Road Bike Tyres Market Size

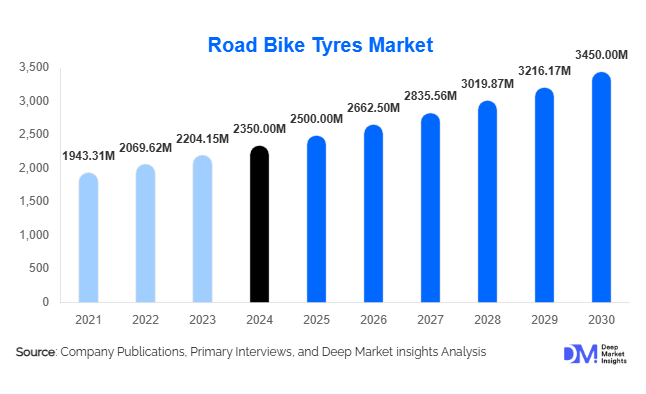

According to Deep Market Insights, the global road bike tyres market size was valued at USD 2,350 million in 2024 and is projected to grow from USD 2,500 million in 2025 to reach USD 3,450 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by rising cycling popularity, technological innovations in tyre materials and design, increasing urban cycling infrastructure, and growing consumer focus on high-performance and sustainable cycling solutions.

Key Market Insights

- Clincher tyres dominate global demand, favoured for their ease of use, reliability, and repairability, particularly among recreational and professional cyclists.

- Technological advancements such as tubeless, puncture-resistant, and composite tyres are expanding premium segments for professional and endurance cyclists worldwide.

- Europe holds the largest market share due to an established cycling culture, high disposable income, and a strong preference for professional and recreational cycling.

- Asia-Pacific is the fastest-growing region, led by China and India, driven by urban cycling infrastructure development and rising middle-class adoption of cycling for recreation and commuting.

- Online retail channels are rapidly expanding, providing consumers with direct access to specialised tyres and increasing global market penetration.

- Sustainability and eco-friendly tyre materials such as bio-rubber and recycled composites are reshaping consumer preference and providing a new growth avenue for environmentally conscious buyers.

What are the latest trends in the road bike tyres market?

Performance and Tubeless Tyres Gaining Traction

The market is witnessing a shift toward tubeless and high-performance tyres. Tubeless tyres offer reduced puncture risk, lower rolling resistance, and improved ride quality, driving adoption among both amateur and professional cyclists. Endurance and gravel riding segments are increasingly favouring wider tyres (26–28 mm and above) for comfort and stability. Advanced rubber compounds, Kevlar reinforcements, and lightweight composites are becoming standard in premium tyres, appealing to competitive cyclists who prioritise performance, speed, and durability.

Technological Innovations and Material Advancements

Emerging technologies are enhancing tyre performance and longevity. Carbon or composite reinforcements, puncture-resistant layers, and aerodynamic designs improve efficiency and reliability. Tyre manufacturers are also exploring sustainable and eco-friendly materials, responding to growing consumer demand for environmentally responsible products. These innovations support both professional racing and recreational cycling markets by combining performance, safety, and sustainability. Online platforms facilitate product discovery and direct purchase, further accelerating adoption.

What are the key drivers in the road bike tyres market?

Rising Cycling Popularity and Health Awareness

Global awareness about health and fitness is driving increased cycling participation. Road biking is favoured for cardiovascular benefits, endurance training, and recreational fitness. Professional cycling events, marathons, and amateur races further stimulate demand for high-quality tyres. Urban cycling initiatives in APAC and LATAM encourage daily commuting by bike, boosting demand for durable and comfortable road bike tyres.

Technological Innovations and Premium Product Adoption

Innovation in tyre design, such as tubeless technology, composite reinforcement, and lightweight materials, is driving premium segment growth. These enhancements improve safety, speed, and performance, attracting competitive cyclists and endurance riders willing to pay a premium. The trend of wider tyres for comfort and gravel biking is also contributing to segment growth.

Expansion of E-Commerce and Direct-to-Consumer Channels

Online retail growth has lowered barriers for consumers to access specialised tyres. E-commerce platforms provide direct-to-consumer sales, comparison tools, and faster delivery, enhancing market penetration and visibility of premium and niche tyres.

What are the restraints for the global market?

High Cost of Premium Tyres

Premium tyres with advanced materials and tubeless technologies are significantly more expensive than standard rubber tyres. Price-sensitive consumers in developing markets may limit adoption, especially for competitive or professional-grade products.

Raw Material Price Volatility

Rubber and composite materials are subject to fluctuations in global commodity markets. Sudden increases in raw material costs can raise production expenses and affect profit margins, potentially slowing market growth.

What are the key opportunities in the road bike tyres market?

Emerging Markets and Urban Cycling Infrastructure

Rapid urbanisation in Asia-Pacific and LATAM, coupled with government investments in cycling lanes and urban mobility, is driving demand for road bike tyres. Countries such as India, China, and Brazil offer significant growth potential as middle-class consumers adopt cycling for commuting and leisure.

Eco-Friendly and Sustainable Tyres

Increasing consumer preference for sustainable products presents opportunities for tyres made from bio-rubber, recycled materials, or low-carbon manufacturing processes. Brands aligning with ESG initiatives can differentiate themselves and attract environmentally conscious customers.

High-Performance and Specialised Tyres

Rising participation in competitive cycling, endurance events, and gravel biking creates demand for specialised tyres. Manufacturers offering lightweight, puncture-resistant, and aerodynamic designs can capture the premium segment and expand their market share globally.

Product Type Insights

Clincher tyres dominate the market, accounting for approximately 55% of global demand in 2024 due to their ease of use and repairability. Tubeless tyres are growing in popularity among competitive cyclists, while tubular tyres remain a niche choice for professional racing. Rubber-based tyres account for 70% of the market, with composite and eco-friendly materials gaining traction in premium segments.

Application Insights

Professional racing and endurance cycling remain the largest applications, representing over 35% of market demand in 2024. Recreational and urban cycling are rapidly growing, particularly in the Asia-Pacific and LATAM. E-bikes and gravel bikes are emerging as new applications, driving the adoption of wider tyres (26–28 mm and above) and performance-oriented designs.

Distribution Channel Insights

Offline retail continues to dominate, holding 60% of market share in 2024 due to consumer preference for in-person fitting and brand trust. Online platforms and direct-to-consumer channels are rapidly growing, driven by convenience, competitive pricing, and access to specialised tyres. E-commerce is expected to expand at a CAGR of 10–12% during the forecast period.

Traveller Type Insights

While the market does not categorise cyclists as "travellers," consumer groups include professional racers, recreational cyclists, and urban commuters. Professional racers dominate premium segment demand, recreational cyclists drive mid-range tyre sales, and urban commuters represent a fast-growing segment in emerging economies.

Age Group Insights

Adults aged 25–45 represent the largest share of demand, balancing disposable income with active cycling participation. Younger cyclists (18–24) drive entry-level and budget tyre adoption, while older adults (46–65) increasingly seek comfort and durability-focused tyres for recreational use.

| By Tyre Type | By Tyre Size | By Width | By Material | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the 2024 market, led by the U.S., where recreational and endurance cycling are popular. Urban cycling infrastructure, e-commerce penetration, and high disposable income support growth. Canada shows steady adoption, particularly in premium and performance tyre segments.

Europe

Europe is the largest market with a 35% share, led by Germany, France, and the U.K. Strong cycling culture, professional racing events, and high adoption of premium tyres drive demand. Wider tyres for endurance and gravel biking are particularly popular, reflecting consumer preference for performance and comfort.

Asia-Pacific

Asia-Pacific is the fastest-growing region. China and India lead demand due to urban cycling initiatives and rising disposable incomes. Japan and South Korea contribute to steady growth, with consumers focusing on premium and eco-friendly tyres. Online retail penetration accelerates adoption across the region.

Latin America

Brazil, Argentina, and Mexico are gradually increasing adoption, driven by urban commuting and recreational cycling. Export of high-performance tyres to these markets is increasing, with demand for endurance and recreational cycling applications.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, shows a growing demand for premium cycling products. South Africa dominates the African market, supported by recreational cycling culture and tourism-driven cycling events.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Road Bike Tyres Market

- Continental

- Michelin

- Schwalbe

- Pirelli

- Vittoria

- Maxxis

- Kenda

- Hutchinson

- Panaracer

- WTB

- CST

- Tufo

- Challenge

- Bontrager

- Specialized

Recent Developments

- In March 2025, Continental launched a new tubeless road bike tyre series with enhanced puncture resistance and lightweight composite materials.

- In January 2025, Schwalbe expanded its eco-friendly tyre line using bio-rubber and recycled materials, targeting environmentally conscious cyclists in Europe and Asia-Pacific.

- In June 2024, Michelin introduced wider endurance tyres (28–30 mm) for long-distance and gravel cycling, addressing rising consumer demand for comfort and stability.