate wellness programs, providing new avenues for market growth.

| Resistance Mechanism | Format | Target User |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the market with a 40% share in 2024. The U.S. and Canada dominate due to high disposable incomes, strong fitness culture, and widespread adoption of home and commercial rowers.

Europe

Europe accounts for 25% of the market, led by Germany, the U.K., and France. Health-conscious consumers and high gym penetration drive demand for premium and eco-friendly rowers.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a CAGR of 9.5%. China and India drive growth due to rising urbanization and middle-class incomes. Japan and Australia provide a steady demand for smart and premium rowers.

Latin America

Brazil leads adoption, followed by Argentina and Mexico. Urban fitness awareness and commercial gym growth support market expansion, though volumes remain smaller than in North America and Europe.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is emerging due to high-income urban consumers. Africa’s market is small, focused primarily on commercial gyms in urban areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rowing Machine Market

- Concept2

- WaterRower

- First Degree Fitness

- NordicTrack

- Stamina Products

- ProForm

- Sunny Health & Fitness

- Kettler

- Life Fitness

- Johnson Health Tech

- Spirit Fitness

- Bowflex

- Core Fitness

- XTERRA Fitness

- Technogym

Recent Developments

- June 2025: Concept2 launched a smart rower with AI coaching and gamified virtual training for home and commercial users.

- April 2025: WaterRower expanded eco-friendly wooden rowers targeting premium home users.

- March 2025: NordicTrack introduced AI-integrated rowers with personalized performance tracking for home fitness enthusiasts.