Ring Light Market Size

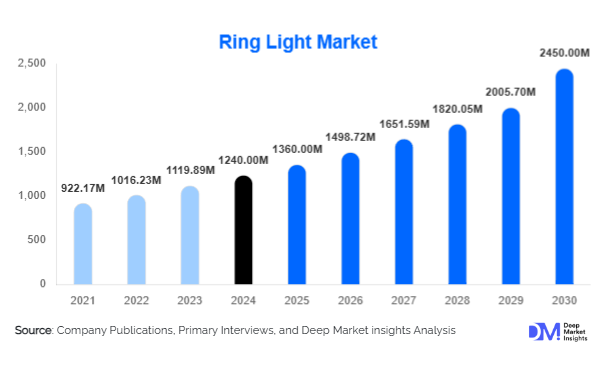

According to Deep Market Insights, the global ring light market size was valued at USD 1,240 million in 2024 and is projected to grow from USD 1,360 million in 2025 to reach USD 2,450 million by 2030, expanding at a CAGR of 10.2% during the forecast period (2025–2030). The growth of the ring light industry is primarily driven by the surge in content creation across social media platforms, rising demand for professional-quality lighting in photography, videography, and online meetings, and increasing adoption across beauty, medical, and corporate end-use applications.

Key Market Insights

- LED-based ring lights dominate the market due to their energy efficiency, long lifespan, and cost-effectiveness compared to fluorescent models.

- North America accounts for over 32% of global demand, fueled by a booming creator economy, remote work adoption, and strong e-commerce penetration.

- Asia-Pacific is the fastest-growing region, supported by a rapidly expanding middle class, rising influencer culture, and affordable manufacturing hubs in China and India.

- RGB and smart ring lights are gaining traction, with app-controlled brightness, color customization, and IoT-enabled features.

- E-commerce channels dominate distribution, with Amazon, Flipkart, and brand-owned websites driving the majority of sales in 2024.

- Medical and dental applications represent an emerging growth area, as ring lights are increasingly used in clinical photography and precision examinations.

What are the latest trends in the Ring Light Market?

Content Creator Economy Driving Adoption

The explosive rise of content creation on platforms such as YouTube, Instagram, and TikTok has fueled demand for affordable yet professional-grade ring lights. Influencers, vloggers, and streamers prefer compact, portable, and dimmable ring lights for consistent lighting across environments. This trend is particularly pronounced in the Asia-Pacific region, where smartphone-based content creation is booming. Micro-influencers and small businesses are also investing in entry-level ring lights, creating a strong demand base across the consumer spectrum.

Integration of Smart and RGB Lighting Technologies

Manufacturers are increasingly incorporating RGB color modes, smartphone app controls, and IoT compatibility into ring lights. These advancements allow users to customize lighting environments for creative purposes, particularly in video production, live streaming, and gaming setups. Smart-enabled ring lights are gaining popularity among professionals who value multifunctional lighting solutions. The introduction of voice-activated and AI-assisted brightness controls further aligns with the growing smart home ecosystem, creating new avenues for premium product adoption.

What are the key drivers in the Ring Light Market?

Expansion of Remote Work and Virtual Communication

The adoption of hybrid work models and the normalization of virtual meetings have significantly boosted the use of ring lights for professional video conferencing. Employees and organizations are investing in compact and mid-size ring lights to improve visibility and create a professional on-screen presence, especially in industries like consulting, education, and corporate communications.

Rising Adoption in the Beauty and Personal Care Industry

Ring lights have become an essential tool for makeup artists, salons, and beauty influencers, as they provide uniform, shadow-free illumination that enhances detail visibility. The growing beauty and grooming industry in North America, Europe, and Asia-Pacific is expanding the demand for ring lights in both professional and consumer applications.

Affordability and E-commerce Penetration

The availability of ring lights across e-commerce platforms at competitive price points has democratized access to professional lighting tools. Entry-level options priced below USD 50 have gained massive traction among students, small businesses, and casual users, expanding the overall addressable market.

What are the restraints for the global market?

Intense Price Competition

Due to a high number of small- and medium-sized manufacturers, particularly in China and Southeast Asia, the ring light market faces significant price competition. This reduces profitability margins for global players and creates a fragmented competitive landscape where differentiation is primarily driven by branding and minor design upgrades.

Durability and Product Saturation Concerns

Low-cost ring lights often face durability issues, leading to high replacement rates and consumer dissatisfaction. Additionally, the rapid influx of low-priced imports has led to product saturation in key markets like North America and Europe, potentially slowing growth in mature regions.

What are the key opportunities in the Ring Light Industry?

Medical and Dental Imaging Applications

With healthcare providers adopting high-quality imaging solutions for diagnostics, dermatology, and dental photography, ring lights are finding new use cases. Hospitals, clinics, and aesthetic service providers are increasingly integrating medical-grade ring lights, creating opportunities for manufacturers to design specialized products with regulatory compliance.

Corporate and Educational Demand

The continued adoption of e-learning platforms and corporate hybrid models is expected to drive sustained demand for mid-range ring lights. Universities, online educators, and corporate trainers are increasingly adopting ring lights to deliver high-quality virtual experiences, opening up new B2B opportunities.

Premiumization through Smart Features

Developing IoT-enabled, voice-controlled, and RGB-featured ring lights provides opportunities for manufacturers to tap into premium consumer segments. As disposable incomes rise in Asia-Pacific and Middle Eastern economies, consumers are expected to pay more for multifunctional, stylish, and durable lighting solutions.

Product Type Insights

LED ring lights dominate the global market, holding a 68% share in 2024. Their superior energy efficiency, long operating life, and versatility across multiple applications make them the preferred choice. Fluorescent ring lights still maintain a niche presence in medical and industrial settings, but their share is declining steadily. Meanwhile, RGB/smart ring lights are gaining traction, particularly in Asia-Pacific and Europe, where adoption among gamers and streamers is rising.

Application Insights

Content creation accounted for nearly 41% of the global market share in 2024, making it the largest application segment. The rise of influencer culture and the increasing need for high-quality visuals across platforms like YouTube, Instagram, and TikTok continue to drive growth. Photography and videography studios represent the second-largest segment, while corporate/remote work and medical applications are emerging as high-growth areas expected to expand significantly by 2030.

Distribution Channel Insights

Online sales dominate with over 64% market share in 2024, led by global e-commerce giants and brand-owned stores. The accessibility of product reviews, competitive pricing, and convenient delivery options make online channels the primary growth driver. Offline sales, though smaller in share, remain important for professional buyers such as photographers and salon owners who prefer in-store trials before purchase.

| By Product Type | By Mounting & Size | By Power Source | By Application | By Distribution Channel | By Price Range |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounted for 32% of the global market in 2024, driven by strong demand from content creators, YouTubers, and corporate professionals. The U.S. dominates regional demand, supported by high disposable income and early adoption of digital content creation trends.

Europe

Europe represented 27% of the global market in 2024, with the U.K., Germany, and France emerging as key demand hubs. The region is witnessing rapid growth in beauty industry adoption and influencer-driven demand, particularly across mid-range and premium segments.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expected to expand at over 12% CAGR during 2025–2030. China and India are leading markets, with strong manufacturing capabilities, low-cost product availability, and a booming content creator economy.

Latin America

Latin America is an emerging market, with Brazil and Mexico being the largest contributors. Demand is largely driven by beauty salons and the growing YouTube and TikTok content creation culture among younger demographics.

Middle East & Africa

The Middle East is experiencing growing demand for premium ring lights, particularly in the UAE and Saudi Arabia, supported by rising influencer activity and corporate adoption. Africa’s demand is limited but steadily increasing due to adoption in photography, beauty, and small-scale content creation sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ring Light Market

- Neewer

- Godox

- Diva Ring Light

- Rotolight

- Nanlite

- Lume Cube

- Falcon Eyes

- UBeesize

- IVISII

- Razer Inc. (for gamer-focused ring lights)

- Fotodiox

- Aputure

- Westcott

- Yongnuo

- Viltrox

Recent Developments

- In June 2025, Neewer launched a new RGB smart ring light series with app-enabled customization and remote-control capabilities targeting gamers and streamers.

- In May 2025, Godox introduced a professional studio-grade ring light designed for beauty clinics and dermatology applications, expanding its medical portfolio.

- In March 2025, Lume Cube announced partnerships with major e-commerce platforms to expand direct-to-consumer sales in North America and Europe.