River Cruise Market Size

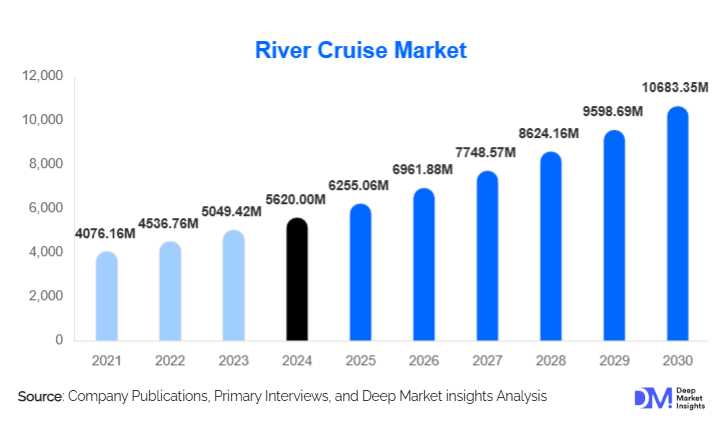

According to Deep Market Insights, the global river cruise market size was valued at USD 5,620 million in 2024 and is projected to grow from USD 6,255.06 million in 2025 to reach USD 10683.35 million by 2030, expanding at a CAGR of 11.3 during the forecast period (2025–2030). The river cruise market growth is primarily driven by rising demand for luxury and experiential travel, increasing disposable income among middle- and high-income travelers, and growing interest in culturally immersive and eco-conscious cruise experiences. Expansion of cruise fleets, technological enhancements in onboard amenities, and strategic marketing by operators to attract new demographics are further fueling global market growth.

Key Market Insights

- Luxury river cruises are witnessing significant demand, driven by travelers seeking personalized itineraries, high-end services, and unique cultural experiences along scenic river destinations.

- Europe dominates river cruise operations, with the Rhine, Danube, and Seine rivers remaining key revenue-generating routes due to well-established infrastructure, historical sites, and high tourist inflow.

- Asia-Pacific is emerging as a high-growth market, led by increasing outbound tourism from China and India and the development of river cruise infrastructure along the Yangtze, Mekong, and Ganges rivers.

- Technological integration on cruise ships, including AI-based guest personalization, online booking platforms, and eco-friendly propulsion systems, is enhancing traveler experiences and operational efficiency.

- The market is shifting toward experiential travel, combining cultural immersion, culinary experiences, and guided excursions with sustainable practices, appealing to younger and affluent travelers alike.

- Regulatory support and safety measures, including enhanced health protocols post-COVID-19, are strengthening traveler confidence in river cruising globally.

What are the latest trends in the river cruise market?

Luxury and Boutique Cruise Experiences

River cruise operators are increasingly offering luxury and boutique experiences to attract high-net-worth travelers. These cruises provide private suites, curated cultural excursions, gourmet dining, and wellness amenities on board. Travelers now seek exclusive experiences that combine leisure with local cultural engagement, such as guided tours of historical cities, wine-tasting excursions, and private performances. Boutique operators differentiate themselves through smaller vessels that navigate less-frequented waterways, offering more intimate and personalized experiences compared to large mainstream cruises.

Technology-Enhanced Onboard and Booking Experiences

Advanced technologies are revolutionizing river cruising. Digital booking platforms allow travelers to customize itineraries, select cabin types, and access real-time updates. Onboard AI services offer personalized activity suggestions, virtual shore excursions, and language translation support. Eco-friendly propulsion systems and energy-efficient ship designs also contribute to operational sustainability. Digital guest engagement platforms, including augmented reality guides and interactive apps, enhance navigation of cultural landmarks, educational content, and entertainment on board, attracting tech-savvy travelers.

What are the key drivers in the river cruise market?

Rising Disposable Income and Affluent Travel

The growing global middle- and high-income population is driving river cruise demand. Travelers are willing to pay a premium for experiential journeys that combine luxury, culture, and leisure. Rising disposable income in emerging economies such as China and India is creating a new wave of consumers seeking river cruise vacations. Exclusive packages targeting wealthy individuals, including private suites, curated excursions, and onboard wellness programs, are contributing to the luxury segment’s growth.

Growing Popularity of Experiential and Cultural Travel

Modern travelers are increasingly seeking immersive experiences that provide cultural, culinary, and historical insights along river routes. River cruises offer structured yet flexible itineraries visiting heritage sites, museums, local villages, and scenic landmarks. This trend aligns with the shift toward slow travel, allowing passengers to explore regions in depth while enjoying onboard comfort. Operators integrating local guides, workshops, and performances onboard are capitalizing on this demand to differentiate offerings from ocean cruises.

Expansion of Cruise Fleets and Operational Infrastructure

Global operators are investing heavily in new vessels and expanding itineraries to underexplored regions. Fleet expansions include modern ships with advanced amenities and eco-friendly systems, increasing overall capacity and efficiency. Port and docking infrastructure upgrades in major rivers like the Danube, Rhine, Seine, and Yangtze enable operators to accommodate larger vessels, enhance safety, and improve passenger convenience. These improvements contribute to higher utilization rates and increased market attractiveness.

What are the restraints for the global market?

High Operational and Travel Costs

River cruising remains cost-intensive due to the expense of building and maintaining vessels, operating fuel-efficient technologies, and providing premium onboard services. High ticket prices limit accessibility for middle-income travelers, concentrating demand among affluent segments. Seasonal fluctuations, port fees, and maintenance expenses further add to operational costs, impacting profitability and slowing market penetration in emerging regions.

Environmental and Regulatory Challenges

Strict environmental regulations, such as emissions controls, waste management policies, and river navigability restrictions, can increase compliance costs and operational complexities. Climate-related challenges, including fluctuating water levels and extreme weather events, may disrupt itineraries and negatively impact passenger experience. Operators must invest in sustainable technologies and safety measures to mitigate these risks, which can be a significant barrier to market expansion.

What are the key opportunities in the river cruise industry?

Expansion into Emerging Markets

Asia-Pacific, particularly China, India, and Southeast Asia, offers substantial growth potential due to increasing outbound tourism, growing disposable income, and rising interest in experiential travel. Investment in new river cruise routes along the Yangtze, Mekong, and Ganges can attract a large demographic of first-time river cruisers. Governments are supporting tourism development through infrastructure upgrades, port modernization, and policy incentives, making this a strategic growth opportunity for operators.

Integration of Sustainable and Eco-Friendly Practices

Environmental sustainability is becoming a central focus. Adoption of energy-efficient propulsion systems, solar-assisted operations, waste management solutions, and low-emission ships allows operators to appeal to environmentally conscious travelers. Partnerships with local conservation groups for shore excursions and cultural preservation activities also enhance brand value. This approach not only meets regulatory requirements but positions river cruising as a responsible and socially aware travel option.

Technological Innovation for Enhanced Passenger Experience

Integration of digital solutions, including mobile apps, AR/VR experiences, AI-powered recommendations, and online itinerary customization, provides personalized travel experiences. Smart cabin management systems, contactless check-ins, and interactive onboard learning platforms improve convenience and engagement, especially among younger, tech-savvy travelers. Innovative services, such as culinary workshops, language lessons, and virtual museum tours, can increase passenger satisfaction and drive repeat bookings.

Product Type Insights

Luxury river cruises dominate the market, capturing nearly 45% of the global revenue in 2024, due to their high-end offerings, exclusive itineraries, and immersive cultural experiences. Mid-range cruises account for approximately 35% of the market, balancing affordability with quality, and appealing to mainstream tourists seeking comfort and convenience. Budget or economy river cruises, representing around 20% of the market, target younger and price-sensitive travelers, often through group packages and shorter itineraries. The trend toward boutique and personalized cruises is strengthening across luxury and mid-range segments, driving innovation in vessel design and onboard amenities.

Application Insights

Tourism-focused cruises are the leading application, offering leisure travel, sightseeing, and cultural engagement, accounting for over 60% of demand in 2024. Experiential and educational cruises, including culinary, wine, and heritage-focused itineraries, are emerging rapidly, supported by rising demand for niche travel experiences. Corporate events, wellness cruises, and themed voyages are expanding as secondary applications. The combination of leisure and cultural immersion continues to drive river cruise adoption, particularly among repeat travelers seeking differentiated experiences.

Distribution Channel Insights

Online travel agencies (OTAs) and operator D2C websites dominate booking channels, offering travelers real-time availability, transparent pricing, and personalized recommendations. Traditional travel agencies remain relevant for high-end and niche cruise packages, catering to luxury clientele and group bookings. Direct bookings through cruise operators are increasing due to loyalty programs, exclusive packages, and digital engagement tools. Social media marketing, influencer partnerships, and targeted digital campaigns are key drivers of awareness and engagement across younger demographics.

Traveler Type Insights

Couples and honeymooners constitute the largest traveler segment for river cruises, particularly in luxury and mid-range offerings, due to preferences for intimate, scenic, and culturally immersive experiences. Group travelers, including friends and family groups, are growing steadily, particularly in mid-range and budget cruises. Solo travelers and millennials are increasingly adopting experiential and themed cruises, leveraging tech-based booking tools and social media recommendations. Corporate clients and event-focused travelers are emerging as niche but high-value segments, supporting demand for specialized river cruise packages.

Age Group Insights

Travelers aged 31–50 years represent the largest market share due to a combination of disposable income, travel frequency, and preference for experiential itineraries. The 18–30 age group is expanding rapidly in budget and themed cruises, driven by tech-savvy and adventure-focused travelers. Older demographics (51–65 years) continue to dominate luxury offerings, valuing comfort, guided tours, and wellness amenities, while the 65+ segment is growing steadily in premium and slow-travel experiences focused on cultural immersion and leisure.

| By Cruise Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the global river cruise market in 2024, driven primarily by U.S. travelers seeking European river destinations such as the Rhine, Danube, and Seine. High disposable income, extensive air connectivity, and a strong outbound tourism culture support growth. Luxury and experiential cruises are particularly popular, while technological adoption in bookings and onboard services enhances market penetration.

Europe

Europe accounts for the largest market share globally at around 38% in 2024, with Germany, France, and the Netherlands leading demand. Well-developed river infrastructure, historical sites, and tourism-friendly regulations make Europe the core market. Mid-range cruises targeting domestic and regional travelers are performing strongly, while luxury boutique cruises continue to expand. The region is expected to maintain dominance due to continuous fleet expansion and cultural tourism appeal.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Australia. Government investments in port development and river navigation infrastructure are enabling new itineraries along the Yangtze, Mekong, and Ganges. Increasing disposable income, rising outbound travel, and growing interest in experiential travel are key growth drivers.

Latin America

Latin America, led by Brazil and Argentina, is gradually adopting river cruises, primarily through outbound travel to European and North American rivers. Demand is concentrated among affluent travelers seeking adventure and scenic routes, with the gradual development of domestic river itineraries.

Middle East & Africa

Africa, with the Nile and Zambezi rivers, and the Middle East, led by the UAE and Saudi Arabia, present emerging opportunities. Egypt remains the dominant destination in Africa, with historical and cultural river cruises gaining popularity. High-income travelers from the Middle East are increasingly exploring European and Asian river cruise options, supported by improved connectivity and tailored luxury packages.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the River Cruise Market

- Viking River Cruises

- AmaWaterways

- Uniworld Boutique River Cruises

- Scenic Luxury Cruises & Tours

- CroisiEurope

- Avalon Waterways

- Riviera Travel

- Hurtigruten Group

- Crystal River Cruises

- Emerald Cruises

- Tauck

- Nicko Cruises

- Plantours Kreuzfahrten

- Grand Circle Cruise Line

- Seabourn Cruise Line

Recent Developments

- In March 2025, Viking River Cruises announced the launch of five new ships with eco-friendly hybrid propulsion systems for European and Asian routes.

- In January 2025, AmaWaterways introduced themed wellness and culinary cruises along the Rhine and Danube, combining local gastronomy and spa programs.

- In July 2024, Uniworld Boutique River Cruises expanded into Southeast Asia with luxury vessels on the Mekong River, offering tailored cultural immersion experiences.